It’s that point of the 12 months once I take a look at what the subsequent 12 months may need in retailer for mortgage charges.

It’s by no means straightforward to precisely forecast mortgage charges, and this previous 12 months was no exception.

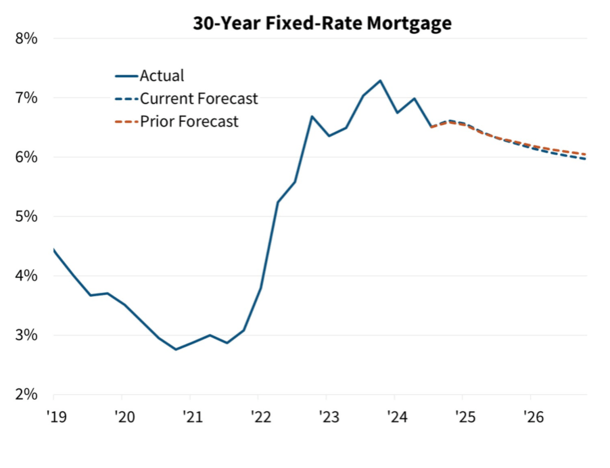

The 30-year mounted ranged from a low of 6.08% in September to as excessive as 7.22% in Could, and apparently, is just not far off year-ago ranges as we speak.

For reference, it ended the 12 months 2023 at 6.61%, per Freddie Mac information, and averaged 6.60% final week.

So what’s going to 2025 appear to be? Nicely, it’s anyone’s guess. However let’s take a look at some fashionable forecasts (together with my very own) to try to make some educated predictions.

Forecasts Count on Mortgage Charges to Enhance, However Keep Elevated in 2025

First off, let’s begin with the overall consensus, which is considerably optimistic on mortgage charges in 2025.

Like final 12 months, most trade pundits and economists count on mortgage charges to ease in 2025, however stay elevated relative to ranges seen in 2022 and earlier.

As for why, it primarily boils right down to excessive authorities spending and still-sticky inflation. This implies the federal government may must problem extra debt by the use of Treasuries, with added provide hurting bond costs.

On the similar time, if inflation turns up once more, bonds will undergo that approach as properly. In fact, this all hinges on what truly takes place underneath the brand new administration.

I’m not totally satisfied mortgage charges will go larger throughout Trump’s second time period, although they climbed initially throughout his first time period.

One massive cause why is that they already jumped about 100 foundation factors (1.00%) since September when it appeared he was the frontrunner.

So his probably inflationary insurance policies, reminiscent of widespread tariffs and tax cuts are already baked in. And if actuality defies expectations, charges have room to maneuver decrease.

They’ll additionally come down if unemployment continues to inch up, as that has been the Fed’s chief concern, not a lot inflation.

Anyway, let’s take a look at some estimates and go from there.

MBA 2024 Mortgage Fee Predictions

First quarter 2025: 6.6%

Second quarter 2025: 6.5%

Third quarter 2025: 6.4%

Fourth quarter 2025: 6.4%

As all the time, I compile a roundup of forecasts from the main economists and housing teams.

I all the time prefer to test in to see how they did the 12 months earlier than as properly, although it’s no indication of efficiency for subsequent 12 months.

First up we have now the Mortgage Bankers Affiliation (MBA), which final 12 months predicted a spread from 6.1% to 7%.

They really anticipated the 30-year to be right down to round 6.10% within the fourth quarter of this 12 months, and maybe would have been proper if charges didn’t leap post-election.

In 2025, they’re enjoying it very conservatively, with a really tight vary of 6.4% to six.6%. In different phrases, solely 20 foundation factors of motion.

That appears a bit too slender to be taken too critically, however something is feasible. Mortgage charges are fairly near ranges final seen in 2001.

And through that 12 months, the 30-year mounted ranged from 6.62% to 7.16%. So it’s not out of the query.

However recently mortgage charges have displayed rather more volatility and have seen a a lot wider vary.

The one upside to this prediction is that extra stability might result in some compression in mortgage fee spreads, which might present some aid.

In the mean time, mortgage spreads stay about 100 bps above their long-term common, that means MBS buyers are demanding a premium versus authorities bonds.

Fannie Mae 2024 Mortgage Fee Predictions

First quarter 2025: 6.6%

Second quarter 2025: 6.4%

Third quarter 2025: 6.3%

Fourth quarter 2025: 6.2%

Now let’s check out Fannie Mae’s mortgage fee forecast, who together with Freddie Mac buy mortgages from lenders and package deal them into MBS.

