It’s now been 10 days for the reason that authorities shutdown started and mortgage charges look like transferring decrease.

They have been already close to three-year lows heading into the shutdown, and now with it dragging on, bond yields are falling as effectively.

The ten-year bond yield, which serves as a bellwether to 30-year fastened mortgage charges, was down practically 10 foundation factors (bps) this morning.

It’s nearing the all-important 4% threshold, which if damaged might result in one other leg down for mortgage charges.

However the extra ominous takeaway right here is that the financial system doesn’t look so good anymore.

Bond Yields Drop as Gov Shutdown Hits Day 10

As famous, the 10-year bond yield was down practically 10 bps this morning regardless of the discharge of any authorities knowledge.

We missed what’s arguably an important knowledge level final Friday, the month-to-month jobs report from the Bureau of Labor Statistics.

And a slew of different stories, however the BLS is reportedly “bringing some furloughed employees again in” to get the CPI report for September launched.

Whereas it doubtless will likely be delayed (for the reason that launch date is October fifteenth), the hope is seemingly to get it out earlier than the Fed’s subsequent assembly on October twenty eighth.

In fact, the percentages of one other 25-bp minimize within the federal funds charge continues to be at practically 95%, per CME FedWatch.

So it’s uncertain any piece of information launched between every now and then will make a lot of a distinction.

There’s only a basic vibe that the financial system has sort of turned, although the inventory market is ripping larger with no care on the earth.

However given shares are buying and selling close to all-time highs, a pullback might be in retailer quickly and that might result in a rally in bonds.

Traders sometimes flee the inventory market when instances get powerful and pile into safe-haven bonds, which will increase the value of bonds however lowers with related yield.

When that occurs, rates of interest on mortgages have a tendency to maneuver decrease.

So there’s a good thesis right here that mortgage charges might transfer markedly decrease within the fourth quarter of the 12 months.

For reference, again in December 2024 I predicted a 30-year fastened within the excessive 5s by the tip of the 12 months, and we aren’t far off in the meanwhile.

I’ve additionally defined that mortgage charges have a tendency to maneuver decrease throughout authorities shutdowns, so between that truth and the very weak labor knowledge as of late, there’s lots of downward stress on mortgage charges.

Mortgage Charges Slip Beneath 12 months-In the past Ranges (Once more)

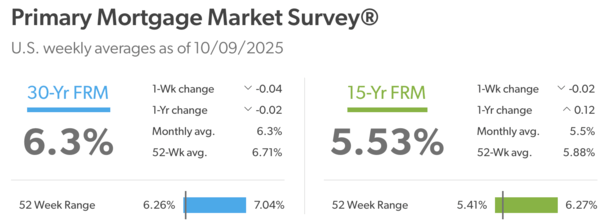

In the meantime, mortgage charges are already beating their year-ago ranges, per the most recent weekly survey from Freddie Mac.

The mortgage financier mentioned the 30-year fastened hit 6.30% this week, down from 6.34% per week in the past and 6.32% this time final 12 months.

The bottom studying for the 30-year fastened in 2024 was 6.08% final September, nevertheless it was very short-lived as an errant sizzling jobs report and subsequent election triggered charges to shoot larger.

Nonetheless, it doesn’t appear there may be a lot standing in the way in which of decrease mortgage charges this 12 months, with financial knowledge decidedly poor and far of Trump’s coverage baked in.

That doesn’t imply we gained’t see pullbacks or surprises, nevertheless it does really feel just like the “pattern is our good friend” proper now for mortgage charges.

Which means there’s a good likelihood they might transfer decrease and beat all of the readings for 2024 sooner or later this 12 months.

And dare I say dip beneath 6%, which might be the bottom studying since very early February 2023.

Within the meantime, even when mortgage charges are sort of caught due to a knowledge blackout, they’re in a reasonably great place.

Given they have been flirting with 7% on a number of events this 12 months, getting into a authorities shutdown at round 6.25% appears fairly fortuitous.

Learn on: Learn how to observe mortgage charges with ease.