In an early weblog put up – Inflation concentrating on spells unhealthy fiscal coverage (October 15, 2009) – I outlined prior analysis that I had executed on the problem of inflation targetting (IT). In my 2008 ebook with Joan Muysken – Full Employment deserted – we offered additional evaluation on the problem. We discovered that there was no vital distinction in inflation and output dynamics between IT and non-IT nations. This was in keeping with the proof from different research. Mainstream economists frequently declare that IT delivers a spread of virtues and central banks that implement IT use rates of interest hikes aggressively when there’s a trace of worth strain rising. The most recent proof from an IMF examine is that there was no vital distinction between IT and non-IT nations within the current inflationary episode. The analysis exposes IT for what it’s – an article of ideological religion quite than an evidence-based and accountable coverage method.

When central banks, infested with Milton Friedman’s Monetarist concepts, tried to implement them within the type of financial targetting – that’s, trying to set limits on the expansion of the cash provide, they quickly came upon that they’d little management over the expansion.

This was a interval when inflation was accelerating largely as a result of OPEC oil worth hikes in October 1973 and the following distributional battle between capital and labour as to who would take the true earnings loss arising from the costlier oil imports.

The UK went early to the occasion, even earlier than the inflation had emerged, when in 1971 it launched its – Competitors and Credit score Management (CCC) – coverage, which noticed the Financial institution of England use open market operations (liquidity administration measures) to regulate the cash provide.

By 1973, the Financial institution acknowledged whole failure and the coverage was scrapped.

Different central banks didn’t heed the lesson and tried to conduct financial coverage by controlling the expansion of the cash provide.

Many OECD nations didn’t heed the lesson and explicitly adopted financial concentrating on as their financial coverage framework, together with the US, Australia, and Canada.

They had been utterly dominated by the Friedman resurrection of the outdated Amount Concept of Cash (QTM) which sourced the accelerating inflation within the progress of the cash provide.

That concept had been utterly discredited throughout the Nice Melancholy by the work of John Maynard Keynes and his colleagues however by some means made a comeback within the Seventies.

Because of this the central banks thought they might management inflation through financial targetting.

The intention was to automate financial coverage by forcing the cash provide to comply with some long-run actual output progress path.

If this development progress charge was 4 per cent every year, and a 2 per cent inflation charge was desired, then the financial progress goal could be set at 6 per cent every year.

The declare was that upkeep of that progress quantity would end in secure macroeconomic circumstances.

The faulty assumptions underlying this experiment had been that the financial authorities really had management over the cash provide and that there was a strong connection between the quantity of cash and nominal gross home product (that’s, velocity was secure and predictable).

These assumptions had been merely assertions derived from the QTM.

The financial concentrating on experiment throughout the Eighties failed in every single place as measured velocity proved to be extremely risky, as totally different measures of cash moved in numerous methods and as business banks and different monetary intermediaries innovated round laws imposed by the financial authorities.

Just like the UK, different nations additionally came upon that such an method couldn’t obtain the intention and that the cash provide progress charge was not one thing that the central financial institution may simply set as an achievable coverage final result.

Suffice to say that the progressive economists (Publish Keynesians, and so on) had lengthy proven that the cash provide was an endogenous final result pushed by the demand for loans from companies and households.

The banking system would reply to that demand by issuing loans (loans create deposits), which might see the cash provide develop.

The central financial institution may do little to constrain that exercise.

These insights, in flip, revealed that the mainstream depiction of the banking system – the place banks are simply intermediaries who accumulate reserves which then permits them to make loans – was utterly at odds with the truth of the system it sought to clarify.

The fact is that banks make loans unbiased of their reserve holdings after which fear about reserve administration individually.

By the early Nineties, it was obvious that the financial targetting method – and Milton Friedman’s principal concepts – had been inapplicable to trendy financial economies.

One wonders how the Monetarists had been capable of keep credibility within the face of the whole failure of their basic concepts.

However Groupthink doesn’t honour empirical credentials, which is a separate story that I gained’t talk about right here.

As a consequence of the failure of financial concentrating on, financial authorities in lots of OECD nations reconstructed their method to financial coverage throughout the Nineties by introducing regimes that focused the inflation charge instantly – or, equally, regimes that positioned a big and specific emphasis on inflation.

What are the primary arguments made by the proponents of inflation concentrating on and the alleged advantages of the financial coverage framework?

In our 2008 ebook (cited above) we characterised the shift to inflation concentrating on because the triumph of the NAIRU ideology.

The Reserve Financial institution of New Zealand adopted inflation concentrating on first in 1990.

That is no shock given the nation had been present process an enormous neo-liberal unwinding of its Keynesian Welfare State for the reason that mid-Eighties.

