On September 19, 2025, the Financial institution of Japan issued its newest – Assertion on Financial Coverage – the place they introduced that there can be no change within the in a single day name charge (the coverage charge). Nevertheless, in addition they introduced that they’d start promoting off their holdings of exchange-traded funds (ETFs) and Japan actual property funding trusts (J-REITs). Many individuals are unaware of what these belongings are and why the Financial institution of Japan can be holding them. Additional, the media went wild and the Japanese share market gyrated (down) upon the information, suggesting that there was one thing vital happening or that the ‘markets’ are simply dumb. It was the latter by the way in which. Nevertheless, this has turn out to be a difficulty in Japan and this weblog put up is about sorting via the nonsense.

The September 19, 2025 announcement mentioned:

… the Financial institution determined, by a unanimous vote, to promote these belongings to the market in accordance with the basic ideas for his or her disposal, which embody the precept to keep away from inducing destabilizing results on the monetary markets. The dimensions of the gross sales will typically be equal to that for the “shares bought from monetary establishments”

The Financial institution stopped shopping for these belongings in March 2024 because it concluded that “the worth stability goal of two p.c can be achieved in a sustainable and steady method.”

So now, greater than a yr later, the Financial institution introduced it will begin promoting these belongings off utilizing the next pointers:

(1) dispose these belongings for satisfactory costs, making an allowance for the state of affairs such because the situation of the ETF or J-REIT market, (2) keep away from incurring losses as a lot as attainable, and (3) keep away from inducing destabilizing results on the monetary markets as a lot as attainable.

The newest – Financial institution of Japan accounts (issued on September 24, 2025) – present that:

1. Whole belongings – 710,701,760,867 thousand yen.

2. Japanese authorities bonds – 572,147,949,539 thousand yen or 80.5 per cent of whole belongings.

3. Pecuniary trusts (index-linked exchange-traded funds held as belief property) 37,186,178,276 thousand yen or 5.2 per cent of whole belongings.

4. Pecuniary trusts (Japan actual property funding trusts held as belief property) 655,021,089 thousand yen or 0.09 per cent of whole belongings.

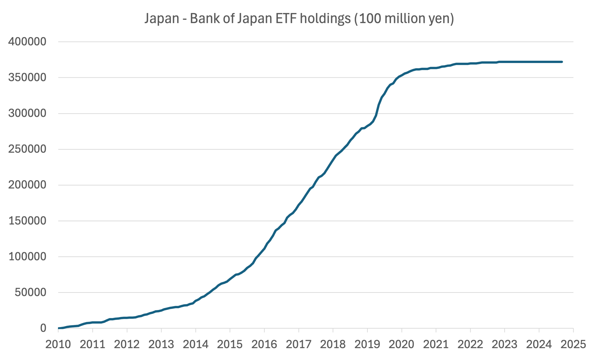

This graph charts the Financial institution’s ETF holdings since December 2010 up till August 2025 (newest time sequence information).

The REITs graph (not proven right here) follows an analogous trajectory albeit at a a lot decrease scale).

So there was a steady means of acquisition

Th Financial institution will begin promoting its inventory again into the market at 330 billion yen a yr for ETFs and 5 billion yen per yr for J-REITs will represent “about 0.05 p.c of the buying and selling values within the markets”.

So very small affect.

So what’s going on?

Is that this problematic?

This saga all started in October 2010, on the peak of the World Monetary Disaster (GFC) when the Financial institution of Japan determined to start out speculating within the Japanese share market.

The hypothesis was seen as a vital a part of its Giant-Scale Asset Buying (LSAP) program, which had been specializing in the acquisition of Japanese authorities bonds since 2001 and its zero rate of interest coverage that started in 1999.

The brand new buy plan was absorbed into its – Quantitative and Qualitative Financial Easing (QQE) which they introduced on April 2013.

The choice by the Financial institution of Japan to start out shopping for merchandise linked to the share market was fairly a deviation from regular central financial institution follow – hardly ever do central banks purchase shares.

It had purchased shares of some particular person banks between November 2002 and September 2004 as a part of a plan to underwrite their viability.

These purchases had been designed to ease the non-performing mortgage issues that had been an overhang from the asset bubble collapse within the early Nineties.

In different phrases, the Financial institution of Japan feared there can be a collapse of some main banks and as a stability coverage they bailed them out.

This was not motivated as a financial easing coverage,

So the Financial institution of Japan moved in and purchased up shares held by the industrial banks that had been rated at BBB- and above.

By September 2004, when this system was discontinued, the Financial institution of Japan held 2,018 billion yen of such shares and so they began promoting them once more in October 2007 however then ended the gross sales as monetary markets deteriorated within the lead as much as the GFC.

The purchases resumed in February 2009 as a result of the Financial institution of Japan assessed that the industrial banks had been recording huge losses from non-performing loans which threatened their solvency.

They ended this section in April 2010 including an additional 388 billion yen to its holdings.

The important level is that these purchases weren’t about financial easing.

However the ETF purchases was one other matter altogether.

On October 2010, the Financial institution of Japan introduced its – Complete Financial Easing (CME) – coverage, which was explicitly designed as a financial easing method.

