This week (July 29, 2025), the Cupboard Workplace in Tokyo launched the Financial and Fiscal Report – 年次経済財政報告 – which is a complete assertion of the place the Financial and Fiscal Coverage Ministry thinks the Japanese financial system goes and the challenges it faces. It’s a lengthy and really thorough doc. However like many official paperwork that the Japanese authorities publishes, it reads fairly in contrast to what different governments which might be form of in IMF-spin mode pump out. The elemental takeaway from studying the Report is that the Japanese authorities continues to be unsure about whether or not the nation has developed out of its deflationary mindset and develop into a ‘growth-oriented’ nation pushed by actual wages development. There may be actually criticism (implied within the Japanese vogue) for companies sitting on massive money belongings who’re underinvesting in native productive capital. However the overwhelming hope of the federal government is that the nascent wage will increase which have been provided principally by the big main firms proceed and unfold all through the financial system into the dominant small and medium enterprises. Most governments are nonetheless within the company cost-cutting mindset – considering that’s one way or the other how productiveness and improved materials well-being will happen. So their foci is on deregulation and attacking commerce unions and that form of ‘provide aspect’ nonsense. The Japanese authorities is firmly banking on a consumer-led, home financial system development technique fostered by in depth wage rises outstripping the expansion in costs.

Earlier current weblog posts about Japanese wages:

1. Financial institution of Japan’s price rise is just not an indication of a radical coverage shift (March 20, 2024).

2. The Japanese wage downside (August 25, 2022).

3. Why has Japan prevented the rising inflation – a extra solidaristic method helps (July 4, 2022).

Newest Shunto or Spring wage outcomes

Commerce unions in Japan are organised by enterprise quite than sector, which might usually make it onerous to get coordinated wage outcomes for staff.

The height physique of the union motion solved that downside method again in 1954 when it proposed coordinated annual wage will increase for many staff and companies.

The so-called ‘spring wage offensive’ or – Shuntō – is performed in February and March annually and it’s a supply of stability within the industrial relations system in Japan.

The big firm commerce unions affiliated with the Rengo (Japanese Commerce Union Confederation) conduct their negotiations concurrently.

This text from the Japanese Heart for Financial Analysis – Historical past of Shunto and Its Financial Significance (October 17, 2023) – supplies plenty of details about the method if you’re occupied with studying extra.

Whereas the negotiations begin with the bigger unions in bigger enterprises the ultimate outcomes unfold to SMEs which should not have robust union organisation and make up nearly all of the workforce

Because the property crash in 1991, unions have misplaced protection and the capability to realize wage will increase via the shuntō has decreased.

Till not too long ago, unions have been on the again foot.

On July 17, 2025, Rengo printed the 2025 outcomes – 2025年春闘 (in Japanese).

We realized from the abstract doc – 2025春季生活闘争 まとめ[2025年7月17日掲載] (my translation and paraphrasing follows):

1. For the second consecutive yr, the 2025 Spring Wage Offensive delivered a wage enhance of over 5 per cent … the wage enhance exceeded the earlier yr’s inflation price.

2. As inflation remained excessive, expectations for wage will increase exceeding inflation have been excessive.

3. Labour shortages in lots of industries and corporations intensified.

4. The dialogue between authorities, unions, and company administration engendered social momentum for the necessity for wage will increase and an acceptance that companies would additionally increase costs.

As an apart, this final level may be very important.

My discussions through the years with many individuals in Japan, together with enterprise homeowners illustrated how within the deflationary interval, customers would actually punish enterprise companies that put up costs.

There was a vicious cycle – companies wouldn’t increase costs and as a consequence would then not supply wage rises.

I recall seeing the next video the place all the workers of a ice cream manufacturing firm – Akagi Nyugyo – publicly apologised for growing the worth of their product by 10 yen (a couple of cents) in 2016.

That they had not modified their worth for 25 years.

The track accompanying the video is by the well-known (now gone) Japanese folks singer – Wataru Takada – known as ‘Worth Improve’ and was launched in 1971.

His father, Takada Yutaka, was a well-known poet and Communist activist.

The track is in regards to the reluctance to extend costs and the way unhappy they’re that they’ve needed to and that they’d delay the rise so long as they will.

Nowhere else would we witness such a company apology.

Because it turned out, customers accepted the modest enhance in 2016 and the gross sales elevated.

Akagi has a popularity of treating its workforce with respect and affords high-quality merchandise.