Canada was subsequent to formally announce inflation concentrating on tips in February 1991 then Israel in December 1991, adopted by the UK in 1992, Sweden and Finland in 1993.

Australia and Spain adopted in 1994.

Inflation concentrating on refers to a financial coverage framework the place the central financial institution explicitly and publicly declares a goal inflation (or worth) quantum and adjustments quick time period rates of interest to control financial exercise (and inflationary expectations) so as to keep precise inflation inside the pre introduced goal, which can be represented by an appropriate vary.

The sturdy deal with sustaining a low and secure inflation was in keeping with the assumption in a NAIRU view of the world, whereby there may be some distinctive actual stage of exercise (summarised in both output or employment) that the economic system gravitates to, and any episodes of worth disinflation will solely quickly push the true economic system under these ranges.

The transfer to inflation concentrating on, be it formally introduced or extra pragmatically applied, reflecting an awesome religion in NAIRU ideology, marked the ultimate phases within the abandonment of full employment in OECD nations.

The trendy coverage framework is in contradistinction to the observe of governments within the Publish World Warfare II interval to 1975 which sought to take care of ranges of demand utilizing a spread of fiscal and financial measures that had been ample to make sure that full employment was achieved.

Over this era – the Keynesian period of full employment, unemployment charges had been often under 2 per cent.

Because the mid-Eighties unemployment charges in most OECD nations had been often above 6 per cent

Extra just lately, underemployment has turn out to be a severe subject as labour markets are casualised and demand for labour suppressed.

Inflation concentrating on proponents declare that it has a number of benefits over earlier financial coverage approaches.

Most of the positive aspects are attributed to the truth that inflation concentrating on allegedly gives the central financial institution with the independence it must be credible, clear and accountable – important circumstances for an efficient coverage regime.

The improved coverage credibility allegedly permits a better sustainable progress charge.

The improved central financial institution independence allegedly overcomes the time inconsistency downside whereby an inflation bias is generated by the strain the elected authorities locations (implicitly or explicitly) on non elected officers within the central banks to attain in style outcomes.

Thus inflation concentrating on can allegedly lock in a low inflation surroundings.

There have been additionally claims that inflation concentrating on not solely reduces inflation variability but additionally reduces the variance of output progress.

If certainty in financial coverage generates extra secure nominal values, it’s argued that decrease rates of interest and decreased threat premiums comply with.

This allegedly stimulates greater actual progress charges through an enhanced funding local weather.

Additional, inflation persistence is allegedly decreased as a result of one time shocks to the inflation charge are shortly eradicated by the coverage coherence.

It was claimed that the decreased inflation variability permits extra certainty in nominal contracting with much less want for frequent wage and worth changes.

This in flip means much less want for indexation and short-term contracts.

Nevertheless, the implications of this are a flatter short-run Phillips curve.

In different phrases, greater disinflation prices – extra unemployment and actual GDP losses.

How massive are the output losses following discretionary disinflation?

Can these output losses be attenuated by the design of the financial coverage?

The conservatives argue that the losses are minimised if the disinflation is fast.

However the credible analysis literature exhibits that the losses are inversely associated to the velocity of disinflation.

There has additionally been no credible empirical analysis which exhibits {that a} extra politically unbiased central financial institution can engineer disinflations with attenuated actual output losses.

The proof is that whereas inflation concentrating on doesn’t generate vital enhancements in the true efficiency of the economic system, the ideology that accompanies inflation concentrating on does harm to the true economic system as a result of it embraces a bias in direction of passive fiscal coverage which locks in persistently excessive ranges of labour underutilisation.

Disinflationary financial coverage and tight fiscal coverage can convey inflation down and stabilise it nevertheless it does so on the expense of making and sustaining a buffer inventory of unemployment.

The coverage method is seemingly incapable of reaching each worth stability and full employment.

An examination of the analysis literature that adopted the introduction of this method means that inflation concentrating on has not been efficient in reaching its goals.

Probably the most complete and rigorous work on the influence of inflation concentrating on is the 2003 examine by Ball and Sheridan who aimed to measure the results of inflation concentrating on on macroeconomic efficiency in 20 OECD economies, of which seven adopted inflation concentrating on within the Nineties.

They used particular econometric methods (that are extensively accepted) to check nations that had adopted concentrating on to those who had not.

Total, Ball and Sheridan discovered that inflation concentrating on doesn’t ship superior financial outcomes (imply inflation, inflation variability, actual output variability, long-term rates of interest).

One of many claims made for inflation concentrating on is that central financial institution independence and the alleged credibility bonus that this brings ought to encourage quicker adjustment of inflationary expectations to the coverage bulletins.

Ball and Sheridan discovered that there isn’t any proof that concentrating on impacts inflation behaviour on this regard.

Here’s a hyperlink to – The issue with inflation concentrating on – which is a 2004 Working Paper model which you may get without cost – (it was subsequently printed elsewhere).

