Once you personal shares you possibly can earn by way of Dividends and capital acquire/loss whenever you promote your shares. Once you personal shares listed outdoors the Indian inventory exchanges whether or not straight or by way of the ESPP, RSU, ESOP plans of your employer, taxation is totally different from the best way shares listed on Indian inventory exchanges are dealt with. On this article, we will cowl what to do whenever you personal Worldwide shares and you’ve got dividends? How are they taxed and proven within the ITR?

Taxation of Worldwide Shares

Investing in overseas shares is handled as funding in unlisted shares as they don’t seem to be listed on the Indian inventory alternate.

Taxation on Dividends of Overseas or Worldwide Shares

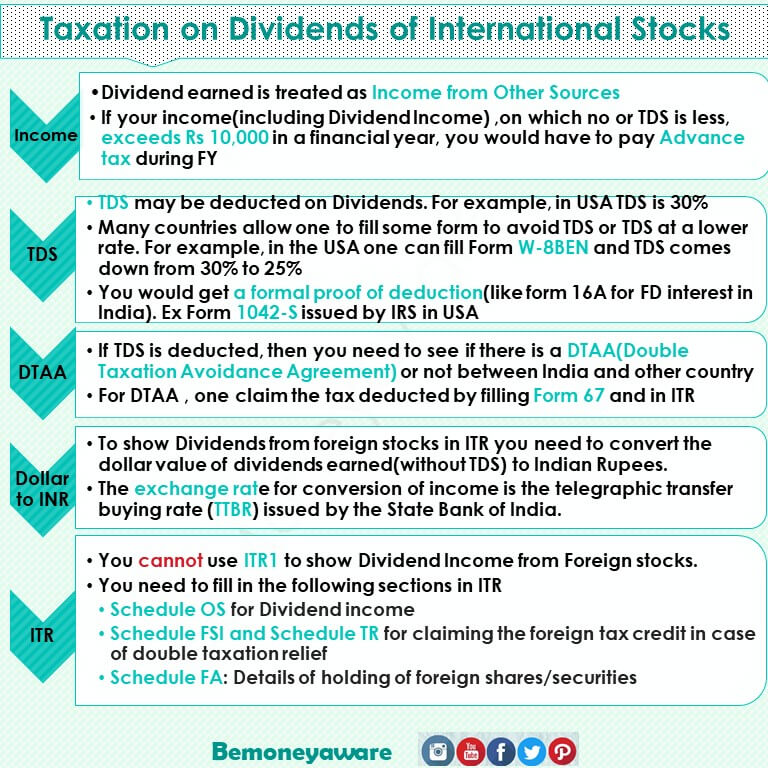

- Dividend earned is handled as Earnings from Different Sources (as within the Indian Shares).

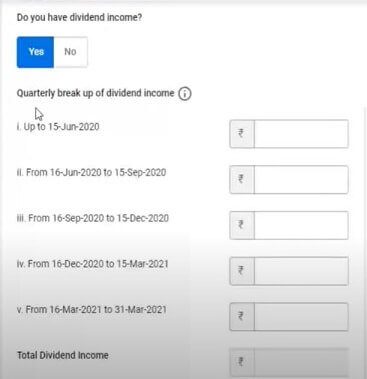

- In case your earnings on which the Indian govt has not deducted or has deducted much less tax, for instance, dividend earnings(Indian or Overseas), Curiosity on Mounted Deposit, exceeds Rs 10,000 in a monetary yr, you would need to pay Advance tax (that is true for the Indian Shares too)

- TDS could also be deducted on Dividends for instance for shares listed within the USA, TDS on dividends is deducted at 25% (it’s known as Tax withholding within the USA)

