Have you ever ever requested your self, “How a lot cash do I have to retire comfortably?” If that’s the case, you’re positively not alone, and it’s one thing that I’ve calculated many occasions as properly! This is without doubt one of the most typical cash questions I hear, and I fully perceive why. Planning for retirement can really feel overwhelming, particularly when…

Have you ever ever requested your self, “How a lot cash do I have to retire comfortably?” If that’s the case, you’re positively not alone, and it’s one thing that I’ve calculated many occasions as properly!

This is without doubt one of the most typical cash questions I hear, and I fully perceive why. Planning for retirement can really feel overwhelming, particularly once you see folks throwing round numbers like $1 million, $2 million, or extra. However the fact is, there’s no one-size-fits-all reply.

What issues most is your private way of life, spending habits, and retirement objectives.

Greatest Methods To Calculate How A lot Cash You Want To Retire Comfortably

On this article, I’m going to interrupt this matter down into straightforward steps so you can begin determining your individual retirement quantity with out feeling burdened, confused, or like the entire thing (retirement) is inconceivable.

Really helpful studying: How To Save For Retirement – Solutions To 13 Of The Most Widespread Questions

1. Take into consideration what “retire comfortably” means to you

Retirement, and even retiring comfortably, will imply one thing totally different to everybody.

Earlier than you determine how a lot cash you want, you first have to consider what a cushty retirement appears to be like like for you.

For some folks, which means touring the world, happening cruises (equivalent to costly world cruises!), or spending winters someplace heat. For others, it would imply downsizing to a smaller house, having fun with hobbies like gardening or studying, and spending time with grandkids.

Retirement appears to be like totally different for everybody, as you possibly can see.

Right here’s a superb train to do – take into consideration one full day in your dream retirement and questions like: What time do you get up? What do you eat? Are you enjoyable, touring, or working a part-time job you want? Are you dwelling in the identical home, or have you ever moved to a smaller house or a brand new metropolis?

Then, write down what sorts of bills associate with the approach to life you’d wish to stay. This can assist you identify whether or not you’ll want roughly than the “customary” retirement quantity suggestions.

You may as well make an inventory of belongings you need in your retirement, equivalent to a journey finances, serving to your children or grandkids, or conserving a second house. Then, construct your retirement plan round these core objectives.

2. Retirement guidelines of thumb (stored easy)

There are just a few useful guidelines you should use to estimate how a lot cash you would possibly have to retire. These aren’t good and I did simplify this lots, however they’re a superb place to start out.

- The 25x rule – Multiply your anticipated yearly prices by 25. So, if you wish to spend $40,000 a 12 months in retirement, then you definitely’ll want $1,000,000 saved.

- The 4% rule – This implies you possibly can withdraw 4% of your retirement portfolio annually with out operating out of cash too shortly. So, when you’ve got $1 million saved, you may withdraw $40,000 per 12 months.

Okay, I do know these two guidelines sound comparable, and that’s as a result of they’re! The 25x rule focuses on how a lot to avoid wasting earlier than your retirement. The 4% rule, then again, focuses on how a lot you possibly can safely withdraw out of your retirement financial savings annually in retirement.

Now, I do need to say that these guidelines often work finest in case your cash is invested and continues to develop throughout retirement (hiya, compound curiosity!). When you’re planning to stay off money financial savings alone, or if you wish to maintain every little thing in low-interest accounts, you’ll most probably want to avoid wasting extra as a result of your cash received’t be rising.

Really helpful studying: What Are Dividends & How Do They Work? A Newbie’s Information

3. Estimate your retirement bills

Understanding how a lot you suppose you’ll want is one factor, however truly understanding your bills is the place the actual planning begins.

Begin by monitoring your present month-to-month bills.

