At present, I’m excited to share an article from Lyn Mettler. Lyn has earned over $6,000 in simply 15 months through the use of a little-known technique referred to as financial institution bonuses. On this article, she breaks down precisely the way it works, why banks are prepared to pay you, and how one can get began, too. Fast abstract immediately from…

At present, I’m excited to share an article from Lyn Mettler. Lyn has earned over $6,000 in simply 15 months through the use of a little-known technique referred to as financial institution bonuses. On this article, she breaks down precisely the way it works, why banks are prepared to pay you, and how one can get began, too. Fast abstract immediately from Lyn: “It’s concerning the best facet hustle I’ve ever come throughout: opening checking accounts and incomes the free bonus (normally $300-$400) for depositing the required quantity normally within the first 90 days.“ Lyn additionally created the Financial institution Bonus Blueprint course, the place she teaches the precise system she makes use of so you may observe alongside and earn a living. This is usually a surprisingly straightforward approach to make additional earnings with out numerous time or effort!

Should you’ve been hanging across the private finance world for some time, you’ve most likely seen dozens of how to earn additional earnings: facet hustles, cash-back apps, survey websites, even reselling on eBay.

However there’s one technique that most individuals utterly overlook—and it’s one of many easiest, quickest methods to earn free cash I’ve ever discovered.

I’m speaking about financial institution bonuses.

Sure, these “open a checking account and get $300” affords you’ve most likely scrolled previous or tossed within the recycling bin with out a lot thought! They could look small at first look, but when you understand how to string them collectively, they’ll add as much as hundreds of {dollars} very quick.

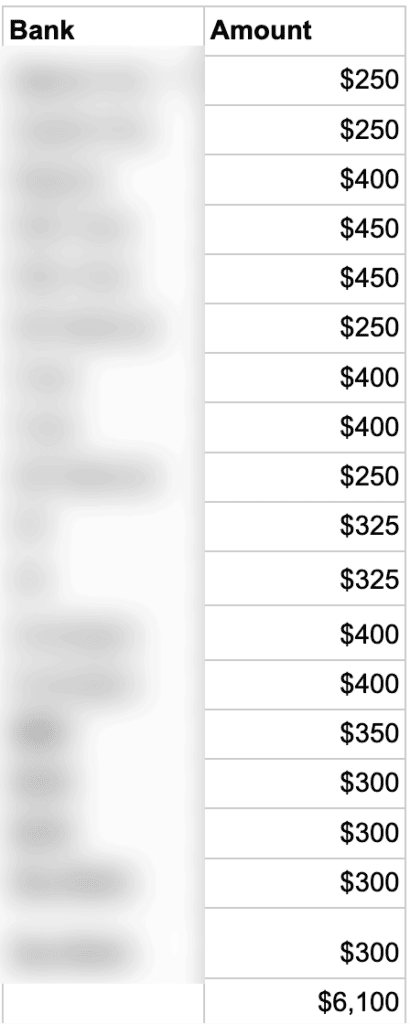

I do know, as a result of I’ve achieved it myself. Since July 2024, I’ve earned greater than $6,000 in free cash by finishing 18 financial institution bonuses—and I’m not stopping anytime quickly.

What Precisely Is a Financial institution Bonus?

A financial institution bonus is when a financial institution pays you (normally round $200–$400, generally extra) to open a brand new checking account with them and meet a couple of primary necessities.

Usually, that appears like:

- Opening a model new checking or financial savings account

- Establishing direct deposits of a certain quantity inside a sure timeframe (normally 90 days)

- Then transferring it again to your primary account (or paying what you want immediately from this account)

After that, the financial institution pays you the bonus.

You don’t must preserve the account open eternally. You don’t want to leap by means of countless hoops. In truth, banks count on that many individuals will open the account, get the bonus, and finally shut it.

So why do they provide this within the first place?

Beneficial studying: 17 Low Effort Aspect Hustles That Can Make You Further Cash

Why Banks Are Comfortable to Pay You Lots of of {Dollars}

After I first discovered about this, I had the identical query: Why would a financial institution simply hand me cash like this? What’s the catch?

Right here’s the within scoop, straight from a colleague of mine who’s labored within the monetary trade.

Banks prefer to preserve a wholesome steadiness of deposits in comparison with the cash they lend out, and providing bonuses is a straightforward approach to herald new money rapidly whereas attracting new prospects.

So to spice up deposits rapidly and to draw new prospects, banks will incentivize prospects such as you and me to maneuver cash into their accounts. Even when it’s only for somewhat bit, that deposit helps their books by exhibiting they’ve the correct amount of money available to cowl their loans.

So no—you’re not hurting the financial institution by opening an account, gathering the bonus, and finally closing it. In truth, you’re serving to them. Win-win!

Observe from Making Sense of Cents: After all, banks are hoping that you simply’ll keep longer than only a few months, too. These bonuses are their approach of getting new prospects within the door. When you’ve opened an account, arrange direct deposit, and linked a couple of payments, they know that it turns into extra of a problem to depart. That’s what makes you a “stickier” buyer – somebody who’s much less prone to change banks once more. So whereas they’re paying you that preliminary bonus, they’re additionally betting that you simply’ll discover it simpler to only keep put.

