‘The place the hell is the market threat?’

– Scott Bessent, United States Secretary of the Treasury

Every time I hear policymakers level to rising markets as proof that their “insurance policies are working,” it makes my Spidey-sense tingle. It ought to do the identical to yours.

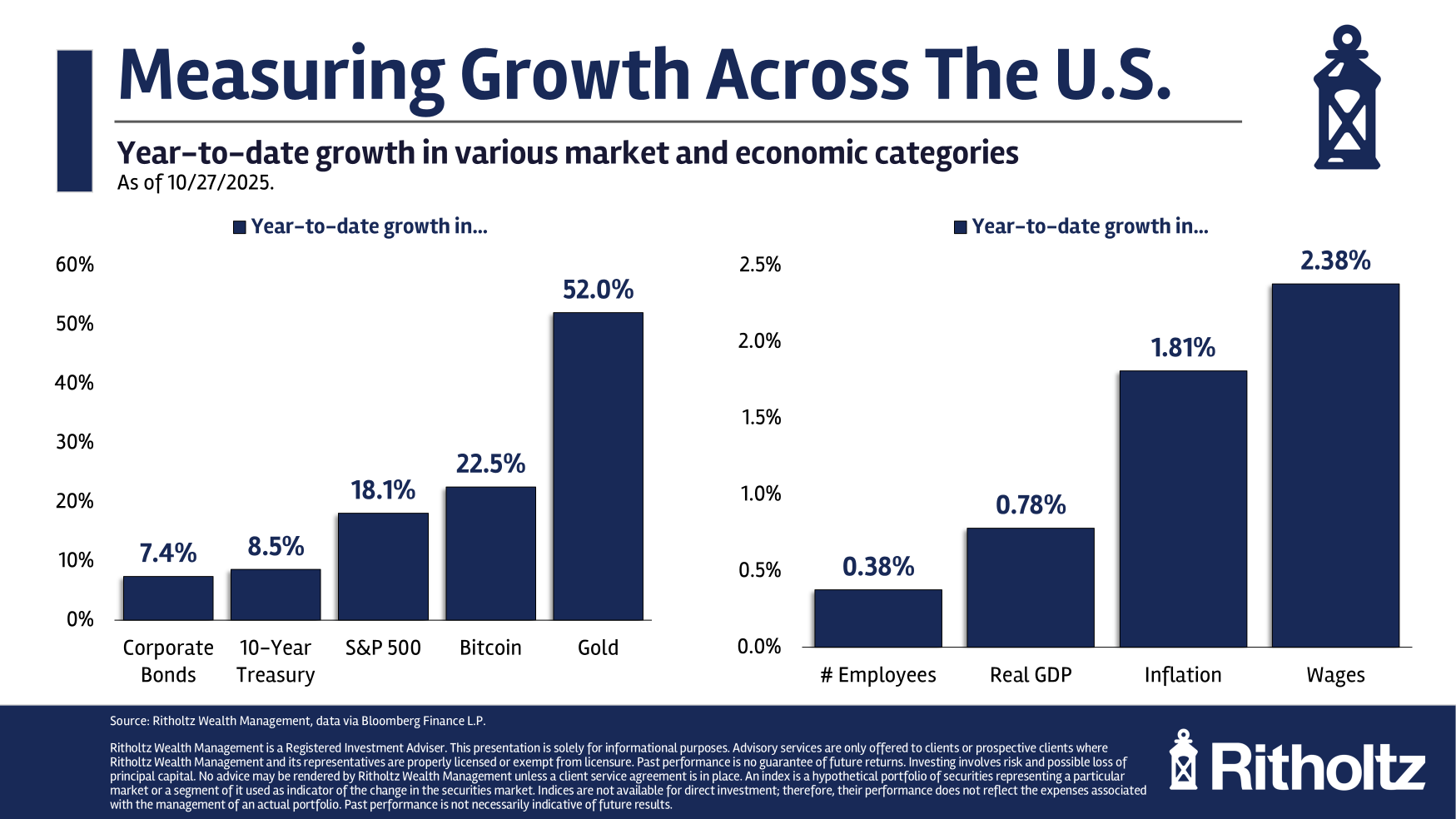

The present second in time feels particularly complicated. Crosscurrents of all-time highs in shares, gold, Bitcoin, and actual property are offset by a variety of aggressive – and doubtlessly problematic – insurance policies.

