This can be a second a part of an as but unknown whole, the place I examine attainable new coverage agendas, that are designed to fulfill the challenges that Japan is dealing with within the instant interval and the years to come back. That is additionally within the context of the elevation of Ms Takaichi to the LDP presidency and shortly Prime Minister. She has instructed that her coverage agenda will shift considerably from the present authorities place, within the sense that she desires decrease rates of interest, whereas nearly all of economists need larger, and he or she is advocating additional fiscal growth, whereas the mainstream need austerity. Within the first half I examined the inflation subject in Japan, which means that the mainstream view that charges must rise is misguided. At the moment, I’m contemplating the scope for fiscal growth.

The collection thus far;

1. Japan – the challenges dealing with the brand new LDP chief (October 6, 2025).

2. Japan – the challenges dealing with the brand new LDP chief – Half 2 (October 9, 2025).

Ms Takaichi is an advocate of Abenomics, which was outlined by a dedication to strong fiscal activism and low rates of interest, with the Financial institution of Japan holding authorities bond yields near zero by way of its large bond-buying program.

Final yr, the brand new chief advised the Financial institution of Japan that it was “silly to boost rates of interest now” and he or she has persistently articulated a view that rates of interest shouldn’t be used as a counter-stabilising coverage device (Supply).

Considered one of her present advisors is a colleague of mine on the College and we now have revealed a number of articles and books collectively.

In consequence, the coverage recommendation is pretty in step with Fashionable Financial Principle (MMT), though she can be getting enter from mainstream economists.

However the mixture of steady low rates of interest (that’s, de prioritising financial coverage as a device to manage the financial cycle) and a dedication to make use of daring fiscal coverage interventions to realize full employment and materials prosperity is clearly extra MMT than an expression mainstream New Keynesian orthodoxy.

The opposite fascinating side of her method is captured by her assertion on the press convention upon taking up the LDP management:

The federal government ought to take duty for financial coverage … (the federal government) … ought to talk intently with the BOJ.

Over the past week, there has not been a number of commentary centered on this side of her method, however as I signalled in Monday’s submit, this challenges one of many shibboleths of mainstream New Keynesian pondering, which has led us all to consider that ‘central financial institution independence’ is non-negotiable and requires no political affect on financial coverage.

I’ve thought-about this subject earlier than in these posts amongst others:

1. The central financial institution independence fable continues (March 2, 2020).

2. Censorship, the central financial institution independence ruse and Groupthink (February 19, 2018).

3. The sham of central financial institution independence (December 23, 2014).

4. Central financial institution independence – one other fake agenda (Might 26, 2010).

5. Senior mainstream economist now admits central banks usually are not as impartial as many consider (June 3, 2024).

The purpose is that the independence narrative was a part of the depoliticisation agenda accompanying the neoliberal takeover of presidency.

It allowed elected governments to shift the blame for rate of interest will increase (and the political fall-out) away from itself by claiming that the financial coverage authority was ‘impartial’ from authorities and so forth.

After all, there is no such thing as a independence.

The elected authorities usually appoints the senior officers of the central financial institution so the appointments are political and the historical past of the RBA board confirms that clearly.

Extra importantly, the central financial institution and the treasury departments for every nation should talk every day as a result of fiscal selections have implications for the liquidity within the system, which, in flip influences the state of the reserves that banks maintain of their accounts on the central financial institution, which, in flip, determines what the central financial institution does as a way to handle that liquidity to make sure it’s in step with their present financial coverage stance.

If that each one seems like gobbledygook then I urge you to return and skim among the posts I’ve linked to above to get the extra detailed rationalization which can clear all of it up for you.

The underside line is that on the operational stage there might be no independence between the central financial institution and the treasury – each macroeconomic coverage arms are a part of the consolidated authorities sector and should work collectively for coverage consistency to happen.

The fascinating level although is that Ms Takaichi is popping out brazenly about this and making it clear that financial coverage must be the duty of the elected authorities and never handed over to unelected and largely unaccountable technocrats.