It was thought-about to be extremely unconventional, though that could be a Western loaded time period.

The asset buy program was one a part of CME, which was dominated by the acquisition of JGBs.

The Financial institution had already been buying dangerous (non-government) belongings as famous above.

But it surely prolonged that method – in a really unconventional method – by shopping for up ETFs and J-REITs straight within the share market.

The motivation was to interrupt into the cycle of pessimism that the Financial institution believed had created a ‘coordination failure’ within the monetary system.

This failure was evidenced by stagnant financial institution lending which arose as a result of the banks had been unable to evaluate the danger related to new areas of funding alternative.

This was a dangle over from the bubble collapse.

The banks had been nonetheless drowning of their non-performing loans and slicing and the Financial institution of Japan launched into its CME program to assist cut back the intense pessimism (danger aversion) that had set in amongst buyers.

The funding neighborhood principally stopped investing in what had been thought-about to be riskier belongings and this turn out to be a self-fulfilling cycle of pessimism and dysfunction.

And so the Financial institution of Japan began shopping for up these riskier belongings to prop up demand and take these at most danger of collapse out of the market.

The purpose was to interrupt the danger aversion and supply a spark to struggling enterprises that had been unable to draw capital.

The Change-traded funds (ETFs) purchases usually are not direct share purchases from firms.

Reasonably they’re thought-about to be oblique share purchases given these funds monitor the – Nikkei 225 – and the – TOPIX (Tokyo Inventory Value Index).

These indexes are combos of particular person firm shares traded on the share market and so they created their composite utilizing completely different weighting strategies (Nikkei 225 makes use of costs, TOPIX market capitalisation).

ETFs are belongings which are successfully combos of many belongings within the share market – a form of composite index, and has the benefit that if one a part of the index (a particular share) falls in worth it may be offset by one other share that’s a part of the index rising in worth – so that they diversify danger to some extent.

However for all intents and functions you may consider them as shares.

The BoJ purchased a large amount of those belongings throughout the interval starting with the GFC because the graph above exhibits.

It additionally diversified the emphasis of this system over time.

For instance, in December 2015, the Financial institution of Japan shifted focus of their EFT purchases in direction of company that had been seen to be main funding in bodily infrastructure and human capital improvement.

As time handed, the speed of EFT acquisition elevated and I gained’t take you thru all of the bulletins that had been made as to the brand new increments.

There was loads of angst round 2015 and 2016, that the Financial institution was biasing its purchases in direction of shares that had been included within the Nikkei 225.

In some circumstances, the Financial institution of Japan acquired greater than half of the shares in some particular firms (for instance, Quick Retailing Co).

The Financial institution responded to those considerations by shifting its purchases extra to shares traded on the TOPIX.

After some years of large-scale purchases, the Financial institution of Japan now owns (not directly) about 7 per cent of the Japanese share market, which is very large.

What was the affect of doing this?

The Financial institution of Japan successfully turned a monetary market speculator and pushed the share costs up on the Nikkei 225 and the TOPIX, offering wealth positive aspects to the already rich.

International buyers additionally did very nicely.

To some extent the completely different parts of the CME labored in opposition to one another in relation to share costs.

The unfavorable rate of interest coverage pushed the yen up and share costs down whereas the EFT purchases pushed share costs up.

The starkest facet of this train is that whereas it was a very pointless operation, it has made the Financial institution of Japan one of many prime buyers within the Japanese share market.

That is an odd standing to have for a central financial institution, significantly because the Financial institution doesn’t have voting rights within the firms it has giant shareholdings in.

Many referred to as the Financial institution a ‘silent’ investor.

The purchases additionally in all probability created conditions the place the share costs in small corporations turned overvalued, which distorts funding calculus.

Whereas, the acquisition of JGBs was justified as a result of it saved the ‘borrowing’ yields down for presidency, given its obsession with issuing debt (one other completely pointless operation), the ETF purchases (and REIT purchases) simply supplied assist for the already rich.

It was company welfare writ giant.

Now the Financial institution of Japan has an issue. It’s a giant shareholder within the Japanese market.

It is aware of that if it sells these ETFs and REITs again to the market at market costs, the rise in provide will drive the worth down and personal shareholders will make losses.

That is the reverse affect of the preliminary purchases which supplied non-public shareholders with huge earnings.

So it has to promote their ETF holdings slowly (and the governor informed the media that it will take 100 years to relinquish their whole holdings).

Even then it’ll act as a dampener on the share market, which is why there was widespread promoting amongst shareholders instantly after the Financial institution of Japan announcement final week.

Conclusion

I believe the Financial institution of Japan is sensible sufficient although to not destabilise the share market and can tailor their gross sales volumes to realize that objective.

The purpose although is that the unique functions represented company welfare – completely pointless and a boon to the already rich in Japan.

It’s one other demonstration of how capitalism is dependent upon the state for its survival.

It’s probably that many extra banks and firms would have turn out to be bancrupt throughout the GFC and its aftermath had not the Financial institution of Japan bailed them out with EFT and J-REIT purchases.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.