“Fiscal assist can handle the direct financial fallout from excessive climate occasions.” That quote got here from an fascinating new analysis paper printed within the 98th version of the Financial institution of Worldwide Settlements Bulletin (February 10, 2025) – Macroeconomic impression of maximum climate occasions. The paper seeks to tease out what the financial impacts and coverage implications are of the local weather adjustments that at the moment are manifest in numerous excessive climate occasions, corresponding to droughts, wildfires, storms, and floods, that are growing in incidence throughout the globe. The researchers recognise that such occasions are more and more imposing “excessive financial prices” and “social hardship” on communities all over the world. Their conjecture is that the “most excessive climate occasions have been rising and are prone to improve additional” which can problem coverage makers. They focus on the implication of this elevated publicity to such occasions for fiscal and financial coverage however recognise that fiscal coverage should be the frontline instrument to answer the injury brought on by such occasions.

The BIS researchers are related to the “BIS Americas Workplace” and selected to review that area (8 main economies) though they indicated the evaluation applies elsewhere.

The main target is as a result of the “macroeconomic impression” of maximum climate occasions “is already tangible within the area” (Americas).

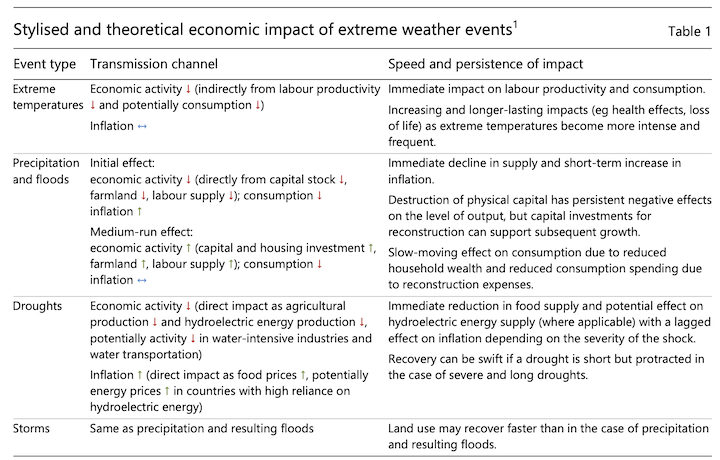

Their remark is that the totally different occasions have totally different macroeconomic impacts that are summarised of their Desk 1, which I reproduce beneath.

One of many fascinating observations is that:

A key characteristic of maximum climate occasions is that their direct impression is localised.

Which suggests implies that regional cooperation is indicated to ameliorate the nationwide impacts (for instance, “Financial exercise could quickly improve in different areas to cushion the availability shock in affected ones”).

Though that shock absorbing capability is restricted if, for instance, the impacted area is the house to a key sector (“accountable for a big share of manufacturing or consumption of particular items”).

The researchers additionally examined the ‘function of insurance coverage’ as a mitigating think about decreasing the macroeconomic impacts of occasion disasters.

There are two main issues in counting on the non-public insurance coverage trade for reduction.

First, it’s clear that insurance coverage premiums are rising which for a lot of households and companies makes it not possible to take care of cowl.

There may be proof of a powerful correlation between losses from pure disasters and non-life insurance coverage premiums.

Second, many insurance coverage firms are withdrawing their cowl in sure areas and/or for sure occasions.

This withdrawal creates what the authors name an “insurance coverage hole” which is the proportion of the losses which are coated by the insurance coverage coverage.

The authors recommend:

Given the big insurance coverage hole and the necessity for fiscal reduction measures, disasters can improve fiscal deficits and sovereign debt yields, affecting the fiscal area to react to future shocks.

Which introduces the primary mainstream fiscal fiction about fiscal area.

The assertion is that if non-public insurance coverage fails within the face of accelerating excessive occasion injury, then fiscal deficits will rise, which can push up authorities bond yields, and cut back the capability of nationwide governments to answer additional main unfavorable shocks.

The assertion is fallacious however as a result of it has a lot traction amongst orthodox economists who advise coverage makers, it serves to tell a bunch of voluntary constraints on authorities coverage settings, which make our responses to local weather change much less efficient (to say the least).

First, there isn’t any direct relationship between the scale of fiscal deficits and the yields that authorities bonds concern at.

