At present (December 4, 2024), the Australian Bureau of Statistics launched the most recent – Australian Nationwide Accounts: Nationwide Revenue, Expenditure and Product, December 2024 – which reveals that the Australian economic system grew by simply 0.6 per cent within the December-quarter 2024 and by simply 1.3 per cent over the 12 months (up from 0.6 per cent). GDP per capita additionally reversed its sequence of damaging outcomes as output development outpaced the underlying inhabitants development. The one supply of expenditure holding GDP development constructive is coming from authorities – each recurrent and funding. The most important element of nationwide expenditure – family consumption spending – returned to a constructive contribution as did enterprise funding and internet exports. However the reality stays that non-government spending remains to be comparatively weak and it’s public spending that’s holding the economic system from close to recession development charges.

The primary options of the Nationwide Accounts launch for the December-quarter 2024 have been (seasonally adjusted):

- Actual GDP elevated by 0.6 per cent for the quarter (0.3 per cent final quarter). The annual development charge was 1.3 per cent (0.6 final quarter).

- GDP per capita rose by 0.1 per cent for the quarter, finish 7 consecutive quarters of contraction. Over the 12 months, the measure was down 0.7 per cent – signalling declining common earnings.

- Australia’s Phrases of Commerce rose 1.7 per cent for the quarter however have been down by 4.8 per cent over the 12 month interval.

- Actual internet nationwide disposable earnings, which is a broader measure of change in nationwide financial well-being, rose by 0.7 per cent for the quarter and was flat over the 12 months.

- The Family saving ratio (from disposable earnings) rose to three.8 per cent (from 3.6).

Total development image – development continues at a lot slower charge

The ABS – Media Launch – stated that:

Australian gross home product (GDP) rose 0.6 per cent within the December quarter 2024 and 1.3 per cent by the 12 months …

Modest development was seen broadly throughout the economic system this quarter. Each private and non-private spending contributed to the expansion, supported by an increase in exports of products and companies …

GDP per capita grew 0.1 per cent this quarter following seven consecutive quarters of falls …

Family spending was up 0.4 per cent within the December quarter after a flat end result within the September quarter …

Development in authorities spending moderated to 0.7 per cent within the December quarter following bigger rises in earlier quarters …

Non-public funding rose 0.3 per cent within the December quarter …

Public funding rose 1.8 per cent …

Commerce in companies contributed to GDP development, pushed by the rise in exports of companies …

The family financial savings ratio rose modestly to three.8 per cent within the December quarter, up from 3.6 per cent within the September quarter.

The quick story:

1. The weak point in non-public home demand continued though family consumption expenditure and enterprise funding returned modest constructive contributions to development on this quarter.

2. Web exports returned an growing constructive contribution.

3. The ABS stated that “Authorities spending continues to help demand” with state and native ranges “hiring throughout the Well being, Training, Policing, and Atmosphere companies.” Public spending continued to develop (+1.8 per cent) with state and native ranges spending on “main transport, water and renewable tasks”.

4. The lengthy sequence of damaging development in GDP per capita ended signifying the general development was extra fast than the underlying inhabitants development, the latter has been working at document ranges.

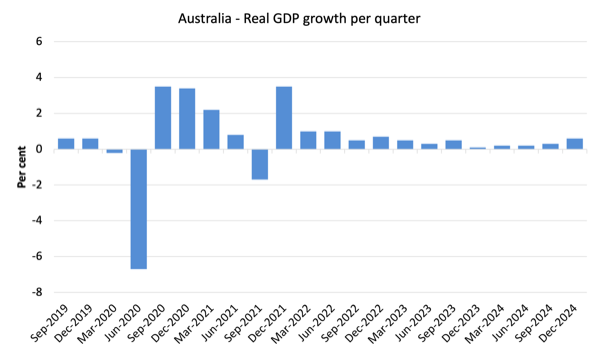

The primary graph reveals the quarterly development during the last 5 years.

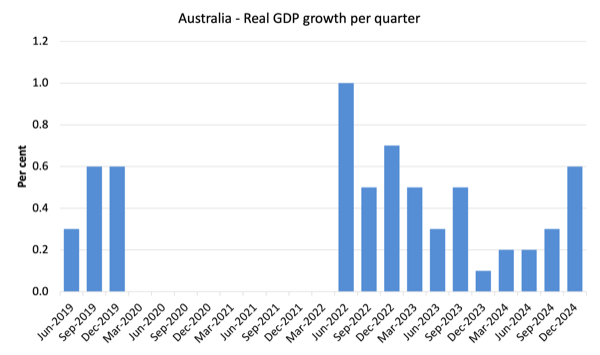

Right here is identical graph with the acute observations throughout the worst a part of the COVID restrictions and authorities earnings help taken out.

