Ever because the finish of World Warfare 2, america has loved unimaginable financial benefits: The greenback has been the reserve forex for financial transactions, the US has been seen as a beacon of democracy and freedom attracting the perfect and the brightest from all over the world (half of Silicon Valley C suites are current immigrants); The U.S. has engaged within the form of geopolitical and mutual protection management that has allowed us to very a lot affect the course of occasions.

A few of this has been problematic: we hollowed out our manufacturing base changing it with providers however failed to coach these employees who have been on the dropping finish of that deal.

However general, the U.S. has gained mightily when it comes to wealth and stature from the post-war world order.

~~~

I attempt to keep away from the shrieking, binary warnings. The extra helpful method is to acknowledge the vary of potential outcomes and assess the likelihood of every. Sure, one thing untoward may occur; I’m not but within the camp of those that consider Pax Americana has ended. However we should acknowledge that this worst-case situation is definitely a practical risk.

Nonetheless, the economic system has been sturdy, company earnings proceed to develop, and markets are making new all-time highs. That mixture has been traditionally very bullish. It’s why I’ve not but succumbed to the negativity rising throughout us.

The current actions from this administration are elevating a wide range of dangers. I first talked about the rising likelihood of serious coverage error again in February. Then once more, after April 2nd (“Liberation day”).

My query for readers as we speak is: “The place is the tipping level?” At what level do the chosen financial and political insurance policies put into place by the federal government develop into an avoidable error, a self-goal, by accident pushing america right into a recession?

I don’t know. However I’m carefully watching three parts that might lead me to issues:

1) Information Opacity: The softening labor market has led to a sequence of weak NFP experiences. Final month, the President fired the pinnacle of BLS; final week, the BLS introduced “the annual launch of shopper expenditures knowledge — initially set for Tuesday — can be “rescheduled to a later date.” This comes on prime of a web site snafu that delayed a traditional jobs knowledge report.

2) Confidence Faltering: One of many parts that allowed the Nice Despair to run so uncontrolled was an absence of uniform measures of the state of the economic system. A significant repair: constructing nationwide financial indicators. We created a sequence of uniform nationwide measures that tracked Gross Home Product (GDP), the Unemployment Price, and Shopper Value Index (CPI). These grew to become a gold customary amongst developed economies, creating constant (if imperfect) measures. Something undercutting knowledge transparency is a rising market danger issue.

3) Overreach: The extra the federal government strikes from its conventional position as a regulator to an energetic participant, the higher the chance of error is. There’s an rising sense of broad and aberrational transactional governmental actions in a number of coverage areas. The Intel deal, the (ignored) TikTok laws, the FCC regulation of content material (Colbert & Kimmel). None of those transactions could be regarded as conventional or regular within the U.S. system of capitalism.

After many years of strong progress, China’s command economic system has slowed from double-digit GDP good points to lower than half of that progress. A few of that was regular deceleration, however quite a bit was attributable to coverage errors: China expensively created huge ghost cities; they burdened provinces with big infrastructure debt. Additionally they ignore the demand aspect of the financial equation.1

~~~

One of many many potentialities is that the noisy headlines are, in actual fact, simply noise. The economic system continues to maneuver alongside briskly, and we skirt a recession, with financial exercise accelerating in 2026 attributable to charge cuts and deficit spending. However a gentle recession now appears to be about as probably as an escape. There are additionally rising dangers of one thing worse.

