The Australian Bureau of Statistics (ABS) launched the newest labour drive information in the present day (August 14, 2025) – Labour Power, Australia – for July 2025, which reveals that final month’s gloom won’t have been the beginning of a downward development. The present information has blurred that outlook and the very best we are able to say is that the longer term is unsure. The virtuous three have been evident this month: rising employment (significantly full-time), fixed participation, and falling unemployment. Underemployment additionally fell 0.1 level on account of the robust full-time employment end result. It stays a incontrovertible fact that with 10.1 per cent of accessible labour not getting used it’s ludicrous to speak about Australia being near full employment. There’s substantial scope for extra job creation given the slack that’s current.

The abstract seasonally-adjusted statistics for July 2025 are:

- Employment rose 24,500 (0.2 per cent).

- Full-time employment rose 60.5 thousand (0.6 per cent).

- Half-time employment fell 35.9 thousand (-0.8 per cent).

- Unemployment fell 10,200 (-1.5 per cent) to 649,000.

- The unemployment price fell 1 level to 4.2 per cent.

- The participation price was regular on 67 per cent.

- The Employment-population ratio was regular on 64.2 per cent.

- Month-to-month hours labored rose 6.3 million (0.32 per cent).

- Underemployment fell 0.1 level to five.9 per cent (falling 16.3 thousand to 896.4 thousand).

- The Broad Labour Underutilisation price (the sum of unemployment and underemployment) fell 0.2 factors to 10.1 per cent.

- Total, there are 1543.3 thousand folks both unemployed or underemployed.

The ABS press launch – Unemployment price falls to 4.2% as feminine participation hits report excessive in July – famous that:

The seasonally adjusted unemployment price fell to 4.2 per cent in July …

Progress in employment was pushed by full-time employment, which was up by 60,000 folks, with a 36,000 individual fall in part-time employment partly offsetting this rise. Feminine full-time staff grew by 40,000 whereas male full-time staff rose by 20,000.

The expansion in employment resulted within the employment-to-population ratio rising barely to 64.2 per cent. The participation price stayed at 67.0 per cent. The feminine employment-to-population ratio and participation price reached 60.9 per cent and 63.5 per cent respectively, each new historic highs …

The underutilisation price, which mixes the unemployment and underemployment charges, fell by 0.2 proportion factors to 10.1 per cent. This was 0.4 proportion factors decrease than July 2024, and three.8 proportion factors decrease than March 2020.

Abstract

1. A slight reversal on final month’s deteriorating end result – however month-to-month figures transfer round so it’s actually too early to inform which manner the labour market is heading.

2. The big drop in full-time employment final month was reversed.

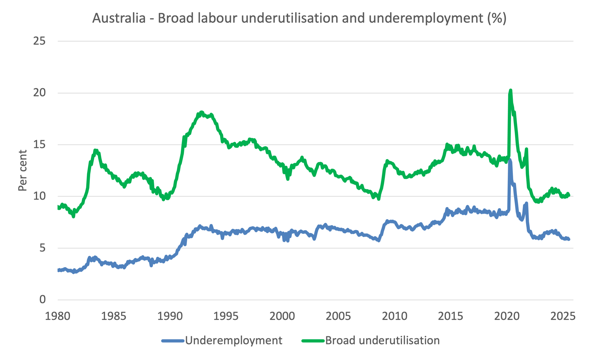

3. There’s now 10.1 per cent of the accessible and keen labour provide being wasted regardless of the modest drops within the official unemployment price and underemployment.

Employment progress stronger in July

- Employment rose 24,500 (0.2 per cent).

- Full-time employment rose 60.5 thousand (0.6 per cent).

- Half-time employment fell 35.9 thousand (-0.8 per cent).