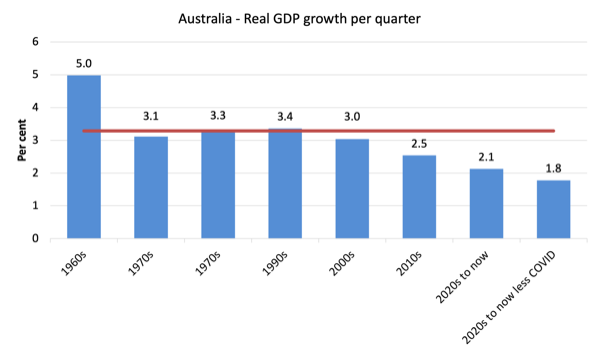

To place this into historic context, the following graph reveals the last decade common annual actual GDP development charge because the Sixties (the horizontal crimson line is the typical for your complete interval (3.29 per cent) from the March-quarter 1960 to the December-quarter 2024).

The 2020-to-now common has been dominated by the pandemic.

However because the earlier graph reveals, the interval after the most important well being restrictions have been lifted generated decrease development in comparison with the interval when the restrictions have been in place.

If we take the observations between the December-quarter 2020 and the December-quarter 2022 out, then the typical since 2020 has been 1.8 per cent each year.

Additionally it is apparent how far under historic developments the expansion efficiency of the final 2 many years have been because the fiscal surplus obsession has intensified on either side of politics.

Even with a large family credit score binge and a once-in-a-hundred-years mining increase that was pushed by stratospheric actions in our phrases of commerce, our actual GDP development has declined considerably under the long-term efficiency.

The Sixties was the final decade the place authorities maintained true full employment.

A GDP per capita recession – maybe over

Up till the December-quarter 2024, GDP per capita had fallen for the seventh consecutive quarters, which implies that complete output averaged out over your complete inhabitants was in contraction.

The which means of the typical is questionable, given the extremely skewed earnings distribution in the direction of the highest finish.

Provided that, if the typical is declining, then these on the backside are doing it very powerful certainly.

Within the December-quarter 2024, the sequence of contraction was arrested and GDP per capita rose by 0.10 per cent.

The next graph of actual GDP per capita (which omits the pandemic restriction quarters between December-quarter 2020 and December-quarter 2021) tells the story.

