To rejoice the launch of my new e book, Millionaire Milestones: Easy Steps To Seven Figures, on Could 6, 2025, I believed it’d be enjoyable to discover numerous millionaire matters main as much as the discharge.

For many millionaires, proudly owning the nicest home they’ll afford is a prime precedence. Provided that many people are nonetheless spending extra time at dwelling post-pandemic, the intrinsic worth of a house has gone up. And for millionaires with youngsters or plenty of furry mates, a spacious home on a big lot can really feel like a necessity.

So on this submit, let’s discover a enjoyable query: How a lot revenue and internet value do you must afford a $10 million dwelling?

This subject is especially attention-grabbing to me as a result of I really like actual property. After I bought my present dwelling in This fall 2023, I instructed myself I’d reached the prime of my property ladder and didn’t need to climb greater. However there’s no hurt in operating the numbers simply in case the economic system roars again or I get fortunate with an funding.

Minimal Earnings Needed To Afford a $10 Million Dwelling

Relating to shopping for property responsibly, I wish to comply with my 30/30/3 dwelling shopping for rule:

Rule #1: Spend not more than 30% of your gross revenue in your month-to-month mortgage fee.

For those who’re financing the house, be certain that the month-to-month mortgage doesn’t exceed 30% of your gross revenue. For those who’re paying all money, you must simply fall under this threshold.

Rule #2: Have no less than 30% of the house’s worth in money (20% for the down fee, 10% as a buffer).

For a $10 million home, meaning:

- $2 million for a 20% down fee

- $1 million as a money reserve or liquid investments

This buffer is your security internet in case of job loss, an surprising expense, or a significant dwelling restore.

Rule #3: Spend not more than 3–5 instances your gross annual revenue on the acquisition worth.

Ideally, you’d earn no less than $3.33 million a yr to purchase a $10 million dwelling responsibly. That’s the 3X rule in motion. You would possibly stretch it and purchase the house on a $2 million revenue in case you have robust revenue stability and development potential, however that’s a calculated danger.

Stretching to 5X your revenue means you’ll doubtless really feel financially tight for no less than the primary yr. For those who go this route, right here’s tips on how to survive essentially the most harmful interval after shopping for a house.

Minimal Web Value Required To Afford a $10 Million Home

After proudly owning a number of properties over the previous 22 years, I’ve discovered the candy spot in your main residence as a share of your internet value is not more than 30%. Ideally, it’s nearer to twenty%.

For those who’re looking for a $10 million dwelling, this doubtless isn’t your first rodeo. You in all probability have already got important wealth and different investments. In distinction, the common American has over 70% of their internet value tied up of their main residence.

A $10 million purchaser is likely to be:

- A profitable entrepreneur

- A senior government at a monetary establishment

- A associate at a prime legislation agency

- A celeb or skilled athlete

- A well-connected or corrupt authorities official who can commerce with insider info

If your home represents greater than 30% of your internet value, you’re at better danger of monetary stress throughout downturns, identical to what occurred through the 2008 World Monetary Disaster. So many misplaced their properties to foreclosures.

In case your main residence represents lower than 10% of your internet value, it’s possible you’ll be under-living relative to your monetary capability. That could possibly be an indication to spend somewhat extra on your self or think about giving extra away.

Splendid Web Value Vary

To really feel financially safe with a $10 million dwelling buy:

- Advisable internet value: ~$33 million (30% allocation)

- Splendid internet value: ~$50 million (20% allocation)

With a $50 million internet value, you may comfortably pay money or tackle a smaller mortgage. Even should you tackle an $8 million mortgage at 6%, your month-to-month fee could be about $48,000—simply manageable at this stage.

