A reader asks:

I’ve been a very long time listener, and whereas I’ve many questions within the realm of finance, the one I hold coming again to is bonds. Once you say the 2020s are the worst ever decade for bonds, after which I see a Enterprise Insider article saying the 60/40 is in its worst stretch in 150 years, I simply can’t perceive what’s going on. I’m a easy investor, principally investing in my work 403b and 457 with goal date funds (I’m in healthcare), however I do personal and proceed to purchase investments like: BNDX, AGG, VBTLX, and so on.

What I’m attempting to know is, if bonds are in a “bear” market, am I shopping for them “on sale” like an individual would do in a bear market with equities? I really feel like everytime I examine my bond holdings are within the “pink”. Does that imply I get them for a lower cost, and I can hope they are going to go up? Or are shopping for bond index funds extra like a static expertise: what you purchase that day is what you get, and so they don’t transfer like equities?

I wrote a put up a few months in the past making the case that is the worst decade ever for bonds.

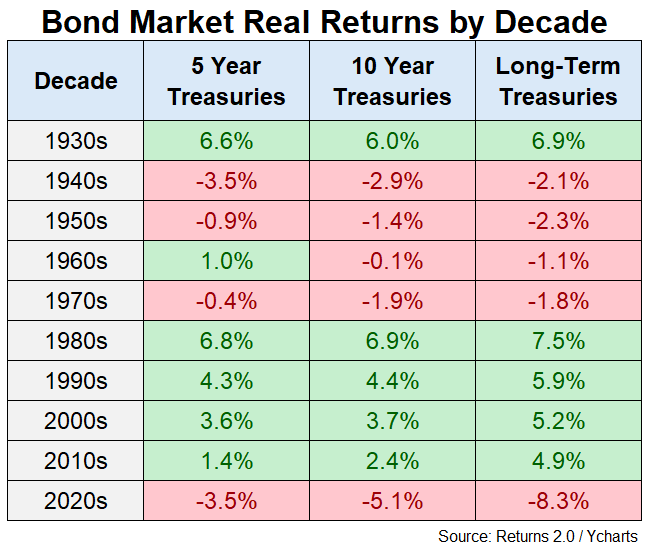

Take a look at the annual returns by decade for numerous U.S. authorities bond maturities:

Now take a look at the inflation-adjusted numbers:

Somewhat greater than midway by means of the last decade, the 2020s have been downright dreadful. The last decade’s not over however we’ve by no means seen returns this dangerous earlier than for an prolonged time frame.