Evaluation of Expenditure Elements

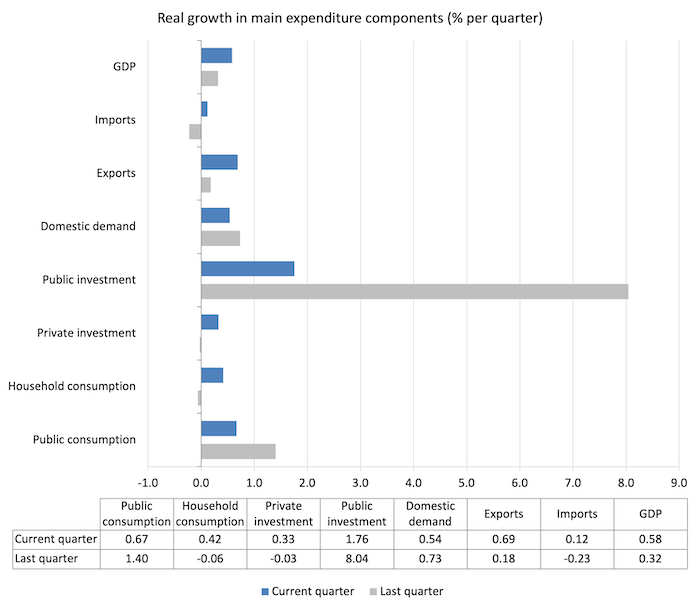

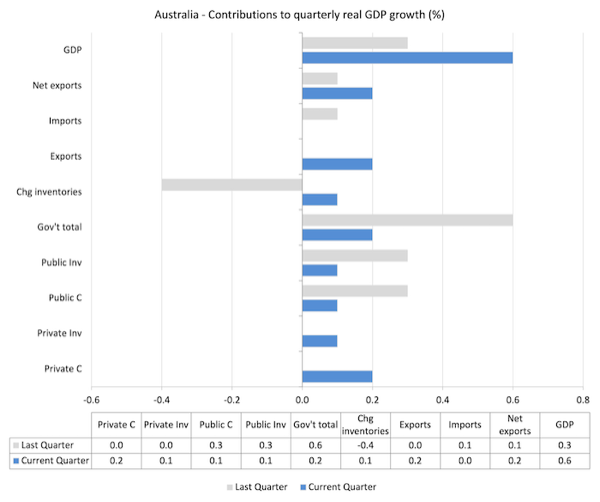

The next graph reveals the quarterly proportion development for the most important expenditure parts in actual phrases for the September-quarter 2024 (gray bars) and the December-quarter 2024 (blue bars).

Whereas public expenditure nonetheless is powerful and personal spending weak, the latter did present some indicators of restoration with family consumption expenture rising by 0.4 per cent and personal capital formation rising by 0.33 per cent.

Modest however maybe an indication of enhancements into 2025.

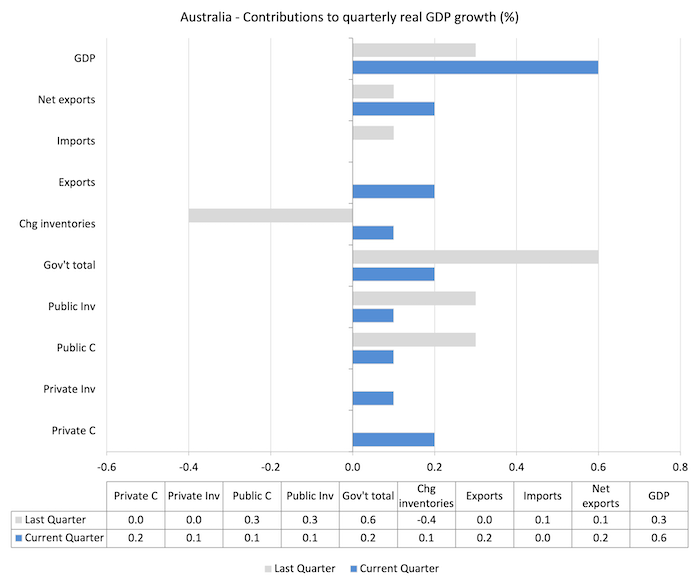

Contributions to development

What parts of expenditure added to and subtracted from the change in actual GDP development within the December-quarter 2024?

The next bar graph reveals the contributions to actual GDP development (in proportion factors) for the primary expenditure classes. It compares the December-quarter 2024 contributions (blue bars) with the earlier quarter (grey bars).

1. Web exports added 0.2 factors to development up from 0.1 factors.

2. Family consumption (0.2 factors) and personal funding (0.1 level) returned constructive contributions after recording zero contributions within the final quarter.

3. Whereas the federal government contribution declined it nonetheless represented a 3rd of the general development charge.

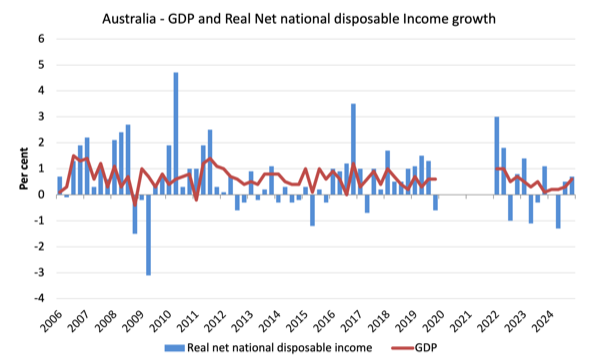

Materials residing requirements rose in December-quarter however was flat for the 12 months general

The ABS inform us that:

A broader measure of change in nationwide financial well-being is Actual internet nationwide disposable earnings. This measure adjusts the quantity measure of GDP for the Phrases of commerce impact, Actual internet incomes from abroad and Consumption of mounted capital.

Whereas actual GDP development (that’s, complete output produced in quantity phrases) rose by 0.6 per cent within the December-quarter, actual internet nationwide disposable earnings development rose by 0.7 per cent.

How can we clarify that?

