“The inventory market is a tool for transferring cash from the impatient to the affected person.” -Warren Buffett

The Wall Road Journal highlighted a brand new examine exhibiting that the median investor spends simply six minutes researching a inventory earlier than shopping for it.

It’s no marvel the typical holding interval for a inventory has dropped from roughly 8-10 years again within the Nineteen Fifties and Nineteen Sixties to just some months at present.

If you happen to don’t know a lot about what you personal it’s going to be exhausting to carry onto it for very lengthy if it doesn’t make you wealthy in a single day.

This short-term mentality is the antithesis of Warren Buffett, who stepped down from his function as CEO of Berkshire Hathaway this previous weekend on the ripe previous age of 94.

Buffett’s longevity is spectacular in some ways.

Compounding the share value at 19.9% per yr for 60+ years is otherworldly. A complete return of greater than 5.5 million p.c is difficult to fathom.

Buffett first purchased American Categorical shares in 1964. Berkshire Hathaway took its first stake in GEICO again in 1976. He’s held Coke since 1988.

I discovered early on in my investing profession that I’d by no means be a stock-picker like Buffett however I instantly latched onto his views on investing for the long-term.

In the newest assembly he mentioned “No person is aware of what the market goes to do tomorrow, subsequent week, subsequent month. However they spend all their time speaking about it, as a result of it’s straightforward to speak about. Nevertheless it has no worth.”

I do know why individuals discuss concerning the short-term a lot — it’s entertaining. However he’s proper that it has no worth. Many of the stuff it’s essential to find out about investing is evergreen.

Buffett has been preaching these things for years.

I’ve been perusing Buffett & Munger Unscripted by Alex Morris, a ebook that organizes thirty years of insights from Buffett’s annual shareholder conferences.

Right here’s an excellent passage from the 1994 assembly:

I purchased my first inventory in April of 1942 after I was eleven. The prospects for World Warfare II didn’t look so good on the time; the U.S. was not doing nicely within the Pacific. I’m undecided I calculated that into my buy of three shares, however simply consider all of the issues which have occurred since then. Atomic weapons, main wars, presidents resigning, huge inflation at sure occasions, every kind of issues. To surrender what you are able to do nicely at due to guesses about what’s going to occur in some macro approach simply doesn’t make any sense to us.

In case your time horizon is measured in many years you’re going to be pressured to cope with some disagreeable situations from time-to-time. That’s life and long-term investing.

I appreciated this one about danger from that very same shareholder assembly:

We outline danger as the potential of hurt or damage. And in that respect, we predict it’s inextricably wound up in your time horizon for holding an asset.

It’s not possible to supply anybody investing recommendation if you happen to don’t perceive their danger profile and time horizon. Extending your time horizon doesn’t assure particular outcomes. There might be poor outcomes over 10-20 yr intervals.

