In the event you’re paid weekly, then determining write a price range for weekly pay that works for you’ll be able to really feel such as you’re placing collectively a jigsaw puzzle. It may be tough to assemble a puzzle with out figuring out your entire image – the identical is true for budgeting whenever you receives a commission weekly!

Though the thought of getting paid weekly may sound very best, it really makes budgeting a bit extra difficult. Receiving cash in smaller increments could make it tough to repay payments on time and make sure you’re saving sufficient cash for the next week.

In the event you’re paid weekly, then you definitely aren’t alone! Over 30% of People are getting paid each week! And you may guess that a few of them have discovered make weekly budgeting work for them.

Immediately I’m breaking down the precise steps for price range whenever you receives a commission weekly. My hope is that these steps assist make budgeting weekly doable for you.

Step 1: Know your paydays.

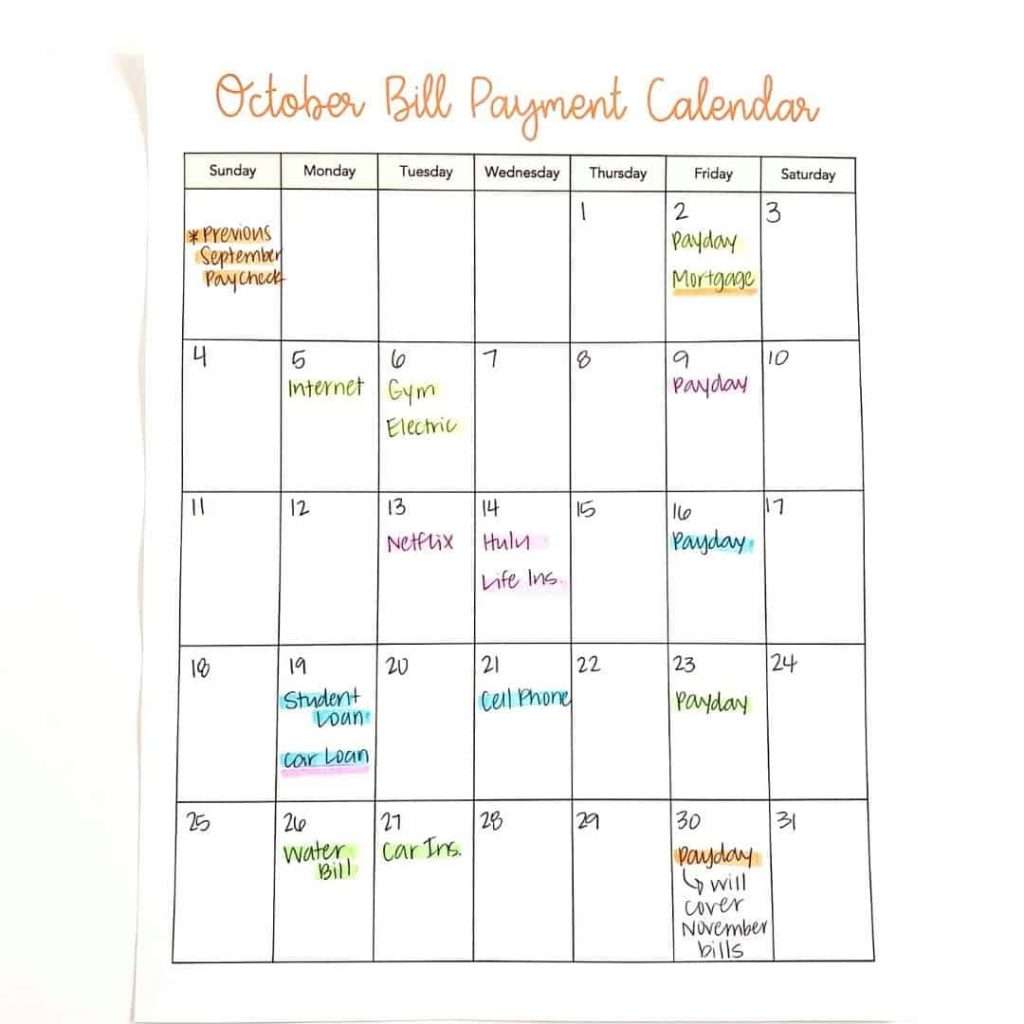

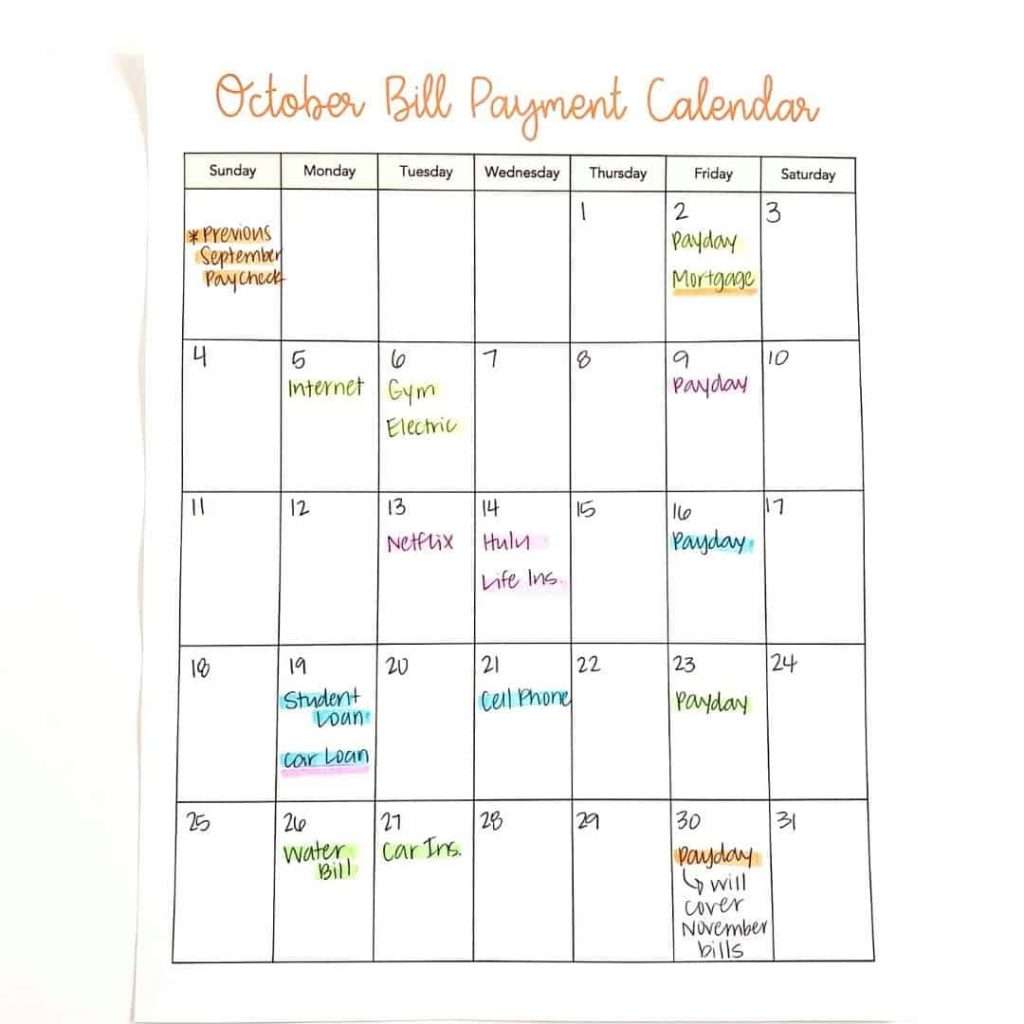

Seize a month-to-month calendar and write down each single day that you just obtain fee. Even higher, write down how a lot cash you’ll make every payday as effectively. This may allow you to visually see which paycheck must cowl every invoice.

Assign every paycheck a separate shade. Then, spotlight that paycheck with its assigned shade. The act of shade coordinating your price range will allow you to really see the way you’ll be capable to break up your paychecks to cowl your bills. This can be a nice technique, particularly for visible learners.

Step 2: Add your payments to the identical calendar.

When you’ve added your paydays to your month-to-month calendar, add your payments as effectively. You’ll must know which payments to pay wherein weeks so that you just aren’t behind on any of your funds.