That could be a marked departure from the orthodoxy.

The place I depart with Ms Takaichi’s said targets are that she seeks to:

… prioritize financial development.

I’ve written earlier than about how Japan ought to lead the world in exhibiting us tips on how to obtain a sustainable degrowth trajectory whereas nonetheless guaranteeing the fabric wants of its residents are met.

For instance:

1. Degrowth and Japan – a shift in authorities technique in direction of enterprise failure? (July 17, 2024).

2. Japanese authorities investing closely in applied sciences to assist its inhabitants age (October 21, 2024).

With an ageing inhabitants, a resistance to large-scale immigration, there at the moment are important constraints showing within the labour market when it comes to out there abilities and so forth.

As I’ve famous earlier than, over 70 per cent of SMEs, which dominate the economic system, are owned by those that on common are over 70 years age.

And there’s a resistance to promoting these companies on the open market when the proprietor will get too previous to run them – in favour of passing them down throughout the household.

Nonetheless, more and more the youngsters don’t need to stick with it the household enterprise custom and so the companies shut when the ageing proprietor is finished.

So slightly than battle in opposition to the demographic actuality, which is on-going and tough to reverse throughout the dominant tradition, it might be extra smart to develop a degrowth technique.

Even when we didn’t maintain that degrowth predilection, it stays to ask simply how a lot capability there’s throughout the present productive useful resource availability to accommodate important financial development anyway.

I ask that query as a result of to advocate rising the fiscal deficit implies that the federal government thinks there’s actual useful resource area out there to soak up the elevated nominal spending with out frightening demand-pull inflationary pressures.

So I’m doing a little analysis on that query and that is the primary tackle the out there proof.

I’ll write extra about this matter as my analysis expands.

The Financial institution of Japan publishes a quarterly time collection – Output Hole and Potential Development Fee – and the most recent information got here out on October 3, 2025.

This information supplies some proof we are able to draw upon to assist us decide the ‘development area’ out there to the Japanese authorities.

The technical paper underlying this information is – Methodology for Estimating Output Hole and Potential Development Fee: An Replace (revealed Might 31, 2017).

I gained’t go into the technical particulars however I’ve written concerning the deficiencies of typical output hole methodology.

For instance:

1. The NAIRU/Output hole rip-off reprise (February 27, 2019).

2. The NAIRU/Output hole rip-off (February 26, 2019).

3. The dreaded NAIRU remains to be about! (April 16, 2009).

4. NAIRU mantra prevents good macroeconomic coverage (November 19, 2010).

5. Structural deficits – the nice con job! (Might 15, 2009).

6. Structural deficits and computerized stabilisers (November 29, 2009).

My very own PhD work was, partially, about this actual subject and my work as a 4th yr pupil on the College of Melbourne (1978) was, partially, about these points.

The thought of an output hole is conceptually sound – it’s fairly clear that we are able to conceptualise some potential output stage past which the productive system can’t squeeze any extra actual output with out additional useful resource capability being added (capital, labour, land, and so forth).

The measure of present manufacturing is obvious sufficient though measures of GDP are poor for what they embrace (for instance, air pollution) and exclude (for instance, residence manufacturing).

Additionally it is pretty straightforward to grasp the idea of a macroeconomic equilibrium unemployment stage the place the conflicting distributional nominal earnings claims between employees, capital and authorities are constant, albeit for a transitory interval, with the true output out there for distribution.

My PhD (and early publications) have been, partially, about theorising and operationalising this concept with a path-dependent system.

Nonetheless, as they are saying, the satan is within the element.

We all know that ideology distorts the measurement course of and the empirical expression of theoretical ideas.

Let me clarify.

