My morning prepare WFH reads:

• The Yr’s Hottest Crypto Commerce Is Crumbling: Selloff in bitcoin and different digital tokens hits crypto-treasury corporations. Shares of “crypto-treasury” corporations, like Micro-Technique, have fallen considerably, with Micro-Technique’s worth dropping from $128 billion at its peak to $70 billion. (Wall Road Journal)

• No one’s Shopping for Properties, No one’s Switching Jobs—and America’s Mobility Is Stalling: The paralysis has left many individuals in homes which might be too small, in jobs they don’t love or shackled with ‘golden handcuffs.’ For everybody, there are financial penalties. (Wall Road Journal) see additionally The Affordability Curse: Politics isn’t simply concerning the phrases you set in your bumper stickers. It’s about what you do if the bumper stickers work. (The Atlantic)

• China’s Shares Are Flying as Beijing Doubles Down on Tech. Why the Financial system Is Nonetheless Struggling. China’s dedication to innovation poses a long-term menace to U.S. corporations. What it wants now could be for its residents to spend extra. (Barron’s)

• OpenAI’s Chairman Is Considering a Lot About Bubbles Proper Now: Bret Taylor, who helped form Google and Fb and now runs a $10 billion AI customer support startup, thinks Silicon Valley can be simply advantageous. (Businessweek)

• A Flood of Inexperienced Tech From China Is Upending International Local weather Politics: At this 12 months’s local weather summit, america is out and Europe is struggling. However rising international locations are embracing renewable vitality due to a glut of low-cost tools. (New York Occasions)

• How luxurious flats grew to become fundamental: Outdated cash v. new cash is a debate as outdated as New York. With regards to housing, luxurious flats are giving older buildings a run for his or her cash. A increase in house development has meant new luxurious may be extra attainable. (Enterprise Insider) see additionally Builders Are Providing Mortgage-Charge Reductions. Residence Patrons Aren’t Biting. New houses are sitting unsold, regardless of builders utilizing sweeteners to shift stock. (Wall Road Journal)

• An outdated manufacturing metropolis sputters again to life: As soon as a hub for weapons and electrical wiring, Bridgeport, Connecticut, is now residence to artisanal manufacturing companies and a wholesome actual property market. (Washington Put up)

• Easy methods to assist family and friends dig out of a conspiracy concept black gap: Some tried and trusted methods that may assist. (MIT Know-how Overview)

• NASA’s Quiet Supersonic Jet Takes Flight: The X-59 efficiently accomplished its inaugural flight—a step towards growing quieter supersonic jets that might at some point fly prospects greater than twice as quick as business airliners. (Wired)

• How a beloved TV nerd grew to become ‘one of many biggest actors of his technology:’ Jesse Plemons broke out on “Friday Night time Lights.” Now, he’s getting into the perfect actor Oscars race along with his riveting efficiency in “Bugonia.” (Washington Put up)

Remember to take a look at our Masters in Enterprise interview this weekend with Kristin Olson, international head of alternate options for wealth at Goldman Sachs. She led GS’s alt capital markets group for 23 years, overseeing $500 billion in alt investments yearly from wealth administration shoppers.

