The UK economic system is heading right into a malaise. The most recent information – UK development exercise in July falls at steepest price since Covid (August 6, 2025) – and – UK providers sector has greatest fall in orders for practically three years (August 5, 2025) – confirms that there’s a slowdown underway. That was prefaced by rising unemployment and falling total GDP progress in earlier knowledge releases. Nevertheless, once we study statements coming from the Labour authorities, the Prime Minister is hinting that there is likely to be tax rises within the Autumn Assertion as a result of a neoliberal oriented ‘suppose tank’ has instructed it that there’s a £40 billion hole within the fiscal outcomes, which is able to breach the self-imposed limits specified of their fiscal guidelines. So the Authorities is considering extra austerity and contractionary coverage at a time when personal spending is subdued and the economic system goes backwards. It simply demonstrates how the obsession with these fiscal guidelines grossly distorts fiscal choice making and focuses authorities eyes on all of the fallacious issues. I’m nonetheless amazed once I suppose how silly all of us have grow to be for considering that any of the stuff is appropriate.

So the place are we at?

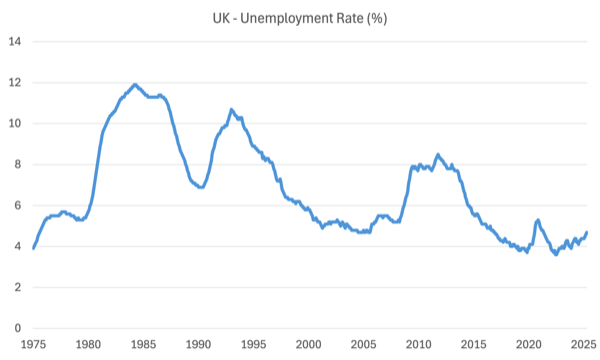

Right here is the newest unemployment price graph – it was 4.7 per cent and rising within the second quarter 2025.

In accordance the newest Workplace of Nationwide Statistics bulletin (revealed July 17, 2025) – Labour market overview, UK: July 2025 – all the opposite labour market indicators are heading within the fallacious course.

1. “Estimates for payrolled workers within the UK fell by 135,000 (0.4%) between Might 2024 and Might 2025, and by 25,000 (0.1%) between April and Might 2025.”

2. “Vacancies are down on the quarter and are beneath pre-pandemic ranges”.

3. “Each common and whole nominal pay annual progress charges are down on the earlier interval.”

4. “The actual annual progress price for each common and whole (earnings) are down on the earlier interval.”

5. “The unemployment price is up on the quarter and the 12 months, and is above pre-pandemic charges. .”

6. “The financial inactivity price is down on the quarter and down on the 12 months, however continues to be above pre-pandemic charges.”

You then add the survey proof that (Supply):

… whole new work within the sector, which accounts for about 80% of the economic system, eased to the slowest tempo since November 2022.

And that (Supply):

Exercise within the UK development sector fell final month on the sharpest price for the reason that top of the Covid pandemic amid a collapse in housebuilding, underscoring the problem dealing with the federal government to fulfill its 1.5m new properties goal.

And what will we get?

An economic system heading in the direction of recession.

So then what ought to the Prime Minister being eager about?

Effectively, in keeping with the newest interview – Starmer declines to rule out election pledge-breaking tax rises in price range after declare Treasury should fill £40bn deficit – because it occurred (August 6, 2025) – his technique seems to be to start out conditioning the general public for a tax rise:

Keir Starmer has defended the federal government’s dealing with of the economic system, however declined to rule out tax rises within the autumn price range.

Which if a tax rise transpired could be precisely the other to what the Labour authorities ought to be doing given the circumstances.

The “£40bn deficit” reference is to a report that was issued yesterday from the Nationwide Institute of Financial and Social Analysis (NIESR), which was once a stalwart analysis and coverage improvement organisation with a Keynesian persuasion however now has grow to be one of many mainstream organisations pushing the fiscal fictions of neoliberalism,

Sadly.