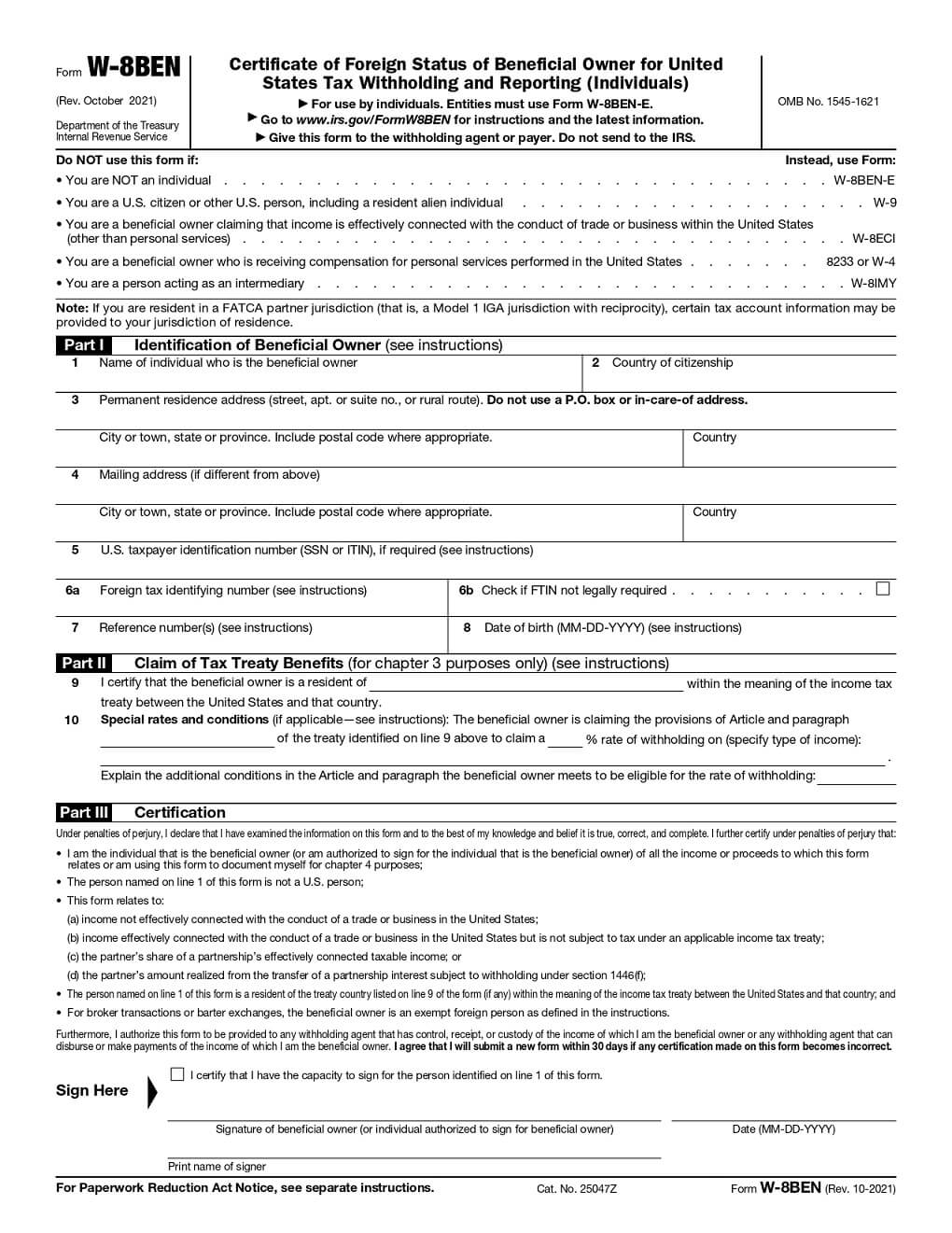

- Many nations enable one to fill some type to keep away from TDS or TDS at a decrease fee abroad instance within the USA one can fill Kind W-8BEN. Any dividends on US shares get taxed at a flat 30% for foreigners. Many nations, nonetheless, have earnings tax treaties with the US(known as DTAA), and residents of those nations get pleasure from a decrease tax fee on dividend earnings. Indian residents, for instance, pay a flat 25% withholding tax on dividends within the US. W-8 BEN type confirms the person’s eligibility for this diminished fee.

