One of many greatest challenges for traders is recognizing precisely how little we learn about what the longer term holds. It’s a uncommon second in market historical past when what comes subsequent is extraordinarily apparent to most traders.

A couple of examples – and be happy to push again on these – embrace the post-1987 crash, the height Dotcom/Tech bubble in Q1 2000, the subprime mortgage increase and bust that led into the Nice Monetary Disaster, and the March 2009 lows.

These examples might seem apparent in hindsight. However recall how few individuals purchased in circa March and April 2009; by October, the transfer off the GFC lows was being known as “The Most Hated Rally” in inventory market historical past. Quick ahead three years to 2012, and strategists have been probably the most bearish they’d been on equities since 1985.

Too many individuals fail to acknowledge how difficult it’s to determine these generational market turning factors in actual time. That is essential when teams of individuals declare future outcomes with each ample confidence and a scarcity of humility.

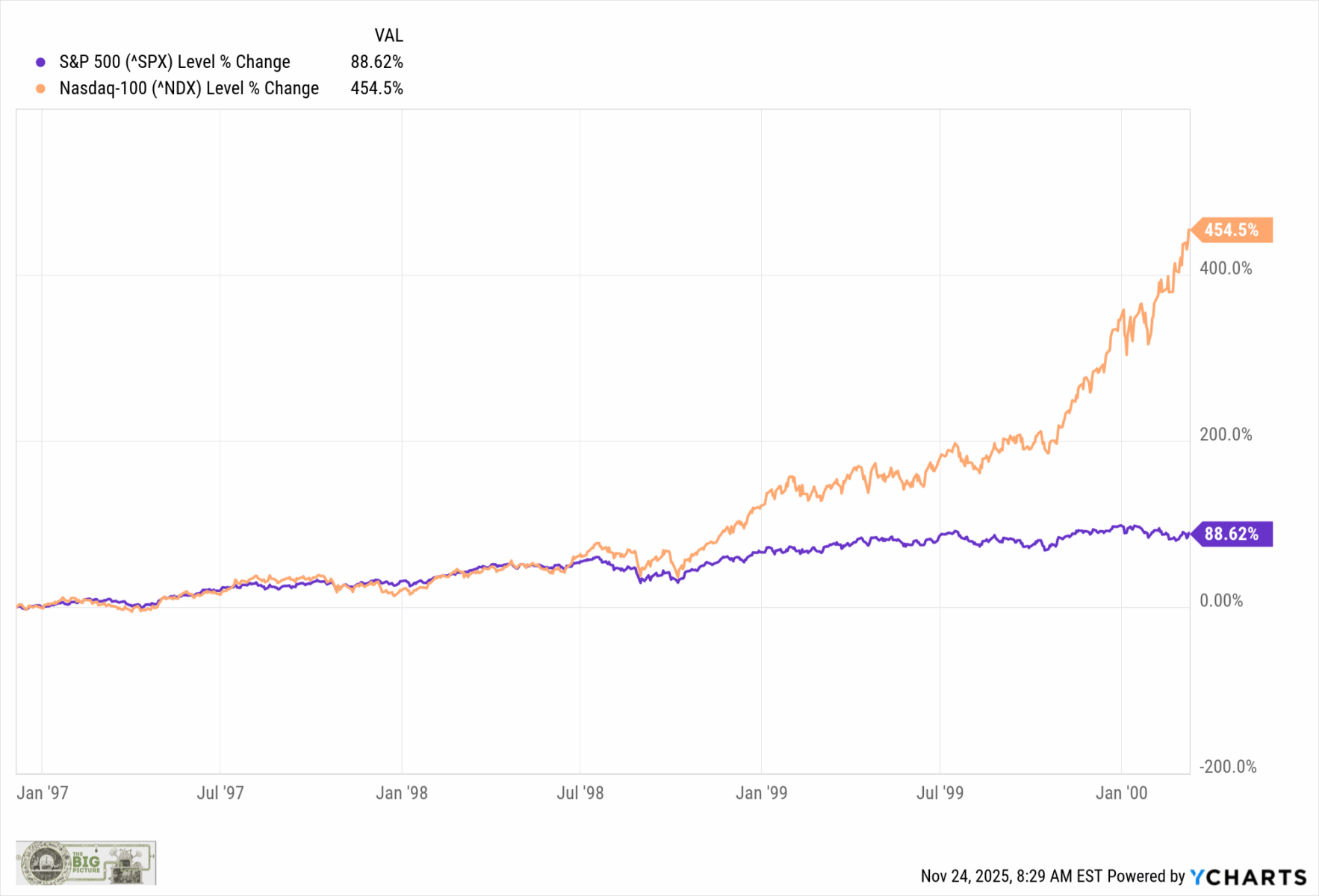

Recall the now-infamous Fed Chair Alan Greenspan’s December 5, 1996 Irrational Exuberance speech. The market moved modestly upwards for an additional two years earlier than exploding larger in late September 1998 (LTCM bailout), after which once more in October 1999 (Pre-Y2K Fed liquidity injection).

With the advantage of hindsight, that now appears extra like “Rational” than “Irrational” exuberance. The S&P500 gained 88.6%, however the extra speculative Tech and Dotcom sectors, represented by the Nasdaq 100, gained an astonishing 454.5%.

Maybe we’re within the late phases of an AI-driven bubble; we may simply as simply be in a once-in-a-generation transformational expertise increase that can drive each the economic system and the inventory market in optimistic instructions for years to return.

As my colleague Ben Carlson requested, “Is that this 1996 or 1999?” I floated a broader query final month:

When was the final time the group, the media, or Wall Road precisely recognized a bubble in actual time?

By definition, it takes a crowd to drive costs to bubblicious ranges. It’s a problem for the group to concurrently speculate on a bubble and precisely determine one because it inflates.

