I’m travelling right now to Tokyo and have little time to jot down right here. However with the newest nationwide accounts knowledge popping out on Monday (November 17, 2025), the discussions throughout the authorities are concerning the measurement of the fiscal stimulus that shall be initiated within the subsequent fiscal spherical. This The Japan Instances article (November 18, 2025) – Additional-big further price range pushed by some Japanese lawmakers – offers some info. The brand new Prime Minister is proposing to restrict the fiscal shift to an additional 17 trillion yen (about $US110 billion) however a small group throughout the ruling LDP need the package deal to be round 25 trillion yen. I believe the stimulus needs to be round 50 trillion yen and there are economists within the monetary markets who agree with me. Extra on that one other day. However the present debate is being performed throughout the context of the newest – Nationwide Accounts – for the September-quarter 2025, issued by the Cupboard Workplace (November 17, 2025). The financial system grew by 1.1 per cent over the past 12 months (down from 2 per cent within the June-quarter). Within the September-quarter, GDP shrank by 0.4 per cent, the primary adverse quarter because the March-quarter 2024. The necessity for stimulus is evident. The controversy is over how a lot.

The abstract outcomes for the September-quarter (seasonally adjusted) had been:

- GDP progress: -0.4 per cent for the quarter (down from +0.6); +1.1 per cent yearly (down from +2 per cent).

- Personal Consumption: +0.1 per cent quarter (earlier +1.4); +0.8 per cent annual (earlier +0.4).

- Personal Residential Funding: -9.4 per cent quarter (earlier +0.3); -7.9 per cent annual (earlier +2.4).

- Personal Non-Residential Funding: +1 per cent quarter (earlier +0.8); +3.3 per cent annual (earlier +2.3).

- Public Consumption: +0.5 per cent quarter (earlier +0.1); +0.5 per cent annual (earlier -0.1).

- Public Funding: +0.1 per cent quarter (earlier -0.1); -0.1 per cent annual (earlier -0.6).

- Exports: -1.2 per cent quarter (earlier +2.3); 2.7 per cent annual (earlier +6.1).

- Imports: -0.1 per cent quarter (earlier +1.3; +1.5 per cent annual (earlier +5.0).

- Home demand: -0.2 per cent quarter (earlier +0.3); +0.8 per cent annual (earlier +1.8).

Abstract:

1. Development is faltering.

2. Home demand is contracting.

3. Authorities spending progress elevated however not sufficiently to offset the decline in non-government spending progress.

4. Exports declined general – reflecting the influence of the imposition of tariffs by the US (significantly within the motorized vehicle sector).

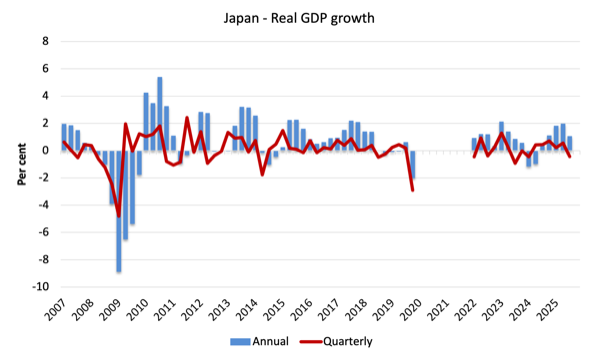

The primary graph exhibits the quarterly and annual actual GDP progress charges from the March-quarter 2007 to the December-quarter 2019.

I excluded the observations from March-quarter 2020 to the December-quarter 2023 as they had been COVID-19 outliers.

Contributions to progress

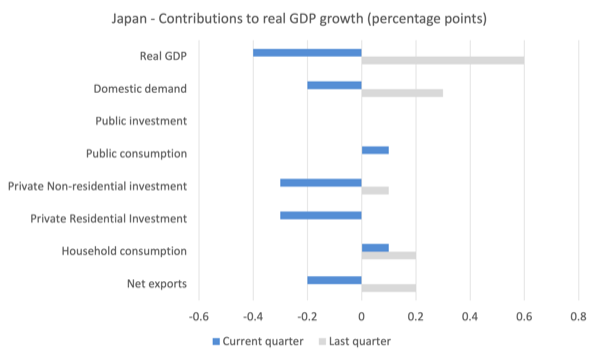

The following graph exhibits the contributions (in proportion factors) to actual GDP progress of the key expenditure classes in Japan for the June-quarter 2025 (denoted final quarter) and the September-quarter (denoted present quarter).