What’s an investor to do amongst all of those conflicting drivers?

My recommendation: Take into consideration this second within the broadest phrases. Perceive that the place we’re at the moment relies upon the place we got here from and the route we took to get right here. Acknowledge that two seemingly contradictory issues may be true on the similar time – markets can hit all-time highs within the face of coverage choices which can be dangerous, however have worthy targets, whereas concurrently seeming more and more reckless, or elevating the potential for a recession, market crash, or worse.

Assume again to January 2025:

-Markets had been having fun with a sturdy transfer upwards since bottoming in March 2009, with all indices breaking out to new all-time highs in 2013. The 2020 pandemic introduced a 34% crash and a right away “V-bottom” Q1 and Q2 of 2020.

-Large fiscal stimulus in the course of the pandemic (and afterward) on prime of ZIRP’s ultra-low charges (till 2022) was extremely constructive to greater fairness and actual property costs.

-Synthetic intelligence had been round for many years, grew quickly within the 2010s, however it exploded after the introduction of ChatGPT in November 2022. That noticed an enormous surge in AI-related CapEx.

Oh, and the newly elected president, generally known as a fan of deregulation and tax cuts. After all, the market entered 2025 sizzling as a pistol. The circumstances initially of this 12 months have been so strong that well-regarded economists claimed there was a “0% probability of recession in 2025.”

Boiling the Frog: For the reason that 12 months started, each the substance of coverage and the implementation fashion have given buyers pause. Liberation Day was a catastrophe, sending shares into freefall. The one factor that halted the crash was the 90-day pause. That gave buyers time to get used to a reasonably radical tariff coverage, in contrast to something seen because the Thirties. The influence was muted (to this point) as a result of imports of products are a comparatively modest share of the general economic system.

There are many positives occurring, and these embrace:

Positives

All-time Highs Shares, Crypto, Housing and Gold

Strong Economic system

Tax Cuts

A lot of Capital availability

Mortgage Charges are falling

S&P500 Earnings at all-time highs

Deregulation

Synthetic intelligence will make firms extra environment friendly

Personal credit score is broadly obtainable

Inflation has off its 9% highs to three%

The Federal Reserve is Reducing (ST) Charges

However there appears to be simply as many negatives, and they’re accumulating:

Negatives

Tariffs are an inflationary drag on economic system;

They Alienate Allies and Buying and selling Companions

Deficits proceed to widen

Inflation stays sticky above 2% goal

On/Off Insurance policies Discouraging (Non-AI) Capex

Non-farm payrolls have fallen to barely optimistic

Firing Head of BLS (Kinda Authorized?) and Fed Governor (Not Authorized?)

Rollout of Tariffs was sloppy and poorly deliberate

Sending troops into cities divisive (maybe unlawful?)

Exec Department Tariffs are unconstitutional (Article I, Part 8)

Problem to Judicial Overview and Rule of Regulation

US Inhabitants to have annual lower for 1st time in historical past

Shut down amid political paralysis

Sentiment is extraordinarily unfavorable

I proceed to see sturdy market positive factors and strong income, whilst financial exercise decelerates and indicators of stress seem.

As I famous in February of 2025, the percentages of an avoidable, self-inflicted coverage error proceed to rise. For now, all-time highs in costs and income outweigh all my different considerations.

However at a sure level, the frog can be boiled, and regardless of the entire positives, ultimately, a mistake will result in the pattern cracking. Till then, we are able to solely watch the info and wait…

Beforehand:

May Tariffs Get “Overturned”? (July 31, 2025)

The Muted Impression of Tariffs on Inflation So Far (July 17, 2025)

Are Tariffs a New US VAT Tax? (March 31, 2025)

All Time Highs Are Bullish (June 26, 2025)

7 Rising Chances of Error (February 24, 2025)