Now that Zillow has gone all-in on mortgages, quickly you may not be capable to evaluate charges from third-party lenders on their web site.

This is able to be unlucky as their so-called Zillow Mortgage Market is a superb instrument to see charges from a bunch of native lenders suddenly.

It permits Zillow guests to rapidly get a way for present mortgage charges and acquire publicity to choices they may not in any other case see.

Now that Zillow House Loans is making an enormous push to originate its personal loans, this market has turn into tougher to seek out (however it nonetheless exists!).

For me, it speaks to an even bigger development within the business, the place there’s much less and fewer room for the smaller unbiased lender or mortgage dealer.

Much less Shopper Selection When It Involves Mortgage Charges

I perceive that Zillow desires its guests to go straight to its in-house mortgage lender in the event that they want a house mortgage (why wouldn’t they?).

Again in 2019, Zillow House Loans was formally launched after they acquired Mortgage Lenders of America within the fourth quarter of 2018.

Initially, the transfer was meant to streamline mortgage financing for its now shuttered Zillow Provides platform, which was an iBuying program that struggled to take off.

Regardless of that setback, Zillow has made a fair larger foray into mortgages in recent times, occurring a mortgage officer hiring spree to develop its enterprise.

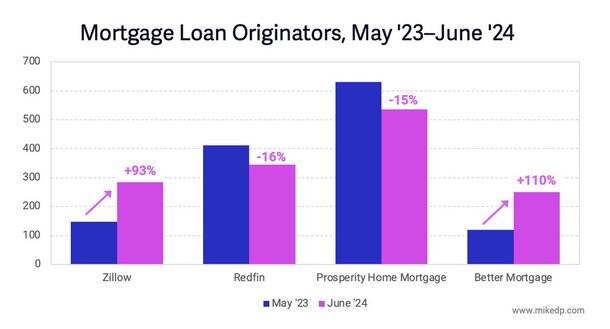

Per business guide Mike DelPrete, the corporate practically doubled its mortgage mortgage originator rely between Could 2023 and June 2024, at a time when different lenders had been shedding employees.

Regardless of a poor lending setting pushed by excessive mortgage charges, the corporate saved hiring.

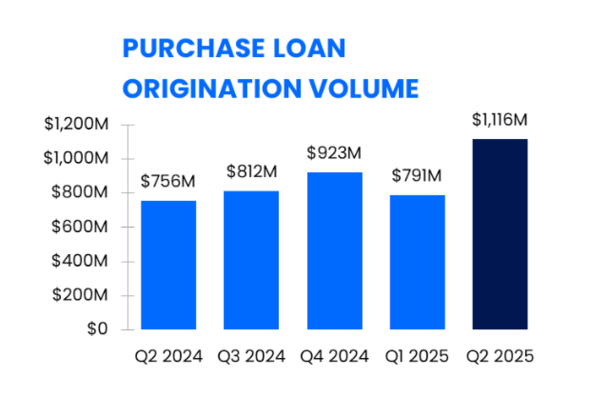

And it lastly paid off, with residence buy quantity exceeding $1.1 billion within the second quarter of 2025, a near-50% year-over-year enhance (see chart beneath).

This has made it abundantly clear that they’re critical about changing into a serious mortgage participant, although they’re nonetheless type of small.

It’s additionally changing into clear that they could not have room of their enterprise mannequin for third-party mortgage lenders.

Many smaller mortgage corporations and native mortgage brokers depend upon Zillow for leads.

Now they could should go elsewhere, although these options appear to be rapidly drying up.

What this implies is the buyer will finally be left with fewer decisions and extra residence loans will wind up with the massive guys.

Research have confirmed that client selection is sweet for mortgages (and certain all the things else), however we’re seeing increasingly more consolidation and that’s dangerous for potential residence consumers.

Mortgages Are Going Vertical

These days, we’ve seen an enormous push for actual property and mortgage corporations to go vertical.

That’s, management extra of the whole course of from begin to end, whether or not it’s actual property agent choice, mortgage origination, or mortgage servicing, as soon as the mortgage funds.

We’ve seen it with Zillow by way of this residence mortgage push, and likewise with their rival Redfin, which received acquired by Rocket Mortgage.

Redfin additionally used to have a mortgage comparability instrument, regardless of the launch of Redfin Mortgage years in the past.

Now those that go to the Redfin web site or use the Redfin app will probably be pitched a house mortgage by Rocket Mortgage.

And as soon as they’ve a mortgage, their in-house mortgage servicer will probably attain out to supply them a mortgage refinance or residence fairness mortgage.

It’s changing into more durable and more durable for a third-party lender to interrupt by means of, and with much less selection, anticipate greater charges/prices.

As I all the time say, when a lender reaches out, attain out to different lenders. Take the time to match quotes past only one lender.

That is particularly essential now as we see extra consolidation within the business, and since mortgages are kind of a commodity.

They don’t actually differ that a lot from one firm to a different, so securing a decrease price with fewer closing prices is vital.

In actual fact, the one actual distinction is likely to be the mortgage course of. As soon as the mortgage funds, it’ll probably function precisely like every other 30-year mounted mortgage (the preferred mortgage selection).

Learn on: The Hole Between Good and Unhealthy Mortgage Charges Has Grown Wider, Store Accordingly

(picture: ok)