In our final piece, we examined simply how lengthy US shares can go underperforming US bonds. The reply was, loads longer than most may deal with.

However what a couple of extra comparable asset – shares exterior the US?

US shares have trounced international shares for so long as anybody can recall. Although as podcast alum Edward McQuarrie has identified, that may simply be a case of “proper hand chart bias“. That’s when an asset has carried out effectively lately it appears prefer it has ALWAYS outperformed, regardless that there may very well be many durations of underperformance too.

Right here’s his instance of US shares vs. bonds:

What’s any of this should do with US vs. international shares? Nicely, Because the GFC in 2009, it’s felt like U.S. shares may do no unsuitable, and also you’ve remodeled 900%. For international shares a measly 300%.

America has been the belle of the worldwide fairness ball. However historical past has a humorous approach of humbling those that extrapolate current traits perpetually.

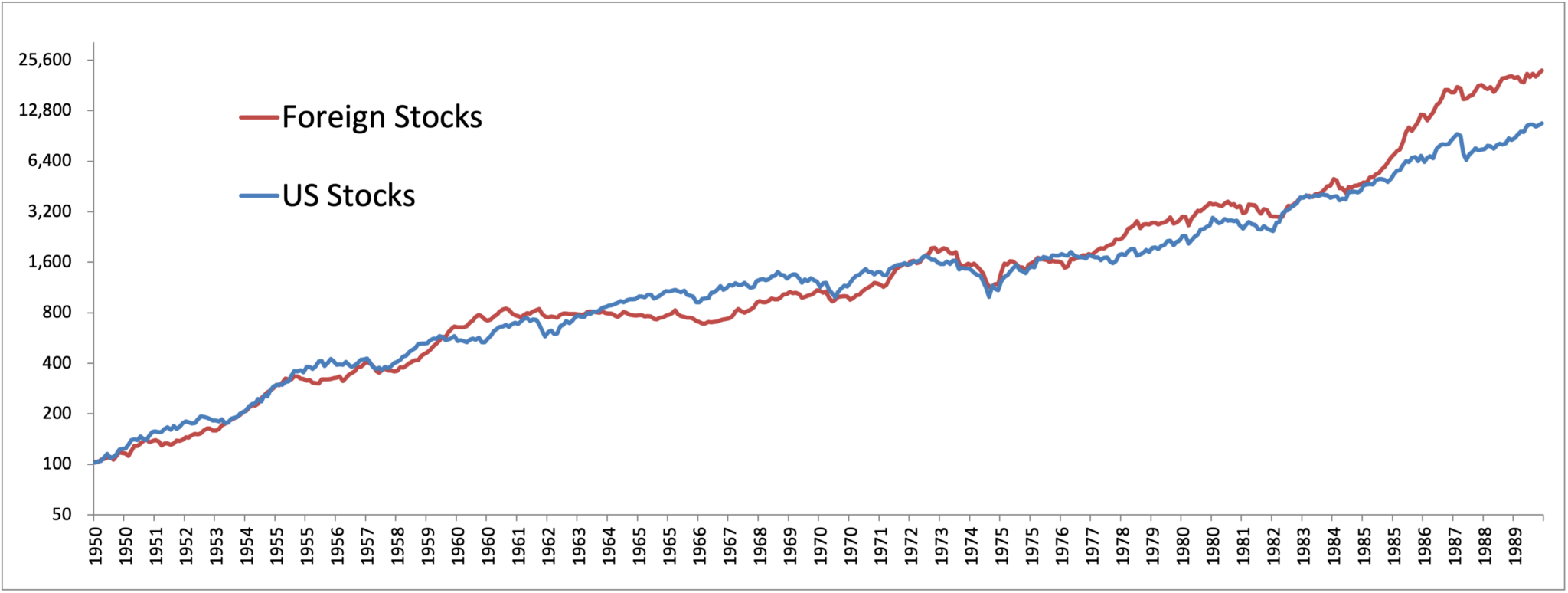

Right here’s the kicker: U.S. shares can—and have—underperformed international shares for many years.

Let’s rewind the tape. Many can recall the current 2000 to 2010 decade, dubbed the “misplaced decade” for U.S. shares, the place the S&P 500 truly misplaced cash. In the meantime, international developed markets (suppose Europe, Japan, and many others.) and particularly rising markets (hey, BRICs!) posted stable good points. It was the basic case of bushes not rising to the sky.

The connected chart hammers this house. For those who had been sitting within the U.S.-only camp for the whole lot of sure durations, you’ll’ve trailed globally diversified portfolios by a mile. And it’s not simply cherry-picking—we’re speaking decades-long stretches.

That was 4 a long time from the Fifties by means of the Eighties. For those who return to the 1800s, international shares outperformed america for 60 years at one level.

What if the outperformance lasted yr after yr? Attempt to think about 5 – 6 years in a row?! May by no means occur, proper? It actually occurred about 20 years in the past, lol, and likewise within the Eighties. Buyers typically are likely to extrapolate from the current previous, with US shares outperforming international markets in 12 of the final 15 years. With vital international outperformance this yr, is the Bear Market in Diversification ending?

The important thing lesson? Diversification isn’t only a cute slogan—it’s a survival tactic.

Our house nation bias blinds us.For those who’re loading up on U.S. shares after a 15-year run as a result of it “feels proper,” that’s your lizard mind speaking. Historical past says beware. Valuations matter. And when U.S. CAPE ratios are touching the stratosphere whereas international markets are lounging within the basement, future returns are likely to comply with the inverse path.

The answer? Personal the haystack, not simply the American needle. A worldwide worth tilt, rebalanced periodically, offers you a shot at taking part when management adjustments—because it all the time does.

In case your portfolio is a 100% U.S. allocation, it is perhaps time to zoom out. There’s an entire world on the market, actually.