A reader asks:

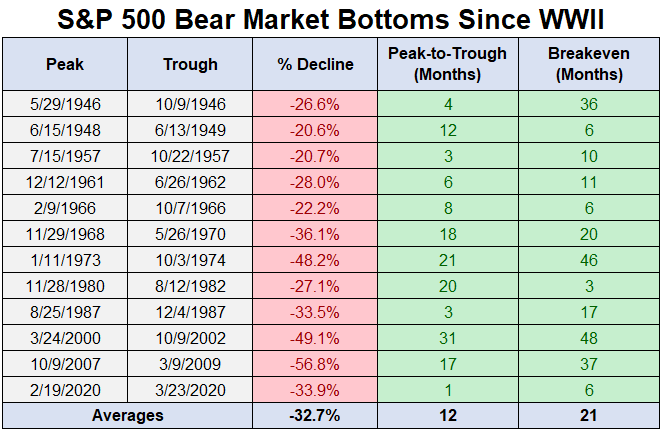

I saved one in all your articles that had some figures from all of the bear markets since 1950 via 2020 (was couple years in the past). It had a desk with the % drop on the trough, the variety of days to the underside, the date and variety of days again as much as breakeven, in addition to that point expressed in years. I’ve hooked up it right here.

Questioning you probably have comparable statistics for a Balanced/60-40 portfolio, which might be extra typical of the common consumer and their expertise? I’m attempting to get a deal with on what’s the acceptable quantity if ’emergency money’ that an investor may maintain in a portfolio, with excessive confidence that this might see them by most main corrections and again to even earlier than they needed to begin chewing into their market-based investments. For a 100% fairness portfolio, it could appear that 24 months would see somebody via all however essentially the most extreme bear markets. I’ve to suppose 60/40 could be even shorter time to restoration on common.

There have already been a handful of bear markets this decade so there was loads of alternative to write down about these items.

I did quite a lot of work on bear markets in the course of the 2020 Covid crash however up to date that knowledge in the course of the 2022 bear market:

You possibly can see the common drawdown is 33% or so whereas the common time it takes to go from peak-to-trough is 12 months. The common breakeven — going from peak to trough and again once more — is 21 months.

As with all market averages there may be a variety across the common itself however these sorts of numbers can assist offer you a variety of potential outcomes, despite the fact that the longer term may not seem like the previous.

This evaluation is a bit trickier for a 60/40 portfolio.

I’ve good day by day inventory market knowledge going again 100 years. That doesn’t actually exist for bonds so we’ve to do that utilizing month-to-month returns.1

