On June 3, 2025 Australia’s minimal wage setting authority – the Honest Work Fee (FWC) issued their resolution within the – Annual Wage Assessment 20256 – which gives for wage will increase for the lowest-paid staff – round 0.7 per cent of workers (round 88 thousand) in Australia. In flip, round 20.7 per cent of all workers, who’re on the bottom tier of their pay award (grade) obtain a flow-on impact. The FWC supplied a 3.5 per cent nominal wage improve for the bottom paid staff in its 2025 Nationwide Wage Case resolution. In opposition to the present CPI progress, that gives for some modest actual wage improve for this cohort. Nonetheless, notice the dialogue above as to the perfect buying energy measure to make use of. In opposition to the extra relevant Worker Chosen Value of Residing Index (SCLI), the choice gives for barely any actual wages progress and fails to redress the huge actual wage cuts lately. The media has failed to choose up on that actuality, and has as a substitute given oxygen to the employers’ responses which known as the choice irresponsible whereas on the similar time pocketing document earnings on account of their revenue gouging. However not less than the lowest-paid staff gained some aid on account of the choice because the FWC largely ignored the whining of the employers.

On this weblog publish – Australia’s minimal wage rises – however not adequate to finish working poverty (June 6, 2017) – I outlined:

1. Progressive minimal wage setting rules.

2. The best way staggered wage selections (yearly) result in falling actual wages in between the wage adjustment factors.

I gained’t repeat that evaluation right here. However it’s important background to understanding why the choices taken by Honest Work Australia have been insufficient for a very long time.

Who’s affected?

Solely a small proportion of staff are deemed to be NMW-reliant – that’s, reliant solely on the nationwide minimal wage.

The FWC notes in its Choice (linked above) that:

… the Australian Authorities’s estimate (based mostly on 2023 EEH information) of 32,100 (representing about 0.25 per cent of all the worker workforce) and was ‘prone to be very small’ …

The Knowledgeable Panel within the AWR 2024 resolution noticed that ‘the NMW has very restricted sensible impact within the Australian industrial relations panorama however its position within the statutory annual wage assessment scheme’.

… the NMW has very restricted sensible impact within the Australian industrial relations panorama however its position within the statutory annual wage assessment scheme’

Nonetheless, a a lot bigger proportion of the out there workforce is deemed to be ‘trendy award reliant’ workers, which signifies that they’re being paid below Australia’s award wage system, which is the bottom allowable wage for the related sector.

These awards are adjusted upwards when the NMW is altered.

The FWC famous that on this case:

The 2025 Profile reveals that 20.7 per cent of all workers have been trendy award-reliant, up barely from 20.5 per cent within the 2023 Profile. The variety of trendy award-reliant workers is about 2.61 million.

What this implies is {that a} small variety of staff truly get the Nationwide Minimal Wage (NMW) however a a lot bigger quantity (the two.61 million or 20.7 per cent of complete workforce) are paid at minimal ranges on so-called ‘trendy award’ preparations, which apply in every sector.

There are 121 trendy awards within the industrial construction.

The observe is that when the NMW is modified, that call then flows instantly into these minimal ranges for the trendy awards.

The traits of those staff are outlined within the FWC Choice:

1. “It’s predominantly made up of workers working part-time hours (lower than 35 hours per week)”.

2. “A majority of contemporary award-reliant workers is now informal (52.8 per cent)” and rising.

3. “predominantly feminine (58.6 per cent)”.

4. “The fashionable award-reliant workforce is, on common, youthful than the workforce as a complete (33.9 years in comparison with 39.9)”.

5. “Trendy award-reliant workers usually tend to be employed in a small enterprise (33.6 per cent) than the workforce as a complete (25.0 per cent).”.

6. “Over one third (35.6 per cent) of contemporary award-reliant workers are low-paid … and 56.9 per cent of all low-paid workers are trendy award-reliant.”

These traits doc the secondary labour market within the Australian financial system – low-paid, casualised jobs with excessive levels of occupational segregation biased towards females and the younger.