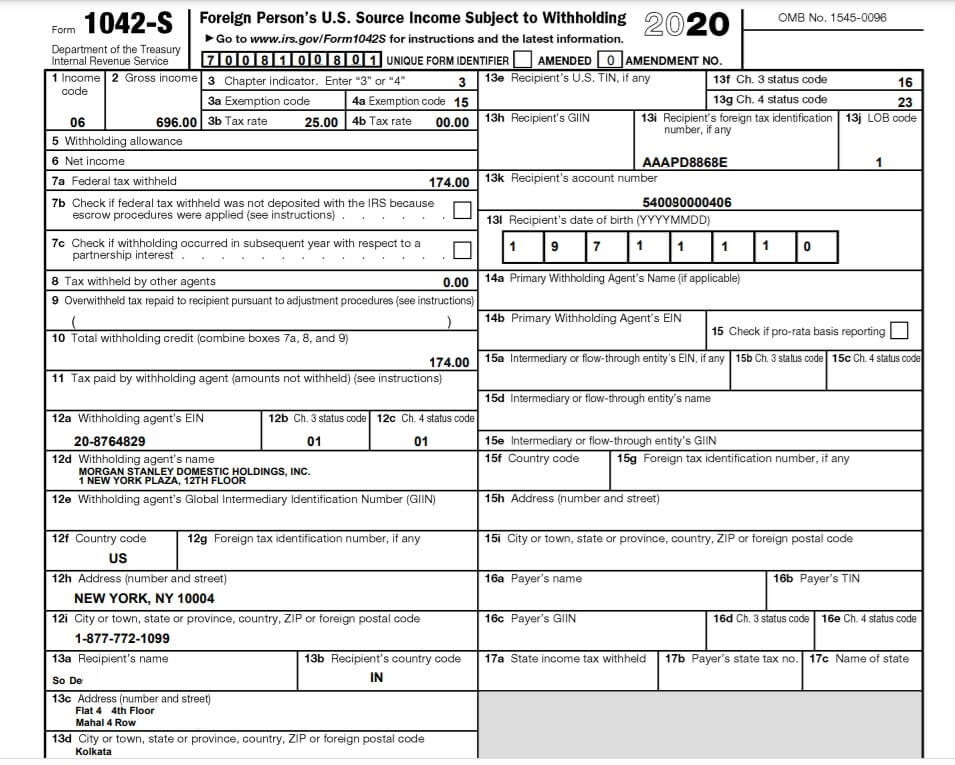

- You’ll get a formal proof of deduction(like type 16A for FD curiosity in India) for instance USA points Kind 1042-S which reveals the quantity earned and tax deducted.

- If TDS is deducted then it’s worthwhile to see if there’s a DTAA(Double Taxation Avoidance Settlement). If sure, then you’ll be eligible to say advantages beneath the DTAA.

- Then you possibly can declare the tax deducted by filling Kind 67 and in ITR(aside from ITR1 as you can not file ITR1 if in case you have overseas property) and pay the remaining tax as per your earnings slab or ask for a refund if additional tax has been deducted.

- To point out Dividends from overseas shares in ITR it’s worthwhile to convert the greenback worth of dividends obtained to Indian Rupees. This quantity needs to be the authentic quantity with out the tax deduction. For instance, Bharat obtained 100$ dividend however 25$ was deducted as tax so he obtained only75$ in his account. However he has to point out the unique quantity with out TDS(tax withheld)

- Beneath the Indian income-tax legislation, the alternate fee for conversion of earnings earned in overseas foreign money into Indian rupees is the telegraphic switch shopping for fee (TTBR) issued by the State Financial institution of India.

- You’re going to get TTBR for the related FY at SBI’s foreign exchange division.

- It’s also possible to get Charges of USD, YEN, Euro, on the RBI(Reserve Financial institution of India) webpage right here.

- Website http://mksco.in/forexrate/ has TTBR charges since 2020.

- You can’t use ITR1 to point out Dividend Earnings from Overseas shares. So if you’re salaried then it’s a must to use ITR2, ITR3.