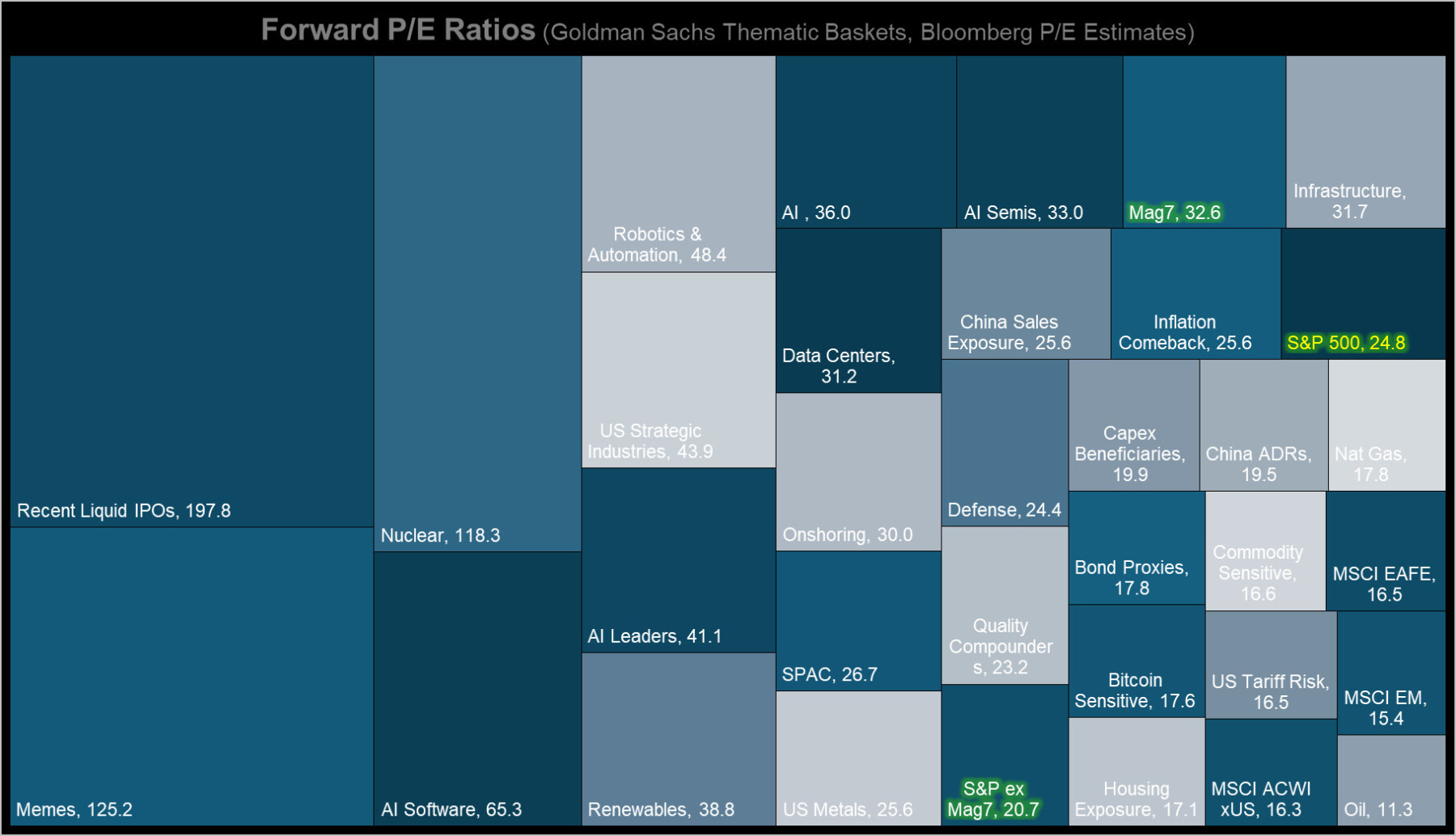

See the Goldman Sachs’ chart of Ahead P/E ratios by theme (at high). Some sectors are extraordinarily overpriced—new IPOs and Meme shares are buying and selling at ridiculous ahead earnings, primarily as a result of they’ve little or no or no earnings. The S&P 493 — S&P 500 minus the Magnificent 7 — nonetheless, just isn’t in bubble territory at 20.7 P/E. Expensive, sure, however bubblicious? Hardly.

Given the revenue progress over the previous few years (and expectations of decrease rates of interest), can traders rationally consider that costs aren’t totally irrational?

Jurrien Timmer of Constancy observes “Meme shares have misplaced some 60 P/E factors, whereas the large gamers (Magazine 7) commerce at a [more] affordable 32.6x and the S&P 493 at 20.7x. For the big caps these aren’t bubble valuations.”

That’s the place we’re as we speak: A 15-year rally that was initially constructed on a market that was lower in half (2007-09), adopted by a post-crash restoration that was helped alongside by zero-interest price coverage, main into the pandemic, which itself was helped alongside by the one largest fiscal stimulus as a proportion of GDP since World Struggle II. At present, we see AI driving a market that continues to publish file earnings. There’s sufficient rationality {that a} run-of-the-mill 5% pullback sends the VIX as much as 25, with real concern amongst merchants and policymakers.

The important thing query traders face is that this:

Is Synthetic Intelligence extra just like the web on the economic system, the place it continues to spice up financial exercise and efficiencies lengthy after its introduction? Or are we in a interval of malinvestment and reckless hypothesis that results in a bubble and a market crash? Each?

You’ll be able to cherry-pick charts that present a bubble or not.

