I don’t have a lot time to put in writing at the moment as I’m transferring home later this afternoon and have a number of work conferences to attend earlier than that. So the subsequent subject would possibly take two shorter elements. As predicted, Ms Takaichi grew to become the primary feminine Prime Minister for Japan on Tuesday after consolidating a coalition with the unlikely 日本維新の会 (Japan Innovation Social gathering or Ishin for brief), who’re based mostly in Osaka and is a sort-of proper wing group that opposes central authorities in Tokyo and is a combination: free market narratives, anti-immigration, blended with issues like government-provided free schooling for all. It’s an unlikely coalition that solely a spot like Japan may conjure up. However she is now PM and the ailing LDP elite guidelines on, though for a way lengthy is one other matter. The brand new PM is, as I’ve indicated towards utilizing financial coverage as the primary macroeconomic coverage software and favours additional fiscal enlargement underneath the brand new heading 責任ある積極財政 (Accountable and proactive fiscal coverage), which was a time period given to her by my analysis collaborator right here at Kyoto College (Prof. Fujii), who will grow to be one among her senior advisors within the new authorities. The query I’m toying with as we put together for this main symposium on the Weight loss plan on November 6, 2025, is what precise scope is there for fiscal enlargement after we are informed that there’s a drastic labour scarcity. That’s what I’m discussing on this a part of the collection at the moment.

Just a few weeks in the past I wrote this weblog publish – Japan – the challenges dealing with the brand new LDP chief – Half 2 (October 9, 2025) – which mentioned the most recent Financial institution of Japan analysis work on output gaps and their estimates of labour and capital shortages.

On the face of it, the analysis means that Japan is at the moment exceeding its labour enter capability, which is often solely a short lived chance given the stress it locations on labour assets and the price it imposes on employers.

The query I’m trying into at the moment is whether or not we will actually belief the ‘official’ analysis on that subject.

Is there actually a labour scarcity?

As on the June-quarter 2025, the Financial institution of Japan estimated that:

1. Output hole -0.32 per cent.

2. Capital Enter hole -0.79 per cent.

3. Labour Enter hole +0.47 per cent.

That signifies that the it’s estimated that Precise GDP is 0.32 per cent under its estimated potential, that the capital inventory (tools, plant and so forth) is working at 0.79 per cent under its capability, and the mixture labour enter is working at 0.47 per cent above its full capability.

In different phrases, the Financial institution is basing coverage on an assumption that there’s over-full employment presently.

The primary necessary level to grasp is that these estimation methods are fairly unsound even when they’re typical.

Whereas the Financial institution of Japan don’t publish their potential GDP estimate in degree phrases (that’s billions of yen), one can reconstruct it from the precise GDP information revealed within the quarterly nationwide accounts by the Cupboard Workplace.

The reconstruction makes use of the method for the output hole, which the Financial institution of Japan publishes on a quarterly foundation, and applies that to the precise GDP information.

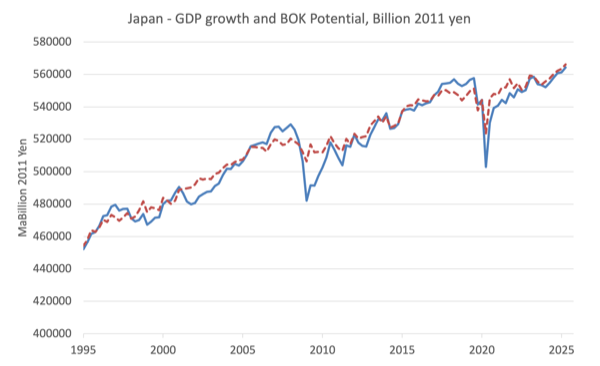

The next graph reveals the precise and reconstructed potential GDP from the March-quarter 1995 to the June-quarter 2025.

The precise GDP is the stable line and the Financial institution of Japan’s Potential GDP is the dotted line.

Instantly you will notice the issue I hope.

Maybe not – however the query it’s best to ask is that this.

Potential GDP is a mirrored image of the obtainable productive assets – capital and labour.

Capital is a sluggish transferring mixture that’s fed by new funding and eaten up by depreciation.

And the labour enter relies on behavioural practices and so forth.

So why does the potential GDP behave in a manner that makes it appear like it tracks the precise sample over time displayed by the precise GDP?

Precise GDP clearly behaves in a cyclical style and follows precise mixture expenditure – you may see that clearly in the course of the GFC interval when Japan’s output progress nosedived.

And once more in the course of the interval when COVID-19 restrictions have been in place.

However why would potential GDP comply with the same, albeit muted cyclical path when the determinants are unlikely to behave in such a cyclical style?

The reply is within the estimation method.