Break them into classes like:

- Housing: lease/mortgage, property taxes, house upkeep/repairs, and HOA charges

- Utilities: electrical energy, gasoline, water, web, telephone, and sewer

- Meals: groceries and eating places

- Transportation: gasoline, automotive insurance coverage, automotive funds, and repairs

- Well being: insurance coverage premiums, prescriptions, copays, dental, and imaginative and prescient

- Journey and enjoyable: holidays, hobbies, and leisure (like listening to stay music or going to the films)

- Private: clothes, haircuts, presents, and subscriptions

When you’ve obtained your present finances, ask your self: Will this improve, lower, or keep the identical in retirement? I do know it’s arduous to estimate now, however the first 12 months of retirement might look fully totally different when it comes to bills than you suppose in the event you don’t plan for it.

Some bills will seemingly go down, like commuting, childcare, or enterprise apparel. However others, equivalent to healthcare and journey, would possibly go up. The quantity that you simply spend on hobbies might go up as properly as a result of you should have extra free time. Don’t neglect about inflation, both. A greenback right now received’t purchase as a lot 20 or 30 years from now.

So many individuals assume that they’ll spend much less in retirement, however that’s not at all times the case. Many individuals spend more cash!

4. Will you’re employed or earn revenue in retirement?

Not everybody desires to cease working fully.

The truth is, many retirees select to work part-time, freelance, or begin facet hustles in retirement. I believe doing one thing you want, even when it’s just some hours per week, could make you further revenue and in addition make you content.

Listed here are some retirement facet hustle concepts:

- Train music classes, tutor, or babysit

- Promote crafts or handmade gadgets on Etsy

- Do freelance writing, bookkeeping, proofreading, or digital assistant work

- Work at a nationwide park, museum, or retailer

- Seek the advice of for companies

Even bringing in $500 to $1,000 a month can assist stretch your financial savings and offer you extra monetary freedom. It will probably additionally assist you to retire earlier or spend extra freely.

I believe an incredible process for this part is to ask your self: Would you need to do a small quantity of labor in retirement if it helped you retire sooner or journey extra?

Really helpful studying: 17 Greatest Retirement Aspect Hustles

5. The place you reside issues

Your location can have a big impact on how a lot cash you could retire comfortably. It’s because dwelling in a high-cost-of-living space means you’ll want more cash saved so to afford your bills.

Some retirees select to:

- Transfer to a smaller house

- Transfer to a lower-cost state with no revenue tax (like Florida or Texas)

- Relocate to a walkable group and go car-free (many cities give out free or closely discounted public transportation passes too!)

- Transfer overseas to a rustic with a decrease price of dwelling

For instance, somebody dwelling in San Francisco will seemingly want rather more in retirement financial savings than somebody dwelling in rural Tennessee. Housing, healthcare, groceries, and extra can all differ a lot, even inside the identical nation.

6. Don’t neglect about healthcare

Healthcare prices are inclined to rise as you age (plus, they’re rising for nearly everybody anyway!), and so they can eat up a giant chunk of your retirement finances in the event you’re not ready.

Whereas Medicare can assist pay for a lot of bills after the age of 65, it doesn’t pay for every little thing. You should still must pay for:

- Copays and deductibles

- Dental and imaginative and prescient care

- Pharmaceuticals

- Lengthy-term care or in-home assist

One approach to plan forward is by utilizing a Well being Financial savings Account (HSA) in the event you’re eligible. HSAs have nice tax advantages: your contributions are tax-deductible; they develop tax-free; and withdrawals for medical bills are tax-free too.

I personally have a good friend who retired however then went again to work part-time (for a similar employer) in order that their household may have free medical health insurance (their employer paid for medical health insurance). So, this can be one thing to look into as properly.

Really helpful studying: 15 Half Time Jobs With Well being Insurance coverage

7. Instruments that will help you determine your retirement quantity

When you’re not a spreadsheet individual or don’t need to use a monetary advisor, don’t fear, there are many free instruments that may assist you determine your retirement quantity by yourself.