Reply: The phrases of commerce improved within the December-quarter and compensation of staff (COE) elevated per cent.

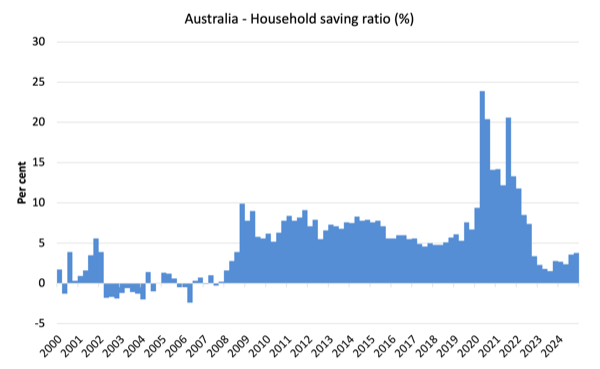

Family saving ratio rose 0.2 factors to three.8 per cent

The RBA has been attempting to wipe out the family saving buffers because it hiked rates of interest hoping that this would cut back the probability of recession.

After all, that course of has attacked the lower-end of the wealth and earnings distribution, given the rising rates of interest have poured hundreds of thousands into these with interest-rate delicate monetary property.

The next graph reveals the family saving ratio (% of disposable earnings) from the December-quarter 2000 to the present interval.

It reveals the interval main as much as the GFC, the place the credit score binge was in full swing and the saving ratio was damaging to the rise throughout the GFC after which the latest rise.

An growing saving ratio supplies the family sector general with an elevated capability to danger handle within the face of uncertainty.

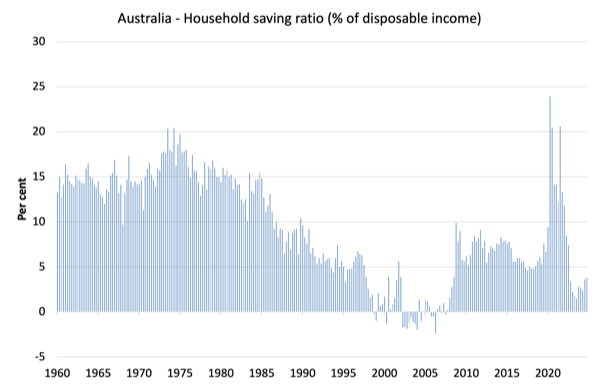

The subsequent graph reveals the saving ratio since 1960, which illustrates the best way by which the neoliberal interval has squeezed family saving.

Going again to the pre-GFC interval, the family saving ratio was damaging and consumption development was maintained by growing debt – which is an unsustainable technique on condition that family debt so excessive.

Despite the fact that the ratio has been rising barely in latest quarters, it’s nonetheless nicely under previous ranges.

The next desk reveals the affect of the neoliberal period on family saving. These patterns are replicated world wide and expose our economies to the specter of monetary crises rather more than in pre-neoliberal many years.

The end result for the present decade (2020-) is the typical from June 2020.

| Decade | Common Family Saving Ratio (% of disposable earnings) |

| Sixties | 14.4 |

| Nineteen Seventies | 16.2 |

| Eighties | 11.9 |

| Nineties | 5.0 |

| 2000s | 1.4 |

| 2010s | 6.6 |

| 2020s on | 9.6 |

| Since RBA hikes | 3.2 |

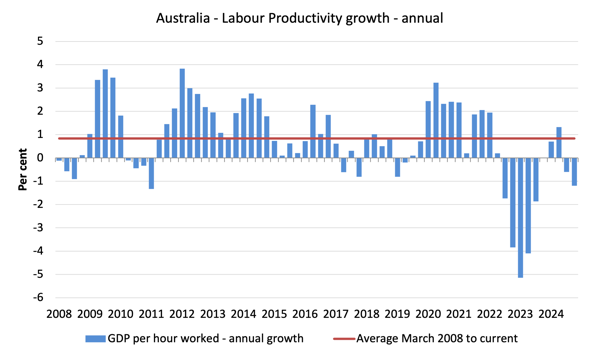

Actual GDP development rose however hours labored rose extra and productiveness development declined

Actual GDP rose 0.6 factors within the quarter, whereas working hours rose by 0.5 per cent.

Which implies that GDP per hour ought to have risen.

Nevertheless, the info reveals that GDP per hour labored fell by 0.1 level for the quarter – that’s, a lower in labour productiveness.

