We are actually full-swing into the nationwide election marketing campaign in Australia (election on Might 3, 2025) and we’ve got a brand new celebration – the Trumpet of Patriots – (funded by a property developer/miner) channelling Trump’s method, the conservatives channelling Trump’s method (though with a slight extra refined voice however not a lot), the Greens chasing their tails, and the Labor authorities desperately making an attempt to remain in energy after operating terrified of doing very a lot during the last three years. It’s not an incredible alternative. The same old scare techniques from the Opposition are out in power – immigration, defence vulnerabilities, and so on and the standard ‘free market’ stuff. The Labor authorities retains hammering on about their fiscal rectitude – two surpluses out of three – as if we’re all mainstream economists who’re obsessive about these irrelevancies. However plainly the voters usually are not so aligned with mainstream economists.

On February 28, 2025, YouGov Australia launched a ballot – Coalition leads 51-49 in newest YouGov ballot, with sturdy assist for Authorities possession of Whyalla Steelworks – wherein 62 per cent of respondents wished the federal authorities to take over a serious steelworks which goes broke.

The ballot discovered:

… overwhelming assist for presidency intervention in the way forward for the Whyalla steelworks:

– 62% of Australians assist a authorities takeover of the steelworks

– 60% are in favor of public possession of the plant

This choice spanned all of the events kind of equally, which rejects the notion that the conservative voters overwhelmingly favour privatisation.

The ballot commented that:

The 60% assist for public possession of the Whyalla steelworks, together with 61% of people that intend to vote Liberal within the subsequent election, demonstrates the sturdy backing for presidency intervention to safe Australia’s metal trade.

As an apart, the Ballot gave the Trumpet of Patriots round 1 per cent of the vote – so the tens of millions they’re throwing on the election gained’t get them very far.

Extra importantly, it demonstrates that in contrast to voters within the US, Australian voters can’t be so simply conned, albeit the problems and realities are barely completely different.

However there was one other YouGov ballot that was much more attention-grabbing – this one run by that group for the nationwide broadcaster, the Australian Broadcasting Fee (ABC).

The ABC report (March 31, 2025) on the outcomes = Few Australians really feel financially higher off, new ballot reveals. Charlotte says she feels ‘nugatory’ – open up all form of questions.

In relation to the title of that article, the Opposition chief has been pulling the Trump line because the marketing campaign will get underway – ‘Are you higher off now than three years in the past?’ – the three years in the past being when the present Labor authorities took workplace.

It’s a no-brainer kind of query in a interval when inflation and rates of interest have risen and companies have been value gouging.

After all, most individuals and definitely those that would not have giant monetary asset wealth are worse off now.

However is that as a result of the present authorities failed, or that the mess they inherited from the, now, Opposition once they have been in authorities has taken time to resolve?

Additional, is a brief blip within the financial development of the nation the actual challenge?

Now we have an existential disaster unfolding (most likely fairly quickly) within the type of our 1.7 instances the regenerative capability of the biosphere footprint to take care of and the adjustment required to maneuver in the direction of righting that ship will contain extreme financial changes in our materials lifestyle.

Additional, whereas I’m essential of the federal government’s dealing with of the employment state of affairs, the very fact stays that unemployment, whereas rising, has not gone wherever close to the place a standard Phillips curve inflation adjustment would have pushed it.

There are causes for that which aren’t the topic of this weblog put up.

However the actuality is that the transition chances stay excessive for brand new entrants and anybody unemployed to achieve employment of some type, and they’re low for these already employed to lose their jobs.

So given our employment prospects are central to our materials lifestyle (for many of us) then the final three years hasn’t been as dangerous as previous conservative governments have delivered.

However again to the ballot I discussed.

Economists are frequently showing on nationwide media – TV, radio, podcasts and so on – claiming that the fiscal deficit is simply too excessive and must be ‘repaired’ and that the residents don’t need their grandchildren burdened with greater taxes because of the debt that the federal government points to match the deficits.

They suppose they converse for all.

However the ballot that was taken to discover attitudes to fiscal coverage delivers some fairly stark outcomes that reject the form of mindset that economists suppose guidelines.

Sure, 42 per cent of the respondents mentioned that by way of private wealth they’re worse off now in comparison with 12 months earlier.

40 per cent mentioned their monetary place was static and 12 per cent mentioned they have been higher off.

Given the extremely skewed wealth distribution that end result would accord with those that maintain monetary belongings and those that are debtors.

When rates of interest began rising in Might 2022 and stored rising 11 instances till they stopped in November 2023, and the overwhelming majority of house mortgages are variable fee, then it’s no shock that the distributional shifts in actual revenue that resulted would depart a small minority higher off (a lot) and a big proportion static (most likely would not have a mortgage), and a barely bigger proportion worse off (round 37 per cent of house owners have mortgages in Australia).

And the monetary squeeze was not simply due to the rates of interest.

The federal authorities ran two surpluses in 2022-23 and 2023-24 which after all impose a liquidity squeeze on the non-government sector which might solely be resolved by wealth discount (liquidation).

Commentators hold telling us that fiscal surpluses are virtuous and enhance nationwide saving.

In truth, a authorities surplus (deficit) is strictly equal to a non-government deficit (surplus).

A non-government deficit requires that sector to shed wealth so as to ‘finance’ the deficit.

Nevertheless, a authorities deficit provides internet monetary belongings (wealth) to the non-government sector (and doesn’t want bond issuance to fund it).

Alternatively, a fiscal surplus can’t be construed as nationwide saving.

Saving is the act of foregoing consumption and investing the saving so as to generate bigger consumption potentialities sooner or later because of the curiosity return on the saving element.

That is smart when utilized to a person, an organization or the non-government sector basically.