The Financial institution of Japan writes that:

The output hole is the financial measure of the distinction between whole demand as an precise output of an economic system and common provide capability, smoothed out for the enterprise cycle — specifically potential GDP – … within the items and companies market of the nation. The potential development fee is the annual fee of change in potential GDP. In issue markets, the output hole expresses the differential between the labor and capital utilization charges and their common previous ranges. The potential development fee is the sum of the typical development of labor enter and capital enter, and the effectivity with which these components are used, specifically whole issue productiveness (TFP).

Taken at face worth, that is uncontroversial, though the absence of any biophysical side on the conceptualisation of potential GDP development charges is a severe and recognized deficiency.

However, primarily, the output hole idea is straightforward to grasp.

The issue is that ‘potential GDP’ isn’t simply measurable and requires us to take a stand on what constitutes full capability utilisation of labour and capital.

That is the place ideology enters the image.

What constitutes full employment of labour?

Within the context of the utmost output that could be squeezed out it should imply having everybody working as much as their desired hours.

Nonetheless, that’s not the way in which the mainstream outline full employment.

They contemplate the Non-Accelerating-Inflation-Fee-of-Unemployment (NAIRU) which is conceptually the unemployment fee the place inflation is steady.

It’s unobservable and the estimates utilizing statistical means are extremely depending on the assumptions and method taken.

As I’ve famous many instances earlier than, the statistical accuracy for the recognized NAIRU estimates is notoriously poor, with extensive normal errors – such that they’re principally ineffective for pinpointing some particular full employment stage.

Furthermore, they’re usually biased upwards, that means that the mainstream depiction of full employment associates a lot larger unemployment charges with that state than the method that I take.

The Financial institution of Japan’s method is comparatively orthodox, initially based mostly on estimating what they name the Labour Enter Hole and the Capital Enter Hole.

They then provide you with a weighted measure of those gaps to outline a complete output hole.

Then utilizing precise GDP figures derived from the Nationwide Accounts, they’ll subsequently estimate the potential GDP.

Why?

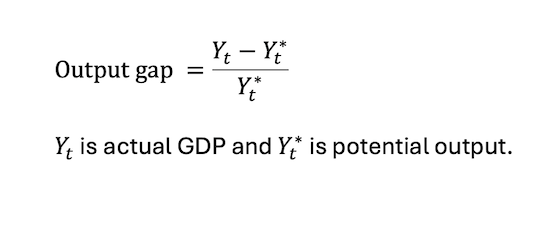

The output hole is outlined in easy algebra as:

You don’t have to be a mathematician to have the ability to work with this definition.

If precise GDP is 100 and potential GDP is 120, then the method offers:

Output hole = (100 – 120)/120 = -0.166666667 or in proportion phrases -16.7 per cent.

That may be a really massive output hole.

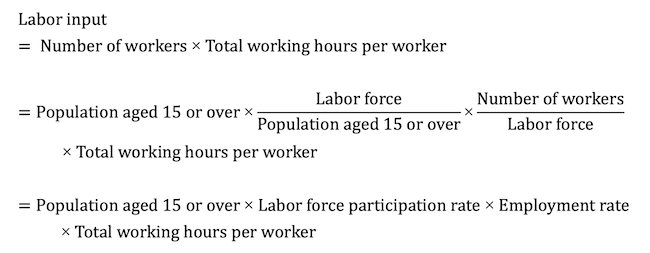

The Financial institution of Japan defines the Labour Enter as:

The Financial institution’s potential Labour Enter measure makes use of the identical expression “which smooths out the

enterprise cycle”.

What does that imply?

I gained’t go into the technical stuff however principally they use statistical instruments to calculate a development and assume that is the complete capability measure.

The distinction between this ‘development’ enter measure and the precise measure is the Labour Enter hole.

It’s problematic as a result of the development could not correspond with an employment stage that satisfies the need for working hours of the out there labour power.

They equally calculate a Capital Enter hole based mostly on the distinction between precise capability utilisation charges and common utilisation charges.

There are all kinds of measurement issues confronted in doing that.

However for now, we simply assume these estimates have some extent of applicability to the true world.