- You must fill within the following sections in ITR for displaying Dividend Earnings

- Schedule OS for Dividend earnings

- Schedule FSI and Schedule TR for claiming the overseas tax credit score in case of double taxation aid

- Schedule FA: Particulars of holding of overseas shares/securities

Let’s take the instance of Bharat owns shares of Microsoft(he can both purchase it straight or as an worker, he may have gotten by way of ESPP/RSU).

He receives a dividend of $100 on which 25% of $100 ie 25 is deducted. The online payout of the dividend is $75 which will get credited to his account.

Bharat ought to add dividend earnings of $100 to his Earnings from Different Sources in his earnings tax return. The dividend earnings is taxed as per the relevant tax slabs.

He can declare a credit score of $25 that’s the tax withheld by the US firm. If he’s 20% tax slab then as extra tax is deducted he can declare for refund of this additional TDS but when he’s 30% tax he has to pay an additional tax of 5%(+ surcharge and cess)

Taxation on Capital Positive aspects of Worldwide Shares

Once you promote the shares then capital positive factors/loss come into play.

- For overseas shares held for greater than 24 months, the capital acquire is taken into account as Lengthy Time period and it’s taxed at 12.5% with out indexation advantages (efficient from July 23, 2024)

- For overseas shares held for lower than 24 months, the capital acquire is taken into account as Brief Time period and it’s taxed as per your earnings slab.

Particulars in our article Methods to present Capital Positive aspects on shares in ITR

TDS deducted on Dividend, Kind 1042-S, Kind W-8BEN of USA

In lots of circumstances, a non-citizen of a rustic has to pay the tax on the earnings it earns within the nation. For instance, an Indian proudly owning US shares(both purchased straight or by way of RSU/ESPP of MNCs) has to pay tax to that nation on that earnings reminiscent of dividends and Capital positive factors.

Kind W-8BEN

For the USA, One could also be requested to fill in Kind W-8BEN to keep away from TDS deductions. The shape is relevant to overseas people who earn cash or earnings from U.S. sources. US MNCs with workers in India usually submit W-8BEN to US brokers to keep away from any withholding associated to US taxes. So, people should present a accomplished W-8BEN type to their U.S consumer(brokers in case of shares) with a view to keep away from paying tax to the IRS(Inside Income Service). Pattern W8BEN type from www.irs.gov is proven under

Kind 1042-S: A proof of Tax Deducted in US

If any Tax is deducted you’ll get Kind 1042-S from USA IRS(Inside Income Service). Kind 1042-S is the shape used to report tax deducted (known as tax withheld) on Earnings paid to overseas individuals by a United States-based establishment or enterprise. Pattern type 1042-S is proven under. The Gross Earnings is 686 USD and Tax Charge is 25% so the Federal tax withheld is 174.

For extra info, see the Directions for Kind 1042-S from the IRS.

Declare Tax deducted on Dividend in Overseas nation

If TDS is deducted then it’s worthwhile to see if there’s a DTAA(Double Taxation Avoidance Settlement) between India and the nation through which the corporate is predicated. If sure, you’ll be eligible to say advantages beneath the Double Taxation Avoidance Settlement (DTAA). This can ensure you don’t need to pay tax on the identical earnings twice.

India has a double tax avoidance treaty with greater than 150 nations. For instance, the USA has DTAA with India.

So if tax deducted is a overseas nation then is that gone? No. you possibly can declare it

Declare TDS deducted abroad with DTAA: Kind 67

You might be required to submit Kind 67 if you wish to declare credit score of overseas tax paid in a rustic or outdoors India.

Kind 67 can solely be submitted on-line on the e-Submitting portal.

Kind 67 needs to be filed earlier than the due date of submitting of Earnings Tax return

Our article Methods to file Kind 67 covers it intimately.

Methods to present Dividend from Overseas shares in ITR

Dividend earnings of shares(each overseas and Indian) is taken into account as Earnings from different sources and is taxed as per the earnings slabs.