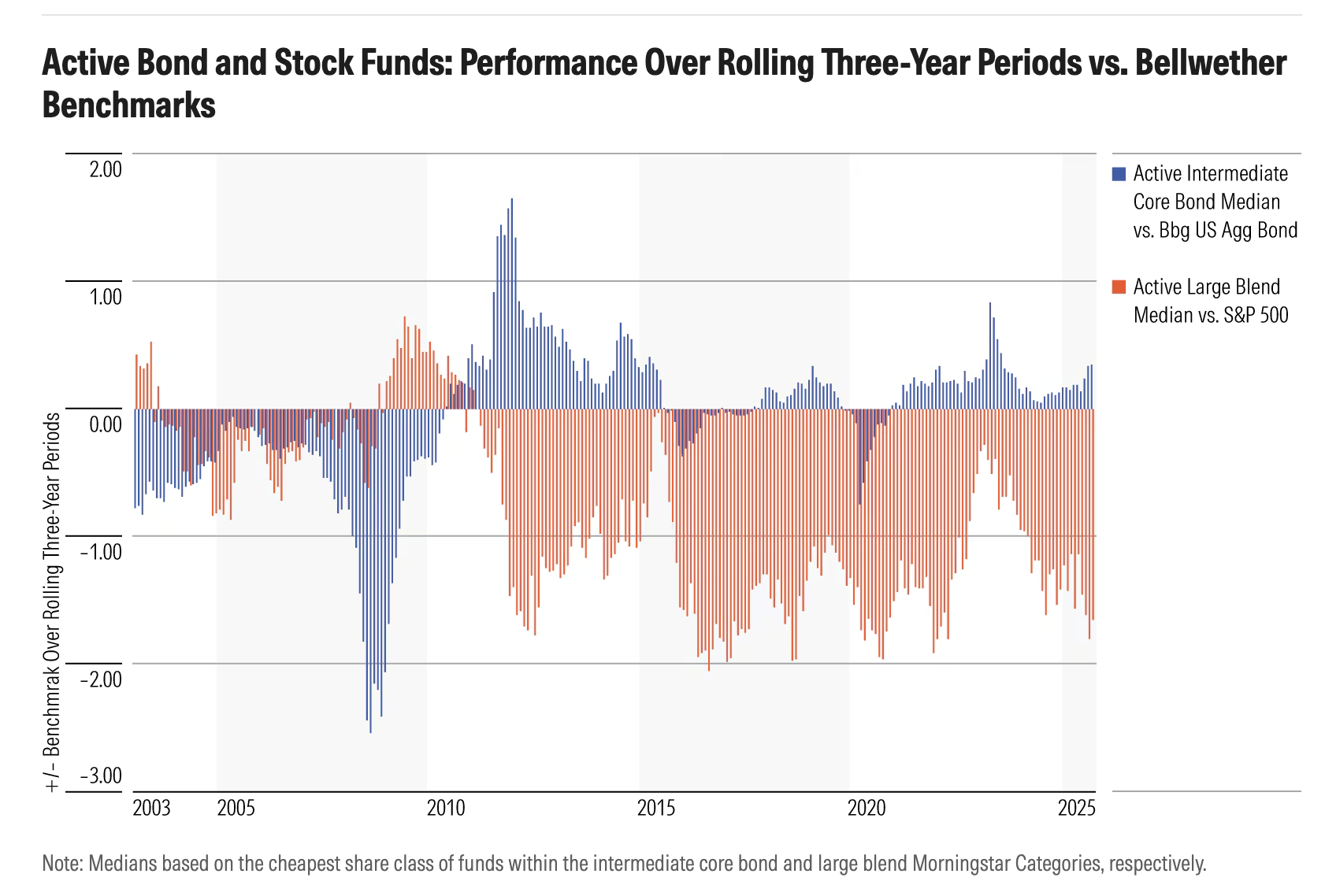

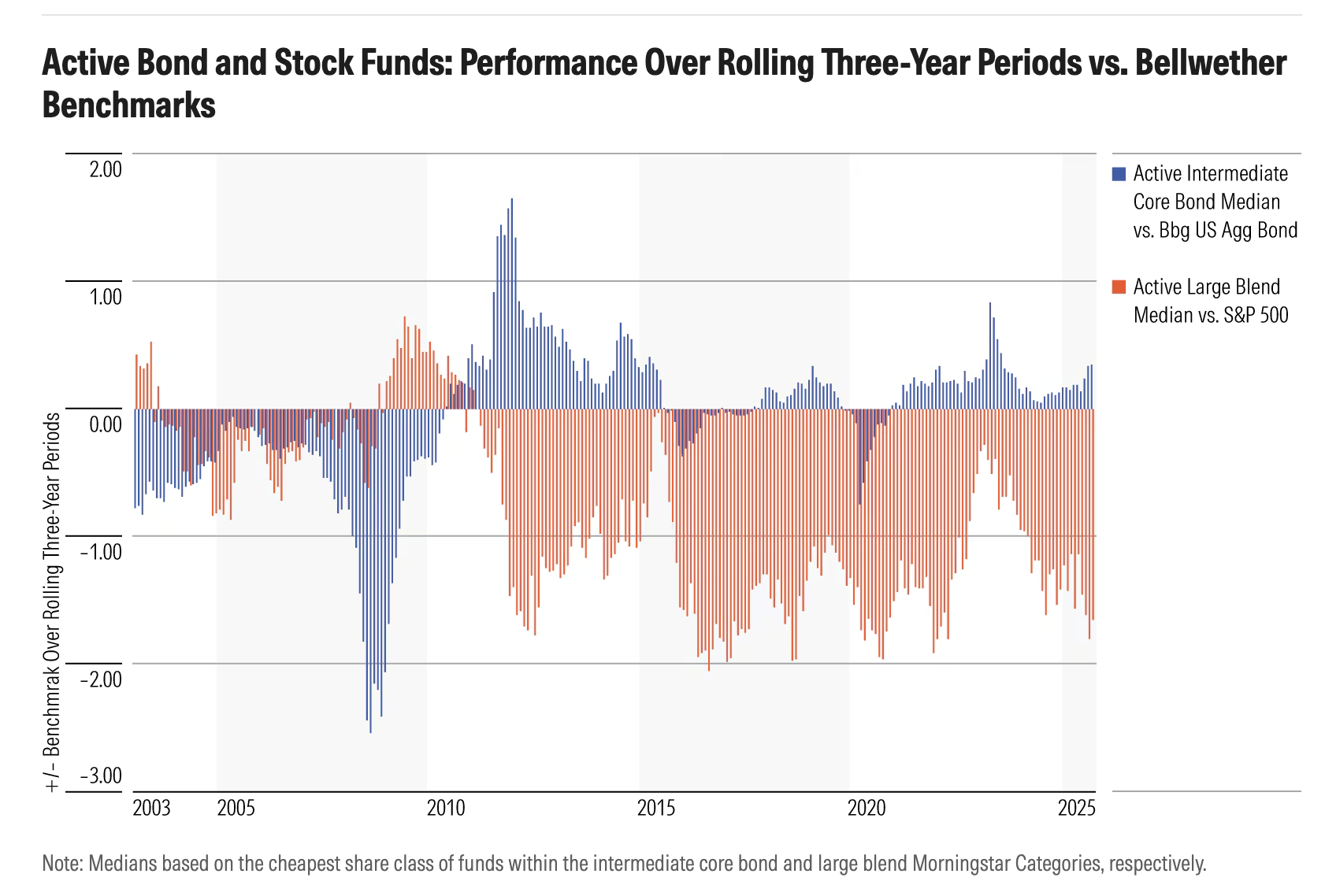

It’s simpler to make a case for utilizing pretty priced, confirmed energetic bond funds than it’s for energetic inventory funds.

Supply: Morningstar

Join our reads-only mailing record right here.