We discovered related outcomes for Australia with the diploma of persistence within the inflation charge being unaffected by the transition to inflation concentrating on in 1994.

A associated perceived advantage of inflation concentrating on is that it expunges inflationary expectations from the economic system.

There’s nearly no analysis on this space which makes use of survey knowledge on expectations from customers, and solely little analysis which makes use of forecaster’s knowledge.

In our 2004 examine we discovered that, amongst different issues, the key mean-shift in inflation and inflationary expectations occurred throughout the 1991-2 recession and had nothing in any respect to do with the onset of inflation concentrating on (1994).

In actual fact, there have been no inflationary pressures within the economic system (aside from a short interval in early 2000 when a ten per cent worth added tax was launched for the primary time) after the 1991-2 recession.

For Australia, no less than, it’s onerous to attribute the decrease inflation within the Nineties and past to the conduct of inflation concentrating on in any respect.

The decline within the inflation juggernaut occurred across the 1991 recession in most nations.

So there was no onerous proof accessible to help the rhetoric of the proponents of inflation concentrating on.

Thought of in isolation, inflation concentrating on doesn’t seem to make a lot distinction.

It’s definitely onerous to differentiate it from non-inflation concentrating on nations.

However the true harm comes from the discretionary fiscal drag which is the ideological companion to inflation concentrating on.

Economists use an idea known as the sacrifice ratio as a typical measure of the prices of disinflation.

The sacrifice ratio exhibits the proportion cumulative lack of actual output divided by the cumulative discount within the inflation charge over the disinflation interval.

Thus, a sacrifice ratio of three implies {that a} one-point discount within the development inflation charge is related to a loss equal to three per cent of preliminary output.

There’s a huge literature on the estimation of sacrifice ratios which usually discover that disinflations will not be costless and, are in reality, vital.

Our 2004 examine calculated three measures of the sacrifice ratio for eight nations over country-specific episodes.

The findings had been in keeping with different analysis.

Of observe, is the discovering that the common estimated GDP sacrifice ratios have elevated over time in Australia, from 0.6 within the Seventies to 1.9 within the Eighties and to three.4 within the 1990’s.

That’s, on common lowering development inflation by one share level ends in a 3.4 per cent cumulative loss in actual GDP within the Nineties.

The IMF comes late to the occasion

For years, the IMF pushed the inflation targetting line onerous as a part of its function as a worldwide neoliberal assault canine.

In doing so, it ignored the analysis proof on the contrary.

Effectively, it appears to lastly be acknowledging that the method has not fulfilled its guarantees.

In a current IMF Working Paper No. 2025/212 (printed October 24, 2025) – Navigating the 2022 Inflation Surge – the authors discover:

… that (de jure) IT frameworks didn’t systematically ship higher inflation outcomes throughout this episode. The decline in inflation again in direction of historic norms was broadly comparable throughout (de jure) IT and non-IT nation teams.

The essential level that I made repeatedly from 2021 onwards as central banks began to hike rates of interest was that the inflationary episode that adopted COVID-19 and the Ukraine invasion was not pushed by extra spending.

Central banks world wide (bar Japan) all claimed that they needed to hike charges to suppress mixture spending however didn’t acknowledge that the pressures had been all supply-oriented and that the key drivers had been under no circumstances delicate to rate of interest adjustments.

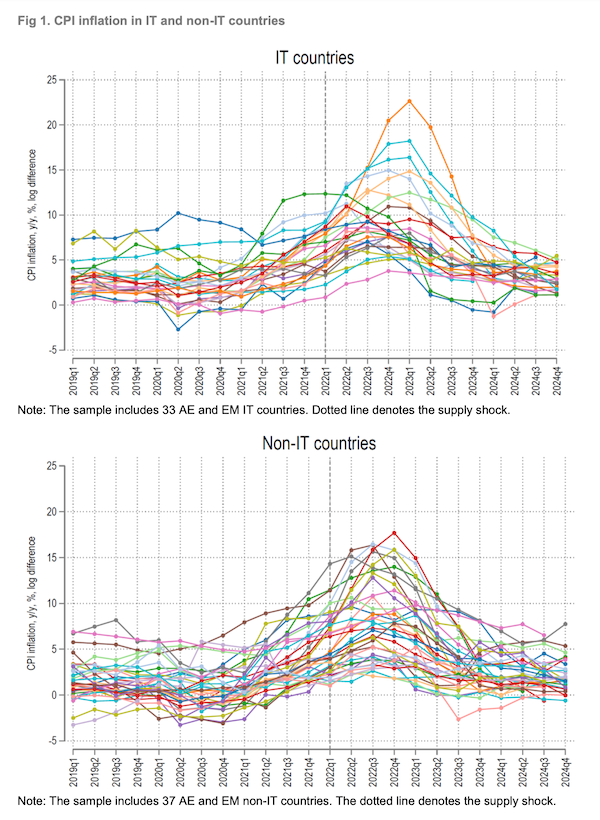

The IMF in contrast the efficiency of “33 superior and rising market IT nations and 37 non-IT friends” over the interval following 2022.