Given the low pay and low hours labored relative to the remainder of the financial system, the FWC estimated that the NMW adjustment wouldn’t have a big impression on total wages progress within the financial system:

The comparatively small contribution to the nationwide ‘wage invoice’ made by the wages of contemporary award-reliant workers signifies that the impact of Assessment selections on annual Wage Worth Index (WPI) outcomes is restricted. Within the AWR 2024 resolution, the Knowledgeable Panel estimated that the three.75 per cent improve which it awarded would contribute roughly 0.4 of a share level to the WPI for the 12 months to March 2025.

Which suggests the choice instantly improves the outcomes for these low-paid staff however the broader financial efficient of the Annual Wage Assessment selections is restricted and “The proportion of the nationwide ‘wage invoice’ for contemporary award-reliant workers is significantly smaller, at 10.5 per cent, than their share of the overall worker workforce.”

Which then ought to discourage anybody from believing the employer organisations which have conniptions when the FWC gives some wage aid for the very low paid staff in Australia.

Their claims replicate their very own greed and willingness to use essentially the most weak staff fairly than being based mostly on any financial evaluation.

The FWC additionally made it clear that:

The principal consideration which has guided our resolution is the truth that, since July 2021, workers who’re reliant on trendy award minimal wages or the Nationwide Minimal Wage have suffered a discount in the true worth of their wage charges. Within the case of contemporary awards, the benchmark C10 award price of pay has declined by 4.5 share factors relative to inflation as measured by the Shopper Worth Index.

The place the events stand

The FWC acquired bids (submissions) from numerous events within the course of of creating its resolution – the ACTU (peak union physique), authorities (federal and state), numerous employer teams.

The Australian Chamber Commerce and Business (ACCI), which represents round 400,000 employers demanded the FWC restrict the rise to 2.5 per cent.

This was consultant of the claims made by the employer teams the bottom declare being for under a 2 per cent rise.

The FWC responded:

… it’s tough to see due to this fact {that a} Assessment consequence throughout the vary might make any distinction of significance to inflation (by cause of an impact on wages progress).

For related causes, detrimental results on nationwide financial and enterprise competitiveness are unlikely. Nor, within the context of a labour market which stays robust total, is it probably that there can be any combination disemployment results. The final three annual wage critiques have seen nominal will increase within the NMW and trendy award minimal wage charges which have, due to the speed of inflation, been considerably larger than for the previous decade, however there has not been any discernible opposed consequence for employment progress or the speed of unemployment. Some constructive nationwide financial impact is probably going, in that trendy award minimal wage price will increase will assist family consumption and shopper sentiment.

ACCI claimed that:

To be sustainable, any improve in wages should be linked to productiveness. ACCI agrees that staff ought to share in the advantages of productiveness positive factors. But, labour productiveness has been contracting, down 1.2 per cent in 2024 calendar 12 months and that is anticipated to persist in 2025. Failure to align wages progress with real productiveness enhancements dangers will solely add to inflationary stress, exacerbating financial challenges.

Different employer teams made the identical declare.

It’s fascinating that though productiveness progress has been gradual lately, when it has been rising on pattern, the employer teams have resisted any notion that nominal wages ought to develop in proportion.

As I’ve demonstrated on this weblog publish (and the earlier updates) – Australian wages progress – actual wages secure – no breakout evident (Might 14, 2025) – since 1999, the true hourly wage index has grown by solely 5.5 per cent, whereas the hourly productiveness index has grown by 24.1 per cent.

Had nominal wages grown with productiveness progress over the past a number of many years, on common, weekly earnings in Australia can be $A284.60 larger or $A14,230 larger on annual foundation.

So maybe the employer teams may prefer to get their cheque books out and pay up!

