For individuals who are searching for investing recommendation, it pays to seek out somebody who generally is a monetary mentor. That’s, somebody whose recommendation you belief, and who has a monitor file of doing effectively. Relating to investing recommendation, there are only a few people who get extra respect than Warren Buffett. That is for good cause. He has persistently given sound monetary recommendation that has helped quite a few individuals improve their web value over time. With this in thoughts, it is smart to, on the very least, take into account the investing recommendation that comes out of his mouth.

At any time when the Berkshire Hathaway annual report goes public, it’s learn over by monetary analysts with a fantastic toothed comb. It is smart. A lot of these studying the report hope they’ll discover some perception that can provide them an edge in their very own investing. The humorous factor is, you don’t should look very arduous to seek out the investing recommendation that Buffett believes most individuals ought to comply with. It is because he places it on the market for everybody to see as vibrant as day.

Buffett’s Recommendation: Purchase Index Funds and Quick Time period Authorities Bonds

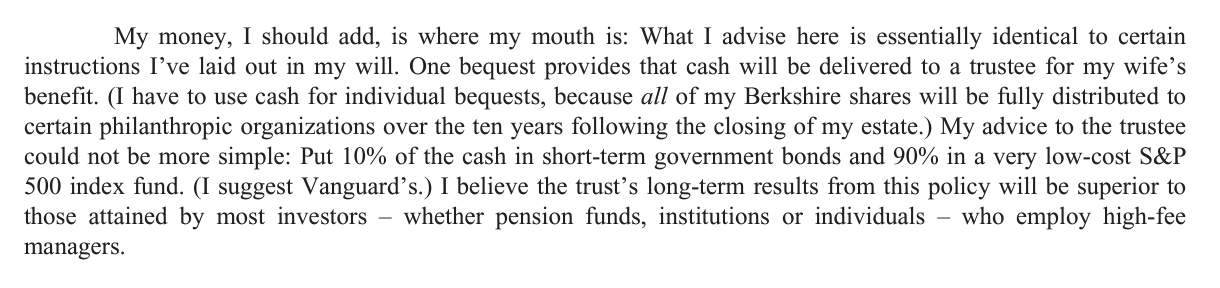

In 2013 Warren Buffett famously wrote that he has given directions to his spouse on what she ought to do with the cash she inherits when he dies (right here). One would possibly suppose that the instruction would possibly get fairly difficult since she’ll be inheriting cash from one of many richest males on the earth.

The reality is that the recommendation is definitely fairly easy. Warren Buffet desires his spouse to speculate 90% of her inheritance right into a low-cost S&P 500 index tracker. He additionally suggested that she ought to make investments the remaining 10% into short-term authorities bonds. That’s it. Nothing fancy, however nonetheless sound monetary recommendation.

He writes:

Research have repeatedly demonstrated that few fund managers are in a position to outperform the S&P 500 over prolonged durations of time (Morningstar, Dow Jones/Spiva, NBER). With the data that the majority energetic fund managers will return much less cash than an S&P 500 index fund whereas charging extra in charges, the recommendation is admittedly nothing greater than frequent sense. That is the best way that Buffett believes most individuals ought to make investments. It’s how top-of-the-line traders on the earth desires his personal spouse to speculate when he’s gone.

The issue for a lot of with this recommendation is that it’s fairly boring. There isn’t a lot pleasure everyday when 90% of your cash is in index funds with the opposite 10% in authorities bonds. It lacks any kind of sexiness, at the very least within the quick time period.

An extra drawback with index funds is they offer you market efficiency, however ONLY market efficiency. This implies index fund holders may have returns that monitor the market, no worse, but in addition no higher. So, with index funds, traders won’t ever get an opportunity to beat the market.