Solely personal and public consumption expenditure supplied any progress stimulus.

Authorities funding expenditure has supplied no stimulus for the final 2 quarters.

The decline in export contribution is right down to the tariff scenario, which noticed motorized vehicle exports stoop considerably.

Earlier quarters had been biased on account of the automobile producers transport bigger volumes of automobiles to the US previous to tariffs taking impact.

There was additionally proof that the producers are absorbing the tariff imposition within the margins (that’s, slicing costs).

The adverse contribution of personal residential funding (principally home building) was resulting from a regulatory change launched by the Japanese authorities which required more and more strict power effectivity requirements on new housing building.

The prospect of guidelines that may make it more durable for foreigners to buy homes in Japan could influence quickly however haven’t but been launched in any formal manner.

Shopper and Enterprise Confidence

The Japanese Cupboard Workplace publishes a – Month-to-month survey of Shopper Confidence.

The most recent outcomes, launched on October 29, 2025 (for a survey performed in October 15, 2025) tells us:

1. “The Shopper Confidence Index (seasonally adjusted collection) in October 2025 was 35.8, up 0.5 factors from the earlier month”.

2. All parts that affect the Shopper Notion Indices had been optimistic:

General livelihood: 34.3 (up 1.1 from the earlier month)

Earnings progress: 40.0 (up 0.6 from the earlier month)

Employment: 40.1 (up 0.2 from the earlier month)

Willingness to purchase sturdy items: 28.9 (up 0.1 from the earlier month)

This means that the family spending is just not about to collapse.

In my current presentation on the Japanese Weight loss plan (November 6, 2025), I argued that slicing or abandoning the gross sales tax would generate the largest GDP return given the way in which that Japanese households reply to the tax hikes.

In Australia, for instance, when the federal authorities launched a worth added tax in 2001, family consumption expenditure didn’t budge a lot in any respect as a result of households simply went extra into debt.

The Japanese households eschew this method and instantly reduce spending after the three gross sales tax hikes since 1997.

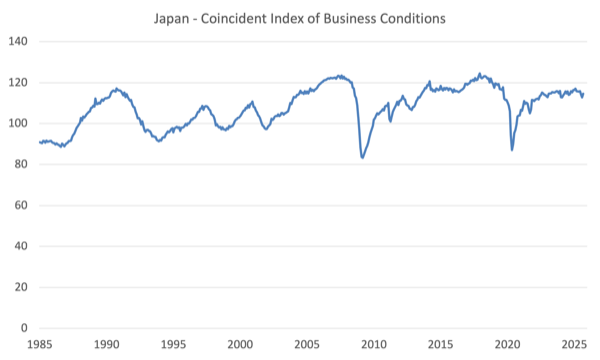

The Cupboard Workplace additionally publishes Month-to-month – Indexes of Enterprise Situations.

The most recent consequence (November 10, 2025) confirmed that circumstances have declined because the begin of 2025, however the September commentary recommended the decline was “halted”.

The next graph is their newest time collection (since January 1985) of their ‘Coincident Index’, which is defined on this doc – Information for Utilizing Composite Indexes and Diffusion Indexes.

Principally, the “composite indexes primarily purpose to measure the tempo and the magnitude (“the quantity”) of financial fluctuations”. The “coincident index … coincides with the enterprise cycle, and is used to determine the present state of the financial system.”

And:

… rising the coincident index displays that the financial system is in an growth section, and lowering coincident index displays that the financial system is in a contraction section. The magnitude of the modifications within the coincident index displays the tempo of the growth or contraction phases.

The controversy over growth

I most just lately mentioned the problem on this weblog submit – Japan – errant fiscal rule is certain to backfire (October 30, 2025).

GDP contracted by 0.4 per cent within the September-quarter 2025.

