A reader asks:

I’m 46 and plan to retire by 55. I’ve calculated that I’ll attain my retirement quantity in one other 6 years giving me an honest buffer for retirement. I’ve a $500k mortgage at 5.625% with 28 years left. I’m comfy with debt and don’t see an enormous concern. I agree along with your ideas on liquidity, and inflation lowering the debt load. The one concern is retiring with the mortgage. We plan to maneuver after retirement and never keep at this home. I’ve run calculations and there’s no vital distinction both method. Discretionary spending is barely decreased till retirement within the payoff situation however will increase by $50k over lifetime. It looks as if it’s finally my choice. I’d recognize any options on find out how to method it. -Raj

There are lots of good private finance angles to this query.

To begin with I’m all the time fascinated as to why individuals invariably choose 55 as their early retirement age. I get questions like this on a regular basis. The age isn’t 53 or 57. It’s all the time 55. Perhaps individuals similar to spherical numbers.

Paying off your mortgage early is a hotly debated private finance subject. Either side of the argument have robust emotions.

I’ve talked to loads of individuals who have paid off their mortgage early and none of them remorse it. It’s extra about peace of thoughts than a spreadsheet choice. That’s comprehensible.

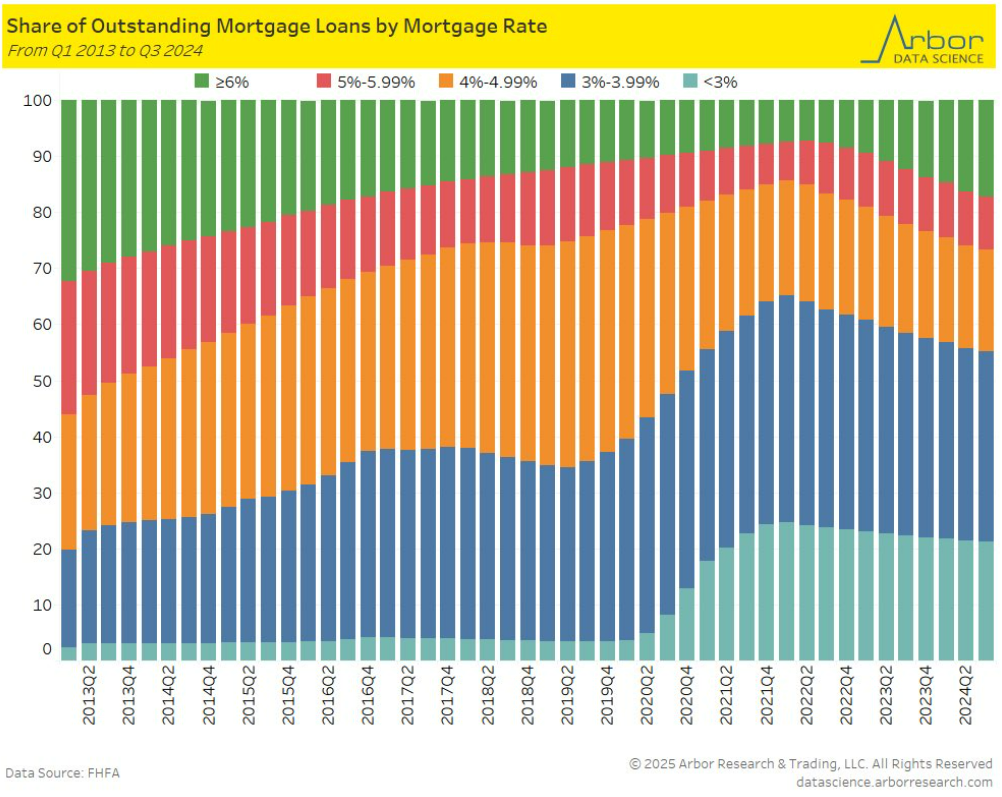

Nonetheless, I do really feel strongly that it mainly by no means is sensible to repay a low-rate mortgage early. And loads of individuals nonetheless have ultra-low charges from the pandemic:

Round 60% of all mortgages are 4% or much less. While you issue within the tax breaks and inflation it simply doesn’t make sense to me why you’ll need to do away with debt at such favorable charges. You’ll need to pry my 3% mortgage from my chilly, lifeless arms.

To every their very own I suppose.

Nonetheless, I believe the calculus modifications when contemplating early retirement.

Retirement itself includes a seemingly never-ending listing of unknowns — future returns, inflation, your lifespan, rates of interest, surprising occasions, household circumstances, sequence of returns, withdrawal charges, and so on. Retirement requires taking an enormous leap of religion. Retiring early solely provides to the diploma of issue.

I like the truth that Raj ran the numbers right here to know the monetary affect of paying off the debt.

As a lot as I hate paying off your mortgage early, I truly like the concept of getting no mortgage in retirement. It provides an added margin of security and peace of thoughts.

One of many causes a fixed-rate mortgage is such a superb deal is as a result of your wages ought to develop over time. While you retire there are not any extra wages to depend on to assist shoulder that month-to-month mortgage burden.

However there’s one other piece of data he shared with us right here that’s related — Raj and his spouse don’t plan on staying in the home after they retire. That modifications the equation for me.

You nearly have to take a look at this from extra of a monetary asset perspective than a private finance angle.

In the event you’re planning on promoting the home while you retire anyway I don’t see the necessity to repay your mortgage. Both method, you’ll obtain the proceeds from your private home fairness while you promote. Sure, the quantity could be a lot bigger in case you paid it off earlier, however that additionally means you’ll be tying up that cash as an illiquid asset within the meantime.

Who is aware of what the housing market will appear to be while you go to promote in a decade? What in case you can’t promote as rapidly as you want to?

That is the form of selection the place there doubtless is not any proper or fallacious reply. All of it is dependent upon your relationship with debt, illiquidity and danger.

You additionally need to keep in mind that 9 years is a very long time. Perhaps your plans change. Perhaps circumstances change.

I’d put a premium on flexibility.

We coated this query on this week’s Ask the Compound:

Barry Ritholtz joined me on the present this week to debate questions on timing market corrections along with your financial savings account, how your portfolio ought to look heading into retirement, managing your mum or dad’s monetary plan and find out how to power your self into splurging somewhat when you will have greater than sufficient cash.

Additional Studying:

How A lot is a 3% Mortgage Value?

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here might be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.