Within the realm of non-public finance, crafting a finances is a necessary first step to managing your cash successfully.

However what if we instructed you there’s a solution to supercharge your financial savings and monetary self-discipline? Enter the world of the “Naked Bones Finances.”

This no-nonsense method includes chopping again to absolutely the necessities, offering a brief lifeline in your funds. On this complete information, we’ll delve deeper into the idea of a Naked Bones Finances, its advantages, and provide useful tricks to make it give you the results you want.

What’s a Naked Bones Finances?

A Naked Bones Finances is your monetary survival technique. It entails budgeting just for absolutely the requirements to tide you over till your subsequent payday.

Think about trimming your finances right down to necessities like shelter, meals, utilities, insurance coverage, and transportation, whereas quickly eliminating non-essential bills similar to eating out, leisure, and luxurious objects. It’s about making intentional selections and getting inventive along with your sources throughout difficult occasions.

Why Use a Naked Bones Finances?

There are a lot of the explanation why somebody would select to jot down a finances that solely consists of absolute requirements.

Emergency Financial savings

A Naked Bones Finances generally is a lifesaver in emergencies when your financial savings are depleted. It means that you can rapidly reduce on non-essentials, serving to you rebuild your monetary security internet.

In a world the place sudden occasions can wreak havoc in your funds, having a Naked Bones Finances prepared might be your monetary armor.

Accelerated Debt Compensation

For these striving to turn into debt free, this budgeting technique might help you break by plateaus. By redirecting funds to pay down debt, you’ll expertise a way of accomplishment as you make seen progress.

Think about the burden lifting off your shoulders as you see these bank card balances shrink and your monetary future getting brighter.

Job Loss

In an unpredictable job market, employment stability is rarely assured. Job loss can strike at any time, leaving you and not using a common earnings supply. That is the place a Naked Bones Finances generally is a essential lifeline.

By instantly chopping right down to the naked necessities, you’ll be able to prolong your monetary runway when you seek for a brand new job or watch for unemployment advantages to kick in. This budgeting method means that you can stretch your obtainable funds additional, decreasing the stress related to sudden unemployme

Getting Forward When Residing Paycheck To Paycheck

If you end up trapped in a cycle of dwelling paycheck to paycheck, a Naked Bones Finances generally is a strategic transfer to interrupt free from this monetary treadmill. It’s straightforward to really feel caught whenever you’re always operating out of cash earlier than the subsequent payday.

By quickly adopting a this sort of finances, you’ll be able to redirect a portion of your earnings in direction of financial savings and debt compensation. This proactive step might help you accumulate an emergency fund, repay high-interest money owed, and in the end transition to a extra secure monetary footing. It’s a short-term sacrifice for long-term monetary safety.

Creating Your Naked Bones Finances

Step 1: Establish Your Necessities

To create your Naked Bones Finances, begin by figuring out the important bills you can not reside with out. These sometimes embrace:

- Shelter: Your mortgage or hire fee.

- Utilities: Important providers like electrical energy, water, and gasoline.

- Insurance coverage: This consists of automotive insurance coverage, medical health insurance, and some other important insurance policies.

- Meals: Finances for groceries, however take out any cash spent on eating out.

- Transportation: Automotive funds, gasoline, and public transportation.

- Childcare: When you have youngsters, this can be a non-negotiable expense.

- Debt Funds: Prioritize important debt funds like mortgages and automotive loans.

Step 2: Eradicate Non-Necessities

When you’ve recognized your necessities, it’s time to eradicate non-essential bills. This would possibly embrace:

- Eating Out: Cook dinner meals at residence as a substitute of consuming out.

- Leisure: Cancel subscriptions, choose without spending a dime actions, and go to your native library.

- Purchasing: Keep away from pointless purchases and give attention to necessities.

- Luxurious Gadgets: Postpone shopping for luxurious objects till your monetary state of affairs improves.

A Pattern Naked Bones Finances

Let’s take a more in-depth take a look at a pattern Naked Bones Finances primarily based on one household’s bills:

- Mortgage/Hire: $1,590.00

- Utilities: $250.00

- Telephone: $135.00

- Web: $68.67

- Safety System: $40.19

- Groceries: $400.00

- Gasoline: $150.00

- Automotive Insurance coverage: $100.40

- Insurance coverage (life & incapacity): $120.00

- Childcare: $650.00

- Sudden Expense: $100.00

- Whole: $3,604.26

Whereas this finances may appear daunting, it’s necessary to keep in mind that a Naked Bones Finances is designed for momentary use. Even when your loved ones has extra bills like automotive funds or bank card payments, this technique can nonetheless be tailored to your state of affairs.