I’m financially constrained and if I enhance my saving fee and generate interest-earning flows from the saving then subsequent 12 months I’ve extra to spend given my base revenue.

Nevertheless, that idea of saving has no utility to a authorities that points the foreign money that we use.

In what sense can it ‘save’?

It has no monetary constraint on its spending as a result of it creates {dollars} by typing numbers into laptop programs that hyperlink authorities to the banking sector.

Meaning its future spending capability in monetary phrases is infinity minus a penny.

Which is similar monetary spending capability it had yesterday and the day earlier than.

And that capability is regardless of what the fiscal stability was yesterday or the day earlier than.

So a authorities doesn’t forego consumption spending within the present interval to generate greater future consumption spending.

It simply doesn’t make any sense to make use of the ‘saving’ idea when speaking about authorities.

That time additionally then rejects all of the claims that governments must construct piggy banks up now for future exigencies and all these types of arguments.

Just like the declare that operating surpluses will construct up a pool of saving that the federal government can draw on because the society ages and extra individuals are requiring pension assist and medical procedures.

These types of claims are completely ridiculous and with out basis.

Anyway, that form of fiscal nonsense is overseas on this election marketing campaign.

And what do Australians consider it?

The ballot requested the survey respondents what needs to be given precedence: fiscal assist (elevated deficits) or debt discount?

66 per cent mentioned that the federal government needs to be offering extra monetary assist and value of dwelling reduction.

Solely 25 per cent mentioned that ‘Decreasing authorities debt’ was the precedence.

So the inhabitants has fairly completely different views than the ‘economists’.

One other query centered on whether or not tax cuts have been useful.

The latest fiscal assertion from the federal authorities gave throughout the board tax cuts (as an election bribe).

Nevertheless, the ballot discovered that:

… most Australians (65 per cent) say they need to have been focused at low-income earners who want it probably the most fairly than a common lower (27 per cent).

So the economists who broadly at all times declare tax cuts are fascinating have missed the sentiment of the individuals who nonetheless worth, it appears, fairness earlier than private achieve.

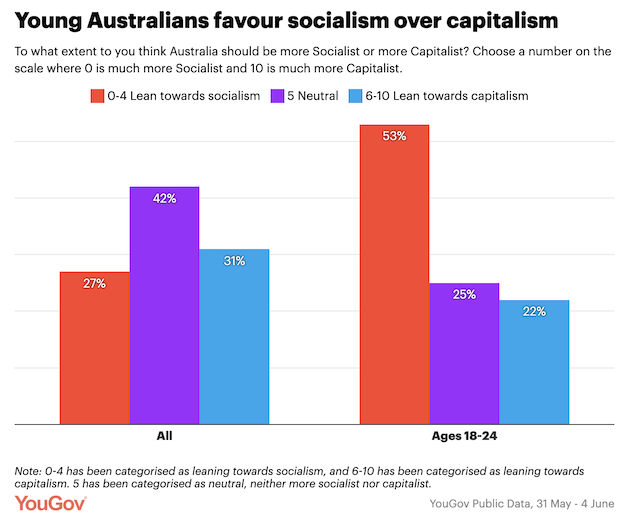

One other YouGov – Public Information Ballot (revealed June 24, 2024) – discovered that:

53% of 18- to 24-year-olds need extra Socialism.

That is significantly attention-grabbing.

The ballot requested respondents “in the event that they suppose Australia needs to be extra socialist or capitalist on an eleven-point scale, 0-10. 0-4 signifies a level of assist in the direction of socialism, and 6-10, a level of assist for capitalism. 5 is the impartial possibility, positioned equally between socialism and capitalism.”

The outcomes are proven on this graphic from YouGov:

Once we consider the longer term, the opinions of the aged cohorts are largely irrelevant.

Will probably be the 18 to 24 12 months olds who’re the longer term leaders and I discovered this end result to be actually heartening.

Solely 22 per cent of this cohort need to stick with a capitalist system.

General, it was the conservative voters (Liberal-Nationwide coalition) who need to stick with capitalism in the primary.

The fact for younger adults into prime-age is that the capitalist system is dudding them.

Their employment is more and more low-paid and precarious.

Their capability to save lots of and buy a home is nearly non-existent

They’re lumbered with huge academic money owed because of the shift to user-pays tertiary research.

And so they perceive higher than most the environmental problem that they inherited.

Not like the claims that everybody is anxious concerning the intergenerational penalties of public debt (the economists’ favorite storyline), the fact is that individuals, particularly youthful individuals are anxious about actual issues – the surroundings and entry to housing.

Which accords with their need for extra public sector intervention, extra public funding, extra public assist.

Now take into consideration this situation.

The views expressed by these respondents are largely what we would time period ‘uneducated’ within the sense that I doubt lots of the respondents who need fiscal deficits continued and enhanced fiscal assist from the federal authorities are throughout the element about currencies – that’s, I doubt they’ve a Fashionable Financial Idea (MMT) understanding of the world.

Their views are expressed although within the face of fixed assertions within the every day media from economists and politicians that they’re harmful and unsustainable.

So regardless of the mainstream financial consensus, giant numbers of Australians reject it.

Now think about if the inhabitants grew to become higher educated alongside the MMT strains and will actually perceive and critique that mainstream economics consensus.

I think then the outcomes would swing a lot additional away from the mainstream fiscal consensus and no politician would dare declare virtuosity for creating fiscal surpluses and so on.

The general public would demand we deal with our unemployed higher.

There can be assist for a Job Assure.

And the general public would demand a lot better public funding in local weather change mitigation than we’re seeing.

And the target market for additional MMT training needs to be the youthful technology.

They’re already ‘pink’!

Conclusion

There may be hope.

That’s sufficient for at the moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.