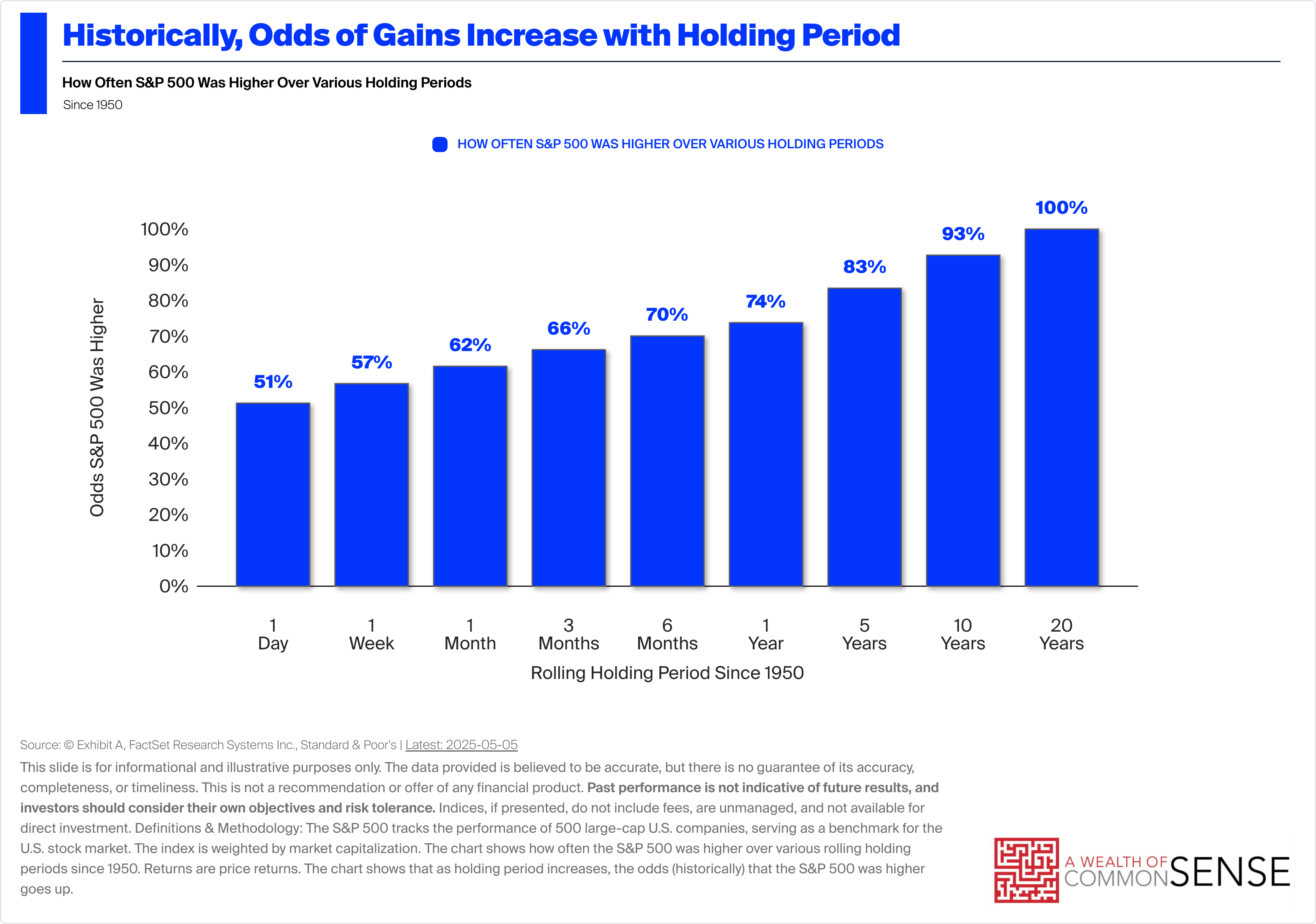

However your odds of success are vastly improved the longer you keep within the sport:

The rationale it’s exhausting to win within the short-run is as a result of the market is extra unpredictable.

In 1999, Buffett spoke about compounding:

Compound curiosity behaves like a snowball on sticky snow. The trick is to have a really lengthy hill, which suggests beginning very younger or residing to be very previous.

After all, pondering and appearing for the long-term is less complicated mentioned than accomplished.

This one from Buffett through the 2020 annual assembly talks concerning the psychology of shopping for and holding shares for the long-run:

I’m not recommending that folks purchase shares at present, tomorrow, subsequent week, or subsequent month. All of it relies on your circumstances. You shouldn’t purchase shares except you count on, for my part, to carry them for a really prolonged interval, and you’re ready financially and psychologically to carry them the identical approach you’d maintain a farm and by no means take a look at a quote — you don’t want to concentrate to it. You’re not going to select the underside and no person else can choose it for you.

If you happen to can’t deal with it psychologically, then you definitely actually shouldn’t personal shares since you’re going to purchase and promote on the flawed time.

Buffett is sort of a strolling pc but it surely was his temperament that allowed him to compound for years on finish. On the 2002 assembly he talked concerning the significance of rationality over brains:

There’s no motive you want a excessive IQ. Temperament, nevertheless, is enormously vital; it might be innate, it might be discovered, it might be intensified by expertise or bolstered in numerous methods. You must be reasonable. You must outline your circle of competence precisely. You must know what you don’t know, and never get enticed by it. You must have an curiosity in cash, I feel, otherwise you gained’t be good at investing. However if you happen to’re grasping, it’ll be a catastrophe, as a result of that can overcome rationality.

Investing for the long-term is straightforward however not straightforward.

Michael and I talked to Morris about Buffett and his new ebook on Animal Spirits just lately:

Additional Studying:

My Favourite Warren Buffett Shareholder Letter