Anyway, in its – Report – the NIESR stated that:

The UK economic system enters the second half of 2025 nonetheless confronting weak progress and cussed inflationary pressures … home challenges dominate the outlook. Chief amongst these is the federal government’s more and more acute fiscal predicament. Merely put, the chancellor can not concurrently meet her fiscal guidelines, fulfil spending commitments, and uphold manifesto guarantees to keep away from tax rises for working individuals. At the very least certainly one of these will must be dropped – she faces an inconceivable trilemma.

However they additional famous that:

The federal government is now not on observe to fulfill its “stability rule”, with our forecast suggesting a present deficit of £41.2bn within the fiscal 12 months 2029–30. With the autumn price range approaching, the chancellor faces unenviable choices.

And:

1. Departmental budgets are already minimize to the bone – “limiting scope for additional cuts”.

2. “the poorest 10% of UK households face an extra decline of their dwelling requirements this 12 months.”

3. The Authorities should breach “its fiscal guidelines – risking increased borrowing prices and even market instability” or enhance taxes and minimize spending

Put all of the items collectively:

1. Economic system is beginning to tank and unemployment is rising.

2. The federal government is being urged to implement much more main fiscal austerity.

2. Which is able to make the already considerably deprived much more worse off than earlier than.

That is trendy Britain – a nation that has allowed ideology to run rampant.

However ask the query: Why do the items need to fall in that approach?

Reply: As a result of the Labour authorities has put itself in voluntary fiscal straitjacket known as its fiscal guidelines, which have been by no means match for function, given the circumstances and are a very confected artefact of recent neoliberalism that serves the pursuits of the highest finish of city on the expense of everybody else.

It will get worse.

The newest ONS bulletin – Public sector funds, UK: June 2025 – launched July 22, 2025 – reveals that:

1. Central authorities borrowing is rising – “the second-highest June borrowing since month-to-month data started in 1993”.

2. “The curiosity payable on central authorities debt was £16.4 billion in June 2025, largely as a result of the curiosity payable on index-linked gilts rises and falls with the Retail Costs Index; this was £8.4 billion greater than in June 2024 and the second-highest June central authorities curiosity payable since month-to-month data started in 1997, after that of June 2022.”

3. “The present price range deficit within the monetary 12 months to June 2025 was £44.5 billion; this was £6.5 billion greater than in the identical three-month interval of 2024 and the third-highest April to June present price range deficit since month-to-month data started, after these of 2020 and 2021.”

So that you get the image?

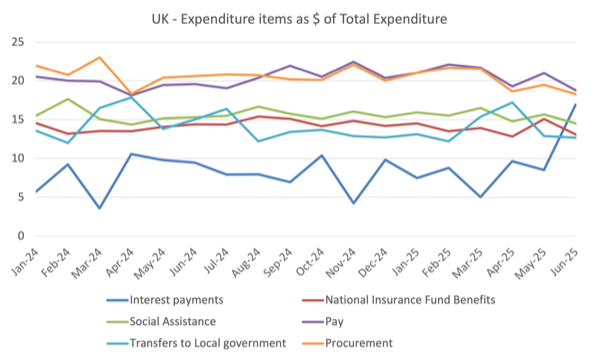

A deeper evaluation of the expenditure actions is kind of attention-grabbing.

Utilizing the ONS dataset – Public sector funds abstract tables: Appendix M (revealed July 22, 2025) we discover that curiosity funds have skyrocketed as famous above.

The next graph reveals the primary elements of central authorities expenditure as a proportion of whole present expenditure from January 2024 to June 2025.

Curiosity funds have risen from 5.7 per cent to 16.9 per cent whereas all the opposite main elements have misplaced share in whole present expenditure – because the cuts have proceeded.

So even whole present expenditure has risen by 23.3 per cent over that point, curiosity funds have risen by 264 per cent.

One other factor to notice is that nominal web funding expenditure by the central authorities has fallen by 67.7 per cent since January final 12 months.