However the different vital level, is made by the FWC Choice:

Nonetheless, as with employment progress, it’s essential to differentiate between productiveness progress out there and non-market sectors. Additionally it is essential to separate out the mining sector, for which measured productiveness just isn’t all the time an correct illustration of productive effectivity as a result of assets which can be simpler to mine are depleted first, with larger commodity costs main mining firms to pursue harder-to-mine assets … Annualised productiveness progress (gross worth added (GVA) per hour labored) within the non-mining market sector from the December quarter 2019 to the December quarter 2024 was a fairly wholesome 1.5 per cent. That is diminished to 0.5 per cent out there sector as soon as mining is included, and throughout the entire financial system, together with the non-market sector, GDP per hour labored was -0.1 per cent annualised, or -0.7 per cent over the entire interval …

Due to this fact, leaving apart the mining sector, it seems that the nationwide financial system’s ‘productiveness downside’ is essentially a consequence of the non-market sector’s disproportionate progress in its share of GVA and hours labored. This flows from governmental coverage selections to enhance the supply and high quality of companies in areas similar to healthcare and social companies. The measurement of productiveness within the non-market sector is problematic since it’s not potential to measure output by reference to the market costs paid for items and companies, as out there sector. The Australian Bureau of Statistics (ABS) usually makes use of manufacturing prices as a proxy for output costs, which means that when speedy employment progress happens within the non-market sector, significantly in lower-paid employment, this has the consequence of accelerating measured output by lower than the rise in hours labored, thus decreasing measured productiveness.

Which all signifies that the NMW resolution won’t compromise the out there non-inflationary nominal wage progress house created by productiveness progress.

The Australian Council of Commerce Unions needed a 4.5 per cent rise, which was rejected however would have helped staff on the backside of the distribution recoup a few of the massie actual wage losses endured over the past a number of years.

An vital side of this resolution is that the federal authorities was robust in supporting a wage adjustment on the backside which would supply for actual wages progress.

That is one important distinction between the Labor authorities and the earlier conservative authorities, though on macroeconomic coverage, the variations are minor.

The Federal Minimal Wage (FMW) Choice

In its 2025 resolution – Honest Work Australia wrote:

The choice we have now made is to extend the Nationwide Minimal Wage and all trendy award minimal wage charges by 3.5 per cent, efficient from 1 July 2025 …

The principal consideration which has guided our resolution is the truth that, since July 2021, workers who’re reliant on trendy award minimal wages or the Nationwide Minimal Wage have suffered a discount in the true worth of their wage charges. Within the case of contemporary awards, the benchmark C10 award price of pay has declined by 4.5 share factors relative to inflation as measured by the Shopper Worth Index.

Staggered changes in the true world

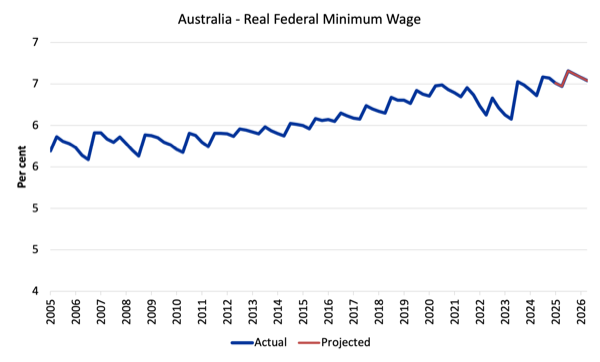

The next graph reveals the evolution of the true buying energy of the NMW since 2005.

Now we have extrapolated the present resolution, which applies from July 1, 2024, over the subsequent 12 months (till the subsequent resolution) utilizing RBA inflation forecasts to deflate the nominal NMW.

The familar saw-tooth sample is evident.

I defined this sample intimately on this weblog publish – Australia’s minimal wage rises – however not adequate to finish working poverty (June 6, 2017).

Every of the peaks represents a proper wage resolution by the Honest Work Fee in order that on the time of the nominal adjustment (July 1 annually) the true NMW normally rises considerably (maybe not again to the place it was 12 months earlier).

Every interval that the curve heads downwards the true worth of the FMW is being eroded.

That’s, in between the choice durations, the inflation is on-going and erodes the nominal NMW.

That’s one downside with these discrete changes and I might a lot fairly the FWC constructed into the system, a characteristic that’s frequent on most multi-period bargains, escalation.

That’s, they might simply index wages to the quarterly inflation price which might higher defend actual wages.

You may gauge the annual progress in the true wage by evaluating successive peaks.

The choices since 2012 have supplied for some modest actual revenue retention by these staff though it will depend on how inflation is measured.

