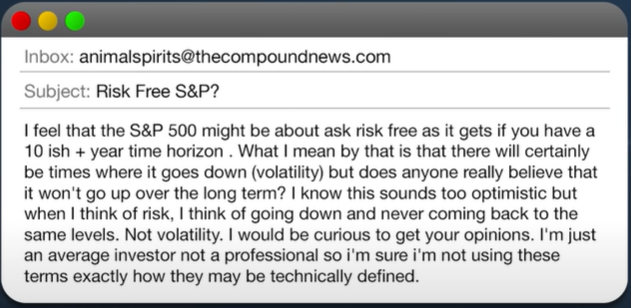

Right here’s an electronic mail we obtained from a podcast listener just lately:

This appears like one thing individuals solely say throughout a bull market. Nevertheless it’s additionally type of a good query in some methods.

Volatility is just not threat except it causes you to make an funding error. The truth is, volatility is a chance should you use it accurately.

And the U.S. inventory market has bounced again to new all-time highs from each single correction, bear market and crash in historical past so that may make it really feel like shares are risk-free in some methods.

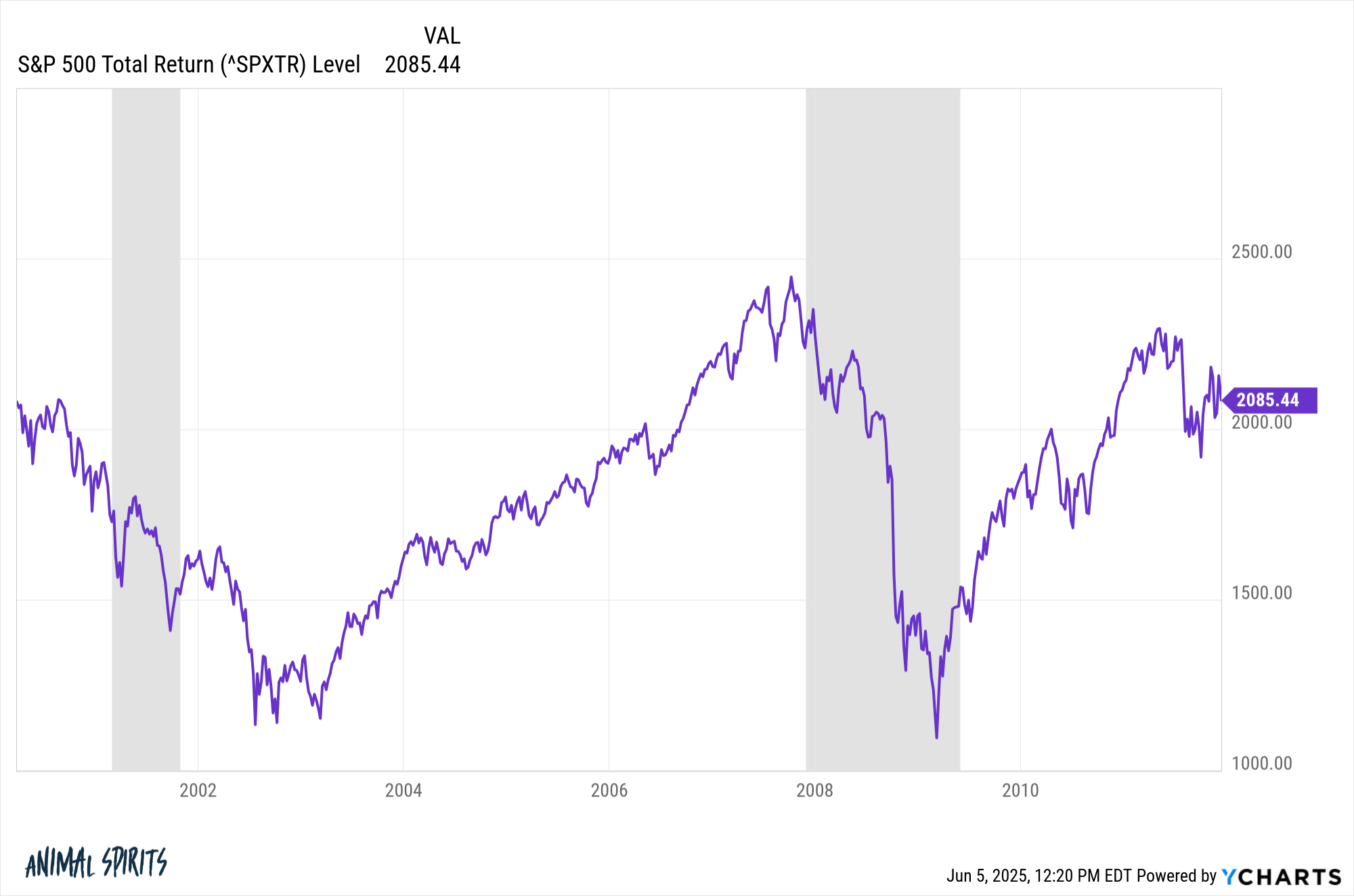

Nevertheless, even a ten-ish plus yr time horizon may be painful at occasions.

You don’t need to look that far again in historical past to discover a misplaced decade situation:

From early-2000 by means of the top of 2011, the S&P 500 went nowhere. And that is complete returns together with the reinvestment of dividends. That’s a misplaced 12 years the place the market did nada for you. It actually felt dangerous to buyers on the time.