Combining Splendid Earnings and Web Value

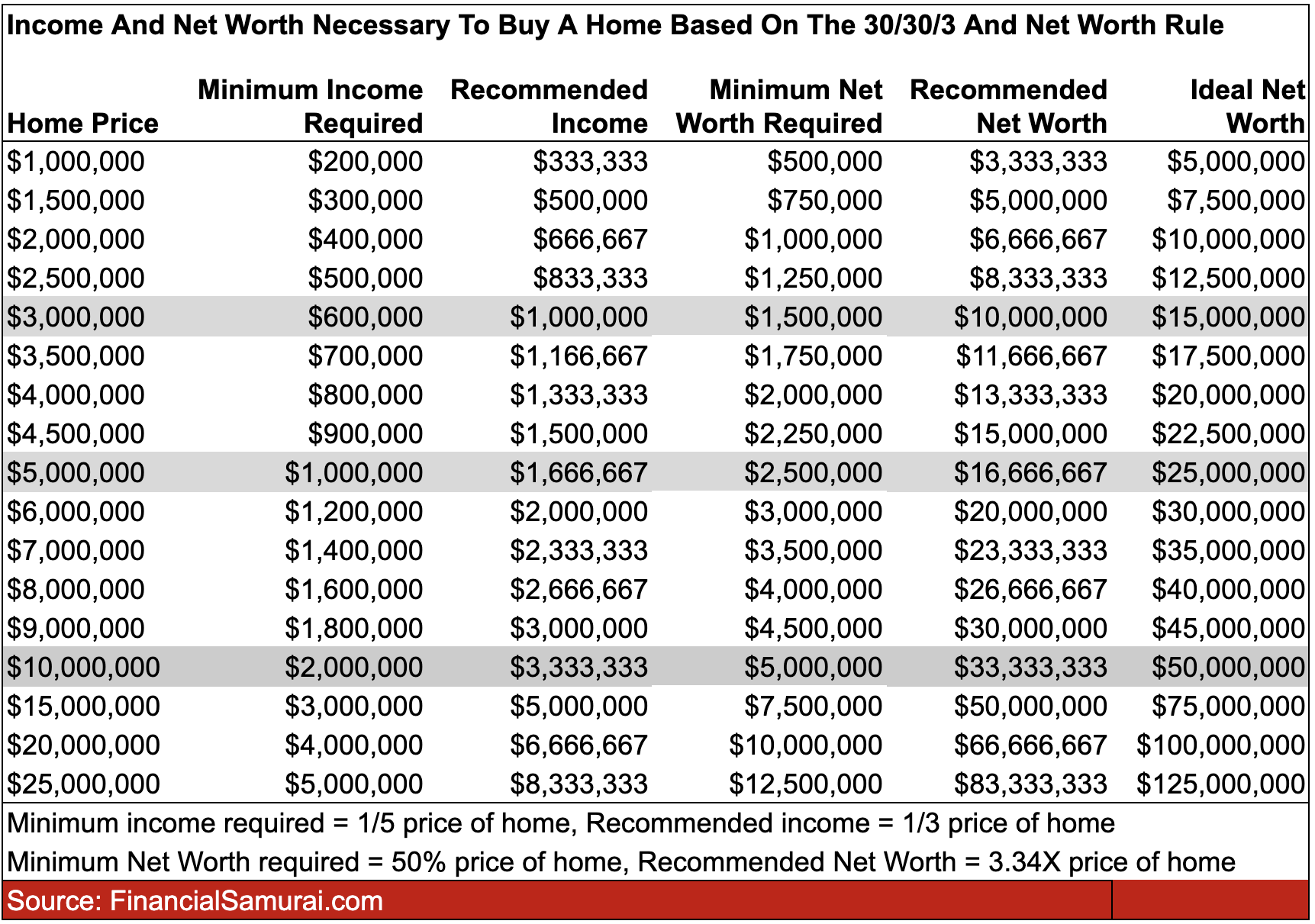

Right here’s a fast reference information to securely shopping for a $10 million dwelling:

| Class | Quantity |

|---|---|

| Minimal Earnings | $2 million/yr |

| Advisable Earnings | $3.33 million/yr |

| Minimal Web Value | $5 million (at 50%) |

| Advisable Web Value | $33.4 million (at 30%) |

| Splendid Web Value | $50 million (at 20%) |

For those who solely meet the minimal revenue requirement, be sure you have no less than the really helpful internet value. Conversely, in case your internet value is on the low finish, you’ll need your revenue to be on the upper aspect. This is a extra complete chart that highlights extra properties at totally different worth factors.

Put Down Extra Than 20% If You Need To Purchase A $10 Million Home

For those who’re planning to purchase a $10 million dwelling, it is smart to place down extra than simply 20%. Most individuals I do know shopping for properties on this worth vary are placing down 50%+, usually paying all money.

Why? As a result of many excessive earners making over $1 million a yr haven’t got excessive base salaries. As a substitute, their base is usually within the $250,000–$600,000 vary, with the remaining coming from inventory grants and year-end bonuses. Banks might not totally acknowledge these types of revenue when underwriting massive mortgages given they’re extremely discretionary.