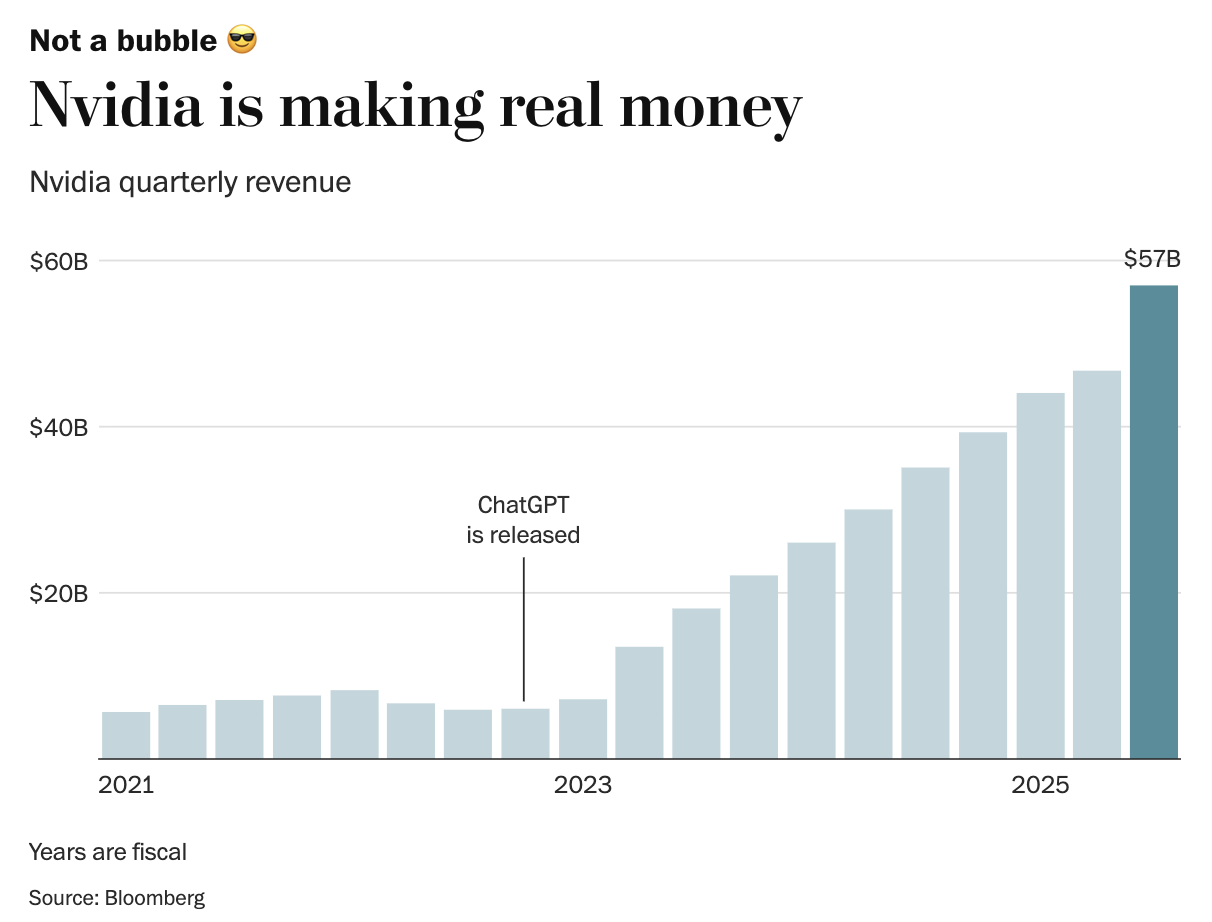

Take into account this chart (by way of the Washington Put up) of Nvidia’s revenues. $57 billion per quarter in income is nothing like what we noticed among the many DotComs within the late Nineteen Nineties; observe the Magnificent 7 collectively pull in additional than $2 trillion yearly in revenues.