They discovered:

Regardless of stronger institutional signaling, IT central banks didn’t constantly obtain higher inflation outcomes than their non-IT friends. Inflation expectations weren’t extra firmly anchored, actual financial prices weren’t unambiguously decrease, and though IT central banks had been considerably extra proactive, their coverage stance didn’t produce considerably totally different macroeconomic outcomes. These findings level to a disconnect between the theoretical promise of IT and its sensible effectiveness in navigating supply-side shocks.

Who would have thought?

The findings additionally help the view I expressed that the central banks mustn’t have hiked rates of interest within the face of supply-side inflationary pressures.

The IMF researchers discovered that:

These findings underscore a broader vulnerability of IT when inflation is pushed by geopolitical occasions, local weather shocks, or structural provide constraints. In such settings, the relationships embedded in normal forecasting fashions shift quickly, pass-through turns into extremely state-dependent, and projection errors widen, undermining the function of baseline forecasts in coverage calibration. The 2022 post-invasion surge, dominated by vitality and meals costs, illustrated these limits.

In different phrases, the IT consensus will not be match for objective (and by no means was).

In addition they admit that:

The credibility case for IT can also be much less persuasive below persistent provide shocks.

In different phrases, central banks lose their authority after they needlessly hike charges and harm the well-being of mortgage holders.

This graph exhibits that “the distinction in inflation trajectories between IT and non-IT nations was not statistically vital”.

So the IMF’s place is that IT does work however not when inflation is being pushed by supply-side components.

First, the proof reported above doesn’t help the religion in IT.

Second, the inflationary episodes of any significance over the past 5 a long time have been supply-side occasions.

The interval of prolonged austerity and the abandonment of full employment (and the assaults on commerce unions) have all mixed to render extra demand occasions nearly extinct.

Curiously, the IMF discovered that:

… IT nations, on common, skilled about 1.5 share factors greater inflation than their non-IT counterparts all through the pattern interval. Whereas the inflation hole has remained broadly unchanged instantly after the shock, a divergence re-emerged after 2023. Inflation declined extra sharply in non-IT nations, widening the distinction as soon as once more.

They’re at wits finish to clarify that whereas making an attempt to carry onto the religion that IT nonetheless works.

The proof that I’ve present in inspecting this era is that the IT nations which hiked essentially the most really precipitated the supply-side inflationary pressures to worsen.

MMT economists level to components corresponding to elevated enterprise prices in concentrated markets being handed on to customers and in Australia, for instance, it was apparent that the RBA hikes had been being handed on by landlords within the type of greater rents.

Even because the supply-side components abated, the lease part of the CPI in Australia was nonetheless driving the inflation charge – courtesy of the RBA rate of interest hikes.

These impacts assist clarify why the inflation was greater in IT nations in comparison with non-IT nations.

The IMF is silent on this apparent causation.

The opposite IMF discovering is that there was no distinction in measured inflationary expectations between IT and non-IT nations – “inflation expectations held regular in each IT and non-IT nations”:

The principle takeaway is that IT central banks haven’t supplied any edge in stabilizing short-term expectations and the hole between IT and non-IT central banks is surprisingly slender. At longer horizons, the distinction is negligible. Merely put, IT didn’t ship a decisive benefit when it got here to anchoring inflation expectations throughout this supply-side inflation shock

Which places a sword by means of the narratives that the likes of the RBA stored utilizing to justify persevering with to hike rates of interest regardless that inflation was already falling.

They stored claiming that expectations would ‘get away’ and turn out to be a separate downside.

No such proof – nor was there in 2022 or 2023 when the mountain climbing was occurring.

It was a sham cowl to justify the unjustifiable.

A remaining level is that the IMF analysis discovered that the IT nations had been extra aggressive in pushing up rates of interest:

This raises a query if IT central banks delivered extra forceful tightening with out reaching higher outcomes, what precisely was gained?

They don’t actually reply that query.

However I can.

An enormous redistribution of earnings from low-income mortgage households to high-income monetary asset holders occurred.

That’s what the central banks actions achieved.

The opposite findings relate to change charge volatility and output volatility – no discernible IT superiority.

Conclusion

Whereas these outcomes must be one other nail within the neoliberal coffin – they gained’t be.

IT and all that goes with it’s an article of religion – not an empirically-grounded and justified method.

So they’ll stick with it regardless of the proof that it doesn’t reside as much as its claims (by some margin).

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.