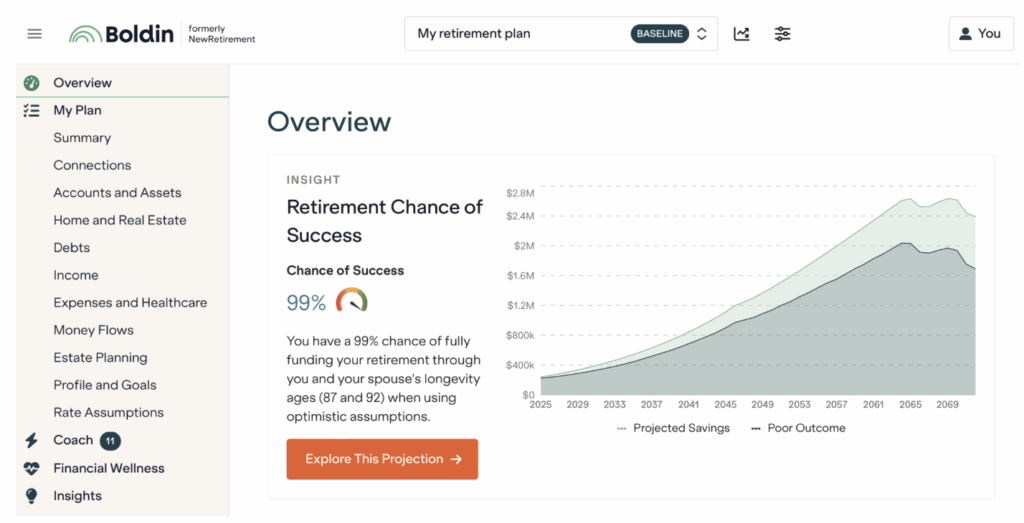

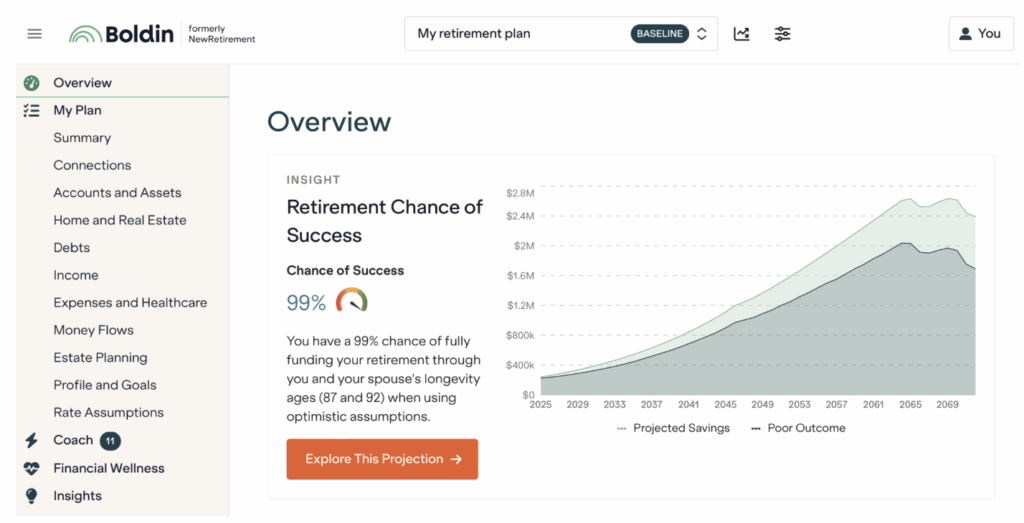

One in style instrument is Boldin. I just lately examined it, and I cherished how easy it was. You possibly can hyperlink your accounts or enter your revenue and financial savings manually. It provides you an easy-to-understand image of your progress towards retirement and even suggests the way to enhance your retirement plan.

You possibly can click on right here to start out a free Boldin account and use their retirement calculator and platform to:

- Be taught what age you possibly can retire

- See your web value

- Calculate your estimated retirement revenue and bills

- Determine the very best age to get Social Safety

And extra.