Naked Bones Finances Ideas

Residing on a Naked Bones Finances might be difficult, however with the following pointers, you’ll be higher ready:

Discover Free Leisure

Hunt down cost-free leisure choices, similar to native parks, lakes, or libraries. Discover nature, get pleasure from a picnic, or borrow motion pictures from the library to maintain boredom at bay with out breaking the financial institution. Bear in mind, not all enjoyable actions include a price ticket.

Put together for Sudden Bills

Put aside a portion of your finances for unexpected bills, anticipating that they may happen finally. Having this buffer will stop you from straying astray when sudden payments come up. Life is unpredictable, however your finances doesn’t must be.

Preserve a Optimistic Mindset

Keep in mind that dwelling on a Naked Bones Finances is only a momentary part in your monetary journey. Keep targeted in your objectives and don’t examine your self to others. Acknowledge how far you’ve come and the place you’re headed.

With dedication and the suitable perspective, you’ll be able to thrive on this finances. The journey to monetary freedom is commonly difficult, however it’s value each sacrifice alongside the best way.

Additional Steps For Monetary Success

Whereas a Naked Bones Finances is a robust software in your monetary arsenal, it’s necessary to keep in mind that it’s a short-term technique. To attain long-term monetary success, think about these extra steps:

1. Construct an Emergency Fund

To forestall future monetary crises, work on constructing an emergency fund that covers three to 6 months’ value of dwelling bills. This fund will present a cushion throughout sudden conditions, decreasing the necessity to revert to a Naked Bones Finances.

2. Make investments for the Future

When you’ve paid off high-interest debt and established an emergency fund, think about investing to develop your wealth over time. Diversify your portfolio with a mixture of shares, bonds, and different investments to realize long-term monetary objectives.

3. Monitor and Alter Your Finances

Often assessment your finances and modify it as your monetary state of affairs modifications. As you make progress in paying down debt or growing your earnings, allocate these funds correctly to maximise your monetary well-being.