I count on some revision in that knowledge within the subsequent launch.

Over the past 12 months, productiveness development averaged -1.2 per cent on the again of weaker output development and stronger hours development.

The next graph presents quarterly development charges in actual GDP and hours labored utilizing the Nationwide Accounts knowledge for the final 5 years to the December-quarter 2024.

To see the above graph from a unique perspective, the following graph reveals the annual development in GDP per hour labored (labour productiveness) from the December-quarter 2008 quarter to the December-quarter 2024.

The horizontal crimson line is the typical annual development because the March-quarter 2008 (0.84 per cent), which itself is an understated measure of the long-term development development of round 1.5 per cent each year.

The comparatively robust development in labour productiveness in 2012 and the principally above common development in 2013 and 2014 helps clarify why employment development was lagging given the true GDP development. Development in labour productiveness implies that for every output stage much less labour is required.

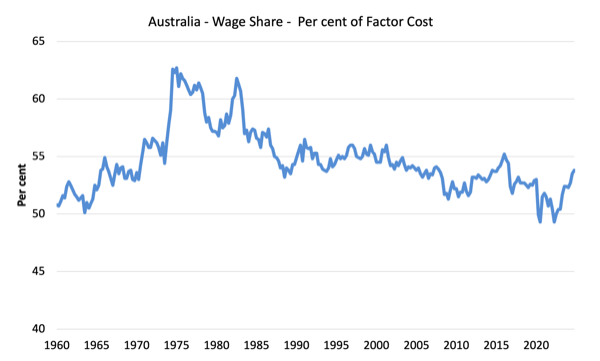

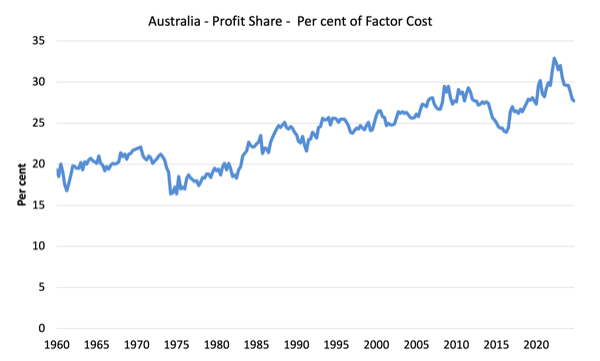

The distribution of nationwide earnings – wage share slight rise

The wage share in nationwide earnings rose to 53.8 per cent (up 0.3 factors) whereas the revenue share fell to 27.7 per cent (down 0.2 factors).

The distinction is the shift within the authorities share.

The primary graph reveals the wage share in nationwide earnings whereas the second reveals the revenue share.

The declining share of wages traditionally is a product of neoliberalism and can finally need to be reversed if Australia is to get pleasure from sustainable rises in requirements of residing with out document ranges of family debt being relied on for consumption development.

Conclusion

Do not forget that the Nationwide Accounts knowledge is three months previous – a rear-vision view – of what has handed and to make use of it to foretell future developments will not be easy.

So within the December-quarter, the expansion within the Australian economic system picked up – 0.6 per cent in comparison with 0.3 per cent final quarter.

GDP per capita additionally reversed its sequence of damaging outcomes as output development outpaced the underlying inhabitants development.

The one supply of expenditure holding GDP development constructive is coming from authorities – each recurrent and funding.

The most important element of nationwide expenditure – family consumption spending – returned to a constructive contribution as did enterprise funding and internet exports.

However the reality stays that non-government spending remains to be comparatively weak and it’s public spending that’s holding the economic system from close to recession development charges.

Clarification on terminology

I advocated a degrowth technique for the worldwide economic system general on condition that our footprint is 1.7 instances the capability of the biosphere to regenerate.

To attain that technique, on condition that many poorer nations should proceed to development, would require fairly substantial reduce backs in spending and consumption within the richer nations.

After I analyse the Nationwide Accounts knowledge or any expenditure/output knowledge, I write as if development is ‘good’.

However that terminology is used within the context that with out financial development and with none substantial shifts in earnings distribution and authorities transition insurance policies, attempting to pursue a recessionary technique would injury the weakest members of our society disproportionately.

In some respects, I’m abstracting from the damaging actuality of our ecological footprint.

That’s sufficient for immediately!

(c) Copyright 2025 William Mitchell. All Rights Reserved.