Ever since I revealed publicly about hitting the much-coveted millionaire milestone I had set for myself again in 2014, a lot of you may have reached out to ask in regards to the breakdown of my funding portfolio.

In the event you’re new to my weblog, right here’s a fast breakdown of the place I began and the way I received right here.

In 2014, I used to be nonetheless an worker who solely knew find out how to funds and save.

I wrote my first article right here to share with my associates about how I managed to avoid wasting $20,000 as a contemporary grad who had began working full-time, which then unexpectedly went viral. That was in an period when most contemporary grads have been incomes $2k – $4k on common, and I used to be being paid the decrease finish of $2,500.

Again then, many individuals left feedback on that article, together with people who suggested me to begin investing now that I had a good capital to work with. Nonetheless, I knew nothing about investing then, so I began studying – by means of a mixture of studying books, attending programs…and studying from Mr Market himself.

I’ll at all times keep in mind my first inventory buy. It was SingPost, which was closely shilled to me by my dealer again then (whom I’ve since “fired”) as he insisted that he was a “licensed skilled” and “knew higher” than me. I purchased SingPost at about $2 and misplaced near 80% of my funding on it. The monetary losses I incurred on that “protected, blue-chip” inventory taught me a painful lesson: the professionals do NOT essentially know higher than us.

In the event you're Gen Z, that was in an period earlier than the invention of digital brokerages i.e. every retail investor had a human dealer assigned to their account, who earned some charges for every transaction that we made.

I used to be decided to be taught, and invested primarily within the Singapore inventory market throughout that point as I continued including periodically at strategic timings over time e.g. in the course of the 2016 oil disaster, the COVID pandemic crash and the 2021 – 2022 crash. The businesses I personal have continued to extend their dividends over time, so I’ve loved each capital features and a progress in passive earnings (my dividend earnings collected every year has crossed 5-digits, which additionally means my yield-on-cost is now at double-digits). I prefer to reinvest these dividends for much more progress.

In 2016, I diversified into US and Hong Kong shares.

As I discovered extra about investing, I realised that the listed shares now we have right here in Singapore are however a drop within the huge ocean. If I needed worldwide progress and publicity, there have been far greater corporations within the US and Hong Kong that have been making an influence throughout world markets.

My enterprise into the US markets have paid off properly. A lot of the firms I invested in have been scooped up at a big low cost over time, together with Meta, Shopify and Masimo, simply to call a number of. I can’t be sharing the undervalued gems I discovered this 12 months as that’s a secret reserved just for my nearer associates and readers 😛

Whereas the Chinese language markets stay down and battered, the US markets have delivered astounding returns over time and soared to new all-time highs this 12 months.

In consequence, my portfolio has benefited from a number of multi-baggers. All these have propelled my portfolio to new all-time highs as properly, as you’ll be able to see within the chart beneath.

In 2017, I added crypto into my portfolio.

I keep in mind being excited after I learnt about how crypto and blockchain know-how works, and I may see how within the close to foreseeable future, it might positively play a much bigger function in our funds. Nonetheless, investing in crypto throughout that interval the place everybody was calling crypto a rip-off wasn’t straightforward (and I, too, needed to take care of a whole lot of hate feedback and criticisms from skeptics and even a number of monetary bloggers who disagreed with me venturing into crypto belongings). Nonetheless, I tuned out the noise and purchased the majority of my cryptocurrencies then as a result of I actually believed in the way forward for this new asset class.

Nonetheless, because it was fairly excessive threat and unstable, I capped my publicity to only 20% of my whole portfolio. I don’t play MEME cash or NFTs, and I don’t commerce crypto futures or derivatives both.

In fact, this 12 months turned out to be a watershed 12 months for crypto, with the SEC approving crypto ETFs and governments lastly giving Bitcoin their stamp of approval (principally due to Donald Trump). As Bitcoin surged previous the $100,000 mark, my portfolio has additionally gone up. In fact, alongside the way in which, I made a number of losses (anybody remembers USDT?) from crypto initiatives that unexpectedly failed, however general, crypto has nonetheless given me a 4-5X achieve on my capital which is simply mind-boggling.

I've a number of associates who began out in crypto throughout the identical time as me, however made a much bigger transfer in liquidating all their different belongings (equities, bonds) to place all of it into crypto. They turned multi-millionaires ("whales") a lot sooner than me - over the past crypto bull cycle in 2020 - and have since cashed out on a number of the cash to purchase property. Do I remorse it? In fact I'm wondering what my life may have been like if I had taken the danger again then, however I additionally know that even when given the prospect to show again time (and with out hindsight bias), I'd have nonetheless made the identical determination as a result of I had to consider my household and children. Typically, it pays to begin investing early when you haven't any commitments to deal with but.

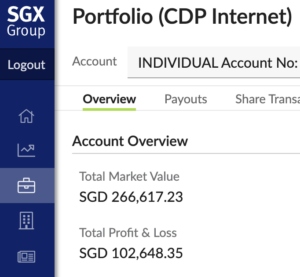

In 2024, my funding portfolio crossed 1 million {dollars}.

Final 12 months, due to the bullish efficiency of the inventory and crypto markets, in addition to the consequences of long-term compounded progress, my funding portfolio has surged previous the $1 million greenback mark this 12 months.

Actually, I didn’t see this coming, and this realisation solely hit me this month after I was doing my yearly assessment of my funds to replicate on how (properly or badly) I’ve executed this 12 months. The objective I had set for myself in my 20s was to hit $1M by the point I turned 45, however again in 2022, this didn’t look doable (my portfolio was down by -35% in that 12 months alone) so I assumed I’d need to push the timeline additional again. Who would have recognized that the markets would come roaring again the way in which it did in these current 2 years?

Among the shares I personal? Meta, Shopify, Disney, Tencent, Alibaba (sure I’m within the inexperienced for this since I averaged down at a time when most buyers have been fleeing), Zoom, DBS, Jardine C&C, and many others. I maintain some ETFs, however they’re a small portion of my portfolio in comparison with particular person shares. As you’ll be able to see from my choice, my funding strategy has at all times been to seek out great firms and purchase them after they’re undervalued – that is very a lot influenced by Charlie Munger and Warren Buffett, whose writings and annual AGM sharings significantly impressed me in my youthful years. Even in crypto, I apply the identical investing philosophy – though the dangers are positively greater there since extra crypto initiatives fail than firms going bankrupt or delisting.

Personally, I don’t commerce, I don’t use margin, and I don’t make use of leverage. I’ve taken programs to discover ways to do them, however have concluded that such high-risk trades don’t go well with me as a result of I merely can not sleep properly at night time for so long as the place is open. I’ve additionally dabbled in choices and futures up to now, however have come to grasp over time that these approaches are actually ill-suited to me given my persona and schedule. As an alternative, I very a lot desire to check the basics of firms and doing market analysis vs. taking a look at charts for patterns, and I keep away from shares like Tesla not as a result of I don’t imagine of their future, however as a result of my coronary heart can not face up to the volatility (aka Elon Musk).

The $1M doesn't embody my 2 properties (1 in Singapore, 1 abroad) or CPF belongings as these are much less liquid investments.

In the event you’ve caught round for the final 10 years and watched my funding progress story occur, I hope this conjures up you that it’s doable to turn out to be a millionaire whenever you persistently save and make investments your option to monetary freedom. I additionally wish to thanks for supporting the work that I do on this weblog, as a result of whereas I don’t take up a whole lot of sponsored gigs in contrast to different full-time KOLs (to the purpose the place I’m infamous among the many companies for being “choosy” and turning down a whole lot of gigs, together with alternatives by XM, and many others – properly, that’s a label I’m joyful to just accept), this aspect hustle referred to as writing (or content material creation?) has nonetheless given me a good earnings that has helped me to avoid wasting and make investments much more.

I’ve loved writing on this weblog for the final 10 years, and I sit up for with the ability to do it for an excellent 10, 20, and even 30 extra years. Maybe then it’ll turn out to be a retirement journey weblog somewhat than educating individuals on managing their funds higher, haha.

In the event you’re new right here and don’t have any urge for food to undergo the 700+ articles that I’ve written and charted within the final 10 years right here, it is possible for you to to learn extra about my story and strategy subsequent 12 months when my ebook is out in bookstores later this 12 months. Please do help that; I’m excited to lastly realise my childhood dream of changing into a printed creator 🙂

2024, you’ve been completely superb – right here’s to higher issues to come back in 2025.

With love,

Price range Babe