The truth that the Financial institution of Japan and the Ministry of Finance use these estimates of the output hole in designing financial coverage is an effective purpose for contemplating them, however my considerations.

They’re prone to underestimate the Labour Enter hole, which suggests we are able to contemplate them for argument sake, to outline the smallest hole – with the truth mendacity above their estimates.

The most recent information got here out final week (October 3, 2025).

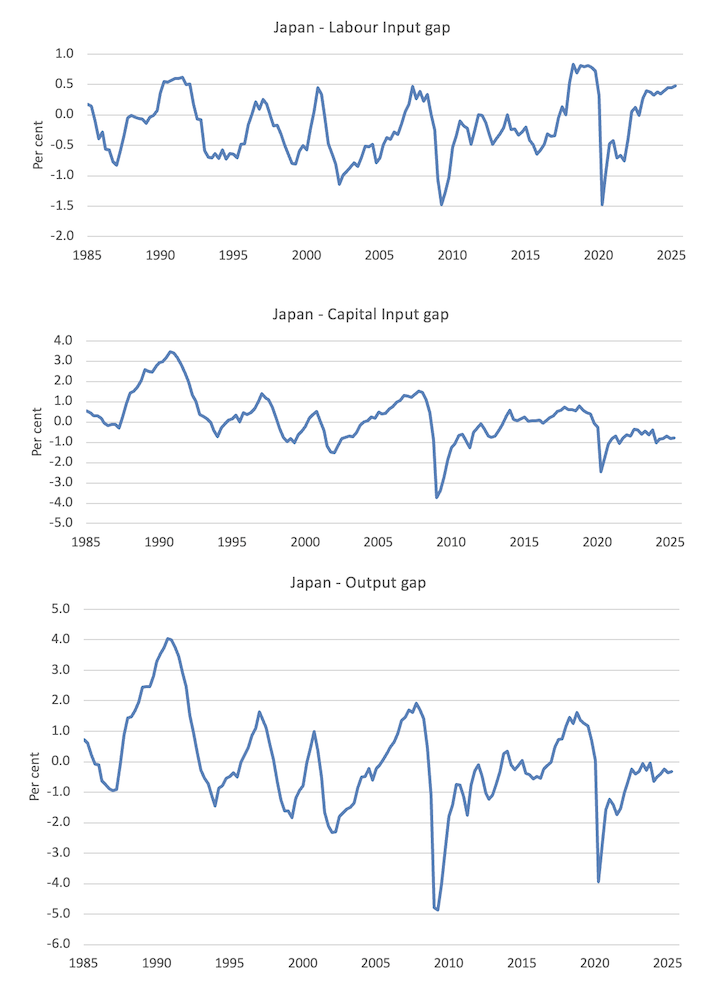

Here’s a graph exhibiting the Labour Enter hole, the Capital Enter hole, and the entire output hole between the March-quarter 1985 and the June-quarter 2025.

As on the June-quarter 2025, the Financial institution estimates an output hole of -0.32 per cent – comparatively small.

They estimate the Labour Enter hole to be +0.47 per cent, which suggests the out there labour power is working over their development potential.

They estimate the Capital Enter hole to be -0.79 per cent, which suggests present capital utilisation is under its long term common utilisation.

So their estimate of a small output hole relies on the concept that the economic system might extract extra output out of capital inventory by working it more durable.

So in line with these estimates, there’s some scope for rising precise GDP development utilizing elevated web authorities spending, earlier than tax offsets could be thought-about.

The query although is how to do this with the labour capability already effectively above potential?

I’m exploring that query subsequent.

And the context is that there’s now a rising antagonism throughout the political divide for the consumption tax.

I’m advised that Ms Takaichi is sympathetic to the argument that this tax might be diminished.

Conclusion

An on-going analysis activity which can culminate in a serious occasion within the Weight loss program in Tokyo on November 7, 2025.

I’ll present extra particulars of that occasion sooner or later.

That’s sufficient for right this moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.