There have been one-off impacts of the brand new building rules which led to a -0.3 factors contribution from Personal Residential Funding.

However excluding that short-term glitch from our assessments implies that general GDP progress was nonetheless adverse.

We additionally haven’t been capable of kind a transparent thought on the general influence of the US tariffs, which was clearly adverse within the September-quarter 2025.

What the US President will do subsequent is anybody’s guess however it’s clear that the Japanese motorized vehicle producers have misplaced some traction within the US market.

Clearly, there is no such thing as a justification for additional rate of interest will increase and the Financial institution of Japan ought to reduce charges.

By way of fiscal coverage, the query is just not whether or not to introduce a brand new fiscal growth.

It’s how giant the growth needs to be.

The brand new Prime Minister is receiving recommendation – ill-informed in my opinion – that she has to stroll a line between stimulating an financial system that’s going backwards and appeasing monetary markets over the scale of the fiscal deficit.

That’s the common bluff that the mainstream economists current.

And bluff it’s.

The development is fake and results in poor determination making.

So whereas some may assume that the additional 17 trillion yen that Ms Takaichi is proposing seems like lots however given the rising spending (output) hole, it’s manner too small an injection.

Even the so-called LDP rebels who desire a 25 trillion yen injection are being constrained of their pondering by that false dichotomy I discussed above.

In each circumstances, a big proportion of the injection could be returned through elevated tax funds from the non-government sector.

Some declare that the rising yields on Japanese authorities bonds is an indication that the monetary markets take into account the fiscal deficit is simply too giant and are demanding increased premiums.

That’s one other false building.

The slight decline within the demand for JGBs is as a result of returns on different monetary property rising in step with the speed hikes that the Financial institution of Japan has initiated.

It’s simply an arbitraging impact and has nothing to do with the scale of the fiscal deficit.

As I famous in my speak on the Weight loss plan a number of weeks in the past, which was attended by many Members of Parliament, there is no such thing as a fiscal disaster in Japan and nor will there ever be.

The obsession with fiscal surpluses is flawed and results in poor determination making.

I argued that there was a vicious cycle in Japan which because the asset value crash in early Nineteen Nineties had locked Japan right into a secular stagnation.

This cycle is characterised by:

1. Extreme retained earnings by Japanese companies.

2. Large underinvestment (private and non-private).

3. In flip, companies are unwilling to offer high quality employment – and so non-regular employment is rising as a proportion of whole employment.

4. This results in low wages progress and suppressed consumption expenditure.

5. And so it continues.

Japan wants a big fiscal shock to interrupt this cycle and switch it right into a virtuous cycle the place corporations usually are not reluctant to speculate, and, in flip, are prepared to supply high quality employment and pay increased wages.

Till that occurs, the stagnation will proceed.

I might advocate, on this regard, an injection of round 45-50 trillion yen achieved by a mix of recent infrastructure spending and the abandonment of the gross sales tax.

Step one is to exhibit to the personal sector that the federal government is severe about stimulating progress and can help the method totally, slightly than adopting stimulus, then bowing to the fiscal surplus fanatics and attempting to chop the deficit once more.

That’s what occurred, for instance, in 1997 and the consequence was a gross sales tax enhance to ‘repair’ the fiscal place driving the financial system into recession after fiscal coverage had supported regular progress.

The purpose of that first step could be not solely to broaden output but additionally to change the non-government outlook from pessimism and gloom to optimism.

Solely then will companies begin spending their large pool of retained income on new funding tasks.

At that time the doom cycle ends and the financial system can proceed to broaden on the again of non-government spending progress with out the identical stage of presidency help.

Conclusion

The most recent Japanese Nationwide Accounts knowledge is ample proof {that a} main fiscal growth is required.

That coverage change should be seen within the context of the doom cycle of secular stagnation that Japan has discovered itself locked into.

A serious fiscal shock is required.

There might be no fiscal disaster in Japan, which implies attempting to realize an misguided trade-off between growth and minimising the shift within the deficit, will at all times result in an growth that’s too small.

That’s sufficient for right now!

(c) Copyright 2025 William Mitchell. All Rights Reserved.