A reader asks:

Long run S&P 500 return figures are sometimes cited as going way back to 1926. Whereas practically a century of numbers sounds nice, no one may actually ‘purchase’ the S&P again then. The index arrives within the 1950’s and Bogle’s index to truly purchase it as a single buy exhibits up within the mid-1970’s. Do 50-year long run return numbers since Bogle keep parallel to the projections again to 1926 or does this contemporary period exhibit any vital variations?

It is a one who is aware of their market historical past.

That is additionally my form of query, so let’s dig into the historical past part earlier than attending to the efficiency numbers.

The Normal Statistics Firm1 initially started monitoring 233 shares, nevertheless it was too exhausting to take care of day by day or hourly quotes on that many shares earlier than computer systems, so the S&P 90 was created in 1926.2

That unique S&P 90 was made up of fifty industrials, 20 railroads and 20 utility shares.

The S&P 500 was created in 1957 made up of 425 industrials, 60 utilities and 15 railroad shares, which lined round 90% of U.S. inventory market worth.

In 1976, monetary shares have been lastly added to the index, which moved to a 400-40-40-20 mannequin of industrials, utilities, financials and transport shares.3

Jack Bogle’s inaugural Vanguard S&P 500 index fund was launched that very same yr. In his remaining guide, Bogle notes that the fund may solely personal 280 shares as a result of it will have been so onerous from a value perspective to purchase all 500 names. There was additionally an 8% gross sales load to purchase that preliminary index fund.

By 1988, the fastened mannequin of 400 industrials, 40 utilities, 40 financials, and 20 transports was deserted to replicate a extra dynamic financial system.

Right here’s the abstract:

1923 – Normal Statistics Firm begins publishing day by day inventory value averages for 233 firms.

1926 – Launch of the S&P 90: 50 industrials, 20 railroads, 20 utilities.

1957 – The S&P 500 is created: 425 industrials, 60 utilities, 15 railroads.

1976 – The index is revised to 400 industrials, 40 utilities, 40 financials, 20 transports.

1976 – Vanguard launches the primary retail index fund monitoring the S&P 500.

1988 – The fastened 400-40-40-20 mannequin is deserted; sector weights change into adaptive to raised replicate the financial system.

Right this moment you’re taking a look at one thing like 35% to 50% in know-how shares relying on how they’re categorized so we’ve clearly seen a variety of change over time.

Now, let’s take a look at the efficiency historical past.

I’ve good historic knowledge from DFA that goes all the best way again to 1926 and the launch of the S&P 90.

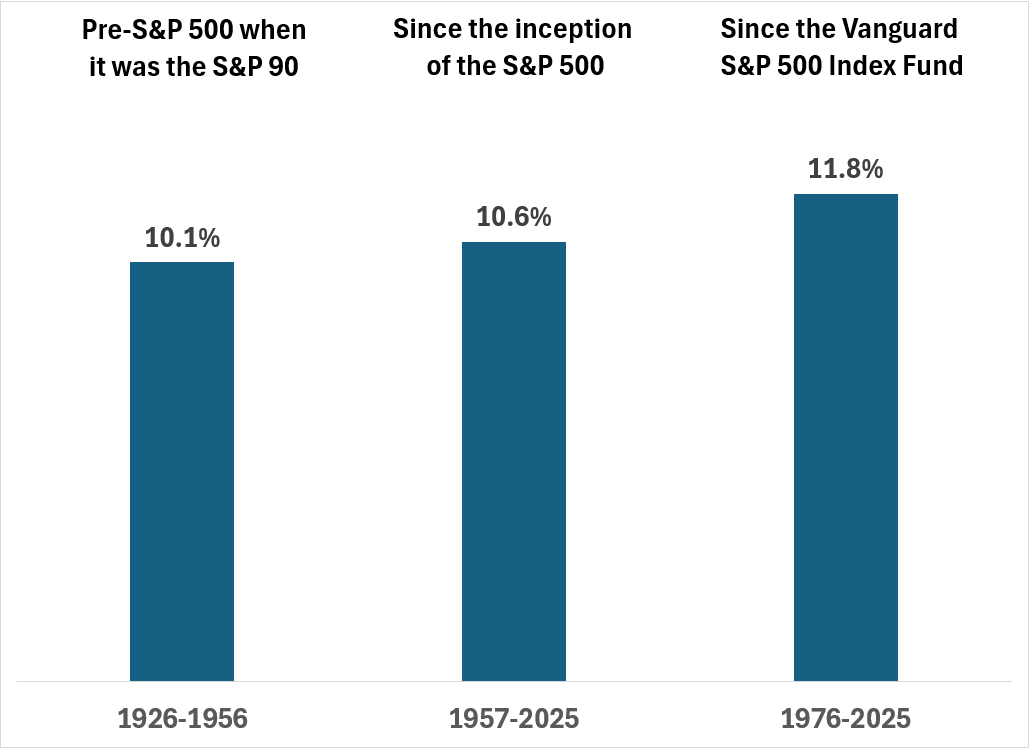

From 1926-1956 the S&P 500 compounded at an annual return of 10.1%. That’s not dangerous contemplating the Titanic-level catastrophe of the Nice Melancholy which noticed shares fall greater than 85%.

