Quickly after the US President introduced – Liberation Day tariffs – I wrote this weblog submit – US authorities is pinning its tariff hopes on some unlikely to be realised assumptions (April 7, 2025) – to assist readers perceive what logic there was, if any, within the determination by the American authorities to impose wide-ranging and seemingly random tariffs on the remainder of the world. The one obvious logic was that his advisors thought that whereas the tariffs would variously improve the US greenback value on last items and companies out there to US customers through imports, the flood of world funding funds into US treasury bonds, on account of the heightened world uncertainty would push the US greenback up and offset the tariff impacts on import costs, as a result of all international items would now be cheaper. We now have a couple of weeks of knowledge out there to see whether or not issues are turning out as Trump and his advisors thought. The definitive reply so far is that the other traits are rising which can see the burden of the tariffs borne by the US customers and producers relatively than the presumption of the Administration that the burden could be pushed onto the remainder of the world, which might precipitate fast change within the favour of the US. It appears at current that an ‘personal purpose’ is being kicked – and – in all probability lots of them.

The substantive doc that outlines the US authorities’s hopes post-tariff imposition was written Chair of Trump’s Council of Financial Advisors, Stephen Miran in November 2024 – A Consumer’s Information to Restructuring the International Buying and selling System.

He wrote:

Tariffs present income, and if offset by foreign money changes, current minimal inflationary or in any other case opposed negative effects, in step with the expertise in 2018-2019. Whereas foreign money offset can inhibit changes to commerce flows, it means that tariffs are finally financed by the tariffed nation, whose actual buying energy and wealth decline, and that the income raised improves burden sharing for reserve asset provision.

Drawing on the expertise in 2018-2019, throughout Trump’s first time period, Miran wrote:

Throughout his marketing campaign, President Trump proposed to boost tariffs to 60% on China and 10% or increased on the remainder of the world, and intertwined nationwide safety with worldwide commerce. Many argue that tariffs are extremely inflationary and might trigger vital financial and market volatility, however that needn’t be the case. Certainly, the 2018-2019 tariffs, a cloth improve in efficient charges, handed with little discernible macroeconomic consequence. The greenback rose by nearly the identical quantity because the efficient tariff fee, nullifying a lot of the macroeconomic affect however leading to vital income. As a result of Chinese language customers’ buying energy declined with their weakening foreign money, China successfully paid for the tariff income.

Why may the offset mechanism happen?

A number of components are talked about – none convincing.

He claims that the tariffs will increase US federal income and financial “deficit issues are more likely to be allayed”, which make US Treasury bonds extra engaging.

He thinks Trump’s selections to “aggressively decontrol parts of the financial system” will increase financial development and make US property extra engaging.

International uncertainty additionally helps given the historic behaviour of world buyers to maneuver funds to US Treasury bonds in such occasions.

You might ask how a strengthening US greenback helps US producers who’re attempting to promote right into a aggressive world market.

Miran acknowledged that ought to the trade fee offset happen then “U.S. exporters now face a competitiveness problem insofar because the greenback has turn into extra pricey for international importers”.

His answer?

An “aggressive deregulatory agenda, which helps make U.S. manufacturing extra aggressive”.

What does that imply?

It must embrace an assault on employees’ wages and circumstances given the proportion of these objects in complete manufacturing prices.

He cited this text (April 29, 2024) – A Trillion-dollar Yr – which was revealed by one of many by no means ending Proper-wing propaganda ‘suppose’ tanks within the US which promotes, in their very own phrases, “free-market options”.

The cited article was attacking the US Environmental Safety Company (EPA) determination to guard folks from PFAS in major water provides eand regulatory guidelines within the US, basically.

The writer thought the prices to enterprise of such safety had been outrageous.

He additionally attacked the EPA for regulating to cut back “tailpipe emissions” in autos and to encourage EV use.

Nonetheless, decreasing “paperwork” gained’t make the distinction between US manufacturing being internationally aggressive once more versus not being so.

They must significantly reduce wages.

Estimates up to now discovered that “China’s unit labour prices” (which mix wage prices with productiveness estimates) had been round 25 to 40 per cent of the US unit labour prices.

Additional, whereas wages development is accelerating in China because the emergence of the center class substantiates, labour productiveness development is extra fast (by some) than it’s within the US.

There was in fact contradictions within the stance taken by Miran.

He additionally famous that the US President has “mentioned adopting substantial adjustments to greenback coverage. Sweeping tariffs and a shift away from robust greenback coverage” as a result of from “a commerce perspective, the greenback is persistently overvalued, largely as a result of greenback property operate because the world’s reserve foreign money.”

If the US greenback, actually, weakens on the identical time the tariff is imposed then the aforementioned ‘offsets’ of the tariff affect on US costs by the exhange fee don’t happen.

The truth is, the trade fee affect would heighten the tariff affect and worsen the scenario confronted by US customers.

What has occurred?

Issues are usually not panning out as Miran advised.

First, as a part of the most recent World Financial Indicators launch, the IMF advised (April 22, 2025) that – The International Economic system Enters a New Period.

They pointed to the tariff selections as resetting the “world financial system below which most international locations have operated for the final 80 years” which is creating “epistemic uncertainty and coverage unpredictability” and the “attendant uncertainty will considerably sluggish world development”.

For as soon as I agree with the IMF.

