There was some debate over the latest determination by the U.S. Division of the Treasury to ask the Fed to return unused CARES Act funding by December 31. Whatever the politics concerned, the choice shouldn’t essentially be a priority for traders with a hard and fast earnings portfolio. However that doesn’t imply there aren’t any implications to be thought-about concerning portfolio investments.

The precise packages ending are the Main Market Company Credit score Facility, the Secondary Market Company Credit score Facility, the Municipal Liquidity Facility, the Most important Avenue Lending Program, and the Time period Asset-Backed Securities Mortgage Facility. There’s no want to recollect these names, but it surely’s necessary to grasp what these packages did for the markets, notably the fastened earnings market.

An Efficient Backstop

In March, the CARES Act created these packages to offer a backstop for the markets. They have been meant to offer corporations, municipalities, and a few small companies with the money wanted to outlive the lockdowns, in case their regular sources of financing dried up on account of traders pulling out of the market. Following the announcement of the packages, many didn’t go into impact for just a few months. Nonetheless, their meant impact occurred instantly. The markets stabilized and firms have been capable of get market financing at affordable rates of interest. As proven within the chart under, yields on investment-grade company bonds fell from a excessive of 4.6 % on March 20 to 2.7 % on April 20. They continued to fall and, as of December 16, had dropped to 1.81 %, simply above the all-time low of 1.80% in November.

Funding-Grade Company Bond Yields

Supply: Bloomberg Barclays U.S. Combination Bond Index, Company Yield to Worst

Simply realizing these packages have been out there triggered the market to step in. Nearly all of allotted funds was not put into motion. In complete {dollars}, the cash loaned by the mixed packages was just below $25 billion, based on the Fed’s most up-to-date assertion, made on November 30. But $1.95 trillion in program funding was initially allotted to those packages.

A Totally different Atmosphere

Despite the fact that COVID-19 case counts are rising considerably within the U.S., prompting new shutdowns in sure states, the financial setting is completely different at present than it was in March. Initially of the pandemic, uncertainty as to the size or breadth of the financial disaster was a lot greater. The backstop packages gave traders confidence that corporations would have the ability to get financing in the event that they wanted it. Many companies have been capable of survive, notably people who have been wholesome previous to the disaster. Now, though uncertainty nonetheless exists as to the toll of the virus, we have now an excellent sense of the measures that governments will take to sluggish the pandemic and which industries shall be most affected. Given the approval of efficient vaccines, we even have a greater sense of the potential size of the disaster. So, we are able to see that key variations now exist that have an effect on the necessity for these CARES Act packages.

Company Survivability

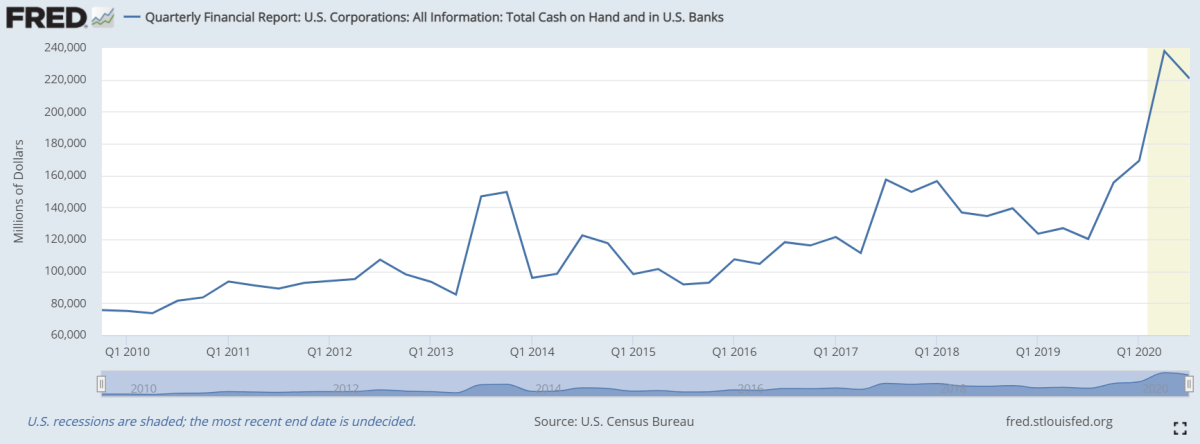

What does this imply for the markets? Traders have extra confidence that investment-grade corporations will have the ability to survive. Despite the fact that some small companies and high-yield corporations might wrestle to rebound, the timeframe for the disaster just isn’t an entire unknown. Additionally, throughout this timeframe, many corporations have been capable of put together for a second wave of the virus. They accessed capital markets and refinanced or, with rates of interest traditionally low, took on further debt. Based on Barclays, from March by November of this 12 months, investment-grade corporations borrowed $1.4 trillion in debt, in comparison with solely $788 billion throughout the identical interval in 2019. To have the ability to survive a sluggish interval, corporations stored a considerable amount of the funds borrowed in money. The chart under from the St. Louis Fed exhibits the full money readily available and in banks for U.S. firms.

What Are the Implications Transferring Ahead?

Though the CARES Act backstop packages are closing, the Fed stays dedicated to utilizing its conventional instruments to assist the markets. They embody preserving short-term rates of interest at 0 % for a number of years and persevering with to buy Treasuries and company mortgage-backed securities till we’re a lot nearer to full employment. These instruments will assist hold rates of interest down. That can assist customers have the ability to refinance their debt and have the boldness to proceed spending. Whereas the backstop packages shall be gone, Congress might restart them if we get a big shock to the markets. In any case, we noticed how efficient they have been in supporting companies throughout the first disaster. Going ahead, companies shall be judged on their capacity to repay their loans over the long run. On condition that investment-grade corporations have largely refinanced any debt coming due, they need to proceed to exhibit low default charges within the close to time period.

With fastened earnings yields falling so low, many traders could also be seeking to discover investments that pay an affordable earnings. When contemplating this technique, it’s sensible to maintain just a few issues in thoughts. When transferring away from short-term investments to get greater yields, you must take into account the basics of particular person companies. Lively administration of fastened earnings can play a job right here, provided that the Fed might not assist your entire market, particularly lower-quality corporations. For that reason, when in search of stability within the fastened earnings portion of your portfolio, chances are you’ll need to take into account higher-quality companies for longer-term investments.

As Warren Buffett mentioned, “It’s solely when the tide goes out that you just be taught who’s been swimming bare.” For now, nonetheless, we’re nonetheless at excessive tide in fastened earnings.

Editor’s Word: The authentic model of this text appeared on the Unbiased Market Observer.