One other in style free choice to plan your retirement is with Empower (this was once known as Private Capital).

It’s okay in the event you’re not there but

When you’re studying this and pondering, “I’m up to now behind, I’ll by no means retire,” please know that you’re not alone, and it’s by no means too late to start out.

The vital factor is to start out right now, even when it’s only a small step like studying this text!

Listed here are just a few different methods to get began:

- Improve your retirement contributions

- Open or max out a Roth or 401(okay)

- Eradicate debt to decrease your month-to-month bills

- Downsize your own home or automotive

- Search for methods to earn further revenue and make investments it

- Discover part-time work in retirement to make your retirement financial savings last more

Now, I do need to say that you simply do not need to be good and each little bit helps. The sooner you begin, the extra time your cash has to develop, however even beginning later can nonetheless result in a cushty retirement.

So, simply begin!

Steadily Requested Questions

Beneath are solutions to widespread questions on how to determine how a lot cash you could retire comfortably.

Are you able to retire at 60 with $500K?

This depends upon your way of life and whether or not you’ve gotten different revenue sources like Social Safety or a pension. When you stay in a low-cost space and maintain your spending low, then it’s potential, however I believe it’s at all times useful to have a plan!

Are you able to retire with $1.5 million comfortably?

Sure, for many individuals that is greater than sufficient in a retirement account, particularly in the event you spend round $60,000 or much less per 12 months. This quantity provides you flexibility, particularly if your own home is paid off and also you don’t produce other debt.

Is $300,000 sufficient to retire on with Social Safety?

It may very well be sufficient for a modest retirement, particularly in the event you stay in a low-cost space and you’ve got Social Safety advantages. Nevertheless, it could require some budgeting.

Can I retire at 55 with $2 million?

Presumably, sure! It actually depends upon how a lot cash you spend annually to know if the $2,000,000 will final you. However, for many individuals, that is greater than sufficient cash to avoid wasting for retirement.

Is $40,000 a 12 months sufficient to stay on in retirement?

Whether or not or not $40,000 a 12 months is sufficient to stay on in retirement depends upon your location, way of life, and whether or not your own home is paid off. Many retirees stay on this quantity or much less, nevertheless it simply depends upon you and your spending.

What is an efficient month-to-month revenue in retirement?

An excellent month-to-month revenue depends upon many issues, equivalent to your retirement way of life (do you need to journey? have any costly hobbies?), the place you reside (California and Hawaii are usually going to be dearer than Arkansas, for instance), and whether or not you’ve gotten debt.

Can I retire and not using a mortgage?

Sure, and many individuals plan their retirement round paying off their houses. I believe it’s an incredible objective to have as a result of, and not using a mortgage, your month-to-month bills might be a lot decrease, making it simpler to stay on a set revenue that’s decrease.

Do I have to think about inflation when planning for retirement?

Sure! Costs for every little thing, like meals, housing, and healthcare, go up over time. When you want $50,000 per 12 months right now, it’s possible you’ll want $65,000 or extra in 10 to fifteen years. So, ensure that your retirement plan grows with inflation.

How A lot Cash Do You Want To Retire Comfortably? – Abstract

I hope you loved my article on how to determine how a lot cash you could retire comfortably.

Personally, that is one thing I take into consideration on a regular basis. I’ve spent years making a life and enterprise that offers me freedom and adaptability. However retirement crosses my thoughts (on a regular basis, to be trustworthy – I really feel like that is regular for a monetary knowledgeable, ha), particularly now that I’ve a daughter and need to ensure that we’re financially free long-term and perpetually.

There’s no precise retirement quantity that works for everybody, so understanding your individual way of life, bills, and objectives will enable you create a plan that works for you.

For some folks, the quantity could also be $500,000, and for others, it could be $5,000,000. I personally know individuals who have retired on every of those quantities and a few who’ve retired on even much less as properly. And, they’re all glad!

What does your dream retirement appear to be? Have you ever discovered your retirement quantity but?

Really helpful studying: