Over the weekend, I used to be a presenter at a Fabian’s Society assembly which sought enter on ‘different taxation insurance policies’ beneath the final tenet of the necessity for the Australian authorities to lift income to make sure a socially simply society. The opposite presenter was John Quiggin and I believe we offered an excellent complementarity for the comparatively giant viewers (for a Saturday afternoon – with soccer finals in progress!). In fact, my opening salvo was to reject the basic premise of the workshop – which is a premise that progressive commentators and activists appear unable to shed to the detriment of their argument. I indicated to the viewers on the outset that the purpose of taxation is usually not to lift extra income for presidency, however, as a substitute, to make sure the non-government sector has much less spending capability. Extra isn’t much less. That could be a essentially totally different body wherein to debate the subject and I closed the workshop by suggesting that one of many single most essential issues that progressives can be taught is to cease utilizing phrases like ‘taxpayers’ cash’ when discussing fiscal coverage. Utilizing these kind of phrases instantly frames the dialogue in opposition to progressive objectives.

The ‘taxpayers’ funds framing error

Common readers will know that I oppose the ‘tax the wealthy to pay for higher providers’ narrative that progressive commentators appear to be obsessive about selling.

Listed here are just a few of my weblog posts overlaying totally different facets of that mania:

1. The tax excessive wealth to extend funds for presidency spending narrative simply reinforces neoliberal framing (September 23, 2023).

2. Tax reform in Australia is required however not as a result of the federal government wants extra of its personal forex to spend (September 26, 2022).

3. Tax the wealthy to counter carbon emissions to not get their cash (January 22, 2020).

4. The ‘tax the wealthy’ name bestows unwarranted significance on them (February 21, 2018).

5. Governments don’t want the financial savings of the wealthy, nor their taxes! (August 17, 2015).

6. Progressives ought to transfer on from a reliance on ‘Robin Hood’ taxes (September 4, 2017).

The Australian authorities points the Australian greenback as a monopolist – which implies it’s the solely physique that points the forex.

Which means it has infinity minus 1 cent {dollars} accessible for spending every time it needs.

Whereas infinity exists as an outlined mathematical idea – boundlessness – it doesn’t have a bodily actuality, which is why the federal government’s spending capability is infinity minus 1 cent.

That capability signifies that taxation is rarely required to lift funds that may then be channelled again into the economic system by way of fiscal spending insurance policies.

The federal authorities due to this fact is rarely spending ‘taxpayers’ funds’.

Taxpayers do pay taxes which contain financial transfers from the non-government sector to the federal government sector.

However these transfers present the federal government with no further monetary capability, provided that its capability is infinity minus a cent {dollars}.

If progressives might simply begin with these easy propositions earlier than they begin framing coverage when it comes to taxes to spend, they might be in a a lot stronger place with respect to the debates.

I typically hear progressives say that Trendy Financial Principle (MMT) is all very nicely, however given the actual politic, inside which these debates are contested, it’s higher to depend on mainstream understandings to make the case for extra authorities spending on progressive objectives.

I remind these economists of the way in which that John Maynard Keynes used the (faulty) neoclassical idea of marginal productiveness concept for labour demand in The Common Principle, to permit him to focus on the availability facet, the place he believed the variations between his strategy and the orthodoxy might finest be highlighted.

It was a call that he regretted when it turned apparent that the orthodoxy manipulated the talk to classify Keynes’ quibbles because the particular slightly than the final case.

And the outcome was the neoclassical synthesis which dominated macroeconomics for the subsequent a number of many years and allowed Monetarism a better path after which the present New Keynesian paradigm to emerge.

The important message of Keynes was shortly misplaced as a result of he made that type of strategic error – utilizing neoclassical framing.

Keynes’ place (which he later acknowledged was a tactical mistake) was contested by – Roy Harrod – who was additionally an antagonist of neoclassical concept and a detailed colleague of Keynes (though Harrod was at Oxford slightly than Cambridge).

Previous to the publication of Keynes’ Common Principle, Roy Harrod wrote to him – Harrod to J. M. Keynes , 1 August 1935 (The letter was reprinted in Keynes, Collected Writings, vol. XIII, pp. 533-34):

as from Christ Church

1 August 1935

Pricey Maynard

You might marvel why I lay such stress on a degree that merely issues formal proof slightly than the conclusions reached. I’m pondering of the effectiveness of your work. Its effectiveness is diminished when you attempt to eradicate very deep-rooted habits of thought, unnecessarily. One in every of these is the availability and demand evaluation. I’m not merely pondering of the aged and fossilized, however of the youthful era who’ve been pondering maybe just for just a few years however very exhausting about these subjects. It’s doing nice violence to their elementary groundwork of thought, when you inform them that two unbiased demand and provide features wont collectively decide value and amount . Inform them that there could also be a couple of answer. Inform them that we don’t know the availability perform. Inform them that the ceteris paribus clause is inadmissible and that [b] we will uncover extra essential useful relationships governing value & amount on this case which render the s. and d. evaluation worthless. However dont impugn that evaluation itself.

The truth that saving is barely one other facet of funding makes it worse not higher. If there have been two separate issues, saving & funding, then it’s clear that the 2 equations is not going to decide each. However with one factor, then when you allowed the cet. par. clause which you rightly don’t, it could be fairly logical and wise to strategy it within the classical manner.

Yours

Roy.

The purpose of the letter was to attempt to persuade Keynes to desert his strategy that will emerge in Chapter 2 of the Common Principle when he assumed a easy Classical marginal productiveness concept to elucidate labour demand.

In adopting this assumption, which he later realised was pointless and empirically unjustified, Keynes opened the door for subsequent developments which perverted his message.

Finally, we might argue that the neo-liberal dominance now’s, partly, resulting from that strategic error made by Keynes.

I lined that type of downside considerably on this weblog put up – On technique and compromise (July 3, 2012).

I present an in depth historic dialogue in that weblog put up which I gained’t repeat right here.

The purpose is that when we begin our argument with the frames and language that’s utilized by these we’re in search of to debunk, the argument is successfully misplaced.

I take into account framing and language in a lot of weblog posts however this one offers an excellent abstract – The right way to talk about Trendy Financial Principle (November 5, 2013).

So progressives may assume they’re being intelligent through the use of frames that permit them (in their very own minds) to be ‘contained in the tent’ and that makes them really feel essential – however all they’re doing is reinforcing the case in opposition to them.

The ‘taxpayers funding socially progressive insurance policies’ is a basic misstep on this regard and may by no means be used to advance progressive arguments.

Regressivity and progressivity

In fiscal coverage, the phrases regressivity and progressivity are used to explain important options of taxation and spending selections.

Often these phrases are utilized to the taxation facet – which is a large mistake.

From the tax perspective, progressivity describes a system the place the typical tax charge (share of earnings paid) will increase as earnings will increase.

Conversely, regressivity is the place the typical tax charge decreases as earnings will increase, which signifies that low-income earners endure the next proportional burden.

Progressives repeatedly fall into the entice of specializing in a single component within the fiscal system – for instance, a broad-based consumption tax – after which eschewing it as a result of it’s a regressive tax.

They then push for progressive taxes – such a earnings taxes with growing marginal tax charges – as a result of they assume that’s fairer.

The issue is that we wish the tax system to be environment friendly and devour as few actual assets as potential when it comes to administration.

Earnings taxes, for instance are a lot simpler to evade and extra expensive to manage than broad-based taxes.

The purpose I made on the workshop on Saturday was that it’s an error to only concentrate on particular person parts of the fiscal system and consider the desirability when it comes to the regressivity or progressivity of these parts.

The proper strategy is to think about the general progressivity or in any other case of the totality of spending and taxing selections in place.

So the perfect tax system may be regressive total however very environment friendly and the regressivity will be simply offset by extremely progressive spending insurance policies.

Tailor insurance policies to fulfill the challenges

The opposite downside of the ‘elevate income to spend’ fallacy is that it concentrates our consideration on cash quantities slightly than tailoring our fiscal interventions to fulfill the precise actual challenges earlier than us.

I discussed a few of these challenges – inequality, degraded public infrastructure, local weather change, housing disaster, extreme political affect of the wealthy, and extra.

This then motivates us to think about why we’re taxing.

Except for tax initiatives that search to alter useful resource allocation – like tobacco and alcohol taxes, for instance, the most important motive that nationwide governments need to tax is to not elevate funds however to make sure the non-government sector has much less funds.

MMT defines fiscal area not in monetary phrases (as within the orthodox strategy) however in actual useful resource phrases.

I mentioned this concept in lots of weblog posts however this one covers the fundamentals – Taxation is an indispensable anti-inflation coverage software in Trendy Financial Principle (June 23, 2022).

The imposition of a tax legal responsibility on the non-government sector by the federal government frees up actual assets that will in any other case have been utilised by non-government spending.

The unemployed or idle non-government assets can then be introduced again into productive use by way of authorities spending which quantities to a switch of actual items and providers from the non-government to the federal government sector.

In flip, this switch facilitates the federal government’s socio-economic program.

Whereas actual assets are transferred from the non-government sector within the type of items and providers which can be bought by authorities, the motivation to provide these assets is sourced again to the necessity to purchase fiat forex to extinguish the tax liabilities.

Additional, whereas actual assets are transferred, the taxation offers no extra monetary capability to the federal government of challenge.

Conceptualising the connection between the federal government and non-government sectors on this manner makes it clear that it’s authorities spending that gives the paid work which eliminates the unemployment created by the taxes.

And the size of this relationship – or, in different phrases, the scale of presidency – then dictates the size of the (preliminary) unemployment created by the tax legal responsibility.

Comparatively giant governments require giant tax revenues, whereas smaller footprint governments require smaller tax takes.

However notice that scaling relationship isn’t about ‘funding’.

It’s about creating the non-inflationary actual useful resource area to soak up the size of presidency spending desired.

The coverage design should be certain that the tax income is enough – and depriving the non-government sector of useful resource utilization – to accommodate the size of spending desired.

Whereas the orthodox conception is that taxation offers income to the federal government which it requires with a purpose to spend, the MMT conception is that the tax income is an indispensable coverage requirement with a purpose to guarantee the federal government can function at its desired scale, with out pushing the economic system into an inflationary episode.

Some urged tax improvements

I’ll write extra about this subject in subsequent posts however for now that is what I mentioned on the workshop on Saturday.

John most well-liked to lift the marginal tax charge for prime earnings earners to 60 per cent from the present charge of 45 cents within the greenback for incomes $A190,001 and over.

I’m not certain whether or not he wished to lift the subsequent tax charge band – marginal charge 37 cents within the greenback between $A135,001 and $A190,000.

I’ve no challenge with that proposal however I’d not prioritise it given the difficulties in assortment and the capability for high-income earners to tax evade.

I went by a lot of options – abandon the tax concessions on funding properties which mainly ship huge bonuses to these with a number of properties (given the capital beneficial properties tax is insufficient) and people bonuses are biased in direction of the highest finish of the earnings and wealth distribution.

I stated I most well-liked the federal government to desert the very beneficiant concessions to superannuants – which has turn out to be a serious manner that earnings inequality is elevated.

These with very excessive pensions can basically get tax free earnings.

I most well-liked although to focus on the introduction of a wealth tax and loss of life duties (inheritance taxes).

There is no such thing as a wealth tax in Australia.

We used to have loss of life duties levied on the state/territory degree however the Queensland authorities turned infested with the ‘Abolition of Loss of life Duties’ motion which emerged within the late Sixties.

In 1977, the Queensland state authorities abolished all loss of life duties.

The opposite states then had been pressured to comply with go well with for worry of dropping their tax bases on account of a ‘flight of capital’ to the sunny climes of Queensland.