In immediately’s still-high rate of interest atmosphere, all-cash gives are additionally extra engaging to sellers and extra sensible for consumers. Right here’s what a mortgage would appear to be at 6%:

- $8 million mortgage = ~$47,000/month

- $7 million mortgage = ~$42,000/month

- $6 million mortgage = ~$36,000/month

- $5 million mortgage = ~$30,000/month

Whereas these funds could also be reasonably priced should you’re making no less than $2 million a yr ($166,667/month), sticking to the rule of spending not more than 30% of your gross revenue on housing suggests a month-to-month cap of $50,000. That’s chopping it shut with an $8 million mortgage.

The Ongoing Value To Personal A $10 Million Dwelling

Proudly owning a $10 million home doesn’t simply imply a giant upfront buy, it means persistently massive ongoing prices as properly. Property taxes alone can vary from $40,000 to over $300,000 a yr, relying in your state. Hawaii gives the bottom property tax charges, whereas states like Illinois, New Jersey, and Texas are among the many highest.

Past taxes, the price to keep up a $10 million dwelling provides up quick:

- Greater heating and utility payments

- Dearer house owner’s insurance coverage

- Elevated upkeep and restore prices

- Expensive landscaping and cleansing companies

- A bigger mortgage fee (until paid in money)

And let’s not neglect furnishing the place. It may value properly over $200,000. The larger the home, the dearer it’s to make it really feel like a comfortable dwelling. When one thing goes incorrect—like a roof leak throughout a “Bomb Cyclone” as I skilled—it turns into a lot tougher (and dearer) to repair.

When evaluating a $10 million dwelling, don’t simply give attention to the sticker worth. Take into account the price of sustaining a $10 million home yearly. Then issue within the alternative value of tying up a lot capital in a main residence that’s not producing revenue.

These ongoing prices are why you have to comply with my revenue and internet value tips by dwelling worth. For those who do not, your own home may take you beneath financially.

Associated: What’s It Like Residing In An $18 Million Mega-Mansion?