Final 12 months, they anticipated the 30-year mounted to vary from 6.5% to 7%, and finish the 12 months round 6.5%.

Not too far off, however it truly turned out to be too conservative. This 12 months, they’re a bit extra bullish, anticipating a sluggish decline again towards 6.2%.

It seems to be a fairly secure forecast, although they do replace it every month and I’m utilizing their newest forecast dated December eleventh.

They appear pretty optimistic, however not optimistic sufficient to place a 5 on the board. They’re additionally anticipating a sluggish enchancment over time just like the MBA.

We all know mortgage charges not often transfer in a straight line up or down, so count on the same old twists and turns alongside the best way.

Freddie Mac 2025 Mortgage Fee Predictions

First quarter 2025: n/a

Second quarter 2025: n/a

Third quarter 2025: n/a

Fourth quarter 2025: n/a

Subsequent up is Freddie Mac, which a pair years in the past stopped offering mortgage fee predictions.

They’re the primary supply of mortgage fee information by way of their weekly Major Mortgage Market Survey (PMMS).

However sadly not present month-to-month forecasts or predictions for the 12 months to come back.

Nevertheless, they do present a month-to-month outlook so we are able to glean a bit bit of knowledge there.

Their newest version mentions latest mortgage fee volatility, however says “as we get into 2025, we anticipate that charges will step by step decline all year long.”

In order that’s a superb signal, and consistent with the opposite forecasts listed above.

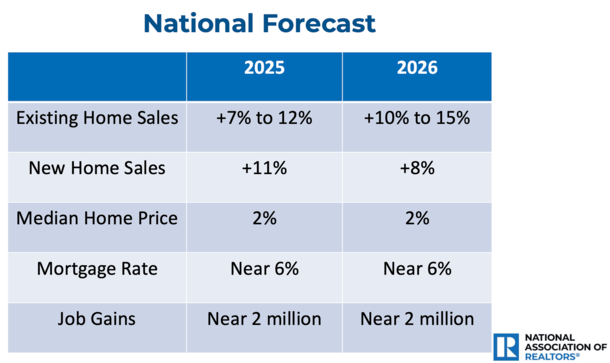

They imagine decrease mortgage charges in 2025 must also reduce among the mortgage fee lock-in impact plaguing current householders, liberating up extra for-sale stock within the housing market.

In flip, these decrease charges ought to increase stock and result in a slight improve in dwelling gross sales subsequent 12 months.

Regardless of extra stock, they nonetheless count on dwelling costs to proceed to maneuver larger, albeit “at a slower tempo.”

Lastly, they forecast whole dwelling mortgage origination volumes to extend “modestly in 2025” because of extra buy loans and elevated refinance functions tied to decrease charges.

Many current householders stand to learn from a fee and time period refinance if charges can get again to the low 6% vary. And thousands and thousands extra will seemingly refi if charges drop into the mid-5s.

NAR 2025 Mortgage Fee Outlook

First quarter 2025: 6.0%

Second quarter 2025: 5.9%

Third quarter 2025: 5.8%

Fourth quarter 2025: 5.8%

Now let’s take a look at the all the time entertaining forecast from the Nationwide Affiliation of Realtors (NAR), which releases a month-to-month U.S. Financial Outlook.

That report incorporates their mortgage fee predictions for the 12 months forward, although the newest one I might monitor down was from October.

However I additionally got here throughout a presentation by NAR chief economist Lawrence Yun, which merely mentioned mortgage charges will likely be “close to 6%” for each 2025 and 2026.

Anyway, each forecasts are fairly bullish as they all the time tends to be. The actual property agent group not often forecasts larger charges and infrequently expects enchancment within the 12 months forward.

And so that is no totally different than prior years. They count on the 30-year mounted to float decrease and decrease and even go sub-6%.

Final 12 months, they anticipated charges to vary from 7.5% within the first quarter to six.3% by round now. That turned out to not be too far off.

Wells Fargo 2025 Mortgage Fee Outlook

First quarter 2025: 6.65%

Second quarter 2025: 6.45%

Third quarter 2025: 6.25%

Fourth quarter 2025: 6.30%

Former prime mortgage lender Wells Fargo additionally releases a U.S. Financial Forecast with all sorts of estimates for each 2025 and 2026.

They too are going with estimates that mirror these of Fannie Mae and the MBA, mid-to-low 6s.

What’s attention-grabbing about their forecast is that they’ve 30-year mounted charges bottoming within the third quarter of 2025 earlier than rising within the fourth quarter.

Then going up a bit extra in 2026. So in response to them, 2025 is likely to be pretty much as good because it will get for some time.