From March 1, 2024, the corporate elevated the worth once more by an extra 10 yen – to 86 yen.

They not too long ago created this ‘Apology WWW Web page’ – 前回より深くお辞儀をしております (This time, we bow even deeper,) as a little bit of enjoyable.

Scroll down the web page and also you see that they’re providing advance apology footage for the long run worth will increase that they may provoke.

They word on the web page:

これからも、厳しい状況が

長引くことも覚悟しています。

知恵を絞り、企業努力を続けていく所存ですが念のため、

先々のバージョンも撮影しておきました。(撮影は1回ですませた方がリーズナブルなので)

Which reads that the agency understands there can be extra worth rises to return and they’ll use all their abilities to keep away from them however simply to be secure now we have filmed future variations of the unique video as a result of it’s more economical to movie them multi function go.

The hyperlinks don’t work but as a result of they haven’t but activated the following worth enhance.

After every worth rise at every future date, the bowing goes deeper.

Very amusing.

The purpose of this little diversion is that it illustrates how the state of affairs in Japan has modified because the mid-years of the deflationary period.

Now companies are making enjoyable of the rising prices quite than being mortified for imposing increased costs on customers.

It’s clear that customers are actually anticipating worth rises and beginning to perceive that their wages will now develop additionally.

The final two Shunto rounds (2024 and 2025) have consolidated that shift in sentiment, with actual wages rising for the primary time in a long time even whereas inflation was a current file highs.

5. Small and medium-sized unions have additionally began to realize wage will increase for his or her members, which has lowered the speed at which the extensive disparity between outcomes for staff in SMEs and the big companies, that sometimes have a worldwide focus, has risen.

6. Nonetheless, the SME outcomes are nicely beneath these for the bigger companies and the disparity has widened.

7. The hourly wage enhance for fixed-term, part-time, and contract staff was 5.81%, exceeding the 5.25% enhance for full-time union members based mostly on the common wage methodology. That is the biggest enhance because the mid-2000s, when RENGO started compiling hourly wage information

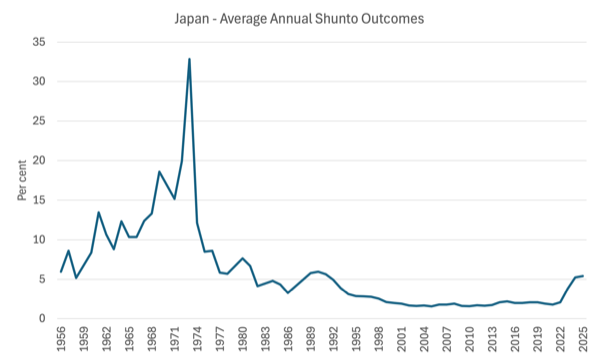

Listed here are the common annual outcomes since 1956 (annual proportion rises).

After the disruption arising from the OPEC oil worth hikes within the Nineteen Seventies, nominal wage outcomes grew to become very modest within the Nineties after the property bubble burst in 1991.

With inflation rising lately coupled with authorities help, the Shuntō is lastly delivering stronger nominal and actual wages development.

And right here is the actual wage equivalents of these common annual wage rises because the property bubble burst in 1990.

In 2023, the common annual wage end result from the spring wage offensive was 3.8 per cent, which delivered very small actual buying energy will increase to staff, given the inflation price of round 3.3 per cent

Within the 2024 spherical, the common annual wage end result was 5.24 per cent at a time when inflation had fallen to 2.7 per cent.

The most recent 2025 spherical noticed common annual wages rise by 5.42 per cent and inflation averaging to date this yr at 3.5 per cent (however falling).

So Japanese staff will take pleasure in a major actual wage enhance once more this yr.

The Annual Report’s view

The Authorities notes that the wage will increase are principally coming from the foremost firms, but customers haven’t but accepted that the shift in sentiment in the direction of increased costs and wages development can be everlasting.

There may be widespread uncertainty of the tariff impacts though some information from Japan at present means that Trump’s insanity is just not having an amazing unfavorable affect but in Japan.

First, manufacturing facility output rose by 0.3 per cent within the June-quarter, which could be because of orders being introduced ahead earlier than the tariffs are imposed.

Second, Toyota recorded “file world gross sales through the first half of 2025 as robust demand for hybrid autos in core markets helped offset headwinds from U.S. President Donald Trump’s tariffs on automobiles imported to america” (Supply).

