As we flip the web page on 2020 (fortunately!), market practitioners are beginning to launch outlook items and portfolio positioning suggestions for the 12 months forward. The current sturdy efficiency of worth, compared with development, has many traders questioning whether or not it is sensible to think about an chubby to this seemingly forgotten asset class, which has benefited tremendously from the current vaccine rally.

As of the tip of December, worth outperformed development by roughly 5 % over the prior three months, based on a comparability of the Russell 3000 Worth and Russell 3000 Progress indices. The ultimate quarter of 2020 turned out to be among the best 90-day stretches of efficiency for worth relative to development for the reason that nice monetary disaster. Traders have taken notice, significantly within the small worth house, the place ETFs skilled their largest four-week stretch of inflows in 10 years, based on Morningstar.

The place Does Worth Stand Right now?

The worth premium has been largely nonexistent over the past 30 years, with development clearly

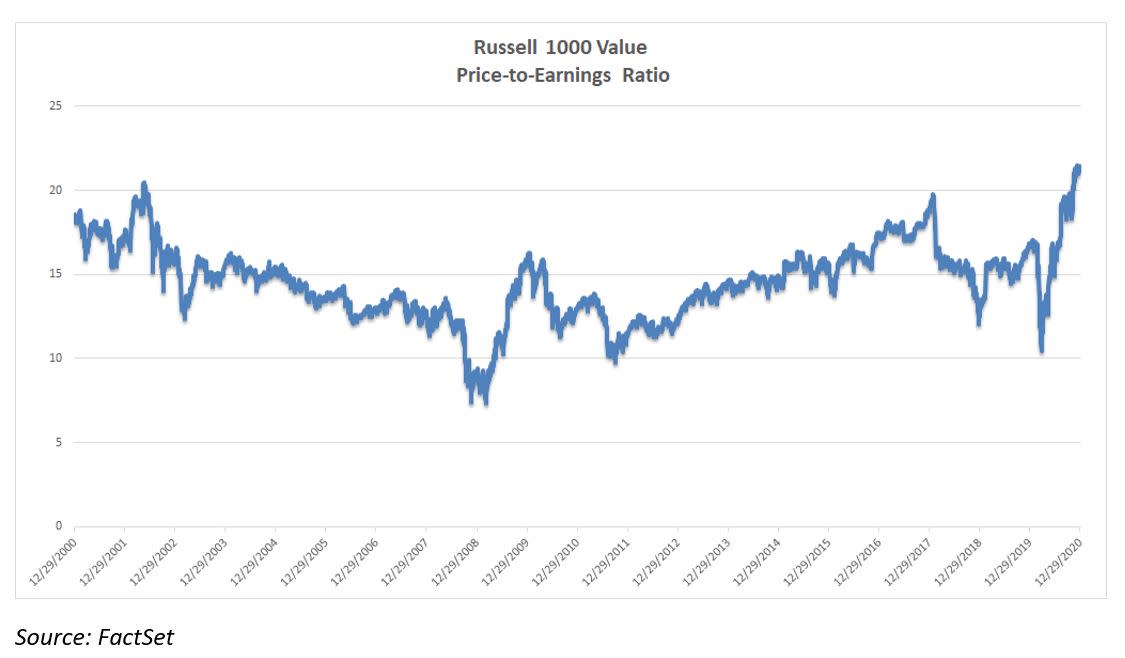

profitable out. Of late, nonetheless, worth has undoubtedly carried out nicely. Even so, I’m not satisfied this development represents the good rotation again to worth that many have anticipated. As an alternative, what we’ve seen is a robust transfer up for value-oriented industries that have been hit arduous in 2020’s pandemic-induced downturn, notably cars, airways, and vitality companies. (The three industries are up 34.8 %, 28 %, and 47.3 %, respectively, within the final three months.) Naturally, with the emergence of a vaccine and lightweight on the finish of the tunnel for a return to a standard economic system, these areas have roared again to pre-COVID ranges. The transfer has been so swift that the Russell 1000 Worth P/E ratio is now at a multidecade excessive, as evidenced within the chart beneath.

The place Will Worth Go from Right here?

In Commonwealth’s view, continued energy in worth is based on the monetary sector doing nicely in 2021, as this space represents the biggest part of the Russell 1000 Worth Index. A handful of main banks at the moment buying and selling at affordable valuations might probably carry the torch ahead. With out their sturdy efficiency, nonetheless, it’s arduous to see how the worth rally might persist—or how the asset class will proceed to outperform development.

For financials to do nicely, we’d more than likely must see a steepening of the yield curve—a state of affairs the place long-term Treasury charges supply yields markedly larger than these of short-term charges. In that setting, banks might lend cash at larger long-term yields (30-year mortgage charges) and pay depositors at short-term yields (financial savings account charges), successfully netting the distinction as revenue. At the moment, long-term Treasury charges are traditionally low in contrast with short-term charges. But when the economic system continues alongside its present trajectory, there’s a really actual risk that long-term charges will transfer larger. That might create a optimistic consequence for financials within the close to time period.

Over the long run, nonetheless, it’s arduous to examine a sustainable worth rally led by financials on a 3- to 5-year foundation. Definitely, we would see a 6- to 12-month extension of the present development, however longer-term outperformance of worth appears unlikely. Worth has skilled a robust transfer off the underside and obtained sturdy inflows, leading to lofty valuations for a lot of sectors and industries. That state of affairs simply doesn’t bode nicely for an asset class with lackluster prospects for relative development.

What Are the Implications for Traders?

At the moment, each the worth and development asset lessons are buying and selling above common valuations. The massive query for traders is, will the risk-reward state of affairs favor growth-oriented investments past a 12-month horizon? To reply this, every investor should think about his or her explicit state of affairs and objectives. For the foreseeable future, nonetheless, it might be affordable to think about overweighting development relative to worth.

The authentic model of this text appeared on the Unbiased Market Observer.