Granted, all of it appears to be based mostly on the trajectory of the 10-year bond yield, which additionally they see bottoming in Q3 2025.

Predictions from Zillow, Redfin, Realtor, and the Relaxation

There are a number of predictions on the market and I need to hold this text considerably concise, so let’s focus on just a few extra earlier than I share my very own.

Zillow has mentioned it expects mortgage charges “to ease, however stay risky.” In different phrases, they’ll most likely get higher in 2025, however expertise the standard ups and downs.

They usually fairly rightly level out that this volatility will provide dangers and alternatives, so keep vigilant.

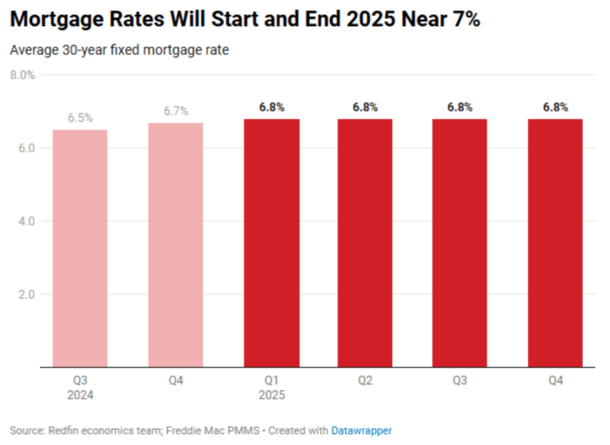

Redfin is fairly pessimistic, saying mortgage charges are prone to begin and finish 2025 round 7%, with a mean round 6.8%.

They’re basing that on Trump’s tariffs and tax cuts and continued financial energy. However they do throw out an alternate principle the place charges drop to the low 6s if these anticipated eventualities don’t unfold.

Over at Realtor, which is owned by Information Corp. and licensed by NAR, they anticipate a decrease 6.3% common in 2025, with charges ending the 12 months at about 6.2%.

They too adjusted their mortgage fee forecast upward to replicate elevated authorities spending, and better costs/inflation attributable to tariffs and decrease taxes underneath a Trump administration and Republican-led Congress.

However just like the others are not sure if and what truly involves fruition, since speeches, phrases, proposals and actuality are very various things.

The Nationwide Affiliation of Dwelling Builders (NAHB) additionally weighed in by way of their month-to-month Macro Financial Outlook.

They count on the 30-year to fall to six.36% in 2025 from 6.73% in 2024, a couple of 40-basis level enchancment.

Mortgage charges are prime of thoughts for the builders who’ve gained a number of market share recently since current provide is affected by mortgage fee lock-in.

Their fee buydowns have made offers pencil over the previous few years, however include an enormous price ticket for the builder.

And at last, First American economists count on mortgage charges to fall between 6% and 6.5% throughout 2025.

The Fact’s 2025 Mortgage Fee Prediction

First quarter 2025: 6.5%

Second quarter 2025: 6.75%

Third quarter 2025: 6.25%

Fourth quarter 2025: 5.875%

Alright, now it’s my flip. I do know mortgage fee predictions are for the birds, however it’s nonetheless price throwing on the market.

Final 12 months I used to be fairly bullish and anticipated a 30-year mounted at 6.25% within the third quarter and 5.875% within the fourth quarter of 2024.

I used to be largely proper concerning the third quarter, however I didn’t issue within the presidential election, which threw off my This fall prediction.

Nonetheless, I take accountability and in contrast to the opposite predictions, I’m going to make changes going ahead so my forecasts are much less linear all year long.

In different phrases, not simply decrease and decrease because the 12 months progresses. That’s too clearly flawed.

That mentioned, I count on a mean fee of 6.5% within the first quarter because the latest run-up in charges doesn’t really feel warranted. So a easy aid rally into the brand new 12 months.

Then an uptick within the second quarter since mortgage charges all the time appear to be at their highest in spring, when dwelling patrons want them essentially the most.

However solely worse by a couple of quarter-percent earlier than falling once more within the third quarter on financial weak spot and elevated unemployment.

And at last slipping under 6% within the fourth quarter, however solely slightly below 6%.

The fundamental premise for me is that I see a weakening financial system and don’t imagine all of Trump’s insurance policies will come to fruition, that are arguably already baked into larger charges.

For the document, I wouldn’t be shocked to see charges hit the high-5s throughout choose weeks throughout different quarters as properly.

In order all the time, there will likely be a lot of alternatives for each dwelling patrons and current householders seeking to refinance. Simply hold your eye on the ball!

Learn on: How are mortgage charges decided?