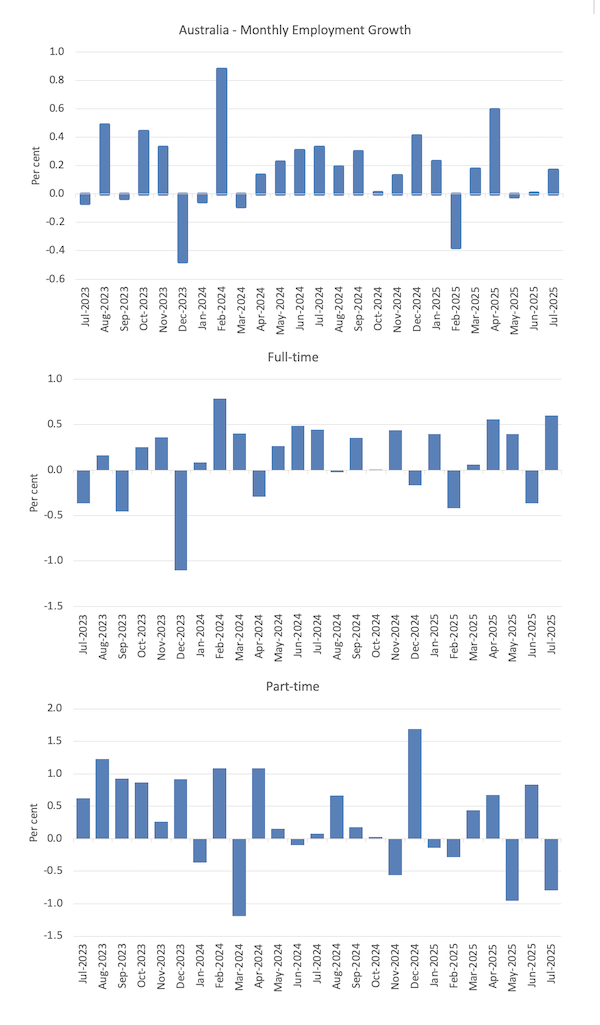

The next graph reveals the expansion in complete, full-time, and part-time employment for the final 24 months.

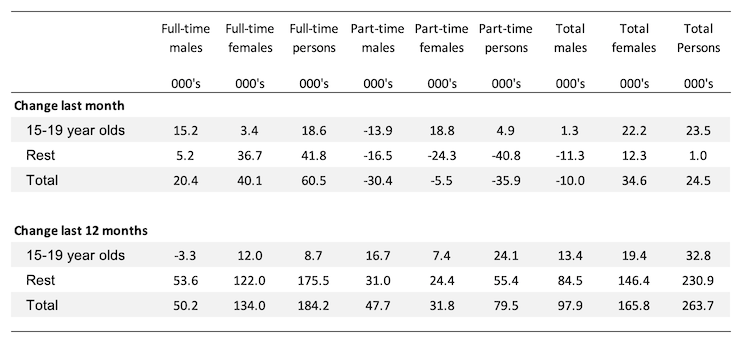

The next desk reveals the shifts over the past 6 months which helps to see the underlying development.

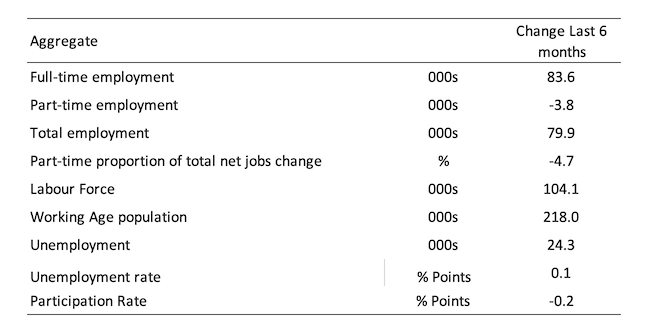

The Employment-to-Inhabitants ratio gives a measure of the state of the labour market that’s unbiased of the provision shifts within the labour market (pushed by the shifts within the participation price).

The underlying working age inhabitants grows steadily whereas the labour drive shifts with each underlying inhabitants progress and the participation swings.

The next graph reveals the Employment-Inhabitants ratio was regular at 64.2 – which gives some counter to the opposite variables which are indicating a scientific slowdown is underway.

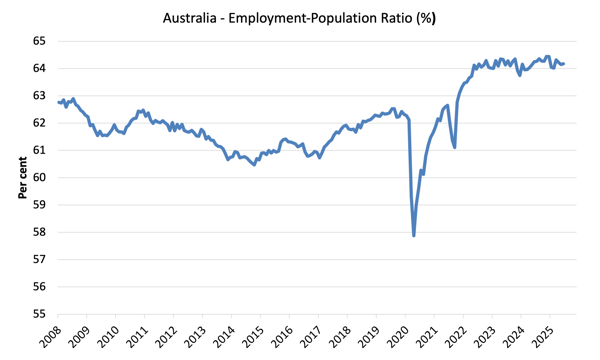

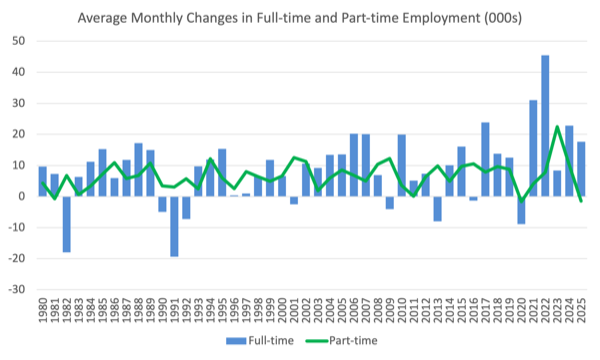

The subsequent graphs present the common month-to-month change in complete employment (first graph) and full- and part-time employment (second graph).