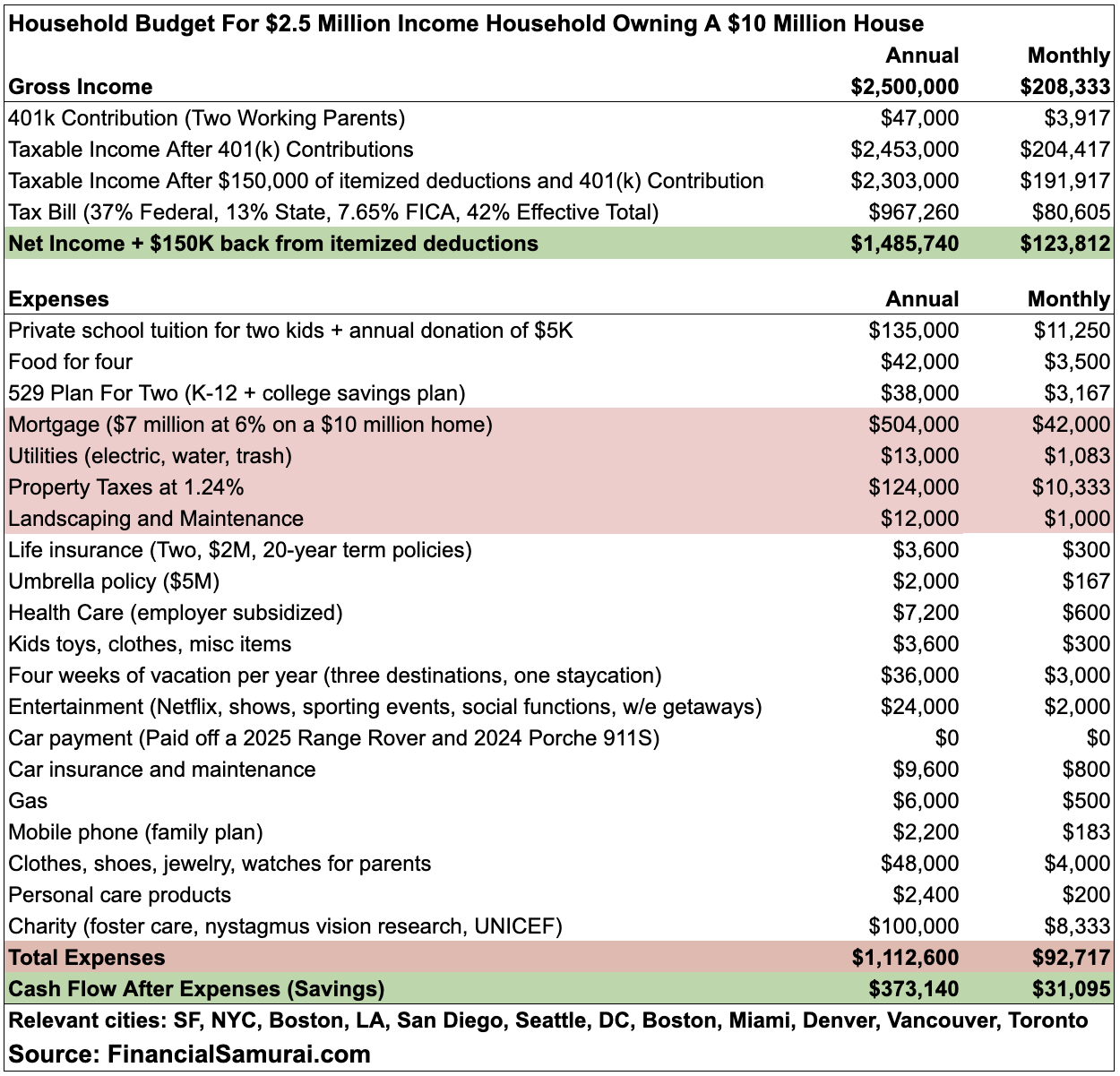

$2.5 Million Earnings Household Funds Proudly owning A $10 Million Dwelling

Right here’s a practical breakdown of a household of 4 dwelling in a high-cost space, incomes $2.5 million a yr:

- Dwelling: They put $3 million down on a $10 million dream dwelling, taking out a $7 million mortgage at 6%, which prices them $504,000/yr. Add ~$149,000/yr for upkeep, taxes, insurance coverage, and landscaping, and the full housing value is round $653,000/yr.

- Children: Their two youngsters attend personal grade faculty for $130,000/yr, plus $5,000 in donations.

- 529 Contributions: They contribute $19,000/yr for every little one.

- 401(ok) Financial savings: Every dad or mum maxes out their 401(ok) at $23,500/yr (2025 restrict), working towards millionaire standing.

Regardless of the excessive bills, they handle to save lots of $373,140/yr of their taxable brokerage accounts and have a $1M+ buffer in money and liquid shares for emergencies.

However right here’s the danger: If one dad or mum loses their job and family revenue drops by 50%, the household could possibly be in deep trouble. Bear markets don’t simply convey down funding portfolios, additionally they improve the danger of job loss.

Even a $5 million internet value, absolutely the minimal I like to recommend to personal a $10 million dwelling, is probably not sufficient. All of it is determined by how that internet value is structured.

As an illustration, if $3 million is tied up in dwelling fairness and $1.8 million is in illiquid firm inventory that vests over three years, then having simply $200,000 in money received’t go far given their excessive burn price. They need to have no less than $500,000 in money. Alternatively, if the $2 million was sitting in a cash market fund, they’d be OK for 2 years earlier than needing to promote their dwelling.

Realistically, to personal a $10 million dwelling with minimal monetary stress, a internet value nearer to $33 million is extra applicable. At that stage, you possibly can climate market volatility, job loss, and unexpected bills. Even higher is a paid off dwelling to defend you from all of the chaos and uncertainty. If you cannot sleep peacefully at evening in your mansion, then what is the level?

Ought to You Purchase a $10 Million Dwelling?

The greatest time to personal the nicest home you possibly can afford is when your youngsters are nonetheless dwelling at dwelling. So, I get why a few of you is likely to be searching $10 million+ listings on-line. It’s enjoyable to dream, and possibly you are even severe about upgrading.

However even should you earn $2 million or extra a yr, I’m not satisfied it’s value shopping for such an costly property. The maintenance alone generally is a main draw back, particularly if the house wasn’t properly constructed. I do know a few individuals who purchased $10+ million properties and ended up spending years making an attempt to repair persistent leaks. What a nightmare.