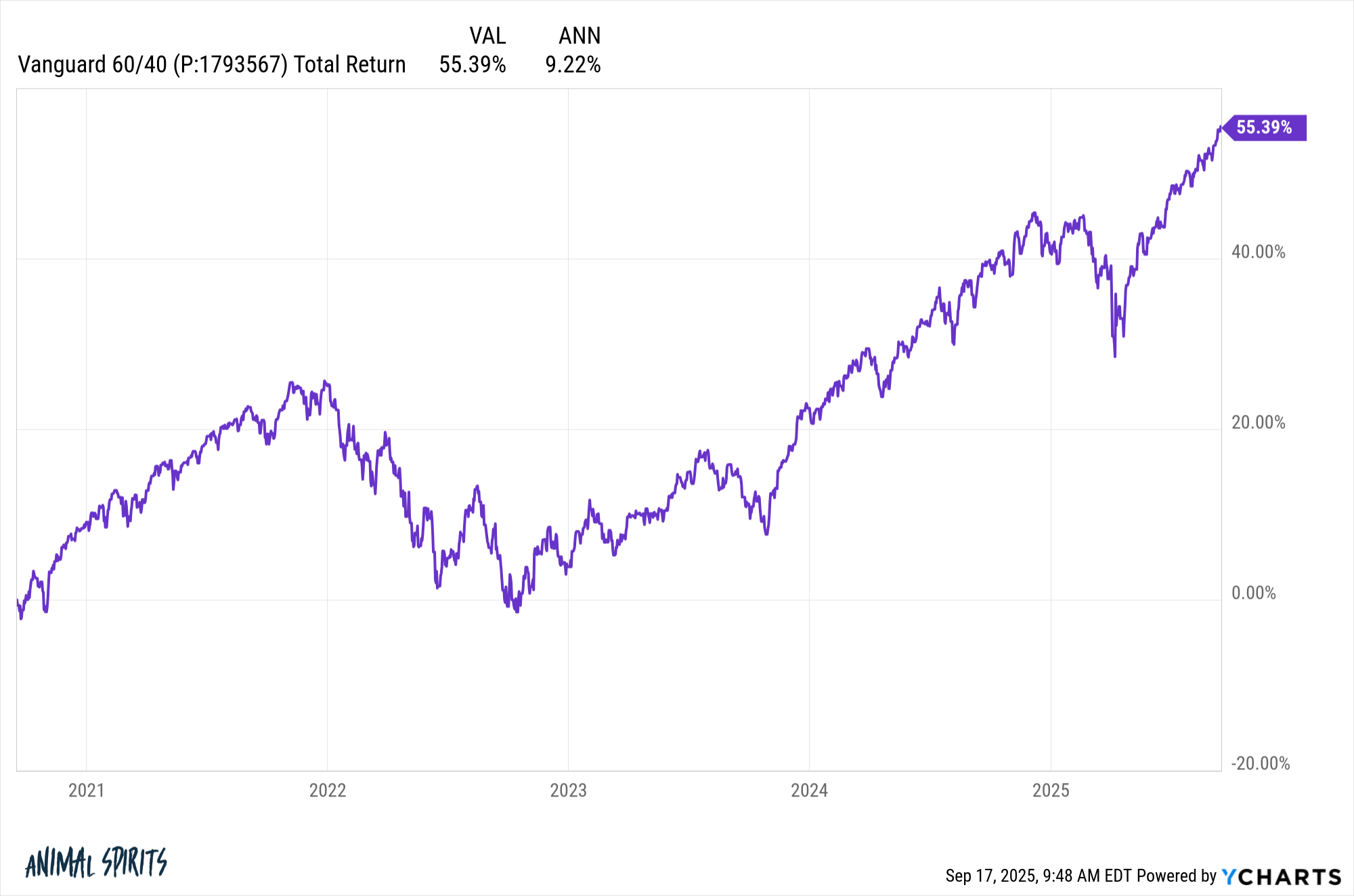

Nevertheless, whereas bonds have had a brutal decade, the inventory market has greater than made up for it. It is a easy 60/40 portfolio1 over the previous 5 years:

Even though bonds have lagged badly over the previous 5 years, a 60/40 portfolio is up greater than 9% per yr.

That is the great thing about diversification. Bonds have stunk however shares have picked up the slack.

I’d say there are two issues you really want to know on the subject of investing in bonds:

1. Charges and costs have an inverse relationship. When bond yields fall, bond costs rise. When bond yields rise, bond costs fall. If this wasn’t abundantly clear earlier than the 2020s, buyers perceive it now.

2. Beginning yield issues quite a bit. Within the brief run, adjustments in rates of interest, inflation and financial progress could make sure sorts of bonds risky. For longer run returns, beginning yield is much and away the most important predictor of anticipated returns.