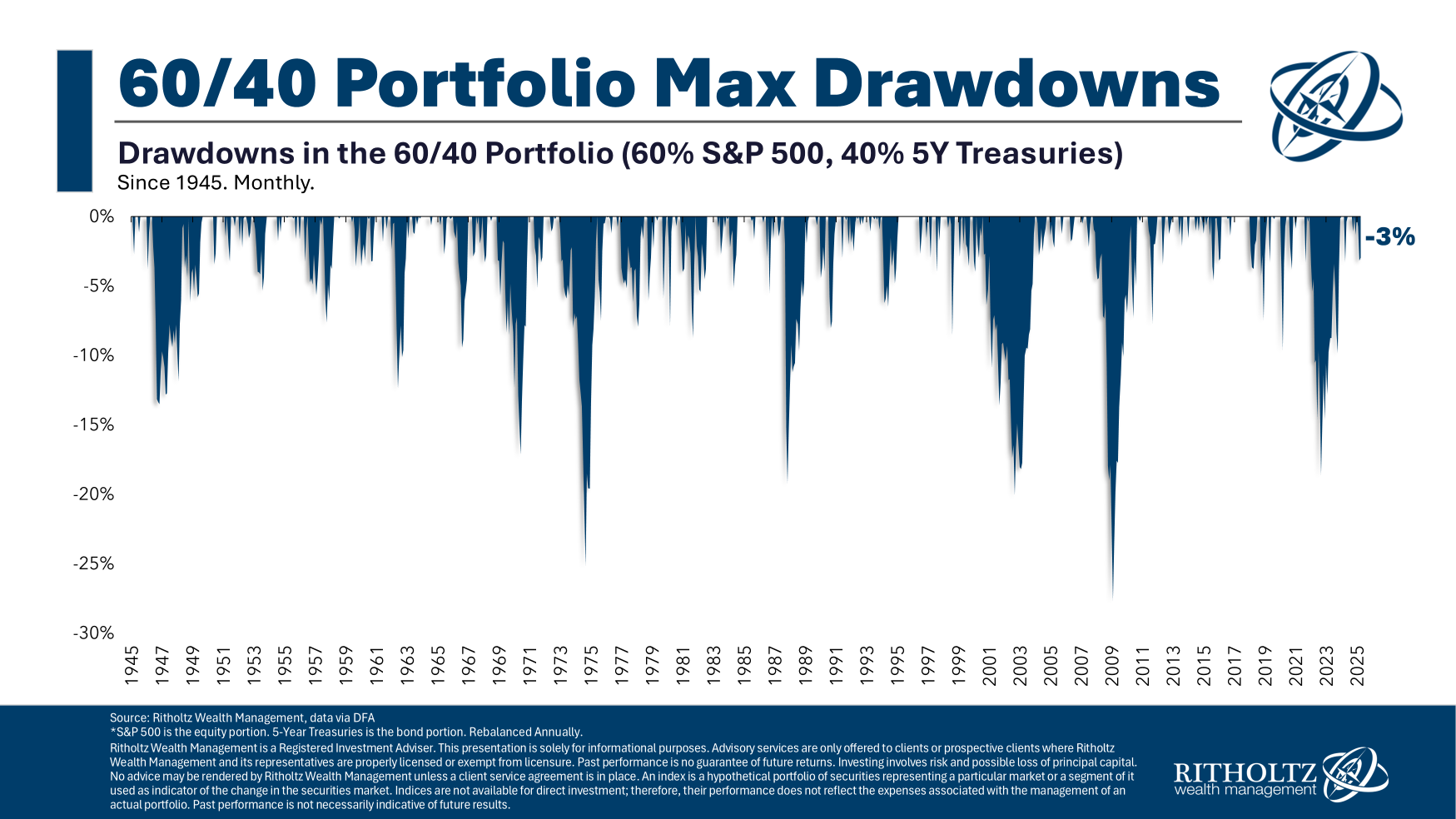

Now that the caveats are out of the best way, right here is the drawdown profile for a 60/40 portfolio consisting of the S&P 500 and 5 yr Treasury bonds going again to the top of World Battle II:

You possibly can see there haven’t been that many down downturns of 20% or worse so I’m going to incorporate all double-digit corrections right here to solid a wider web.

By my calculations there have been eight double-digit drawdowns for a 60/40 portfolio since 1945. That compares with 44 double-digits drawdowns for the inventory market in that very same timeframe.

So the excellent news is a 60/40 portfolio does a very nice job of dampening volatility and lowering drawdowns. That’s one of many promoting factors of a balanced portfolio!

Now let’s take a look at the magnitude and size of these drawdowns:

A number of issues stand out from the information right here:

The drawdowns for a 60/40 portfolio are shallower, final simply as lengthy from peak-to-trough and take longer to recuperate from than the common inventory bear market.

These attributes all make sense due to the character of investing in bonds.

Mounted revenue acts because the shock absorber throughout most inventory market sell-offs2 so it is sensible that the losses are extra muted.

For instance, the S&P 500 has had 17 down years since 1945, with a median lack of -13%. The common return for five yr Treasuries in those self same down years was +5.3%.

It’s additionally fascinating to notice that the restoration intervals take for much longer for a 60/40 portfolio than the inventory market. The common breakeven was 29 months.

This additionally is sensible as a result of mounted revenue returns are usually a lot decrease than inventory market returns. And that is very true popping out of a bear market when the inventory market tends to take off like a rocket ship.

A balanced portfolio mixes the tortoise with the hare.

The wonderful thing about a balanced portfolio is you possibly can take distributions from the mounted revenue facet of the ledger if you’ll want to spend down a few of your investments. That manner you’re not promoting shares whereas they’re down. Or you possibly can lean into the ache and rebalance into shares after they’re on sale.

Investing is all the time and ceaselessly about trade-offs and remorse minimization.

Balanced portfolios are usually not an ideal answer as a result of good options don’t exist within the markets.

However a 60/40 portfolio continues to be a fairly good choice for these traders who want decrease volatility, decrease drawdowns and extra stability than investing solely within the inventory market.

I did a deep dive into this query on Ask the Compound this week:

Invoice Candy joined me on the present once more to debate questions from our viewers about harvesting beneficial properties in your inventory portfolio to diversify, distant work for much less cash versus going again to the workplace for extra, mis-timing the market and selecting the correct benchmark on your investments.

Additional Studying:

How Lengthy Does it Take For Shares to Backside in a Bear Market?

1This implies the drawdowns would possible look a bit worse however that is horseshoes and hand grendades — shut sufficient is sweet sufficient.

2Most, not all. The 2022 bear market noticed each shares and bonds fall.