The three issues which you could glean from these developments are:

1. There may be widespread austerity being imposed on public sector together with native authorities.

2. The Labour authorities is undermining the already depleted public infrastructure by slicing its capital spending as a part of its ‘invisible’ austerity.

I exploit that time period ‘invisible’ as a result of governments sometimes implement austerity by massive cuts to capital initiatives as a result of the general public are much less acutely aware of the implications.

It takes a while earlier than the bridges and sewers collapse and roads put on out and so forth.

Ultimately although the funding required to repair the harm when it does begin to manifest far outweigh any on-going upkeep and enchancment outlays.

Neoliberal myopia.

3. The large enhance in expenditure on curiosity funds are going to the rich together with speculators on the expense of the poorest individuals in Britain.

Then take into consideration this.

As famous above, the ONS inform us that the skyrocketing curiosity funds are “largely as a result of the curiosity payable on index-linked gilts rises”.

What are these debt devices?

Index-linked Gilts – “differ from standard gilts in that each the semi-annual coupon funds and the principal cost are adjusted consistent with actions within the Common Index of Retail Costs within the UK (also referred to as the RPI).”

The British Treasury launched a – Financial Progress Report – in Might 1981, which sought to justify its choice to subject the sort of asset (first subject was March 27, 1981).

In that Report the Treasury argued that whereas the listed gilts could be “marketable” (that’s, may very well be purchased and bought in secondary markets) the possession of these belongings was:

… restricted basically to pension funds, and to life insurance coverage corporations and pleasant societies in respect of their UK pension enterprise solely. An establishment wishing to buy the inventory should signal a statutory declaration to the impact that it’s an eligible holder inside the phrases of

the prospectus. The inventory could solely be purchased and bought by eligible holders.

I gained’t go into the explanations they gave for these restrictions.

Suffice to say the restrictions have been eliminated in March 1982 only a 12 months after the Treasury had argued vehemently for the restrictions.

The Treasury additionally stated that “listed borrowing imposes self-discipline, in that it turns into much less simple for Authorities to inflate as a approach of resolving speedy difficulties.”

Which is likely one of the main causes they preserve issuing these completely pointless devices.

They’re certainly one of a number of voluntarily imposed fiscal constraints that make it tougher for presidency to function.

Who owns these monetary devices?

Information from the UK Debt Administration Workplace – Distribution of gilt holdings – reveals that as at August 6, 2025

1. Whole Quantity Excellent (together with inflation uplift for index-linked gilts) = £2,761.80 billion nominal for the Gilt market.

2. Of that 24.3 per cent are index-linked – some £670,987 billion.

As on the third-quarter 2024 (newest knowledge) – Distribution of gilt holdings – on possession reveals that of that excellent gilt legal responsibility:

1. 30.5 per cent was owed to financial monetary establishments.

2. 21.1 per cent to insurance coverage corporations and insurance coverage funds.

3. 15.9 per cent to different monetary establishments.

4. 32.1 per cent to abroad holdings.

So not solely is the British authorities compromising the foremost coverage departments (and repair scope and requirements) which has a detrimental affect on odd British individuals, however it continues to subject belongings to “abroad holdings” that enrich the rich who will not be even within the nation.

And in the meantime, they’ve considerably minimize abroad assist which has helped the least advantaged in different nations.

It’s a poisonous combine.

And why?

Central to the why is the ridiculous obsession with the fiscal guidelines.

Conclusion

My evaluation stays the identical: in attempting to fulfill the parameters of the self-imposed fiscal guidelines, the British authorities will undermine the actual economic system and inflict hardship on the least advantaged residents.

I agree with the NIESR that the federal government can not meet the fiscal guidelines until it inflicts additional important austerity and drives the economic system into recession.

Even then, the recession will scale back tax income and enhance some parts of expenditure, which is able to make it exhausting to get inside the fiscal guidelines boundaries.

And all for?

Nothing of consequence.

That’s sufficient for right now!

(c) Copyright 2025 William Mitchell. All Rights Reserved.