Second, if, for some motive, the bond markets turned more and more threat averse and demanded greater yields, and if the federal government thought the earnings flows that might comply with from curiosity repayments was not acceptable for the given macroeconomic settings, then it might instruct the central financial institution to interact in yield curve management à la the Financial institution of Japan at current.

Third, a nationwide authorities that points its personal forex might cease issuing debt altogether provided that it isn’t wanted to facilitate authorities spending and the central financial institution has alternative routes to handle liquidity as a part of its rate of interest upkeep operations (for instance, paying a assist price on extra reserves).

Fourth, a currency-issuing authorities’s spending capability in monetary phrases is at all times infinity minus a penny.

How a lot of that capability it chooses to make use of (that’s, the extent of presidency spending) relies on its aims and the state of spending and saving flows within the non-government sector relative to out there actual (productive) sources.

The capability to spend as much as that monetary restrict at this time is just not conditional on what the federal government spent beforehand.

The selection of how a lot to spend in anybody interval is conditional within the sense that if the federal government has been operating its fiscal coverage appropriately and sustaining full capability utilisation of the out there productive sources, then its fiscal area is restricted within the present interval.

Be aware, fiscal area is just not a monetary idea as implied by the BIS researchers.

Fiscal area is an actual idea and displays the out there productive sources that may be introduced again into productive use by authorities spending.

Fiscal area is restricted at full employment, however immense when there may be mass unemployment.

It has nothing to do with the deficit to GDP ratio or the general public debt to GDP ratio.

So utilizing discretionary fiscal coverage to treatment the results of an excessive climate occasion, for instance, is just not restricted in monetary phrases.

But when governments imagine the fiction that previous deficits restrict their present fiscal area then they’re susceptible to creating poor coverage responses.

For instance, in February 2022, there was a significant flooding occasion in northern NSW (Australia), a area the place the so-called ‘Northern Rivers’ dominate the panorama.

You’ll be able to examine that incident on this UK Guardian article (February 20, 2023) – The endless fallout of the northern rivers floods: ‘Individuals are simply worn down’.

Main flooding happens in that area at 9.72 metres above the – Australian Top Datum – which is the benchmark in opposition to which vertical heights are measured on this nation – and is roughly the typical sea degree of “thirty tide gauges positioned across the whole shoreline.”

The Levee Wall Safety in place can resist as much as roughly 10.7 metres AHD.

In 2017, there was a significant occasion the place the water degree within the rivers rose to 11.59 metres AHD.

However in 2022, the extent rose to 14.4 metres AHD – huge – the most important pure catastrophe since Cyclone Tracey in 1974 worn out Darwin.

Lismore is a medium-sized nation city and round 20,000 households had been critically impacted.

The federal government responded with assist however the scale of assist was insufficient – fiscal constraints had been used to ‘justify’ the average help.

Many households are nonetheless dwelling in caravans, tents and many others 3 years after the occasion.

Additional, because of an unwillingness of presidency to spend the suitable quantity essential to relocate the flood susceptible a part of the city to greater floor, the rebuilding has been executed in situ – which implies that huge losses will probably be repeated when the subsequent flood happens – and they’re occurring with more and more frequency.

It additionally can’t be mentioned that the federal government confronted useful resource constraints – constructing supplies which were used to rebuild the homes that had been destroyed might have simply been used elsewhere the place the flood menace is decrease or non-existent.

The BIS researchers then sought to statistically estimate the unfavorable results of maximum climate occasions.

They discovered:

1. “considerably unfavorable impact of maximum climate occasions on output within the brief time period, however their results on long-term GDP development are combined”.

Droughts result in a “robust unfavorable impact on GDP development over the next six quarters … whereas storms, floods and wildfires don’t.”

For the US, storm injury prices about 0.25 per cent of GDP between 2000 and 2023.

2. “The results on inflation fluctuate in each magnitude and course, relying on the sort and magnitude of the shock.”

Inflation falls “after excessive temperature shock”.

Results are “short-lived” growing “quickly over the three-month interval after most kinds of catastrophe”.

The extra excessive the occasion the “extra pronounced and protracted impact on inflation”.

Storms – push up vitality inflation for one month.

Wildfires – “robust improve in meals costs solely two to 3 months after the shock”.

“General, we don’t discover a persistent impression of maximum climate occasions on inflation”.

3. General “common annual price of pure disasters was sizeable … The worst occasions in these international locations precipitated damages over 10 instances bigger than the median” and fluctuate throughout nations relying on the kind of occasion.

