Actual GDP development slowed within the fourth quarter of 2024, however the financial system completed the yr at a stable fee. Whereas client spending continued to drive development, gross personal home funding detracted over a full share level primarily attributable to a decline in personal inventories.

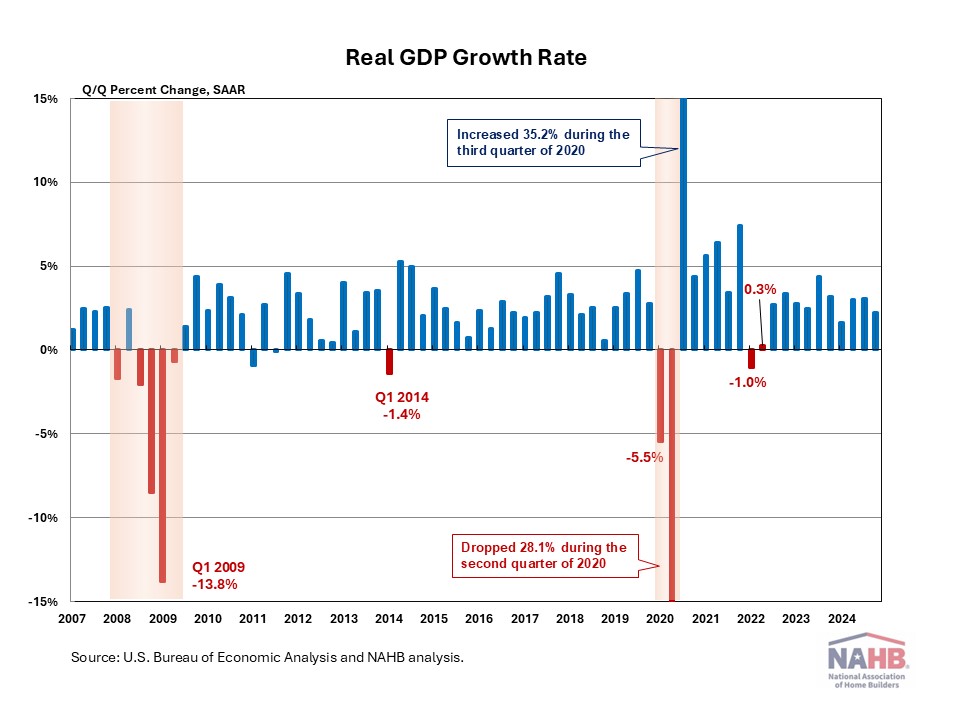

In keeping with the “advance” estimate launched by the Bureau of Financial Evaluation (BEA), actual gross home product (GDP) expanded at an annual fee of two.3% within the fourth quarter of 2024, following a 3.1% achieve within the third quarter of 2024. This quarter’s development was increased than NAHB’s forecast of a 1.8% enhance.

Moreover, the information from the GDP report means that inflationary stress continued on the finish of 2024. The GDP worth index rose 2.2% for the fourth quarter, up from a 1.9% enhance within the third quarter of 2024. The Private Consumption Expenditures Worth (PCE) Index, which measures inflation (or deflation) throughout numerous client bills and displays modifications in client habits, rose 2.3% within the fourth quarter. That is up from a 1.5% enhance within the third quarter of 2024.

For the total yr, actual GDP grew at a wholesome fee of two.8% in 2024. It was barely slower than the 2023 degree of a 2.9% enhance and matched NAHB’s forecast.

This quarter’s enhance in actual GDP primarily mirrored will increase in client spending, and authorities spending.

Client spending, the spine of the U.S. financial system, rose at an annual fee of 4.2% within the fourth quarter. This marks the best annual development fee because the first quarter of 2023. The rise in client spending mirrored will increase in each items and companies. Whereas items spending elevated at a 6.6% annual fee, expenditures for companies elevated at a 3.1% annual fee.

Within the fourth quarter, authorities spending elevated at a 2.5% fee.

Nonresidential mounted funding decreased 2.2% within the fourth quarter. The lower in nonresidential mounted funding mirrored decreases in gear (-7.8%) and buildings (-1.1%). In the meantime, residential mounted funding elevated 5.3% within the fourth quarter after two consecutive quarters of declines. Inside residential mounted funding, single-family buildings rose 3.1% at an annual fee, enhancements elevated 2.7%, whereas multifamily buildings declined 7.2%.

In comparison with the third quarter, the deceleration in actual GDP within the fourth quarter primarily mirrored

downturns in gross personal home funding and exports. Inventories fell and dragged down the contribution to actual GDP by 0.93 share factors. Imports decreased.

For the frequent BEA phrases and definitions, please entry bea.gov/Assist/Glossary.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your e mail.