For complete employment the month-to-month common modifications have been:

- 2022 – 44.8 thousand

- 2023 – 30.8 thousand

- 2024 – 33 thousand

- 2025 to this point – 16.2 thousand

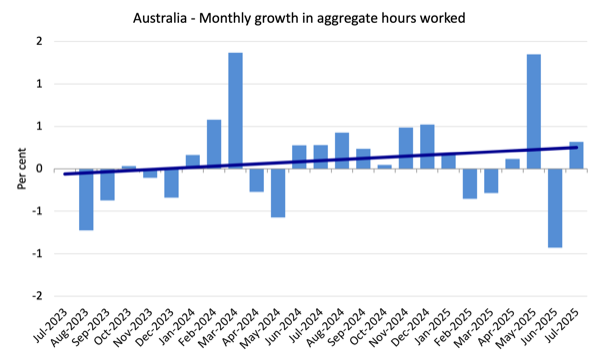

Month-to-month hours labored rose 6.3 million (0.32 per cent) in July 2025

A slight restoration from final month.

The next graph reveals the expansion in month-to-month hours labored for the final 24 months, with the straight line being a easy linear regression to point development.

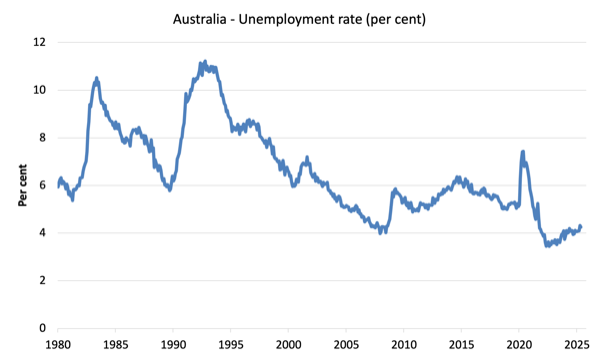

Unemployment fell 10,200 (-1.5 per cent) to 649,000 in July

A great end result – full-time employment rising, participation fixed and unemployment declining modestly.

The next graph reveals the evolution of the official unemployment price since 1980.

Broad labour underutilisation – down 0.2 factors in July

- Underemployment fell 0.1 level to five.9 per cent (falling 16.3 thousand to 896.4 thousand).

- The Broad Labour Underutilisation price (the sum of unemployment and underemployment) fell 0.2 factors to 10.1 per cent.

- Total, there are 1543.3 thousand folks both unemployed or underemployed.

The next graph reveals the evolution of underemployment and the Broad labour underutilisation price since 1980.

Teenage labour market – enchancment

- Complete teenage (15-19) employment rose 23.5 thousand (2.8 per cent) in July 2025.

- Full-time employment rose by 18.6 thousand (10.5 per cent).

- Half-time employment rose 4.9 thousand (0.7 per cent).

The next desk summarises the shifts within the teenage labour marketplace for the month and over the past 12 months.

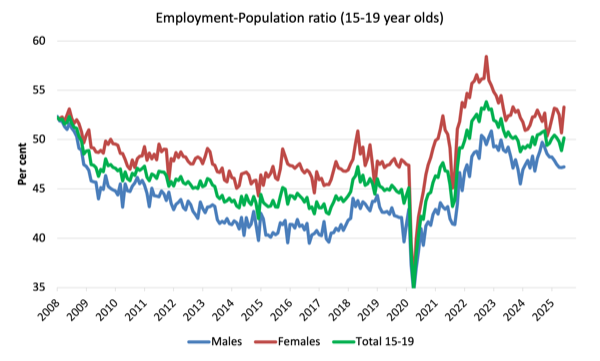

To place these modifications right into a scale perspective (that’s, relative to dimension of the teenage labour drive) the next graph reveals the shifts within the Employment-Inhabitants ratio for youngsters.

The Teenage Employment-Inhabitants ratios and their month-to-month modifications in July 2025 have been:

- Males: 47.2 per cent unchanged

- Females: 53.3 per cent 2.6 factors – vital enchancment.

- Complete: 50.2 per cent 1.3 factors

Conclusion

My customary warning to take care in decoding month-to-month labour drive modifications – they will fluctuate for numerous causes and it’s imprudent to leap to conclusions on the again of a single month’s information.

- Final month, it appeared like there have been indicators of a scientific slowdown starting to unfold within the labour market.

- Nevertheless, the present information has blurred that outlook and the very best we are able to say is that the longer term is unsure.

- The virtuous three have been evident this month: rising employment (significantly full-time), fixed participation, and falling unemployment.

- Underemployment additionally fell 0.1 level on account of the robust full-time employment end result.

- It stays a incontrovertible fact that with 10.1 per cent of accessible labour not getting used it’s ludicrous to speak about Australia being near full employment. There’s substantial scope for extra job creation given the slack that’s current.

That’s sufficient for in the present day!

(c) Copyright 2025 William Mitchell. All Rights Reserved.