Persistently making over $2 million a yr can also be no straightforward feat. You possibly can experience a scorching streak for some time, however the economic system strikes in boom-bust cycles. I noticed this firsthand throughout my banking days, once more when small enterprise homeowners had been pressured to close down throughout COVID, and now with tariffs arresting client spending and spiking enter prices. One yr you are up, the subsequent you’re making an attempt to remain afloat. Your window of alternative to make large bucks doesn’t final eternally. Beware about extrapolating your excessive earnings with ever-increasing features!

That’s why I imagine you want a internet value of no less than $33.3 million earlier than shopping for a $10 million dwelling. Your internet value is extra dependable than your revenue, however even then, it is not bulletproof. Simply take a look at 2025, when tech shares dropped greater than 20%. If $30 million of your $33.3 million internet value was tied up within the Magnificent 7 firms, you’d be gazing a ~$6 million loss. Ouch.

One other issue: what are you upgrading from? For those who’re leaping from a one-bedroom condo to a 6,000-square-foot, six-bedroom mansion as a result of your AI firm IPO’d, making you a decamillionaire, that’s in all probability overkill. However should you’re buying and selling up from a $6 million, 3,900-square-foot dwelling with 4 bedrooms, the bounce could also be extra cheap. Additional, you’ll have the expertise to really make use of the additional area.

For the sake of adaptability and long-term appreciation, an excellent rule of thumb is to not improve your main residence by greater than 100% in worth. Past that, the dangers and complexities begin to outweigh the rewards.

A Higher Manner To Stay In A $10 Million Dwelling

Whilst you’re engaged on constructing your revenue and saving up a down fee for that dream $10 million home, think about a better method: put money into actual property to maintain up with the market, with out overextending your self.

You would possibly need to comply with my BURL technique, which stands for Purchase Utility, Hire Luxurious. The thought is straightforward: put money into properties that generate excessive rental revenue, and lease the posh life-style as a substitute of shopping for it.

For those who comply with this technique, you may generate sufficient passive revenue to lease a $10 million dwelling—and nonetheless have cash left over.

For instance, as a substitute of shopping for a $10 million home at a 3% cap price, which might generate simply $300,000 a yr in rental revenue, you may lease that very same home for $300,000 a yr. Then, make investments the $10 million in higher-yielding multifamily properties at a 7% cap price, and earn $700,000 a yr in passive revenue.

After masking your lease, you’d nonetheless have $400,000 earlier than taxes to spend or reinvest. Plus, your funding properties may respect over time, particularly in the event that they’re situated in fast-growing, extra reasonably priced 18-hour cities.

By utilizing the BURL technique, you’re optimizing your capital and your life-style. The issue is, after getting an eight determine internet value, the tenancy is eager to personal the whole lot.

There’s no level in turning into a multi-millionaire should you’re not going to take pleasure in life greater than the common individual. There needs to be some reward for all of your exhausting work and risk-taking. If a $10 million house is what you need and you may afford it, go for it. Simply be aware of the dangers that include shopping for a house you undoubtedly don’t want. Better of luck with the brand new buy!

Order My New Guide: Millionaire Milestones

For those who’re able to construct extra wealth than 93% of the inhabitants and reside the nice life, seize a duplicate of my new e book, Millionaire Milestones: Easy Steps to Seven Figures. With over 30 years of expertise working in, finding out, and writing about finance, I’ve distilled the whole lot I do know into this sensible information that can assist you obtain monetary success.

The fact is, life will get higher when you will have some huge cash. Monetary safety provides you the liberty to reside in your phrases and the peace of thoughts that your youngsters and family members are taken care of. You would possibly even think about shopping for your $10 million water-view mansion on a big plot of land after studying my e book.

Nevertheless, earlier than you get to a $10 million internet value, you first have to succeed in the $1 million milestone. Millionaire Milestones is your roadmap to constructing the wealth you must reside the life you’ve all the time dreamed of. Order your copy immediately on Amazon and take step one towards the monetary future you deserve!