From the creation of the S&P 500 in 1957 by means of July of this yr the S&P 500 has an annualized return of 10.6%.

The IPO for the primary Vanguard S&P 500 index fund was on August 31, 1976. In the event you begin from the start of September 1976, the S&P is up 11.8% per yr.

Right here’s a useful chart I created:

As you may see, the returns haven’t degraded over time with the arrival of the S&P 500 index or the index fund. In reality, they’ve gotten higher which is partly from the truth that it’s now simpler to put money into the inventory market.

Extra folks investing means more cash flowing into shares which implies increased valuations and such.

Definitely, you would poke some holes by altering your begin and finish dates to make issues look higher or worse than these figures. However I’d say these time frames cowl a variety of market and financial environments.

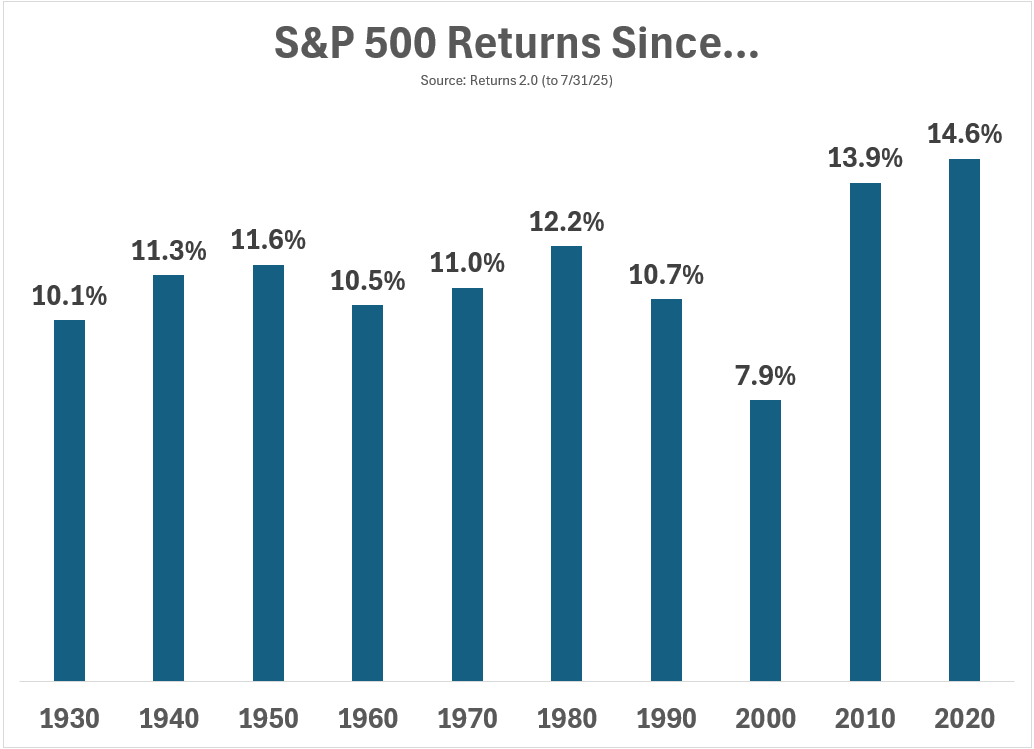

Right here’s one other method to view longer-term S&P 500 returns:

Over shorter time frames you will get increased (2010 and 2020) or decrease (2000) than common outcomes. Over longer time frames the annual returns are comparatively constant.

There’s loads extra that may and shall be thrown on the inventory market within the coming a long time however the modifications we’ve skilled over the previous 50-75 years in market construction haven’t broken portfolio returns.

The long term nonetheless wins out.

I answered this query on the newest version of Ask the Compound:

Barry Ritholtz joined me on the present this week to debate questions on shopping for luxurious automobiles on a budget, methods to diversify away from the Magazine 7, methods to measure your monetary advisor’s efficiency, and methods to carry out due diligence on personal funding alternatives.

Additional Studying:

The Evolution of Monetary Recommendation

1They didn’t merge with Poors Publishing till the early Nineteen Forties, which is when it grew to become Normal & Poors.

2You can see the costs for the S&P 90 on an hourly foundation whereas the remainder of the shares they tracked solely had weekly value reporting.

3It’s loopy that it took this lengthy however apparently many monetary firms traded over-the-counter up to now.