Right here’s a loopy stat from Bloomberg:

Half of American households account for 97.5% of the wealth on this nation.

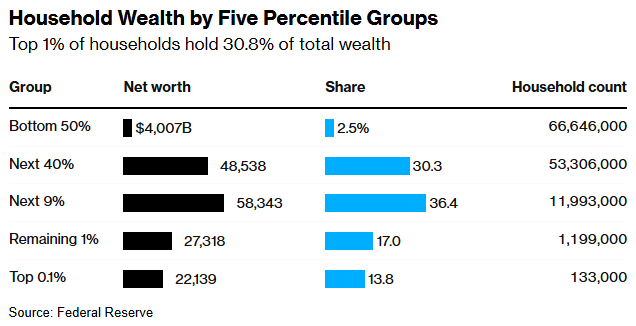

That is the breakdown from Federal Reserve knowledge:

On the one hand these numbers — 2.5% of wealth — appear virtually inconceivable for the underside 50%.

Alternatively, that is an enchancment from the final decade.

It was a lot worse popping out of the Nice Monetary Disaster. In 2011, the highest 50% managed 99.6% of the wealth, whereas the underside 50% accounted for simply 0.4%.1

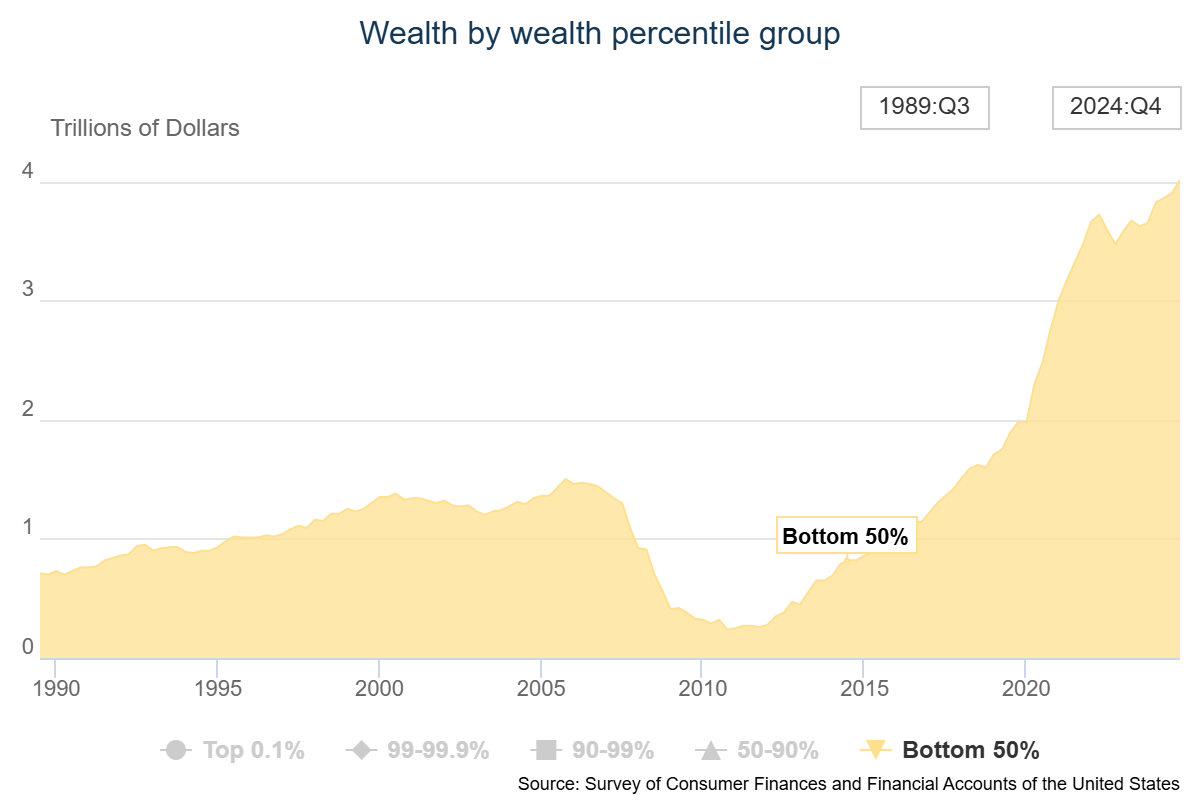

The pandemic noticed a large enhance within the wealth of the underside 50%:

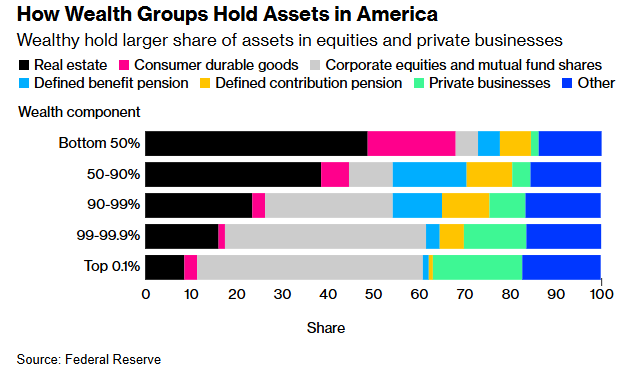

Rising residence values have helped since housing makes up nearly all of monetary belongings for the underside 50%:

Roughly half of all wealth for the underside 50% resides of their residence whereas simply 5% is in shares. These numbers for the highest 10% are 19% and 36%, respectively.

Family funds are in an odd place. The wealthy are getting richer, however everybody else is getting richer, too, simply at a slower tempo normally.

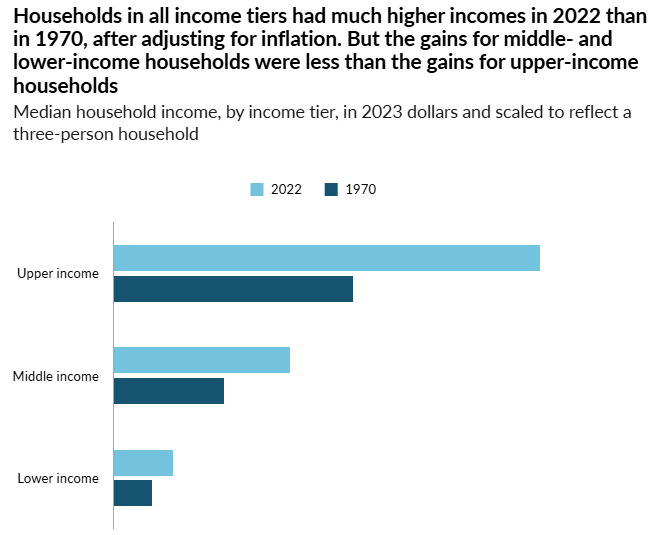

Pew Analysis reveals higher revenue households have seen their incomes develop a lot sooner than center and decrease revenue households since 1970:

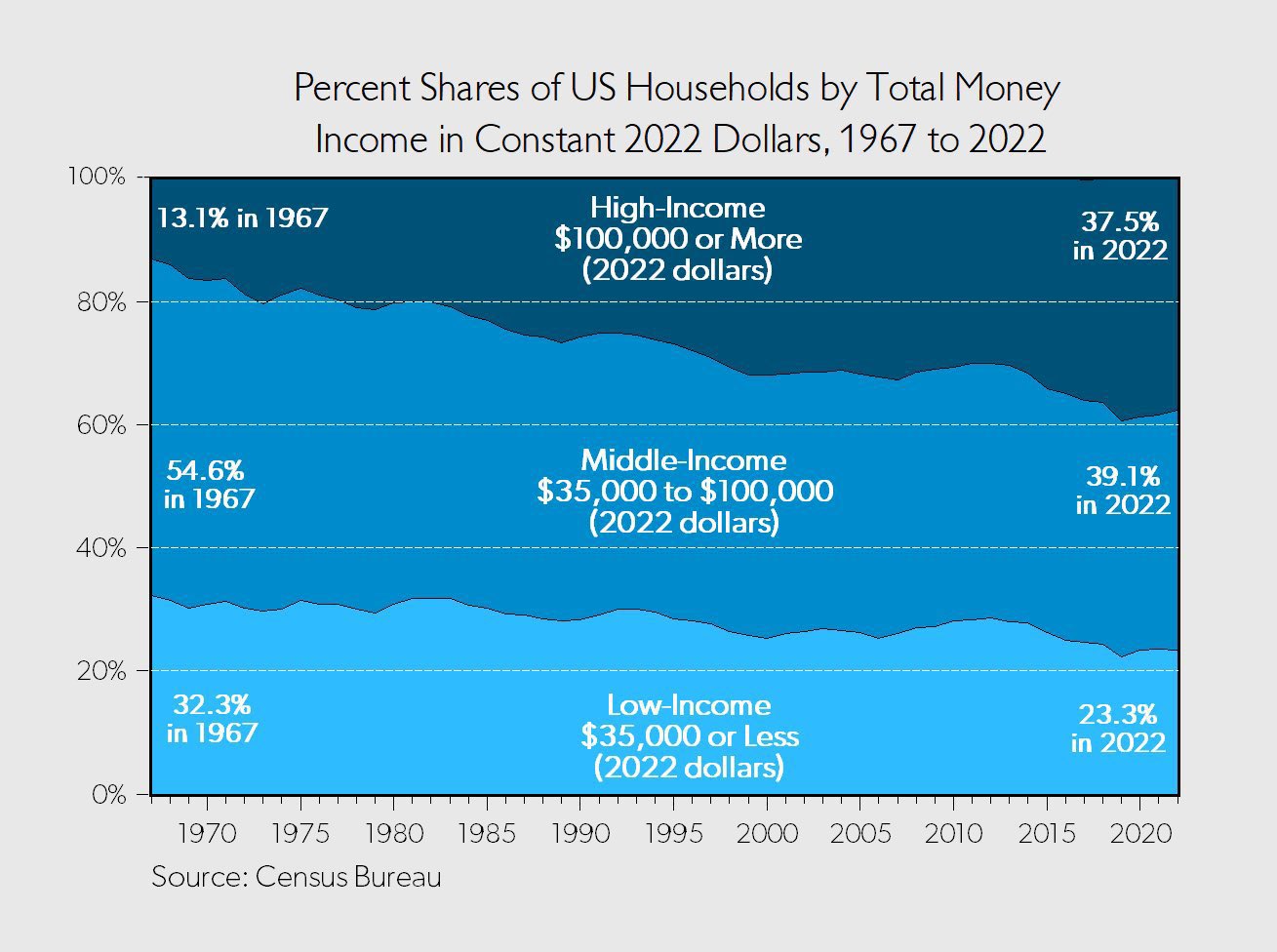

Take a look at this chart from Chris Freiman on the shrinking center class:

The center class is shrinking as a result of extra persons are transferring into the higher class.2 This can be a good factor however it doesn’t make the individuals on the skin wanting in really feel any higher about their station in life.

You will need to acknowledge that the individuals who make up these totally different revenue and wealth buckets are continuously altering over time.

I wrote about this in Don’t Fall For It:

Analysis reveals over 50% of Individuals will discover themselves within the prime 10% of earners for no less than one yr of their lives. Greater than 11% will discover themselves within the prime 1% of income-earners sooner or later. And near 99% of those that make it into the highest 1% of earners will discover themselves on the skin wanting in inside a decade.

An analogous dynamic is at play in relation to web value. It’s not static.

I used to be within the backside 50% for years after I graduated school. I had scholar loans and a automobile mortgage. I didn’t make a lot, so I didn’t save a lot. My web value was detrimental till my late 20s.

I don’t know what the appropriate stage of family wealth distribution ought to appear to be. I sympathize with the concept that our system ought to reward risk-taking however we also needs to attempt to raise up as many individuals as attainable.

I’m unsure there’s a steadiness that might ever make everybody joyful.

The essential factor is to get to a spot the place you’re proud of what you have got.

Simpler mentioned than executed.

Additional Studying:

The Wealth Impact

1The very best share for the underside 50% was 4% of whole wealth within the Nineteen Nineties.

2I do know some individuals will quibble together with his definitions of higher, center and decrease class however the level is these numbers are inflation-adjusted over time.

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here can be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.