Make investments In Actual Property Passively

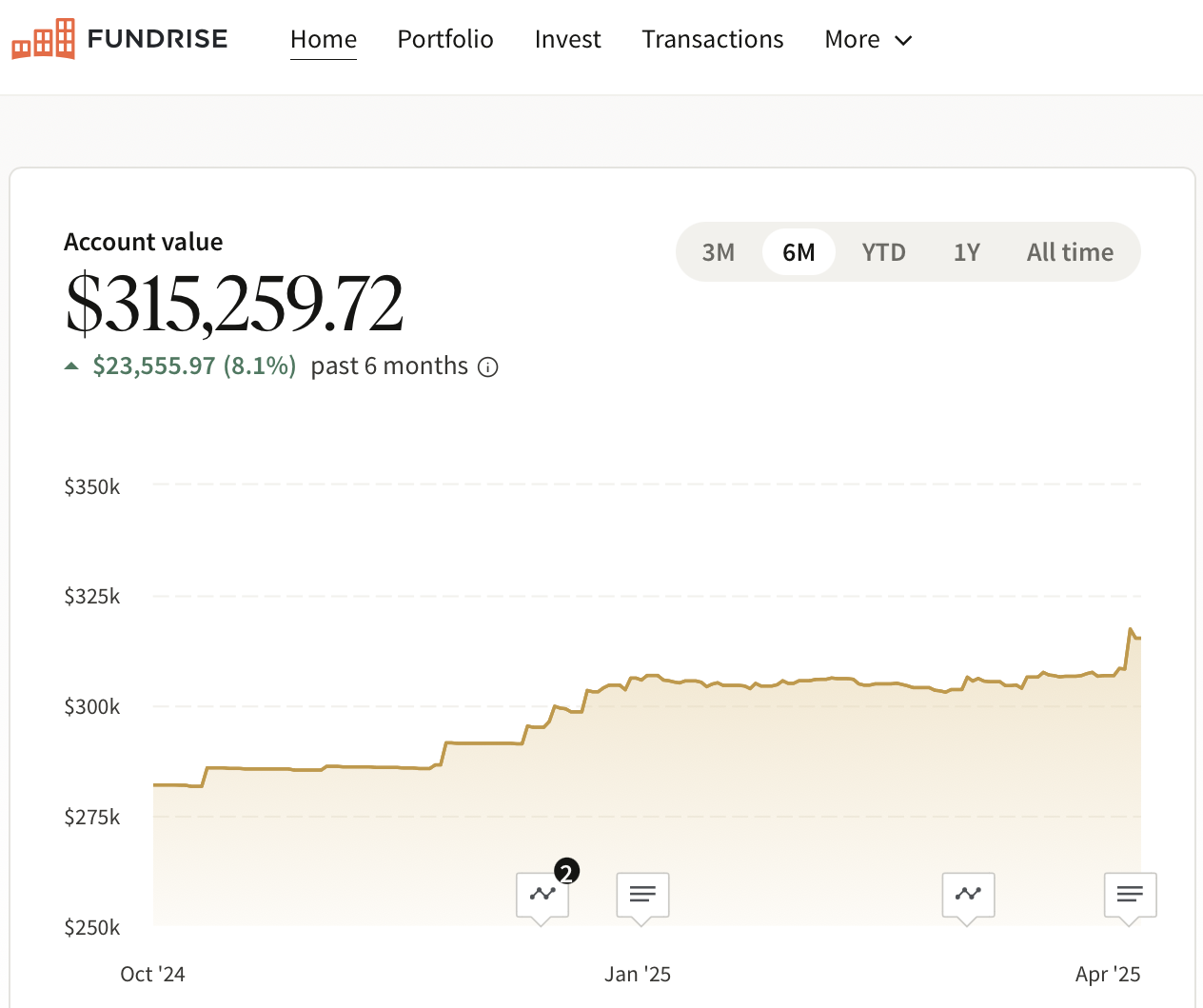

Take a look at Fundrise, one of many main actual property crowdfunding platforms with over 380,000 buyers and roughly $3 billion in belongings beneath administration. With the economic system in turmoil and inventory market volatility operating excessive, there’s a rising flight to extra secure belongings like actual property to assist climate the storm.

Since 2016, I’ve invested about $1 million throughout numerous personal actual property funds and offers to diversify away from my pricey San Francisco actual property holdings. My aim has been to generate extra passive revenue and capitalize on long-term demographic shifts towards the Sunbelt, the place Fundrise concentrates a lot of its portfolio.

Fundrise is a long-time sponsor of Monetary Samurai, and I’ve personally invested over $300,000 on the platform thus far.

The Minimal Earnings And Web Value Wanted To Purchase A $10 Million House is a Monetary Samurai authentic submit. All rights reserved. Be part of 60,000 others and join my free weekly publication right here.