The CPI inflation report launched this week confirmed that it’s going to be troublesome to shut out the ultimate mile within the struggle in opposition to inflation. Nonetheless, because of that report, it looks as if traders are lastly coming to grips with the Fed’s message of upper charges for longer.

I really feel snug saying there’ll proceed to be volatility, each up and down, because the markets react to the month-to-month inflation information experiences. If the inflation information helps charge cuts, markets will doubtless go up. If the inflation information helps leaving charges alone, markets are more likely to go down.

For instance, this Tuesday (2/13) there have been marginally increased CPI inflation readings than what the analysts anticipated. Nicely, that despatched the S&P 500 down -1.4% and the Nasdaq down round -1.6% on the day. Largely as a result of the markets interpreted this dataset as a motive for the Fed NOT to chop rates of interest.

However too many individuals like to oversimplify the impacts from Fed charges by saying, “Excessive charges/charge hikes are dangerous for shares, and low charges/charge cuts are good for shares.” Positive, the sentiment of that relationship is mostly true, however it’s by no means that straightforward.

If that’s all you’re fixated on relating to the Fed, I feel you might be lacking what’s in all probability most necessary to traders: the flexibility to plan round a major interval with increased rates of interest.

Impacts of Price Instability & Uncertainty

Rate of interest ranges feed into each a part of the financial system. The speed set by the U.S. Federal Reserve is a key element to establishing rates of interest for numerous loans, curiosity funds and different yield-focused investments. If you wish to attempt to guess which path charges are headed, begin with the speed set by the U.S. Fed. Wherever it goes—up, down, or sideways—the consequences filter by way of into the broader economic system.

For the reason that finish of the pandemic, rates of interest have been on the rise. Starting in March 2022, the Fed went from a virtually 0% charge to over 5% in roughly a yr. Arguably essentially the most painful half was the staggering velocity of those hikes.

It’s powerful for a enterprise or a person to successfully plan for his or her long-term future when there’s that a lot volatility in rates of interest and borrowing prices. Uncertainty round charges may cause many traders and enterprise leaders to delay main purchases or investments till they’ve extra readability.

Frankly, I don’t blame them.

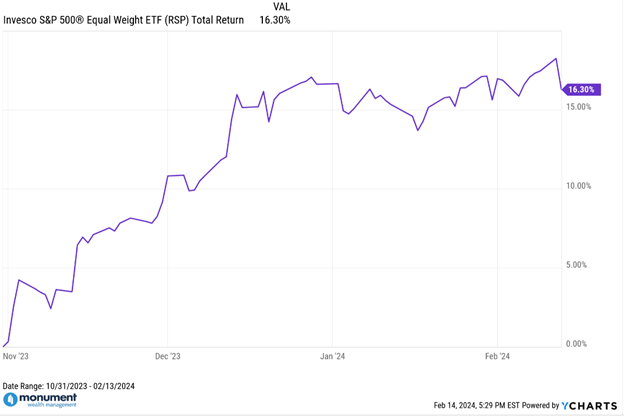

Fortunately, evidently the Fed has signaled an finish to this mountain climbing cycle throughout its previous couple of conferences. Eradicating a number of the unknowns round charges is without doubt one of the main causes we’ve seen broad market rallies just like the equal-weight S&P 500 ETF (ticker: RSP) being up round +16.3% complete return from 10/31/23 by way of 2/13/24 (see chart under).

It’s not a coincidence that there was additionally a Fed assembly on the finish of October. Right here’s an instance of upside volatility attributable to the Fed.

With out the worry of charges shifting considerably increased, it ought to give enterprise leaders the chance to start out planning and financing longer-term investments that can increase future progress. That’s excellent news for traders on the lookout for the subsequent wave of progress. Sure, the price of debt is increased than a number of years in the past, but when charges aren’t more likely to rise considerably sooner or later, corporations and traders can appropriately issue that into the funding selections being made right now.

Discovering A New “Regular” for Curiosity Charges

Larger charges develop into much less of a storyline to your portfolio when you may plan for them forward of time, however that solely works if charges keep comparatively flat. Fortunately, the Fed’s purpose isn’t to be persistently making main strikes. What they need is for charges to discover a new regular or a “impartial” stage.

The Fed is understood for its twin mandate which boils all the way down to low unemployment and manageable inflation. By doing that they’re trying to create a “impartial” economic system that’s neither too scorching nor too chilly. An economic system that’s too chilly is rising under development or stated in a different way, is likely to be leaving financial meat on the bone. However an economic system that runs too scorching can result in runaway inflation.

So, what’s the particular “impartial” rate of interest for the Fed?

Whereas it’s unimaginable to know for certain, the Fed itself has estimated it to be round 2.5% when inflation is at its 2% goal, or round 0.50% above the present inflation as defined on this Reuters article. So, with inflation presently round 3%, then “impartial” within the Fed’s eyes is likely to be round 3.5%.

Curiously, I feel it’s additionally very attainable that the “impartial” charge stage post-pandemic has really moved increased than the beforehand estimated 2.5% like this article written by the Minneapolis Fed President suggests. The next “impartial” charge would imply the Fed wants to chop even much less from right here as inflation strikes again down in direction of their goal.

With the Fed charges presently sitting at 5.25% to five.50%, they’re doing precisely what they stated they might: Taking a restrictive stance and staying like that till they’re completely snug inflation is properly underneath management. It’s going to be a while earlier than the Fed decides to return to a “impartial” charge coverage, and that “impartial” is likely to be even increased than what it was earlier than.

All of which means that rates of interest in all probability received’t be shifting a complete lot decrease from right here.

0% Curiosity Charges Are Gone: Get Comfy with the New “Regular”

Let’s be trustworthy, all of us acquired used to 0% rates of interest and free cash. Companies may simply finance short-term progress initiatives with out an excessive amount of worry of future penalties and prices. Cash was so low-cost that many companies and traders didn’t create and observe by way of on a long-term plan.

That’s not the case anymore.

Gone are the times of 0% rates of interest, at the least for the foreseeable future, however that doesn’t imply the world is ending. All it means is that corporations and traders have to adapt to what may very well be a long-term development of upper charge ranges in the event that they haven’t already. Everybody knew rates of interest had been going to must go up finally whether or not they admitted it or not. It’s not wholesome, regular, or sustainable for an economic system to completely have 0% charges.

So, in case you locked in low charges years in the past, kudos to you. Trip that for so long as you may. Nonetheless, in case you’ve been delaying a purchase order or funding in hopes of timing a drop in charges, perhaps it’s time to rethink. Who is aware of how lengthy you is likely to be ready at this level?

(Additionally, don’t ever attempt to time the monetary markets. EVER.)

Proper now, the mixture of the financial information and the Fed’s public messaging of “increased for longer” make it look like there are minimal charge cuts on the horizon. Whereas which may make borrowing dearer, planning to your investments must be simpler now that there’s doubtlessly extra stability, and perhaps even some predictability in charge ranges.