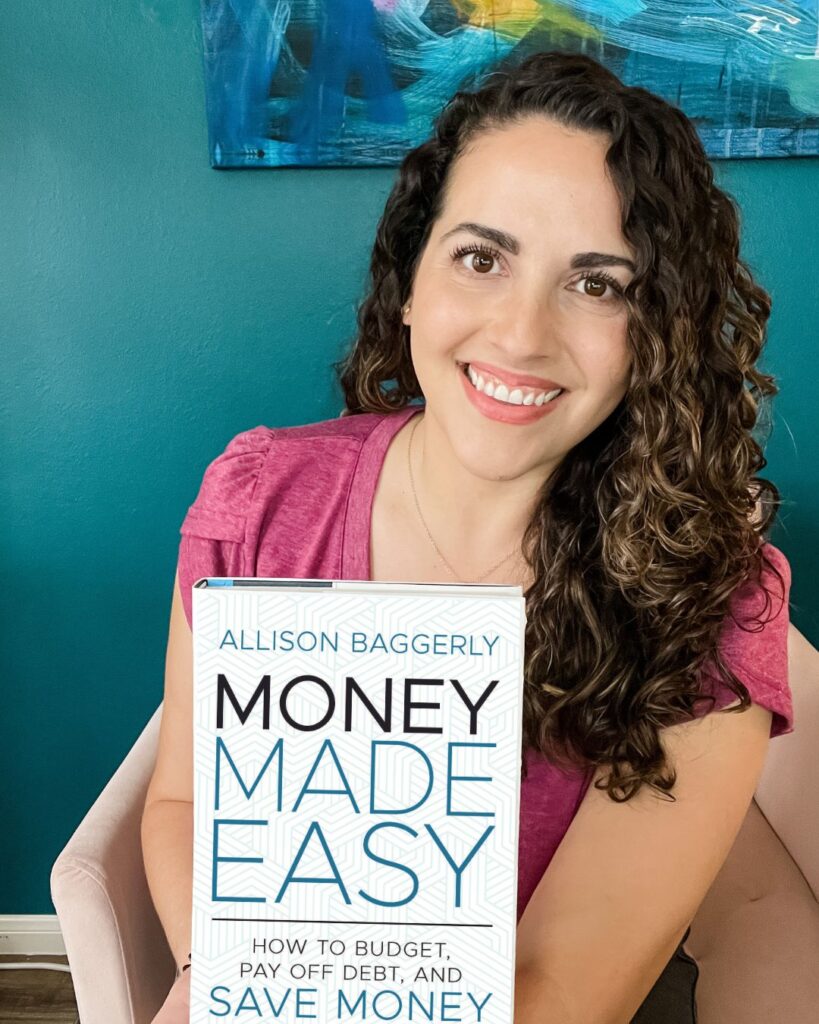

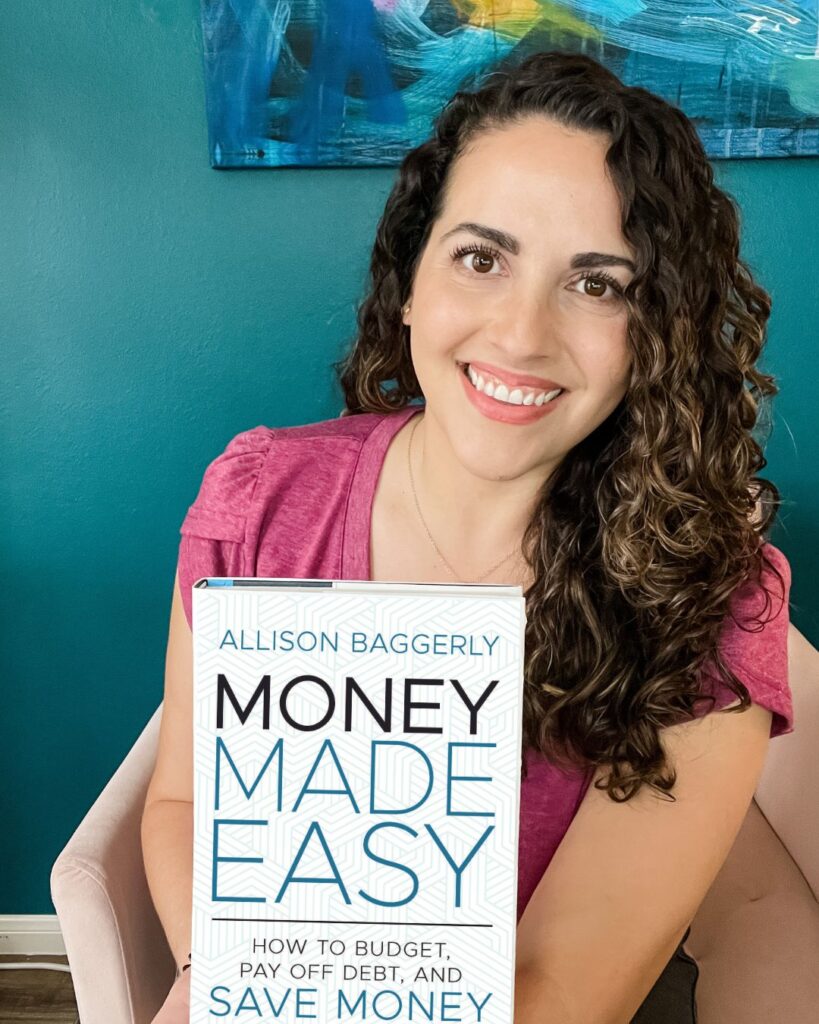

4. Search Monetary Training

Spend money on your monetary literacy. Attend workshops, learn books, or take on-line programs to reinforce your understanding of non-public finance. The extra you understand, the higher geared up you’ll be to make knowledgeable monetary selections.

The Backside Line

A Naked Bones Finances won’t be a long-term life-style selection, however it’s a robust software for constructing financial savings, eliminating debt, and weathering monetary storms. By prioritizing requirements and embracing frugality, you’ll be able to harness this budgeting technique to reinforce your monetary resilience and safe a brighter monetary future.

So, are you able to make the leap into the world of the Naked Bones Finances? Embrace this monetary problem, and watch your financial savings soar. You’ve received this!

Bear in mind, it’s a stepping stone towards a safer monetary future the place you’ll be able to obtain your objectives and reside life by yourself phrases.