My Story: From Skeptical to $6,000

After I first heard about financial institution bonuses, I’ll admit—I used to be skeptical. It sounded too straightforward.

However I made a decision to check it. I opened an account with a nationwide financial institution that was providing $400 for a direct deposit of $500 or extra inside 90 days. Straightforward peasy. I switched one paycheck over to that account. Certain sufficient, a couple of weeks later, $400 confirmed up. A few minutes of my time netted me $400 completely free.

I used to be hooked.

From there, I began stacking affords—generally working one bonus for me and one other for my husband on the identical time. I’d let two paychecks hit one account, shut it after the bonus posted, and transfer on to the following.

In simply 15 months, I’ve accomplished 18 bonuses totalling greater than $6,000.

That’s $6,000 for doing nothing greater than shifting cash round—one thing we’re already doing each month.

Actual Folks Are Doing This Too

And it’s not simply me. I’ve shared this technique with my readers and members, and right here’s what a few of them have stated:

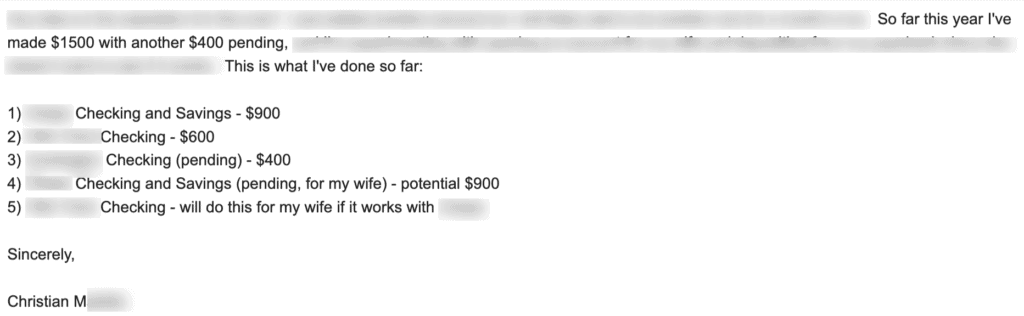

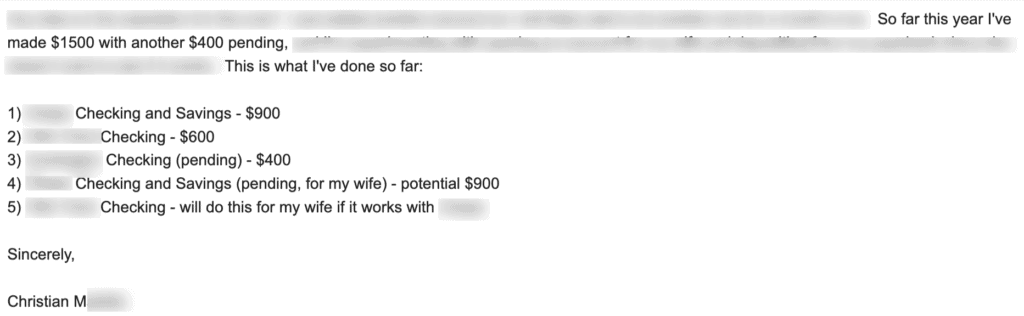

- “To date in 2025, I’ve made $1,500 with one other $400 pending.” – Christian

- He’s opened 5 accounts up to now utilizing my technique.

- “I used to be impressed by Lyn’s information on incomes financial institution bonuses, so I opened an account to see if I may cowl some sudden vet payments. Yesterday, I acquired the $300 bonus.” – Janet

- “I acquired my first bonus and we put that towards our Disney trip! I’m hoping that every one the bonuses collectively can pay for all of our eating bills at Disney.” — Jim B

- “I’m within the technique of incomes 2 $400 bonuses — really easy!” – Jason

I used a current financial institution bonus to purchase season tickets to Notre Dame residence soccer video games – so enjoyable! (I get a reduced worth as a present graduate pupil, so for under, $300 I can go to as many video games as I would like).

What may you employ a financial institution bonus to cowl?

- Vacation items

- Your subsequent resort keep

- Sudden bills (like vet or medical payments)

- Braces

- Faculty financial savings and tuition

- Debt

- Donation

- Funding

- Automobile funds

- New tires

- A brand new equipment

- Your subsequent journey card annual charge

- A flowery dinner out

- New garments

- Fashionable new sneakers

- A present

It’s not a “get wealthy fast” scheme. It’s not one thing shady or sophisticated. It’s merely profiting from affords banks are already placing on the market and opening your hand to free cash they’re already handing out. I would like my justifiable share, don’t you?

Why This Works So Properly as a Aspect Hustle

What I like most about this technique is how low-effort it’s.

- You don’t want particular abilities.

- You don’t want a ton of time.

- You don’t want to speculate cash up entrance.

