Should you’re hoping for a fast launch of Fannie Mae and Freddie Mac, you may wish to train some endurance.

Whereas the percentages of the pair exiting conservatorship elevated sharply as soon as Trump’s second time period started, it nonetheless faces an uphill battle.

One of many main sticking factors is mortgage charges, which many count on to extend in the event that they’re launched.

Having a near-explicit assure that Fannie and Freddie will purchase and securitize mortgages makes them cheaper for customers.

The expectation is that if/after they go public, mortgage charges would should be larger to compensate for elevated danger.

Fannie and Freddie Have Been in Conservatorship Since 2008

First some fast background. After the worst housing disaster in latest historical past, Fannie Mae and Freddie Mac, generally known as the government-sponsored enterprises (GSEs) have been positioned in conservatorship.

This was basically a authorities bailout because the pair have been “severely broken” because of the early 2000s mortgage meltdown and “unable to satisfy their missions with out authorities intervention.”

The association allowed them to proceed to help the very fragile housing market because it recovered over the previous decade.

However maybe no one anticipated the pair to stay in authorities arms so long as they’ve.

Ultimately look, it has now been practically 20 years! In fact, this isn’t the primary time efforts have been made to launch them again into the wild.

Throughout Trump’s first time period that started again in 2017, there was plenty of speak of a launch. And the shares of each corporations responded accordingly.

They have been buying and selling within the $1 vary in late 2016 and rapidly elevated to greater than $4 per share in early 2017 earlier than fading once more.

As soon as the privatization of Fannie Mae and Freddie Mac misplaced steam, they finally grew to become penny shares.

Numerous Investor Hypothesis Surrounds Their Launch

Like eight years in the past, there’s been plenty of investor hypothesis surrounding their launch, which arguably is a part of the issue.

It appears people are extra attention-grabbing in making a buck on a commerce than contemplating the precise implication of their launch. Go determine…

The most recent speculator to get in on the obvious gold rush was investor Invoice Ackman, whose Pershing Sq. Capital Administration agency “may personal about 180 million frequent shares of the 2 corporations.”

And he may reportedly see a $1 billion achieve on the funding, with the shares doubtlessly climbing to round $34 post-IPO.

For reference, they at the moment commerce at round $6 every, so it will characterize fairly the achieve.

Just like circumstances previous to Trump’s first presidential victory, the pair have been buying and selling within the $1 vary.

However they’ve since skyrocketed, with each FNMA and FMCC up roughly 500% since Trump gained a second time period and hypothesis about their launch reached euphoric ranges.

As famous, that is the battle of curiosity at the moment in play. And the identical concern we noticed eight years in the past. It’s a inventory commerce as an alternative of a “Hey, is that this good for our nation?”

Fannie and Freddie’s Launch Will Hinge on Affect to Mortgage Charges

Whereas traders are hoping the pair get launched and make them untold riches, we must always solely launch them when it’s protected and applicable to take action.

If newly-appointed Treasury Secretary Scott Bessent, who’s by the way additionally the brand new performing director of the Client Monetary Safety Bureau (CFPB) does the suitable factor, that may not be for a while.

In an interview with Bloomberg this week, when requested about their launch, Bessent stated, “Proper now the precedence is tax coverage. As soon as we get by that, then we are going to take into consideration that.”

He added that “The precedence for a Fannie and Freddie launch, an important metric that I’m is any research or trace that mortgage charges would go up.”

“So something that’s accomplished round a protected and sound launch goes to hinge on the impact of long-term mortgage charges.”

Merely put, he and people round him are conscious that mortgage charges will doubtless rise if Fannie and Freddie are compelled to face on their very own.

And since mortgage charges have surged from round 3% to begin 2022 to roughly 7% as we speak, the very last thing the Trump administration desires is larger charges.

So actually it boils right down to serving to traders get wealthy or serving to on a regular basis Individuals purchase properties with decrease mortgage charges.

Might be an attention-grabbing choice…

The Pair Ought to Be Launched, However Maybe Slowly After They Scale back Their Footprint

My ideas on the matter are that the pair aren’t able to be launched. Not a lot has modified since they went below conservatorship, apart from mortgage high quality vastly enhancing.

Positive, they don’t have practically as many worries about mortgage defaults and foreclosures, however in addition they proceed to again the overwhelming majority of dwelling loans in america.

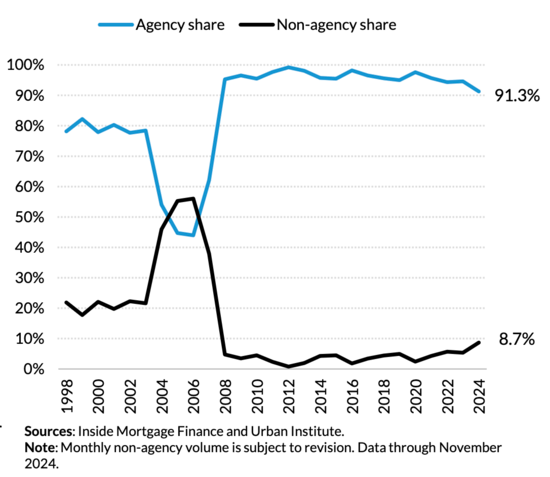

Look a the chart above from the City Institute. Greater than 91% of MBA issuance is agency-backed, which does embody FHA and VA too. However about 40% of first-lien originations are GSE, whereas simply 4.1% is private-label.

With out them, there can be chaos within the mortgage market. Even when launched, there would doubtless be chaos.

Nevertheless, they need to be launched sooner or later if they’re actually public corporations, and never authorities entities.

A greater approach about going about it is likely to be significantly decreasing their footprint earlier than that occurs (sorry traders).

To take action, they will pull again or utterly cease shopping for and securitizing mortgages tied to second properties and funding properties.

In different phrases, restrict their choices to major residences for on a regular basis householders versus those that are shopping for a second, third, fourth, and even fifth dwelling.

Paradoxically, this might additionally liberate for-sale provide, which has plagued the housing marketplace for at the very least the previous decade.

There might be extra adjustments to their product menu, which might make it smaller, with the implied function of ushering in additional personal capital to the mortgage market.

As Fannie and Freddie acquired smaller, personal gamers may develop bigger and play extra of a job.

This would cut back our reliance on the pair, and reduce the influence of their eventual launch.

(picture: Virginia State Parks)