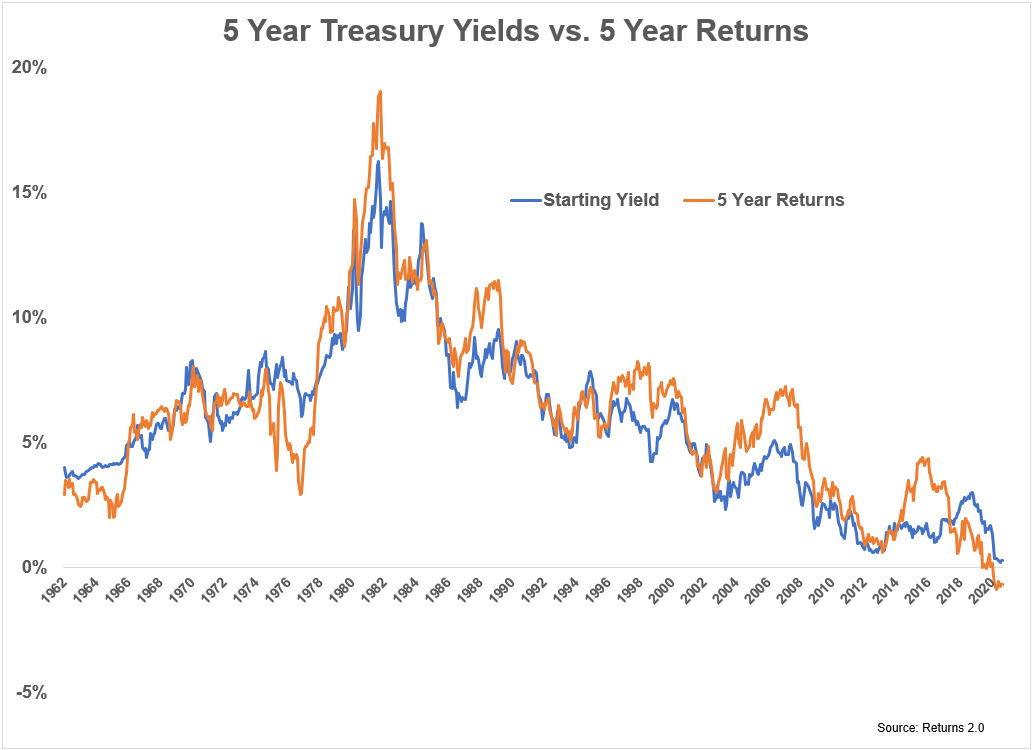

That is my favourite bond market relationship:

This reveals the beginning yield for five yr Treasury bonds together with the following 5 yr annual return. The correlation between the beginning yield and the following 5 yr return is 0.93. If it’s essential brush up in your statistics, that’s a powerful to fairly sturdy relationship.

That is for presidency bonds. For different bonds like excessive yield, company bonds, and so on., it’s essential take the beginning yield and subtract any defaults, that are sometimes very low however nonetheless occur now and again.