You may also see the troughs grew to become shallower between 2012 and 2016 than previously as a result of the inflation price moderated on account of the GFC and the austerity since that has saved financial exercise at reasonable ranges.

In more moderen years the peak-trough amplitude has risen once more and the FMW changes have didn’t redress the buying energy erosion to the nominal FMW though every adjustment gives some fast actual wage acquire for staff, these positive factors are ephemeral and the inflation course of systematically cuts the buying energy of the FMW considerably by the point the subsequent resolution is due – these are everlasting losses.

Final 12 months’s resolution meant the buying energy of the FMW returned to a degree not seen since 2020.

The present resolution nearly holds that line.

The opposite concern is that within the 12 months forward, there’s modest actual wage erosion in comparison with the true NMW on the finish of 2023.

The opposite downside pertains to the suitable measure of inflation.

I talk about that concern intimately on this weblog publish – Actual wage cuts proceed in Australia as revenue share rises (Might 15, 2024).

In a nutshell, the FWC makes use of the CPI because the measure.

Nonetheless, the Australian Bureau of Statistics (ABS) recognise that there was a “have to develop a measure of ‘the worth change of products and companies and its impact on dwelling bills of chosen family sorts” they usually now publish their so-called Chosen Residing Value Indexes (SLCIs), which use expenditure patterns of various cohorts in society (as weights within the index) to evaluate the “the extent to which the impression of value change varies throughout completely different teams of households within the Australian inhabitants”.

One in all their SCLI is the Worker Households index.

Within the March-quarter 2025, for instance, the annual progress within the CPI was 2.4 per cent, whereas for the Worker SCLI it was 3.4 per cent.

Over the latest inflationary episode the SCLI has been properly above the CPI in progress phrases.

What this implies is that latest nominal wage changes designed to protect actual buying energy that use the CPI because the inflation measure will significantly understate the true wage erosion.

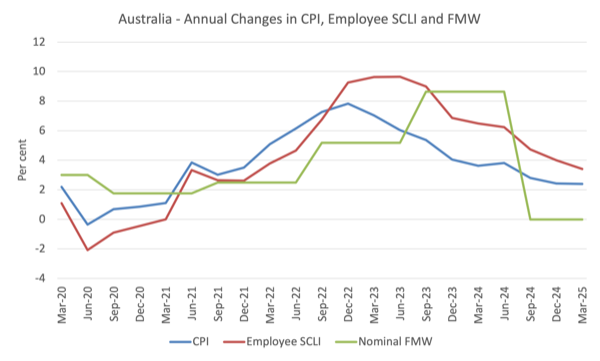

The next graph reveals the issue – it reveals the annual actions within the CPI, Worker SCLI and the nominal FMW for the reason that March-quarter 2020.

When the FMW is above the opposite traces then the true buying energy of the minimal wage is rising and vice versa.

You may see that for the reason that December-quarter 2021, the true erosion within the nominal FMW has been important aside from the 2024 resolution and the latest resolution.

In that context, the three.5 per cent improve within the NMW and its flow-ons, barely preserves the buying energy of the employees in receipt, which isn’t one thing that the media narrative within the final 24 hours has picked up on.

Lowest-paid staff enhance relative to different staff however all staff nonetheless fail to share in productiveness progress

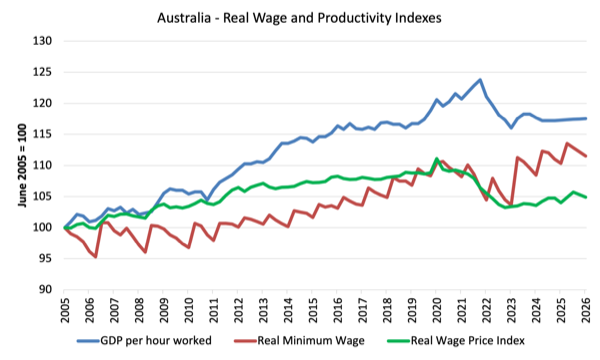

One other perspective is to check the motion within the Federal Minimal Wage with progress in GDP per hour labored (which is taken from the Nationwide Accounts).

