Ten %? Twenty %? Extra?

I’ve written lots about the advantages of each 401(okay)s and IRAs. We’ve additionally regarded on the rising Roth 401(okay) possibility and when it is sensible for younger traders.

However everyone’s subsequent query is: “Okay, okay, however how a lot ought to I put into my 401(okay)?”

One of the crucial well-liked posts on this weblog’s ten-year archives is “How A lot Ought to Be In Your 401(okay) At 30?”

I used to be 25 after I wrote it, attempting to resolve how a lot to contribute to my very own 401(okay).

However what I realized from over 200 (generally nasty) feedback is that setting a financial savings benchmark by age alone is foolish; no two savers are the identical. You possibly can’t examine the engineer who graduated at 22 right into a $65,000-a-year job with no pupil mortgage debt to a physician who begins practising at 29 and has $200,000 in loans. Or the social employee incomes $35,000 a 12 months and needing all of it simply to eat.

You should utilize this fundamental 401(okay) calculator to estimate how a lot you’ll save in your 401(okay) primarily based in your private standing:

At the moment I need to present barely extra tactical recommendation. As a share of your revenue, how a lot do you have to contribute to your 401(okay)?

- For those who’re in debt?

- If you can even do a Roth IRA?

- In case your employer doesn't match funds?

The 2 elementary guidelines of retirement financial savings

Listed below are two guidelines that may apply to virtually everybody:

- In case your employer matches 401(okay) funds, contribute sufficient to get the complete match. Do that first. Even for those who’re in debt. Even for those who don’t put in a penny extra. It’s free cash, and it is best to take it.

- Subsequent, for those who can contribute to a Roth IRA, work on contributing the complete annual restrict a 12 months to that account earlier than you contribute any additional to your 401(okay) (other than what’s essential to get the employer match). This will provide you with a pleasant cushion of tax-free money in retirement.

Determine the ratio you’re probably the most comfy with—however hold upping your financial savings

There are many ratios on the market recommending how one can divide up your revenue. Some are so simple as spend 50%, save 50%. Though an admirable purpose, most individuals may have a tough time with this. Particularly in your twenties. I like 75/20/5.

- Spend 75%

- Save 20%

- Give 5%

However work out the ratio you’re comfy with. Chances are you'll need to defer charitable giving till you’re debt-free. For those who want most of your revenue to eat, it is perhaps spend 90, save 10 and even 95/5. That’s okay. However it is best to reevaluate this as your monetary state of affairs modifications and goal to get to no less than 80/20.

On this instance (75/20/5), for those who earn $40,000, you'd spend $30,000 or $2,500 a month, save $8,000 a 12 months, or $667 a month, and—if you'd like—put aside $2,000 a 12 months to your chosen causes. Observe that we’re working off of before-tax revenue, in order that $2,500 a month for spending is perhaps extra like $2,000 after taxes).

Working backwards from this, let’s say your employer will match as much as half of a 6% contribution to your 401(okay). So 6% of your pre-tax revenue is $3,000. Your employer throws in $1,500. You set that in, and you've got $3,500 left in your financial savings price range.

For those who don’t have a totally funded emergency fund, this comes subsequent. Open a easy on-line financial savings account—they’re boring, however secure—and cargo it with money.

When you have a lot for a wet day, you then return to your retirement choices. For those who qualify for a Roth IRA, that’s in all probability the place the $3,500 ought to go. For those who don’t qualify or have greater than that max left to spend, return to your 401(okay) and up your contributions.

The 4 ranges of retirement financial savings

The lesson is: Determine what share of your revenue it can save you in whole, and allocate it appropriately:

Stage 1: Max out your employer match in your 401(okay). (Free cash!)

Stage 2: Max out your emergency financial savings (about six months’ residing bills).

Stage 3: Max out your Roth IRA (as much as the annual cap).

Stage 4: Max out your 401(okay) (as much as a complete restrict for worker contributions).

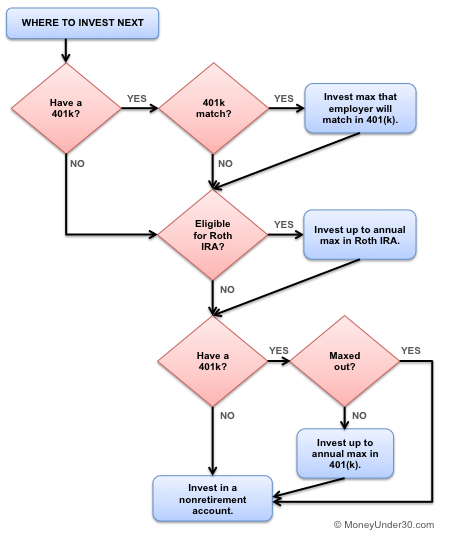

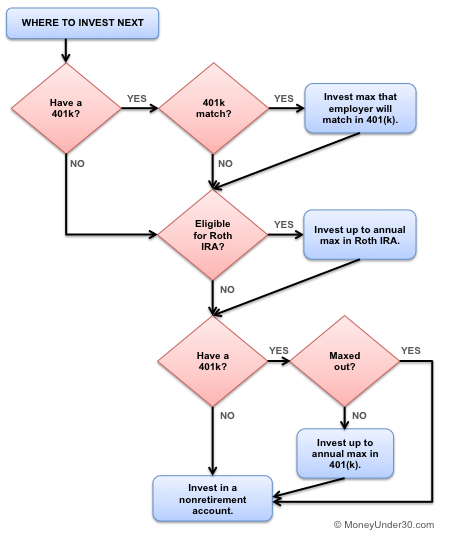

This flowchart will even assist.

For those who’re in debt, concentrate on high-interest balances when you save

In case your employer matches 401(okay) contributions, put in sufficient to get that match, even for those who’re in debt.

Subsequent, for those who’re in bank card debt, cease. Put your more money in direction of paying that off earlier than making further retirement contributions. Focus first on getting out of bank card debt after which come again.

Bought pupil loans? Comply with the above schedule anyway. Until your non-public loans have double-digit rates of interest, I don’t advocate repaying pupil loans early.

It by no means hurts to save lots of extra

Twenty % is a good purpose, however some retirement specialists truly counsel saving extra like 25% and even 30. Why?

You already know that saying, “Previous returns are not any assure of future efficiency”? That’s why. It’s true that the annual common return of the S&P 500 between 1928 and 2014 was 10%, for instance. However that doesn’t imply something for future returns.

We have now no manner of figuring out what future returns can be—they could possibly be 8%, they could possibly be 4%. However the one method to hedge in opposition to an unsure future is to save lots of more cash. The extra you've gotten, the much less you want jaw-dropping returns to fulfill your targets.

Get assist together with your 401(okay)

Have already got a 401(okay)? Whilst you’re researching contributions, take a minute to investigate your present holdings too—there could possibly be massive financial savings to be discovered.

Try Empower for a free app that creates easy-to-understand visuals of the investments you personal in your 401(okay), IRA, and different funding accounts. There’s additionally Wealthfront for an amazing all-in-one monetary app that permits account holders to take management over their funds, automate saving and investing, and handle their accounts multi functional place.

Abstract

Everybody’s monetary state of affairs is completely different, and thus everybody’s retirement contributions will even be completely different. The secret is to discover a ratio you’re comfy with, however that additionally encourages you to save lots of a bit additional than you may in any other case. We advise aiming for a ratio of 80/20 to begin with, and upping as you'll be able to.