Prior to now 30 years the next has occurred:

1995-2000: Dot-com bubble

1997: Asian monetary disaster

1998: Russian default and LTCM collapse

2000-2002: Dot-com bust (S&P -50% and Nasdaq -83%), 9/11, Enron/WorldCom scandals

2003: Iraq Battle

2007-2009: Nice Monetary Disaster, housing costs collapse 26%, U.S. inventory market falls 56%, Bernie Madoff Ponzi Scheme outed

2009-2012: European Debt Disaster

2013: Taper Tantrum

2016: Brexit

2018-2019: U.S.-China Commerce Battle

2020: World pandemic, oil costs go destructive

2021-2022: Provide chain shock, Russia-Ukraine battle, 9% inflation, charges spike

2025: Liberation Day

This checklist may go on and on. There’s loads of different stuff that occurred that I missed.

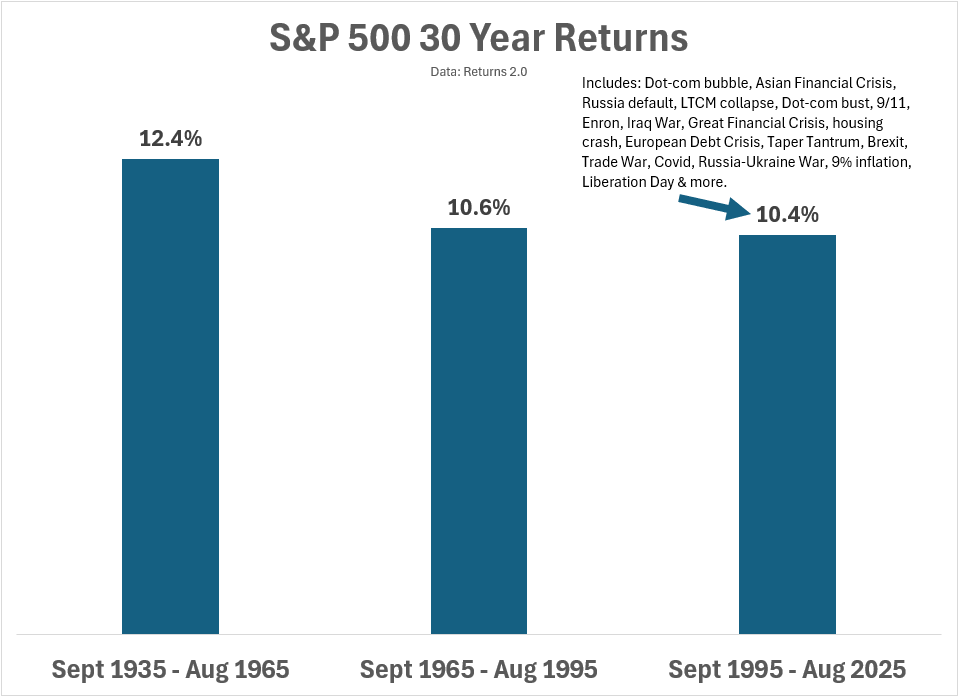

Regardless of all of this, the S&P 500 returned 10.4% per yr:

The Nineteen Sixties, Seventies and Nineteen Eighties had been no picnic both. But the earlier 30 years noticed annual returns of 10.6% per yr.

A variety of actually unhealthy stuff occurred within the Nineteen Thirties and Nineteen Forties. That’s two of the worst a long time in trendy historical past. The inventory market was up greater than 12% per yr within the 30 years from the summer season of 1935 via the summer season of 1965.

A variety of unhealthy stuff will occur once more. I can assure it.

I don’t know when and I don’t know why however there can be crashes, recessions, monetary crises, battle, geopolitical upheaval, and extra.

And I nonetheless spend money on the inventory market.

Why?

Dangerous issues occur and life goes on.

Folks get up every single day seeking to higher their place in life.

Companies are continually in search of methods to earn more money.

The inventory market is the one place the place anybody can spend money on human ingenuity.

I’ll take that wager even when there’ll certainly be setbacks alongside the best way.

Additional Studying:

31 Years of Inventory Market Returns

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here can be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.