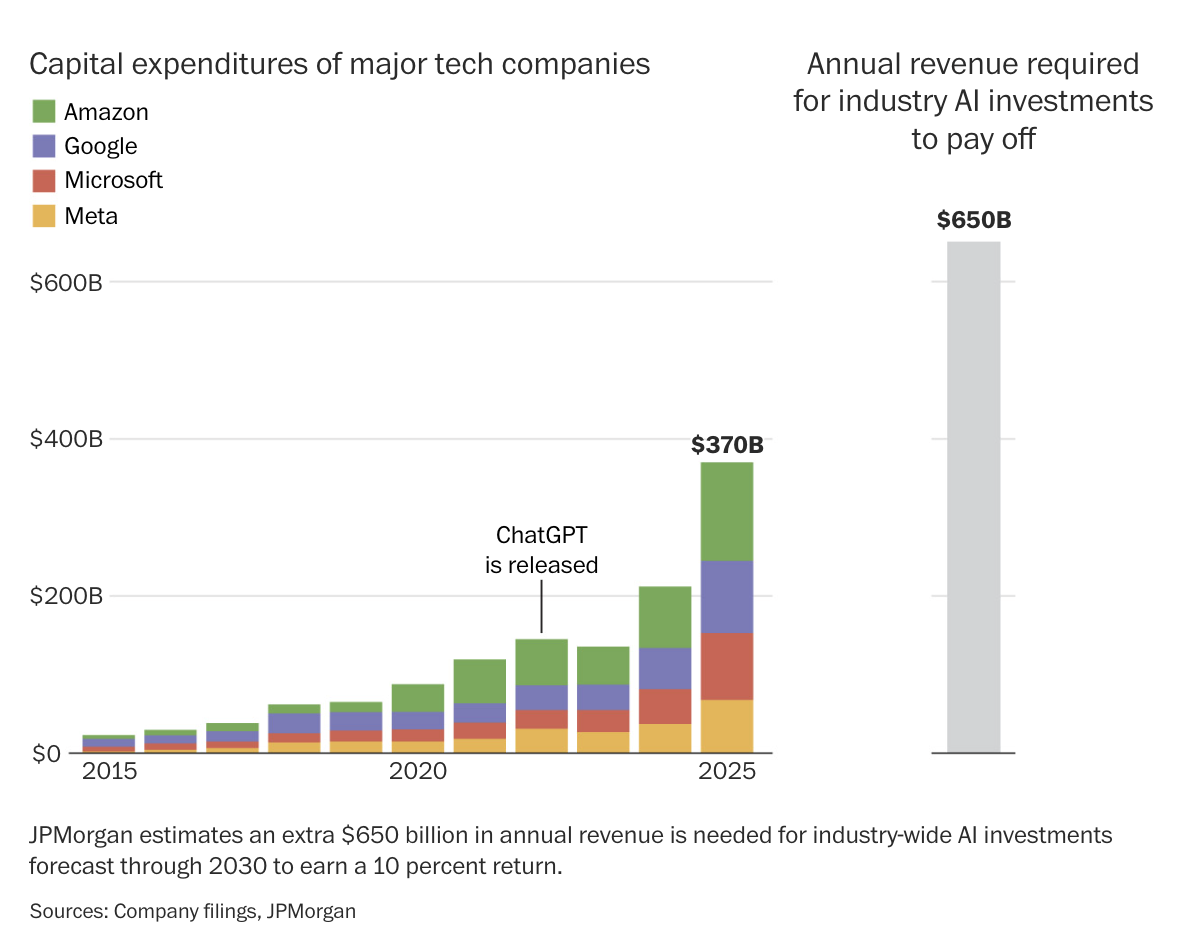

However the subsequent chart is the one which I discovered particularly compelling: Will investments in AI payoff to the tune of $650 billion in revenues above present ranges by 2030?

When you suspect you understand the reply to that, you understand how to deploy your capital. In case you are assured you understand the reply, the percentages recommend chances are you’ll be overplaying your hand…

Beforehand:

The Most Hated Rally in Wall Road Historical past (October 8, 2009)

Understanding Investing Regime Change (October 25, 2023)

A Quick Historical past of Bubbles (October 24, 2025)

The Magnificent 493 (August 12, 2025)

All Time Highs Are Bullish (June 26, 2025)

The Inventory Market Stays Undefeated (Might 19, 2025)

RealTime Bubble Guidelines (October 16, 2025)