In case your payments change from month to month, then be very cautious, so that you don’t miss the due date! In actual fact, arrange your payments on auto-draft to make sure that you don’t have any late charges. In the event you’ve ever needed to pay late charges, then you understand how annoying it’s!

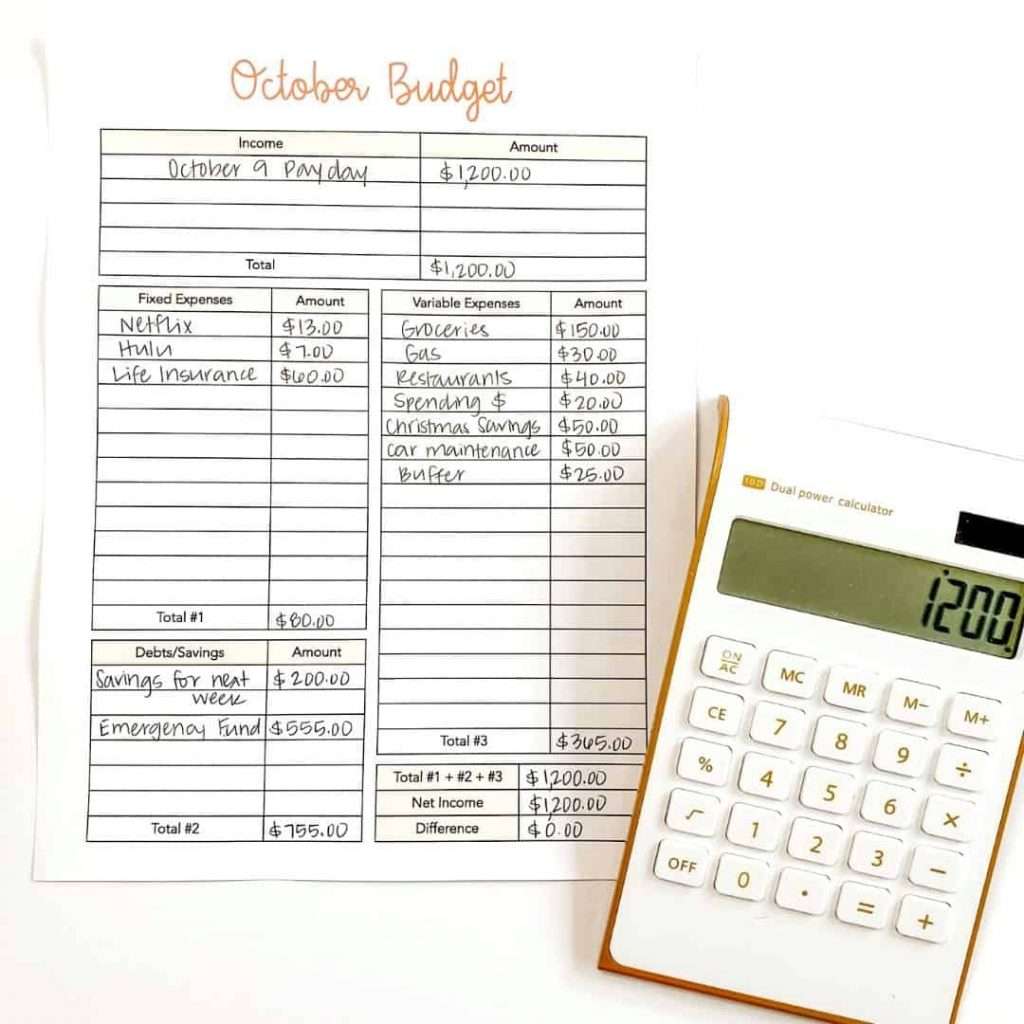

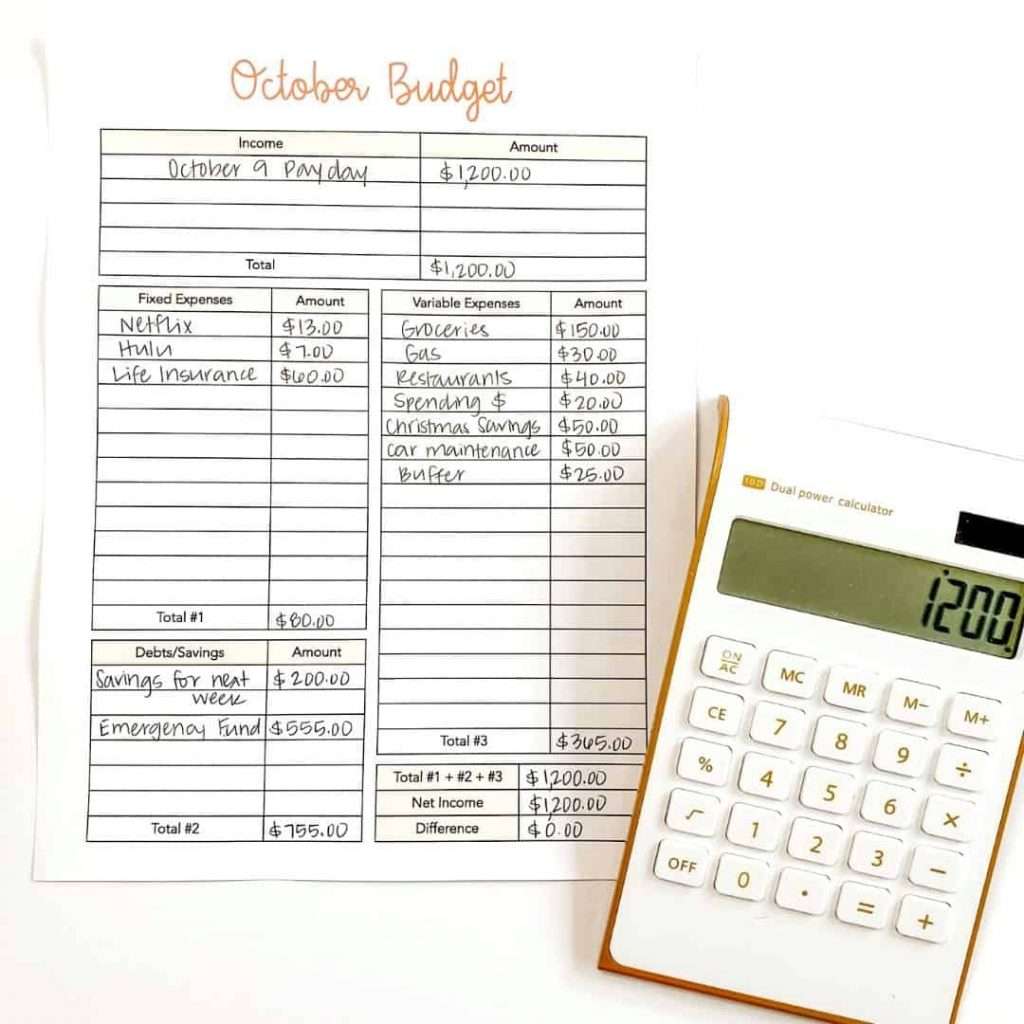

Step 3: Record out all different bills.

Seize one other piece of paper and checklist out your regular bills for every week. This could embrace variable bills reminiscent of groceries, fuel, and spending cash. Break down these bills by how a lot you spend every week. You may spend $600 for groceries every month, which might come out to $150 every week.

Having bother pondering of the whole lot to incorporate in your price range? Return by means of your previous two financial institution statements and comb by means of all of your spending. Categorize your bills beneath classes reminiscent of meals, fuel, magnificence, and many others. By wanting by means of your earlier spending, you’ll be extra more likely to embrace all classes in your price range.

You might be shocked at a few of the numbers. In the event you see areas the place you’ve been spending greater than you anticipated, take this chance to attempt to reduce down these added bills. Groceries and consuming out are typically an enormous one for most individuals, and consuming in additional can scale back that month-to-month quantity.

Step 4: “Assign” your paychecks to cowl your payments and bills.

When you’ve included all your payments in your price range calendar, then it’s time to assign your paychecks to cowl sure payments and bills. To do that, you’ll wish to spotlight the payments that you just’ll be paying with sure paychecks. In the event you plan to pay your electrical energy invoice together with your inexperienced paycheck, then spotlight your electrical energy invoice inexperienced.

Be certain to assign a few of your paychecks to assist partially cowl payments in future weeks. A couple of of your bigger bills, reminiscent of your mortgage, may want a number of paychecks to cowl.