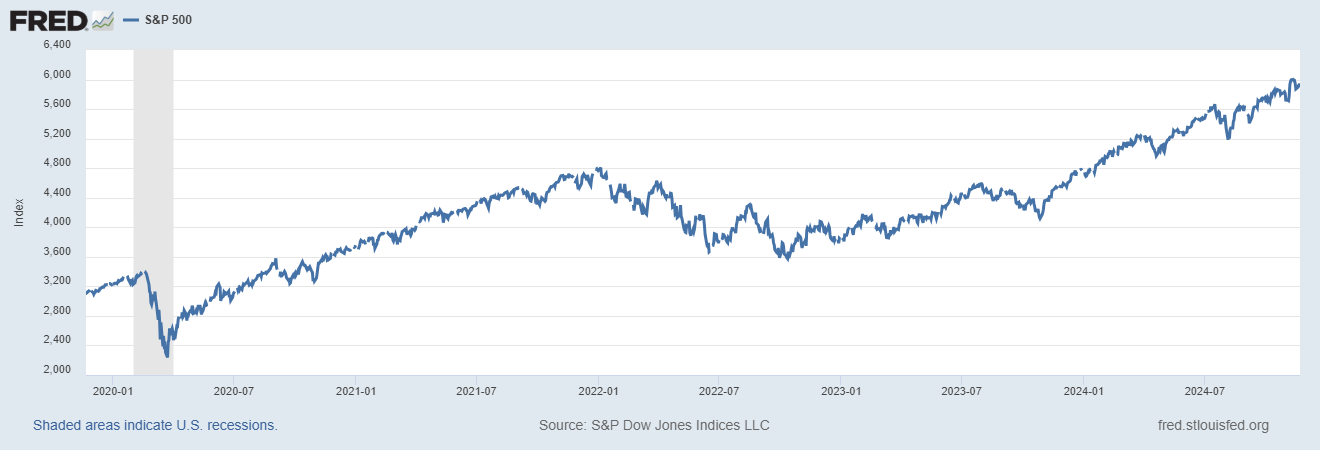

And in some years, the index has really misplaced cash. For instance, right here is the efficiency of the S&P 500 as charted by the St. Louis Federal Reserve. It exhibits that in 2022, the S&P really took a lack of round 20 %. In that yr, traders would have been higher off holding company or authorities bonds.

Does Buffett Follow What He Preaches?

No. He doesn’t.

The fact is that Buffett’s buying and selling conduct and his public pronouncements don’t all the time match. Whereas Buffett brazenly preaches purchase and maintain, his buying and selling conduct has been way more various. Throughout his early profession, Buffett used arbitrage methods, short-term buying and selling, liquidations, fairly than investing in index funds or utilizing the purchase and maintain methods that he grew to become well-known for with corporations like Coca-Cola. Within the latter levels of his profession he was in a position to diversify his portfolio utilizing fastened revenue arbitrage, currencies, commodity performs, and different methods.

If you’d like extra particulars on this, get a duplicate of James Altucher’s ebook: Commerce Like  Warren Buffett

Warren Buffett. The ebook walks you thru the methods that Warren Buffett makes use of to generate income buying and selling the fairness and debt markets. Altucher’s ebook might be additionally probably the most correct and complete work on Buffett’s buying and selling profession that you’re prone to discover anyplace. It is best to undoubtedly give it an intensive learn if you’re severe about understanding how Buffett actually made cash.

Second, Buffett undoubtedly didn’t get wealthy from following his personal boring recommendation. Most of his profession has been wrapped up in shopping for and proudly owning money wealthy corporations – not holding index fund shares. If you’d like an in depth blueprint on how he did it, take into account getting a duplicate of The Snowball: Warren Buffett and the Enterprise of Life. It’s an authoritative and complete evaluation of Buffett’s profession – loaded with classes for the typical investor. Each books work effectively collectively to provide you a superb overview of what Buffett did to make his enterprise profitable.

Associated Articles

Warren Buffet And His Boring Investing Recommendation Will Make You Wealthy

Fifteen Inspiring Warren Buffet Investing Quotes

Is 10% A Good Return? What’s a Good Return? Or A Dangerous Return?