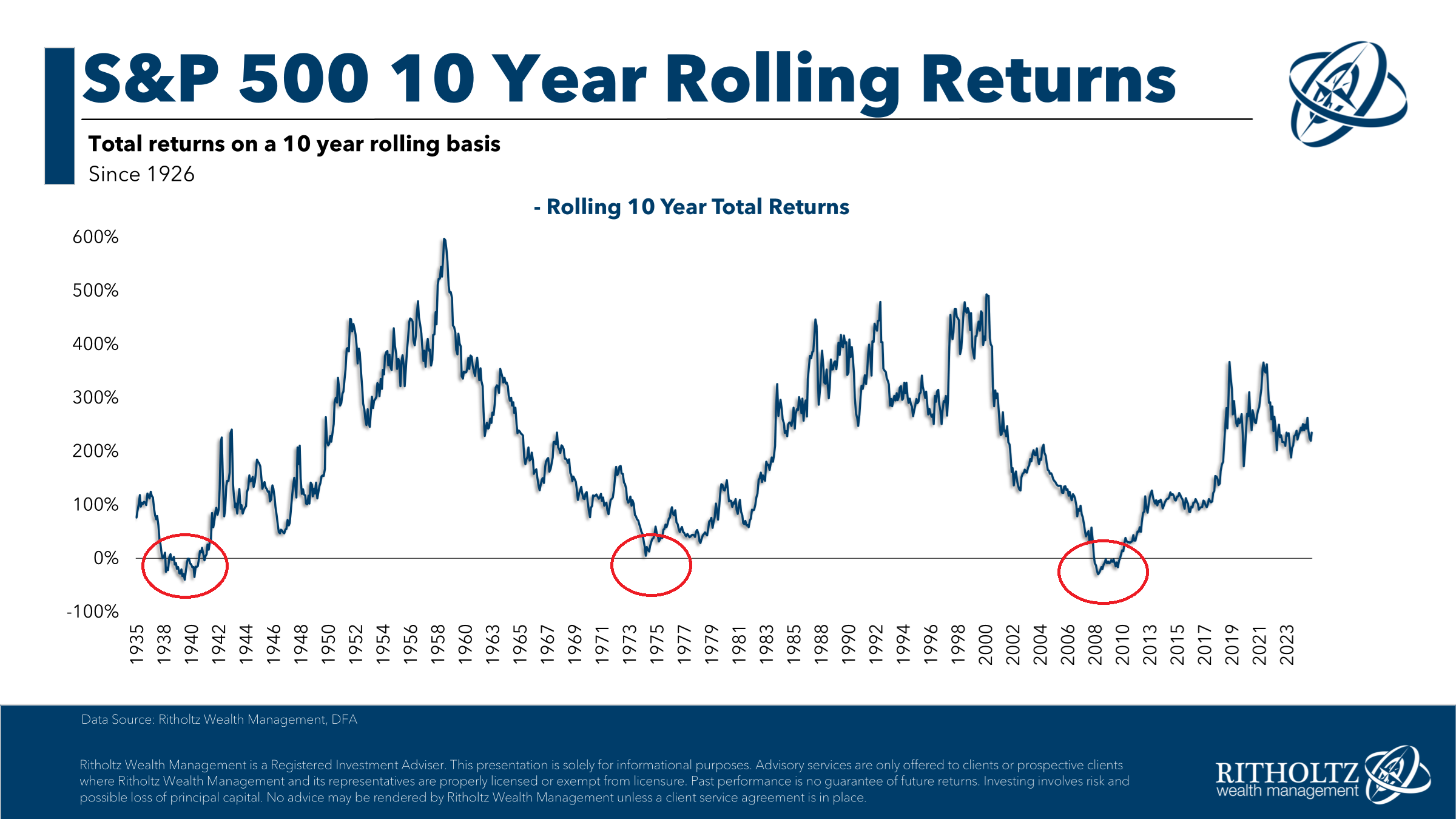

To be truthful, it’s uncommon to see this kind of threat. Over the previous 100 years or so, returns have been constructive over rolling 10 yr returns 95% of the time:

That’s a fantastic win price. The median 10 yr return was a +175%.

However you’ll be able to see there have been three distinct intervals of poor decade-long returns — the Thirties, Nineteen Seventies and 2000s.1 Ten years can really feel like an eternity in the case of watching your portfolio simply treading water.

That’s actual threat.

However threat can also be within the eye of the beholder in the case of market environments like this.

For those who’re nonetheless saving and investing regularly, a extremely unstable market that goes nowhere for a decade is a godsend. For those who dutifully plowed cash into the market from 2000-2011 you set your self up for the epic bull market that adopted the misplaced decade.

Some individuals don’t have the power to easily sit tight throughout markets that spin their wheels for 10 years so that they diversify. Diversification can give you a smoother experience and offers you the power to lean into the ache by means of common rebalancing.

However all of this discuss is only theoretical to an investor who hasn’t lived by means of a misplaced decade and felt the agony they will carry.

As Fred Schwed so eloquently wrote:

Like all of life’s wealthy emotional experiences, the complete taste of shedding essential cash can’t be conveyed by literature. You can’t convey to an inexperienced lady what it’s really wish to be a spouse and mom. There are particular issues that can’t be adequately defined to a virgin by phrases or footage. Nor can any description that I would supply right here even approximate what it feels wish to lose an actual chunk of cash.

It’s straightforward to say what you’d do in that scenario however you don’t know for positive till you truly dwell by means of it.

I don’t know when this can occur once more.

Possibly market cycles have sped up and we get extra frequent drawdowns however they don’t final as lengthy. Or perhaps that’s wishful pondering and the subsequent monetary disaster will result in a chronic interval of discomfort within the inventory market. The truth is, the idea that we’ve someway finished away with prolonged downturns in all probability makes it extra possible we’ll see one due to a Minsky mindset.

Both method, it’s all the time good to stress-test your portfolio to raised perceive the sorts of dangers you would encounter within the markets.

I agree that extending your time horizon as an investor is all the time useful.

However threat nonetheless exists.

Michael and I talked in regards to the thought of the S&P 500 being risk-free and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Might We See One other Misplaced Decade within the U.S. Inventory Market?

Now right here’s what I’ve been studying these days:

Books:

1And the Nineteen Seventies outcomes are worse than they appear as a result of inflation was so excessive.

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.