GDP per hour labored is a measure of labour productiveness and tells us concerning the contribution by staff to manufacturing.

Labour productiveness progress gives the scope for non-inflationary actual wages progress and traditionally staff have been in a position to take pleasure in rising materials requirements of dwelling as a result of the wage tribunals have awarded progress in nominal wages in proportion with labour productiveness progress.

The widening hole between wages progress and labour productiveness progress has been a world pattern (particularly in Anglo international locations) and I doc the implications of it on this weblog publish – The origins of the financial disaster (February 16, 2009).

However the assault on dwelling requirements has targetted greater than the underside finish of the labour market, though the minimal wage staff have actually been extra disadvantaged of the prospect to share in nationwide productiveness progress than different staff.

The latest FWC selections gives some aid to that pattern.

The next graph reveals the evolution of the true Federal Minimal Wage (pink line), GDP per hour labored (blue line), and the Actual Wage Worth Index (inexperienced line), the latter is a measure of basic wage actions within the financial system.

The graph is from the June-quarter 2005 up till June-quarter 2026 (listed at 100 in June 2005 and extrapolated as above out to 2024).

The final recognized statement is the March-quarter 2025.

I’ve extrapolated out to the June-quarter 2026 utilizing commonplace assumptions of regular progress in productiveness, and RBA inflation forecasts for the CPI sequence.

By the March-quarter 2025, the respective index numbers have been 117.6 (GDP per hour labored), 104.9 (Actual WPI), and 111.0 (actual FMW).

All staff have didn’t take pleasure in a fair proportion of the nationwide productiveness progress. Nonetheless, the latest FWC selections have seen the bottom paid staff enhance their place relative to different staff.

Like all graphs the image is delicate to the pattern used. If I had taken the place to begin again to the Eighties you’ll see a really giant hole between productiveness progress and wages progress, which has been related to the huge redistribution of actual revenue to earnings over the past three many years.

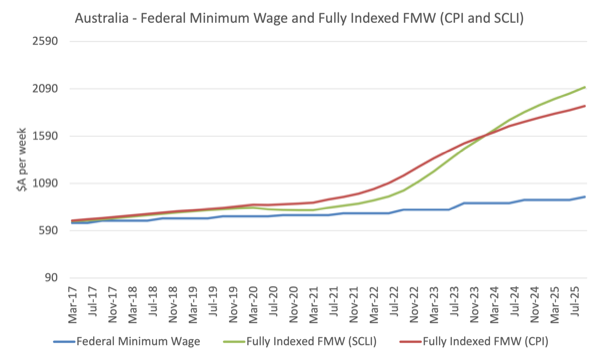

The extent of actual wage erosion on the backside

I calculated what the Federal Minimal Wage (NMW) can be had the FWC (and its antecedents) totally listed the FMW from the March-quarter 2016 degree of $A672.70 per week.

I used the CPI and the Worker SCLI to inflate that nominal weekly wage out to the September-quarter 2025, which is when the most recent FWC resolution takes impact.

The next graph compares the precise NMW for the reason that March-quarter 2016 with what it will have been in nominal phrases had it grown in step with the CPI and the Worker SCLI – that’s, had it been totally listed.

The variations are huge:

1. The nominal NMW within the September-quarter 2025 can be $A948 per week.

2. If totally listed to the CPI for the reason that March-quarter 2016, it will have been $A1,908.37 per week a distinction of $A960.37 per week (nearly double).

3. If totally listed to the Worker SCLI for the reason that March-quarter 2016, it will have been $A2,106.10 per week a distinction of $1,158.10 per week.

Conclusion

The FWC supplied a 3.5 per cent nominal wage improve for the bottom paid staff in its 2025 Nationwide Wage Case resolution.

In opposition to the present CPI progress, that gives for some modest actual wage improve for this cohort.

Nonetheless, notice the dialogue above as to the perfect buying energy measure to make use of.

In opposition to the extra relevant Worker SCLI, the choice gives for barely any actual wages progress and fails to redress the huge actual wage cuts lately.

In fact, the employers have been aghast on the resolution whereas on the similar time pocketing document earnings on account of their revenue gouging.

Usual.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.