By 1982, all of the states and territories had deserted the tax.

On the federal degree, Property Duties as they had been recognized had been deserted in 1979.

We must always undoubtedly take into account reintroducing Property Duties on the federal degree – which might cease all of the ‘smokestack chasing’ (competitors between the states and territories for capital) that will come up if one state tried to introduce loss of life duties alone.

However the actual motion must be within the space of a wealth tax.

In Australia, like most international locations, there’s a excessive diploma of wealth inequality.

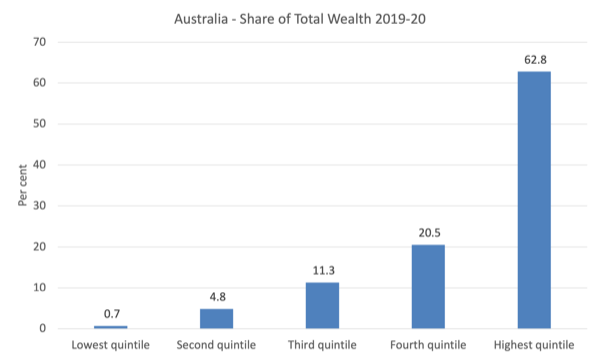

The next graph exhibits the shares of whole wealth by quintile for 2019-20 (newest information).

60 per cent of the households in Australia have simply 16.8 per cent of the full wealth.

The highest quintile includes round 2,030 households with a internet value vary of $A1,400,000 to over $A10 million.

The highest decile includes round 1,180 households with a internet value vary exceeding $A2 million.

The distribution is not going to have modified a lot since 2020 though the nominal internet value quantities may have elevated considerably on account of the newest actual property bubble.

A wealth tax would handle the issue of accelerating internet value inequality (the Gini coefficient has risen from 0.602 in 2009-10 to 0.611 in 2019-20).

It will additionally assist advance our purpose of decreasing the capability of the rich in Australia to affect the political course of by lobbying and media possession and so on.

Most opposition for a Wealth tax is predicated on the double taxation argument – the wealth is a inventory that has been collected, so the argument goes, by being thrifty with earnings flows, which have already been taxed by way of the earnings tax system.

Does that argument stand as much as scrutiny?

The Nationwide Accounts information permits us to interrogate the proposition.

The Australian Bureau of Statistics releases the – Australian Nationwide Accounts: Finance and Wealth – information (newest version for March-quarter 2025 launched on June 26, 2025).

It’s at all times launched after the principle expenditure information which got here out final week and applies to the June-quarter 2025.

The most recent Finance and Wealth information exhibits that:

Family wealth grew 0.8% ($137.1b) to $17,309.7b by the tip of the March quarter. The rise in internet value was pushed by land and dwelling property …

Non-financial property owned by households elevated by 1.2% ($151.8b). The worth of residential land and dwellings elevated $125.3b or 1.2 per cent, with each property costs and the variety of dwellings growing through the quarter.

The overwhelming beneficial properties in family internet value don’t come from financial savings out of earnings earned by work however by way of capital beneficial properties (totally on housing).

So the ‘double taxation’ argument, even by itself phrases is specious when utilized to Australia.

The Capital Good points taxation in Australia can be extremely concessional with the so-called ’50 per cent low cost’ being launched in 1999, which signifies that the earnings flowing from these beneficial properties is taxed at half the standard charge of earnings tax.

I haven’t time right now to put in writing a couple of Wealth tax situation that we now have been growing on the Centre of Full Employment and Fairness (CofFEE).

Suffice to say that there’s huge scope to prune the wealth of the highest finish of the distribution and the remainder of us wouldn’t discover a factor.

Conclusion

In a later weblog put up, when the brand new wealth information is obtainable I’ll write up the mannequin we now have been growing.

Even a modest wealth tax would have an effect on the capability of the highest finish to control the political system.

That’s sufficient for right now!

(c) Copyright 2025 William Mitchell. All Rights Reserved.