I consulted the – EM-DAT Worldwide Catastrophe Database = which is housed on the Centre of Analysis on the Epidemiology of Disasters (CRED) on the College of Louvain in Belgium.

Between 2000 and 2025, they report 132 main pure disasters for Australia together with Drought, Flood, Infestation, Storms, and Wildfires.

When it comes to whole $US injury in 1000’s, they estimate (the info is just not excellent) that the prices of the occasions are:

Drought $US 4,844,049 1000’s

Flood $US 3,3415,798 1000’s

Infestation $US 212,336 1000’s

Storm $US 664,3507 1000’s

Wildfires $US 25,677,500 1000’s

So very vital by way of whole impression on GDP.

I’m finding out this dataset extra fastidiously and can report extra element in the end.

The BIS Paper lastly thought-about the coverage implications and argued that:

Fiscal assist can handle the direct financial fallout from excessive climate occasions.

Which was the opening quote.

This can be a vital recognition from central bankers as to the relative significance of fiscal and financial coverage for macroeconomic stabilisation within the face of unfavorable shocks.

Fiscal coverage can at all times cut back the unfavorable earnings losses arising from such occasions.

They then argue that:

Whether or not and the way financial coverage responds rely on: (i) how a particular occasion impacts bodily capital; (ii) the relative impact on provide and demand; and (iii) the dangers of second-round results on inflation and inflation expectations.

As soon as once more that is vital as a result of it demonstrates that even with the mainstream paradigm, financial coverage is restricted in what it could actually do.

They conclude that:

… tightening financial coverage might be acceptable if the impression of an excessive climate occasion on inflation is anticipated to be extra persistent.

They declare that if fiscal coverage is constrained then it’s higher “‘wanting by way of’ inflation”, which implies that the impacts on the supply-side on costs from the acute climate occasion are prone to be short-lived and so long as there isn’t any proof of persistence extra demand, then central banks mustn’t react and simply look ahead to the inflationary impacts to dissipate.

This logic bears on the current financial coverage shifts in response to the pandemic-induced inflation.

As common readers will know, I argued on the exterior (in 2021) that the inflationary impacts of the pandemic (after which Ukraine and OPEC+) can be transitory and that there was no proof of a structural extra demand (an excessive amount of spending).

In that case, the central banks ought to have maintained their financial coverage positions (that’s, not hike charges) in the way in which that the Financial institution of Japan did.

Then the large earnings redistributions from low-income mortgage holders to high-income monetary asset holders wouldn’t have occurred.

And the inflation would have dropped as the availability components abated, which is what occurred.

However being the BIS, they needed to revert again to Monetarist doctrine kind.

They declare that central banks must contemplate “an elevated sensitivity to inflation after the current bouts of upper inflation and the ensuing excessive worth ranges in lots of international locations” as a result of:

… even small and short-lived shocks to inflation might result in a extra persistent improve in inflation expectations.

This was the argument that central banks used within the current inflationary episode to justify growing rates of interest.

The RBA, for instance, stored warning us that inflationary expectations had been presumably going to interrupt out in the event that they didn’t convey inflation down rapidly.

There was by no means any trace of that taking place (the breakout) and it was only a ruse to offer the RBA cowl.

Apparently, the BIS authors shut with the remark that if a significant climate occasion wipes out bodily capital or housing then:

… the financial prices of a rise in coverage charges (ie excessive charges slowing the rebuilding of the capital inventory and thus resulting in longer intervals of decrease productiveness development) could outweigh the prices of short-term will increase in inflation.

Central financial institution coverage makers not often acknowledge the long-term injury of rate of interest hikes.

They discuss getting inflation down rapidly however ignore the likelihood that their price hikes will cut back long-term funding in productive capital, which leaves a nation extra susceptible to stagnating development hitting up in opposition to a ‘lowered’ inflation ceiling because of the gradual development in potential GDP (because of the lagging capital formation).

Conclusion

Lastly, whereas I discovered the BIS dialogue fascinating it was targeted on what occurs when a significant climate occasion happens.

One other dialogue is cut back the vulnerability to those occasions earlier than they happen within the face of local weather change.

In that context, the fiscal implications that come up from insurance policies that will probably be required to transit to low-carbon economies are huge and financial coverage has little to supply in assembly that problem, aside from to keep away from hindering vital capital formation.

That’s sufficient for at this time!

(c) Copyright 2025 William Mitchell. All Rights Reserved.