A method it can save you this cash simply is to maneuver the cash it’s essential put aside right into a separate checking or financial savings account. You’ll be able to even label this account “Payments” as a result of you recognize it might want to assist cowl any payments you’ve within the coming month!

If in case you have computerized funds arrange, attempt to embrace some buffer cash (cash that’s within the account always) in your payments account so that you just all the time have cash prepared for funds.

Under is an instance of what your price range calendar may seem like:

Step 5: Write your weekly price range.

The final step is to really write your weekly price range. Since you’re paid every week, it solely is smart to make a brand new price range each week. Fortunately, this shouldn’t take you lengthy in any respect. The extra you’re employed on writing a price range, the faster it’ll take you!

Print off 4 copies of a price range web page – I personally use those from my Finances Life Planner. You’ll be able to write the dates on the high of every web page. Use this web page to maintain observe of your price range each single week. You’ll be able to even staple all 4 of them collectively and hold them in your fridge! That approach, it’s all the time in view for contemporary reminders of what your spending ought to be.

The purpose is to jot down a price range every week you could follow!

What occurs when you’ve too many payments due at a time?

What do you do in case your electrical energy, mortgage, mobile phone, and web invoice are all due in the identical week? If so for you, then it’s time to name every firm and ask them to maneuver your due date.

Take time to elucidate that it is going to be simpler for you financially to shift the due date by every week or two. Most locations will fortunately do it for you, particularly in the event that they suppose it will allow you to pay their invoice on time! Whenever you’re in a position to unfold out your payments over the month, you gained’t be as overwhelmed with regards to making your invoice funds.

What in case you don’t find the money for to cowl all your payments?

In the event you’re on the level the place you’ve made your weekly price range, and you continue to have too many payments or bills, then you’ve two decisions. Right here’s the reality: you’ll be able to’t disguise from primary math. You want your earnings to be better than your bills, interval. In any other case, you’ll slowly begin to enter debt or suck cash out of your financial savings.

Choice 1: Discover methods to chop out gadgets or cash in your price range.

In the event you can’t cowl all of your bills, then one possibility you’ve is to chop gadgets and spending out of your price range. A simple method to spend much less every month is to undergo every of your payments and ask your self the next questions:

- Can I cancel this invoice or subscription?

- Can I name and negotiate this invoice for a greater price?

- Ought to I store round for a greater price?

By asking your self these three questions, you’ll discover methods to chop again in your month-to-month payments. Want extra concepts and assist? Try 25 Issues To Minimize From Your Finances Immediately and 5 Methods To Cease Residing Paycheck To Paycheck.

Choice 2: Enhance your earnings.

In the event you don’t have any further bills to chop out of your price range (or in case you simply don’t wish to reduce something out of your price range), then it’s time to extend your earnings! Try 15 Methods To Make An Further $500 Every Month for concepts on enhance your earnings!

Fast Ideas To Make A Weekly Finances Simpler.

Budgeting whenever you’re getting paid weekly doesn’t need to be tough. Under are a couple of tricks to make budgeting even simpler:

- Keep in mind that a few of the cash you’ve left for the week ought to roll over for the upcoming weeks. It’s okay to have cash left over in your price range – this can be a good factor! When you’ve cash left over, you’ll be extra ready for these upcoming payments and bills sooner or later.

- Create a separate checking account devoted to paying payments. This manner, you’ll be able to transfer cash into your separate account to assist cowl any future payments. Making a separate checking account makes invoice paying a lot simpler!

- Arrange a weekly price range assembly with your self or your loved ones. This assembly could be a quick 20-minute assembly the place you pay any payments, write your upcoming price range, or observe your spending. Make these price range conferences a precedence by including them to your weekly calendar!

- Keep in mind that you want time to regulate to budgeting. I’m a agency believer that budgeting takes no less than 3-4 months to get accustomed to. You’re going to overlook an expense once in a while, and that’s okay. Give your self some grace since you’re on this for the lengthy haul.

The Backside Line On Weekly Budgets

Budgeting whenever you receives a commission every week might sound extra difficult, but it surely could be simpler than you suppose! By following these 5 steps on price range weekly pay, you’ll be capable to write a stellar price range that works for you and your loved ones!