For dividends from Overseas shares, you can’t use ITR1

You must fill within the following sections in ITR for displaying Dividend Earnings

- Schedule OS for Dividend earnings

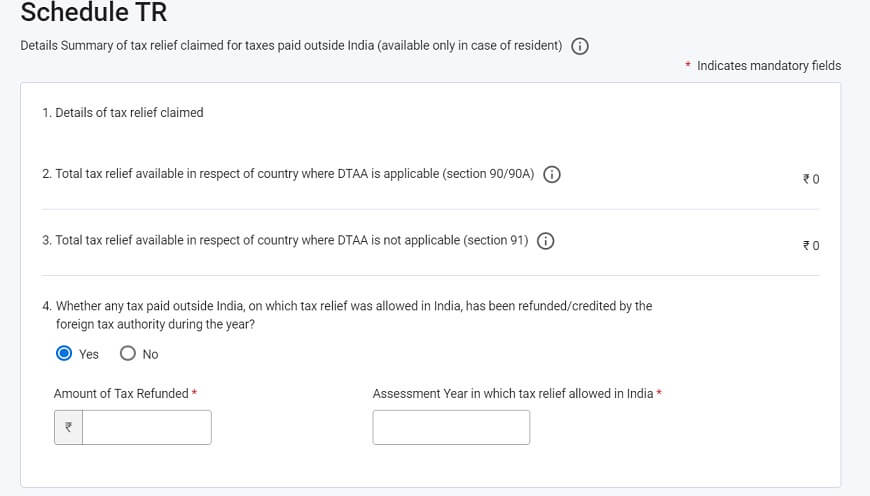

- Schedule FSI and Schedule TR for claiming the overseas tax credit score in case of double taxation aid

- Schedule FA: Particulars of holding of overseas shares/securities

Present Dividend Earnings as Earnings from Different Sources

To point out Dividends from overseas shares in ITR it’s worthwhile to convert the worth of dividends obtained to Indian Rupees. This quantity needs to be the unique quantity with out the tax deduction. For instance, in our case, Bharat obtained 75 $ as a dividend in his account however he has to point out the unique quantity with out TDS(tax withheld)

As Dividend is taken into account as Earnings from Different Sources, as proven within the picture for the brand new Utility. It needs to be proven for each quarter(due to Advance Tax).

Alternate fee: TTBR

Beneath the India income-tax legislation, the alternate fee for conversion of earnings earned in overseas foreign money into Indian rupees is the telegraphic switch shopping for fee (TTBR) issued by State Financial institution of India

You’re going to get TTBR for the related FY at SBI’s foreign exchange division or entry http://mksco.in/forexrate/

It’s also possible to get Charges of USD, YEN, Euro, on the RBI(Reserve Financial institution of India) webpage right here.

Declare Tax deducted in Schedule FSI and Schedule TR

Schedule FSI and Schedule TR for claiming the overseas tax credit score in case of double taxation aid

The earnings tax act permits Indian residents to say a credit score of overseas taxes paid by a taxpayer in opposition to their whole tax legal responsibility in India.

- Part 90 is for claiming the overseas tax credit score in a case the place India enters right into a DTAA (double taxation avoidance settlement) with one other nation. Supplied the agreements point out claiming of such FTC

- Part 90A When there may be DTAA with the Specified Associations, then Tax Reduction will be claimed u/s 90A and shall be calculated in the identical method as Part 90.

- Part 91 is for with claiming of FTC the place India has not entered right into a DTAA (double tax avoidance settlement) with the nation the place the earnings arises for a taxpayer

Schedule FSI to say Tax Deducted

Schedule TR for claiming the overseas tax credit score in case of double taxation aid

Fill in the identical particulars as in Schedule FSI

Overview of Overseas Shares

Associated Shares:

Disclaimer

All content material on this web site is for instructional and informational use solely. Please don’t construe this as skilled monetary recommendation. You must seek the advice of a certified monetary particular person(tax advisor/monetary advisor) prior to creating any precise funding or buying and selling choices. We settle for no legal responsibility for any interpretation of articles or feedback on this weblog getting used for precise investments/taxation functions!

Be part of our Telegram Group BeMoneyAware and Checkout our Instagram Channel Bemoneyaware

Do you get Dividend from Worldwide Shares? How do you present within the ITR?