The Financial institution of Japan makes use of filters based mostly on the precise GDP path – in different phrases, the potential simply maps out the same path to the precise.

One such filter (which isn’t the one used however provides comparable outcomes) could be a multi-period transferring common.

So the quantity of impartial info that the Financial institution of Japan’s potential GDP measure and its output hole measures (and if you need extra technical element it’s best to learn the unique analysis paper) present is moot.

Reply: not a lot.

The opposite level to notice is that the Financial institution of Japan has frequently estimated that the Japanese financial system is producing above its potential.

For instance, between the March-quarter 1996 and March-quarter 1998, the estimated output hole averaged 0.82 per cent. And between the September-quarter 2005 and the September-quarter 2008, the estimated output hole was 1.13 per cent. And extra not too long ago, between the June quarter 2017 and the March-quarter 2020, the typical was 0.99 per cent.

A sustained interval of ‘over manufacturing’, which is what a constructive output hole in idea represents, would generate price pressures that ought to feed into wage and value will increase.

Throughout these durations none of these nominal pressures confirmed up, which is an extra trace that the output hole measure supplied by the Financial institution of Japan will not be measuring the strain within the financial system very precisely.

Which signifies that the conclusion that the Labour Enter hole is at the moment over-fully employed needs to be handled with appreciable doubt.

Which signifies that the scope for enlargement could also be bigger than the Financial institution of Japan’s output estimates counsel.

Additional, if one research the earlier graph, it appears like when the Japanese financial system displays constructive GDP progress, the expansion charge is pretty comparable throughout the phases.

For instance, I calculated the next progress phases:

| Interval | Common Quarterly progress % | Common annual progress % |

| June-quarter 1999 to March-quarter 2008 | 0.35 | 1.29 |

| June-quarter 2011 to September-quarter 2019 | 0.28 | 0.96 |

| December-quarter 2020 to June-quarter 2025 | 0.25 | 1.24 |

Now clearly one may decide and select quarters to begin and end the calculation of those averages however some experimentation didn’t actually alter the numbers an excessive amount of.

Main as much as the GFC Japan grew extra strongly than it has within the aftermath of the GFC and within the aftermath of the preliminary COVID-19 impacts, which is comprehensible.

Giant recessions create a number of harm and it takes a while to recuperate totally, which is why coverage makers ought to use fiscal coverage to average them (or keep away from them altogether).

Primarily based on that, I constructed an estimated development progress (utilizing the final section averages as the idea of my extrapolation).

The dotted line is the extrapolated development and will be understood as saying what would occur between the June-quarter 2025 and the December-quarter 2030 if the Japanese financial system grew on the common quarterly charge that it exhibited between the December-quarter 2020 and the June-quarter 2025.

The next graph reveals what Japan would possibly count on out to the December-quarter 2030 based mostly on that assumption.

Curiously, if I extrapolated the Financial institution of Japan’s potential progress charge estimate out to the identical finish level I’d get just about the identical end result, which is not any shock, given the shut relationship via building between the precise and the estimated potential.

The query although is on this time of alleged labour scarcity can such GDP progress will be maintained regardless of how modest it appears to be?

Productiveness once more

The subsequent process I’m pursuing is to return to phrases with the productiveness query, which I began within the weblog publish on Monday – Japan – the place will the productiveness progress come from? – Half 4 (October 20, 2025).

Attempting to estimate productiveness precisely is a troublesome process and plenty of an utilized economist has fallen over making an attempt.

There are wildly completely different estimates of Japan’s productiveness and so a definitive assertion is tough.

However that would be the subject of the subsequent half on this collection.

If productiveness progress in sure sectors is low then extra staff are required to provide a given unit of output relative to if there was increased productiveness.

So it is very important estimate productiveness by sector as precisely as doable to be able to assess whether or not innovation and funding in new applied sciences and so forth can ‘free’ up some labour assets at the moment getting used.

I say that with many caveats together with cultural practices which might be clearly as necessary as meagre output per unit.

There are some estimates of extra employment in Japan that implies there may be (Supply):

… greater than 40 p.c of present employment is doubtlessly in extra …

The estimate comes from analysis on the Japan Heart for Financial Analysis, which is a non-public analysis institute funded principally by enterprise organisations.

If that estimate was even remotely correct then there isn’t any labour scarcity in Japan.

What is taken into account to be a labour scarcity is then only a poor allocation of labour assets.

The answer to that drawback is kind of completely different to what’s required if there’s a true scarcity.

Conclusion

Inspecting these points is the place I’m heading.

However now I’m heading into a number of hours of house shifting in Kyoto – carrying issues and so forth. And in contrast to the duty in Australia we shall be utilizing bikes so much!

That’s sufficient for at the moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.