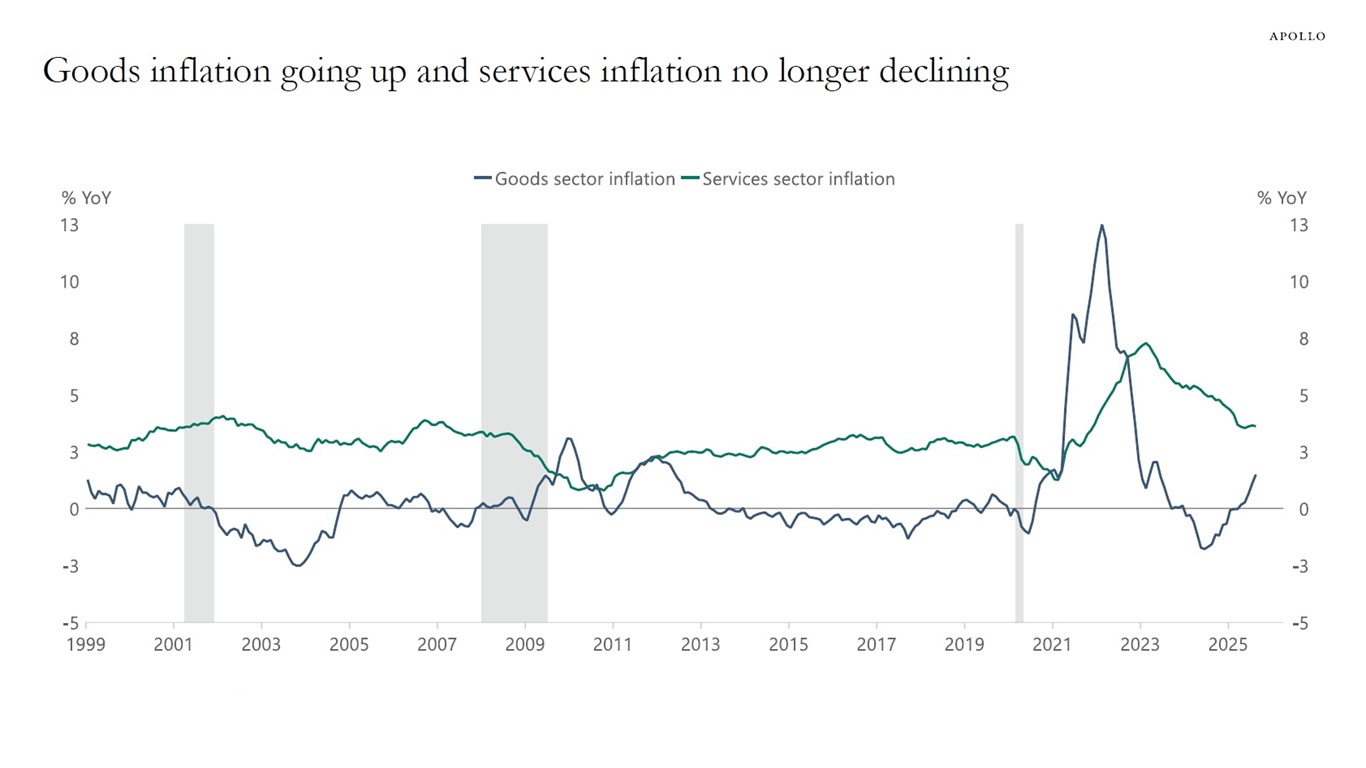

This administration inherited a sturdy economic system. There have been, under the water degree, some fractures – residual inflation (see chart at prime), softening labor market, horrible housing affordability, and elevated private and non-private debt. However Presidential administrations usually are not judged by the playing cards they’re dealt, however somewhat, how they play their palms. This administration has been doubling down on aggressive, high-risk performs.

I’m hopeful that we skate, avoiding a recession. However we should acknowledge the truth of rising dangers, together with the potential of recession, stagflation, or worse…

See additionally:

Bureau of Labor Statistics postpones key knowledge report (Axios, September 19, 2025 )

Beforehand:

Dangers & Alternatives of the New Administration (February 3, 2025)

7 Growing Possibilities of Error (February 24, 2025)

The Penalties of Chaos (April 7, 2025)

Crosscurrents (August 25, 2025)

How A lot is the Rule of Regulation Price to Markets? (August 2, 2021)

__________

1. See Dan Wang’s guide “Breakneck: China’s Quest to Engineer the Future” for extra particulars…