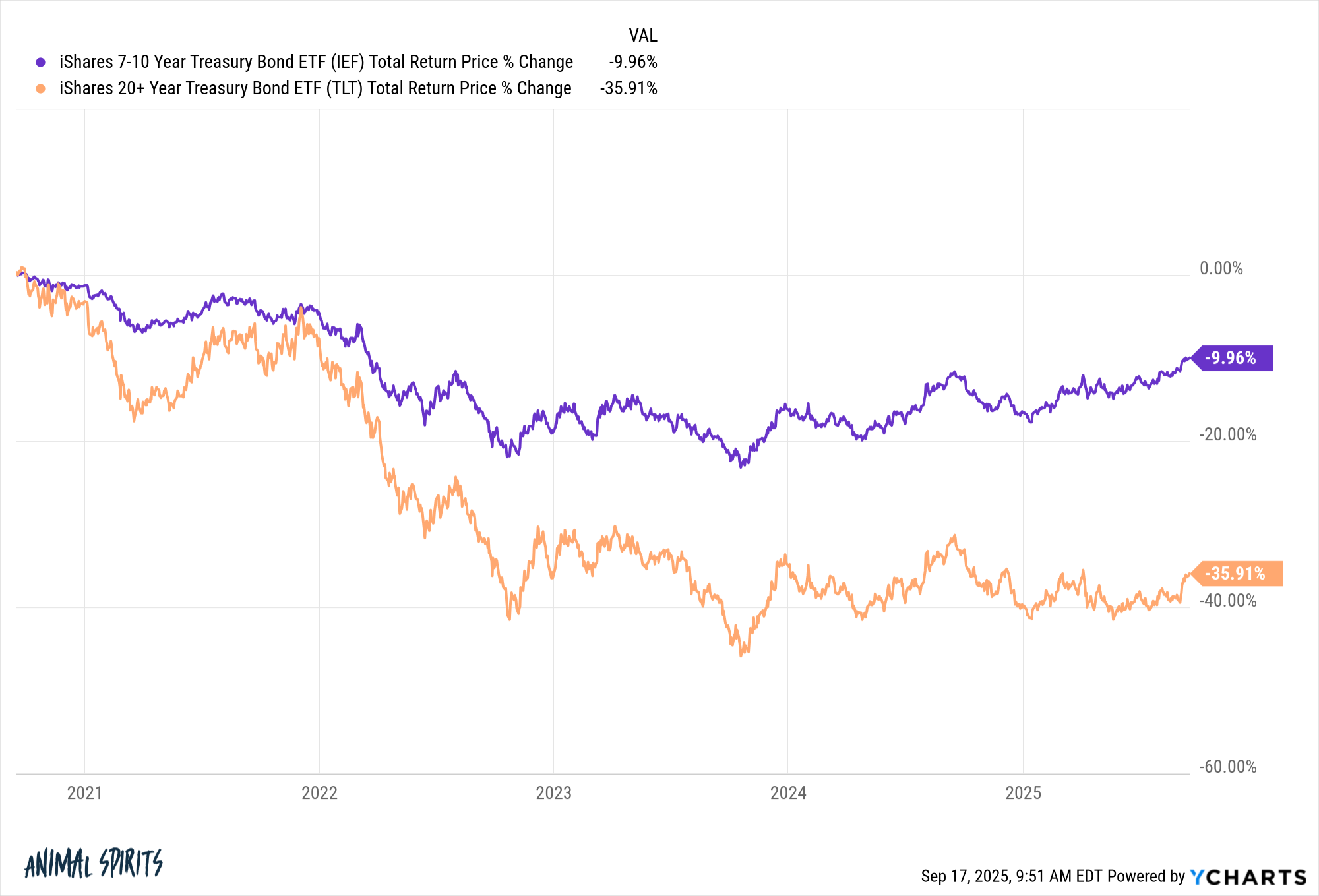

It’s true that some bonds are nonetheless on sale:

U.S. authorities bonds with maturities of seven years or larger have mainly been underwater since 2021. Lengthy-term bonds have gotten smoked within the 2020s from the affect of rising charges mixed with excessive length.

The excellent news about falling bond costs is you’re getting to take a position at greater beginning yields. Meaning anticipated returns have risen. Your short-run returns are down however your long-run returns are going up. It’s buying and selling short-term ache for long-term achieve.

You’ll be able to’t say bonds are a screaming purchase right here as a result of inflation might re-accelerate. Authorities spending reveals no indicators of slowing down. We’ve got but to expertise the total affect of the brand new tariff insurance policies. If that forces rates of interest to rise, that might harm bonds once more within the short-term.