However total, companies are terrified of the tariffs and the Japanese authorities believes there may be “a threat of reverting to the cost-cutting mindset that grew to become ingrained in company habits because the Japanese financial system fell into deflation after the collapse of the bubble financial system.”

The Report notes that Japanese companies throughout the dimensions spectrum have accrued massive money and financial institution deposit reserves as “precautionary balances” through the disaster years.

They haven’t been reinvesting their retained earnings in new capital formation, which has additionally hampered home development and created the state of affairs the place wage will increase weren’t being provided.

The Cupboard Workplace notes that “capital funding exceeded present earnings till the Nineties, however remained roughly equal from the early 2000s till the Lehman Shock of 2008. Because the 2010s, working earnings have persistently exceeded capital funding, apart from the April-June quarter of 2020, when working earnings fell sharply as a result of unfold of COVID-19. The hole between the 2 has been widening.”

So that could be a main problem for the federal government – to persuade the companies into reinvesting their earnings in productive capability.

They imagine that to solidify “the virtuous cycle of wages and costs that has lastly begun to take maintain” companies should reinvest within the home financial system.

The opposite facet that has modified dramatically because the bubble burst within the early Nineties is that the rise in retained earnings has led to an enormous enlargement of company stability sheets (and fairness) whereas debt positions have declined sharply:

… firms have been leveraging the growing company earnings because the late Nineties to scale back the extreme debt that had been a hindrance to enterprise exercise after the collapse of the bubble financial system, strengthening their fairness capital, and solidifying their monetary bases.

So the companies are safer now however nonetheless not taking the following step and investing in new capital.

The elevated earnings have been invested overseas as nicely in actual property, shares, and money and deposits:

Japan’s company sector has skilled a continual state of extra financial savings because the late Nineties. The savings-investment stability of nonfinancial company enterprises reveals that within the late Nineties, a shift from a state of affairs during which funding exceeded financial savings (a capital scarcity) to a state of affairs during which financial savings exceeded funding (a capital surplus) occurred, a state of affairs that has persevered for roughly 1 / 4 of a century.

Thus, Japanese companies are sitting on big stockpiles of money and the federal government needs it launched into the financial system to develop exercise and wages development.

How have companies been capable of obtain the expansion in earnings in a comparatively subdued financial interval because the bubble burst?

Largely via the dreaded ‘cost-cutting’ which have impacted on their willingness to supply increased wages and higher coaching.

The uncertainty for customers although has led to family consumption expenditure persevering with to be constrained.

Staff aren’t satisfied that the current wage will increase can be everlasting.

The Cupboard Workplace notes that:

1. “households have but to understand wage will increase as sustainable, leading to little expectation of will increase in everlasting earnings.”

2. “expectations of continued worth will increase are dampening client confidence and suppressing precise consumption.”

3. “issues in regards to the future, together with retirement, increase the financial savings price and curb consumption via precautionary financial savings motives.”

Nonetheless, there may be undoubtedly a shift occurring.

Whereas the 2 earlier financial cycles have been pushed by exports and manufacturing, the present development cycle, albeit modest, is being pushed by elevated home service exercise as home demand will increase.

The Cupboard Workplace believes this may insulate the financial system considerably from the Trump gymnastics on tariffs.

The chance is that the tariffs will injury the export sector and companies will have interaction in worth cuts and resume the:

… cost-cutting mindset that curbs wages and funding so as to safe short-term earnings … previous expertise suggests {that a} worsening output hole following a unfavorable financial shock, within the absence of established norms for wage and worth will increase amongst financial entities, will increase the chance of the financial system falling again into deflation.

The federal government’s mission is to “preserve a virtuous cycle of wages and costs, notably within the service sector, which has a excessive labour price ratio, by attaining and establishing a secure inflation price of two% as quickly as attainable, stabilizing financial entities’ inflation expectations, and selling worth pass-through and honest commerce practices for labour prices, in small and medium-sized enterprises.”

The shift can also be being pushed by growing labour shortages.

Additional, the federal government needs to scale back lengthy working hours and likewise reform the superannuation system in order that staff aren’t caught of their present jobs.

Conclusion

This publish actually represents the notes I took as I learn the Cupboard Workplace’s Report yesterday.

There’s a main shift in financial sentiment unfolding in Japan and for many who research this stuff (like me) it’s offering very fascinating analysis terrain.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.