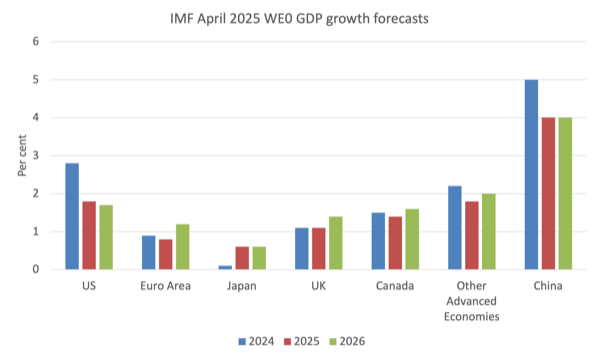

The IMF has diminished its estimate of US development from 2.8 per cent (revealed in January 2025) to 1.8 per cent in April.

Based on their calculations, “tariffs account for 0.4 proportion level of that discount.”

In addition they elevated the “US inflation forecast by about 1 proportion level, up from 2 p.c.”

The next graph exhibits the most recent development forecasts from the IMF.

It’s clear that they suppose the tariffs will harm US development greater than every other nation proven.

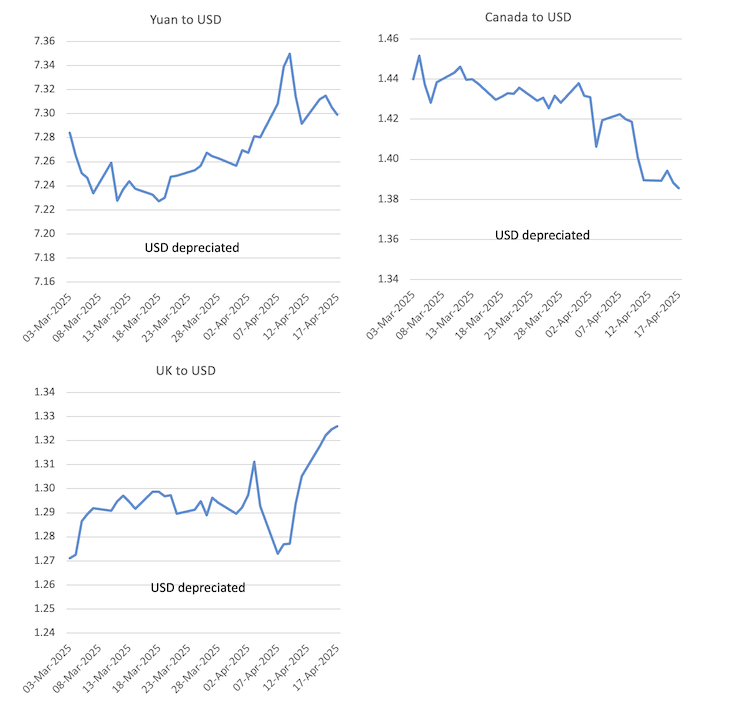

The actions in trade charges have additionally been reverse to that required to offset the value impacts of the tariffs.

Listed here are some chosen nations.

Observe the citation within the charges shouldn’t be uniform, that means that when the Australian greenback rises towards the US greenback, it’s an appreciation, whereas, for instance, it’s the reverse for the yen and peso.

Nonetheless, in every of the circumstances proven, the USD has depreciated.

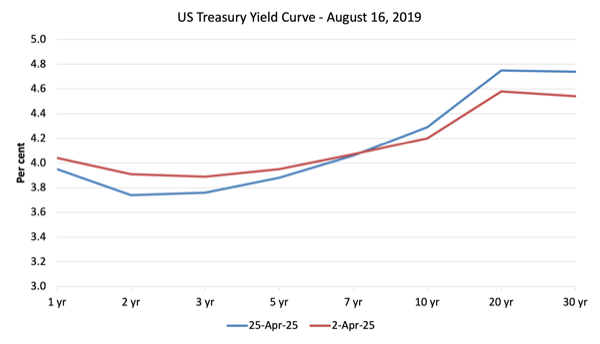

There has additionally been lots of information currently about the way in which the bond markets are defying previous historical past by transferring funding funds out of US Treasury bonds regardless of rising uncertainty that’s normally related to the other motion of funds.

Final week, Reuters reported (April 24, 2025) – Japanese buyers turned web consumers of abroad bonds final week – that:

U.S. Treasury yields have climbed this month, as bonds offered off, with hedge funds unwinding leveraged foundation trades and abroad buyers promoting U.S. debt in obvious retaliation for tariffs and amid rising doubts in regards to the safe-haven standing of U.S. property.

Japanese buyers are the biggest holders of U.S. Treasuries with roughly $1.13 trillion in holdings.

In the meantime, abroad buyers have been buying Japanese property, pushed by safe-haven demand and expectations that the Financial institution of Japan is more likely to delay its rate of interest hike so as to assist the financial system.

The UK Guardian article (April 9, 2025) = Dramatic sell-off of US authorities bonds as tariff struggle panic deepens – additionally reported comparable traits.

It mentioned: “US authorities bonds, historically seen as one of many world’s most secure monetary property, are struggling a dramatic sell-off as Donald Trump’s escalation of his tariff struggle with China sends panic by all sectors of the monetary markets.”

Right here is the US yield curve for short- and long-term Treasury bonds on April 2, 2025 and April 25, 2025 (most up-to-date out there knowledge).

Not solely has there been an total sell-off but additionally a swap into shorter-term bonds because the uncertainty will increase.

The upper longer-term yields will entice funds again into the US, which we’ve seen within the final week or so.

However the actuality is kind of completely different to that predicted by the Chairman of Trump’s key financial advisory physique the Council of Financial Advisors.

Conclusion

It’s nonetheless solely a month or so for the reason that US liberated itself and these processes don’t happen in a single day.

So it may nonetheless work out the way in which Miran and Co hope.

However I doubt it.

It’s trying very very like an personal purpose at this stage.

I clearly preserve my eye on these traits and as they are saying ‘we’ll see’.

That’s sufficient for as we speak!

(c) Copyright 2025 William Mitchell. All Rights Reserved.