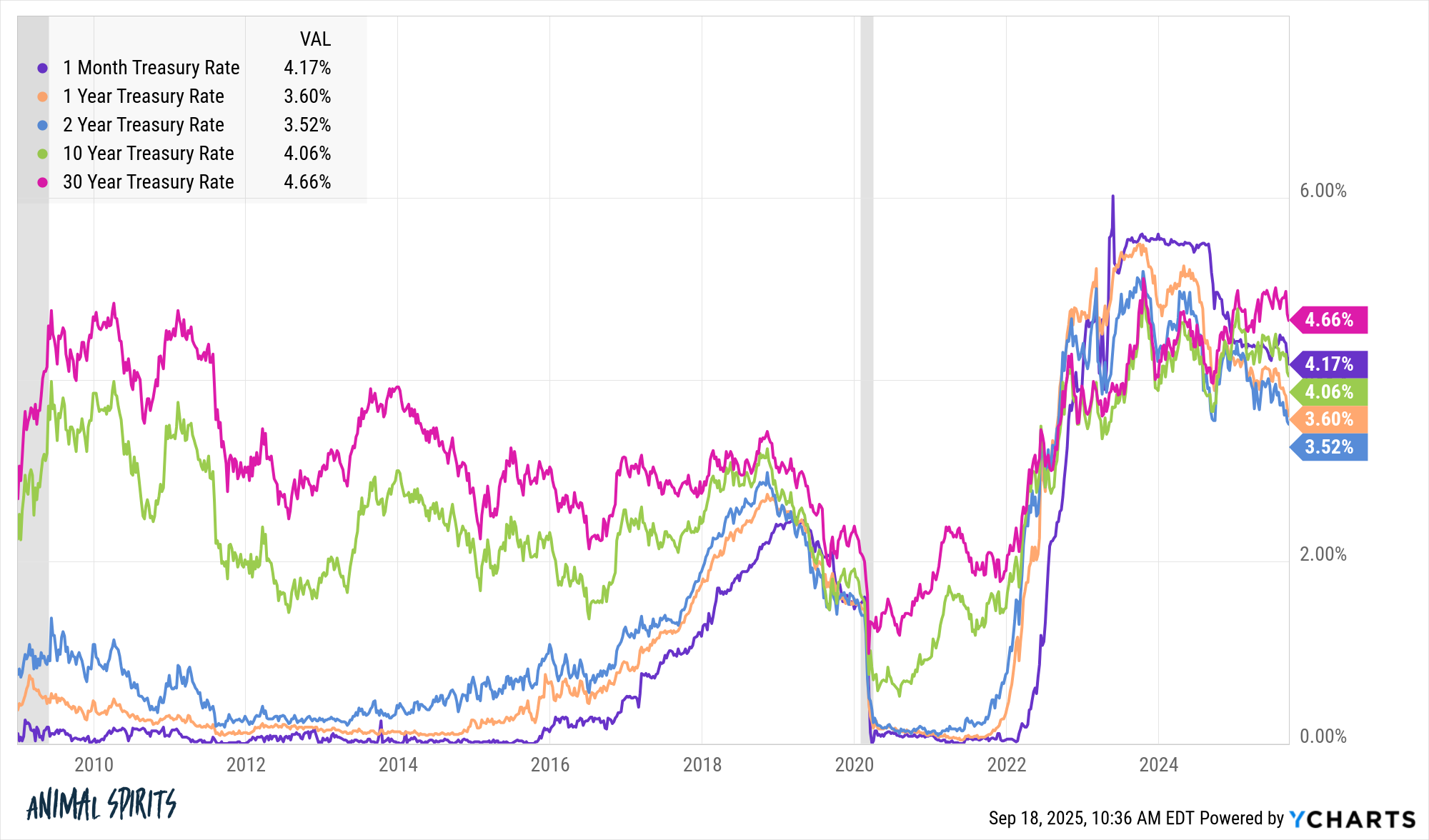

The case for investing in bonds is that yields are a lot greater than they have been for everything of the 2010s:

There’s a a lot greater margin of security constructed into fastened earnings now than there was when charges fell to the ground in the course of the early days of the pandemic.

If the labor market continues to weaken, bonds are an ideal hedge in opposition to an financial slowdown. Plus, the Fed simply minimize charges yesterday and signalled there will probably be extra cuts by means of yr finish. That’s simply short-term charges and doesn’t assure longer-term bond yields will fall but it surely most likely helps.

And if bond yields don’t fall an excessive amount of or rise an excessive amount of from right here, you’re incomes one thing within the vary of 4-6% proper now relying in your credit score high quality and length. That’s fairly good contemplating inflation is sub-3%.

The one factor many buyers have realized by residing by means of their first fastened earnings bear market is it’s important to be extra considerate about your bond allocation.

There are specific fastened earnings property which are higher for rising charge environments (money, T-bills, short-term bonds, floating charge debt, short-dated TIPS, and so on.).

There are specific fastened earnings property which are higher for falling charge environments (Treasuries, long-term bonds, mortgage-backed securities, and so on.).

And there are particular fastened earnings property which are higher for greater yields (company bonds, excessive yield, rising market debt, non-public credit score, and so on.).

All of it will depend on what you need to get out of your fastened earnings allocation.

For many buyers there are three causes to personal fastened earnings:

- The earnings.

- Safety in opposition to volatility.

- Liquidity for spending functions.

For some it’s a mixture of the three.

As with all funding, there are all the time trade-offs concerned. You simply have to choose the allocation and technique you’re snug sticking with that meets your willingness, want and talent to take danger.

I lined this query on an all new version of Ask the Compound:

Invoice Candy joined me on the present this week to debate questions on monetary recommendation for service members, when to let up in your Roth contributions, 30 yr fastened charge mortgages vs. ARMs, HSAs and tax planning for an early retirement.

Additional Studying:

Is This the Worst Decade Ever For Bonds?

160% Vanguard Complete U.S. Inventory Market Index Fund and 40% Vanguard Complete U.S. Bond Market Index Fund.