If you have already got a paycheck or advantages that may be direct-deposited (and greater than a paycheck counts as a direct deposit, which I clarify inside my Financial institution Bonus Blueprint course), you are able to do this. And in contrast to most facet hustles, you don’t need to preserve grinding away at it. As soon as the bonus posts, you’re achieved. On to the following one!

How A lot Can You Actually Earn?

Right here’s a sensible take a look at what’s potential:

- A single bonus is normally value $200–$400.

- Do 1 per 30 days, and also you’re taking a look at ~$3,600

- Should you and a partner/companion each take part, you may simply double that.

- You possibly can even present your youngsters with jobs how to do that and take that earnings and put it aside away for a wet day!

Like I stated, I’ve personally earned over $6,000 in about 15 months. That’s greater than many individuals make in a part-time job over the identical interval—with out clocking in anyplace and spending just a few minutes right here or there engaged on this.

However What About Taxes?

You may be questioning: If I earn this cash, do I owe taxes on it?

Sure, financial institution bonuses are thought-about taxable earnings. The financial institution will ship you a tax doc on the finish of the yr, just like for those who earned freelance earnings, curiosity earnings on a checking account, or another kind of earnings.

I’m not an accountant, so I like to recommend you verify with yours in your particular state of affairs. However even after taxes, these bonuses are effectively value it, since you’re nonetheless netting a ton of free cash.

My Secret Weapon: A Easy System

Right here’s the factor. It’s not sufficient to only open a random account once you see a suggestion. To maximise your earnings, you want a system.

It is advisable to:

- Know which banks are at present providing the perfect offers

- Know which banks to keep away from as a result of they make it tough (most don’t, however I’ve had a couple of that I might NOT advocate)

- Observe necessities and deadlines so that you don’t miss a bonus

- Perceive easy methods to strategically rotate who’s incomes the bonus

- Know the simplest methods to entry your cash as soon as it’s deposited (each direct deposits and the bonus) and shut the account once you’re achieved

- Perceive easy methods to arrange the account, like must you arrange overdraft safety, add your partner to the account, ask for a debit card or checks, and so on.

- Keep away from widespread errors that would disqualify you

That’s precisely why I created my Financial institution Bonus Blueprint course. It’s the step-by-step system I’ve used to earn $6,000 in free cash (and counting).

Listed here are some testimonials from individuals who have taken my course:

Ceaselessly Requested Questions

Beneath are solutions to widespread questions on making extra cash with financial institution bonuses.

1. Does this harm my credit score rating?

No. Not like bank cards, opening a checking account normally triggers a “gentle pull” (or nothing in any respect) in your credit score report, not a tough inquiry. So there’s normally no affect to your credit score rating. Should you’re fearful, it’s a good suggestion to verify the supply particulars first simply to ensure.

2. Do I’ve to maintain the account open eternally?

Under no circumstances. When you’ve met the necessities and the bonus has posted, you may shut the account if you’d like. You loaned them the cash they wanted, now take yours and run :). Simply make sure that to verify whether or not the financial institution requires you to maintain the account open for a couple of months earlier than closing it, as some will take the bonus again for those who shut too quickly.

3. What if I don’t get a paycheck direct deposited?

Many banks settle for issues like Social Safety advantages, retirement distributions, and even tax refunds. It doesn’t at all times need to be a paycheck—although it’s best to at all times verify the wonderful print.

4. What number of bonuses can I do without delay?

It relies on how a lot flexibility you have got together with your direct deposits. I normally advocate beginning with separately till you get the dangle of it.

5. Is that this actually definitely worth the effort?

Let me put it this fashion: would you turn the place your paycheck lands for a month if somebody handed you $300? I’ll do that each single time!

How I Made $6,000 in 15 Months From Financial institution Bonuses – Abstract

Should you’ve been in search of a facet hustle that doesn’t eat up your time, a approach to enhance your financial savings with out reducing again, or only a enjoyable problem that pays you actual cash—you’ll wish to give financial institution bonuses a attempt.

I’ve seen firsthand how this may add hundreds to your checking account in a yr. And as soon as you realize the system, it turns into computerized.

The reality is, most individuals skim proper previous these affords with out realizing how highly effective they’re. However the ones who take motion? They’re laughing all the best way to the financial institution—actually.

👉 Should you’d prefer to be taught precisely how I do it (step-by-step), take a look at my Financial institution Bonus Blueprint. It’s the precise course of I used to earn $6,000 in 15 months, damaged down so you can begin incomes your individual free cash instantly. How a lot can YOU earn?

Please click on right here to be taught extra about Financial institution Bonus Blueprint.

Have you ever ever tried incomes cash from financial institution bonuses? If that’s the case, how a lot have you ever made—or would you ever give it a attempt?

Writer bio: Lyn Mettler is a long-time journey author, entrepreneur, and couponer who loves a superb deal. She mastered the artwork of at all times flying her total household of 4 free in 2015 and now runs the Households Fly Free membership, the place she teaches households across the U.S. her easy system to fly and journey totally free utilizing miles and factors. She has visitor posted on Making Sense of Cents prior to now as effectively, and you’ll learn it at How My Household of 4 Flies Free 6 Instances Each Yr.

Beneficial studying: