“One of the bullish issues that may occur to any market is for it to succeed in new multi-year highs.“ Bloomberg, March 5, 2014

Markets closed at a brand new all-time excessive right this moment.

The same old suspects have already proffered their litany of horrors – valuations are too excessive, positive factors are too slender, we’ve got an excessive amount of market focus and a toppy really feel, to say nothing about the entire new geopolitical dangers that proceed to build up in tariffs, warfare and oil costs.1

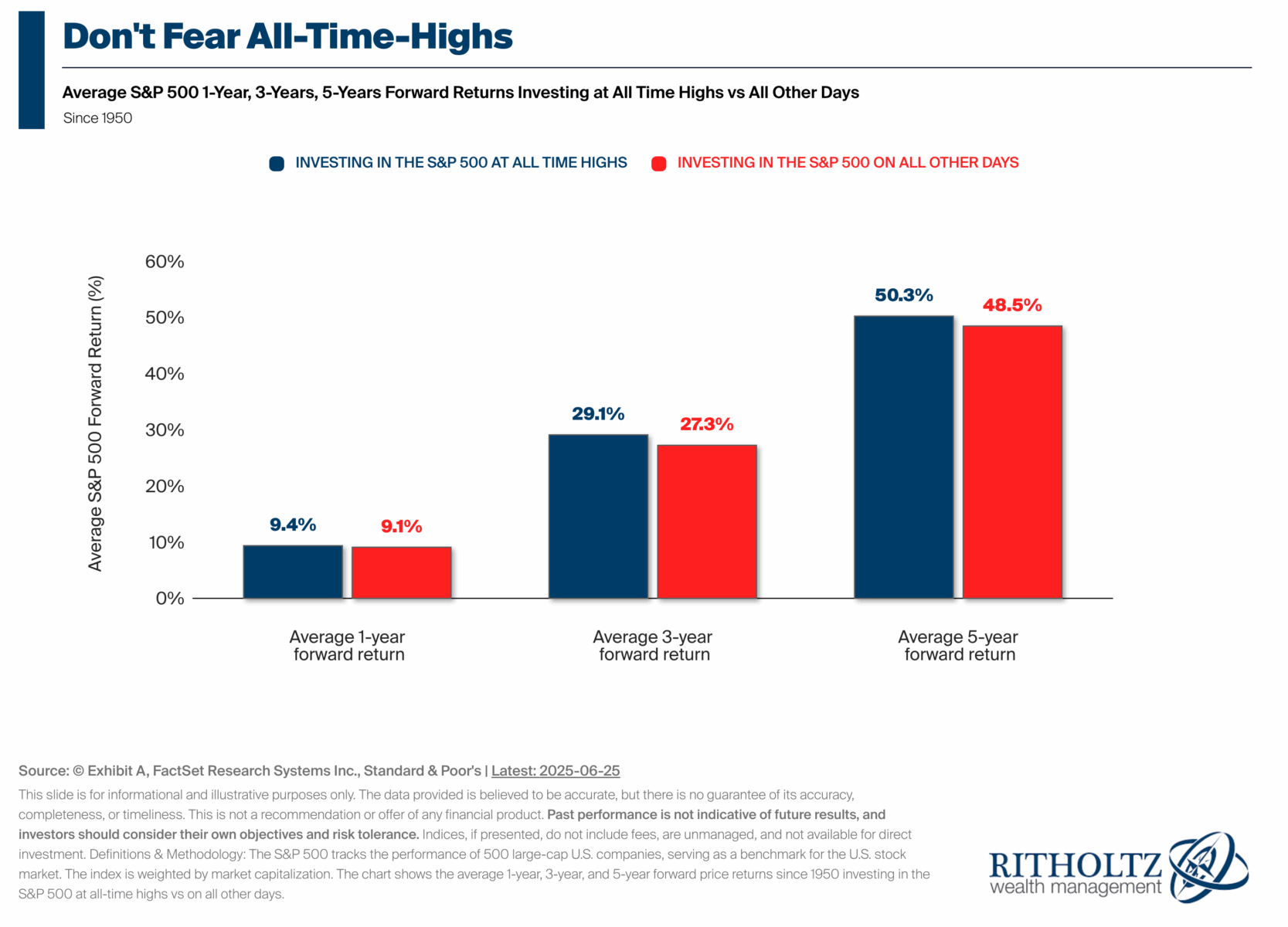

The issue is that the information merely doesn’t again up their fears:

“Think about the precise historic knowledge. New highs happen very often throughout bull markets. This makes the crash insistency a lot much less compelling. Certainly, we are likely to see many extra new highs throughout the secular bull markets than we do throughout the bear cycles.”

A column I wrote for Bloomberg in 2014 identified that the Dow made 492 new all-time highs from 1982 to 1999; within the 12 years masking 1952 to 1965, it made 279. Admittedly, the final all-time excessive at all times takes place earlier than a bear market. However the knowledge reveals that in the event you make investments throughout all-time highs, you do higher than you’d in the event you’re investing randomly on some other day in a market cycle (see chart at high).

You could be questioning when to skip an all-time excessive, however making that wager looks like a idiot’s errand. Word we have been having this identical dialogue 11 years in the past; take into account how disastrous promoting the 2014 all-time highs (pandemic and all) would have been.

Sure, it’s true: To keep away from that final all-time excessive, the 479th ATH earlier than the March 2000 high, you’d have needed to miss a considerable variety of the 478 prior highs that preceded it over the prior 16 years or so.

The chances there make that appear like a horrible wager to me…

Beforehand:

No, Market Highs Are Not a Unhealthy Signal (March 5, 2014)

All-Time Highs Are Traditionally Bullish (February 22, 2024)

See additionally:

All-Time Highs within the Inventory Market are Normally Adopted by Extra All-Time Highs (A Wealth of Frequent Sense, February 8, 2024)

Nothing is Extra Bullish than All-Time Highs (The Irrelevant Investor, February 03, 2024)

Ought to You Purchase An All-Time Excessive? ({Dollars} & Information December 29, 2020)

__________

1. I’m reminded of a quote from the psychologist Paul Ekman:

“Feelings change how we see the world and the way we interpret the actions of others. We don’t search to problem why we’re feeling a selected emotion; as an alternative, we search to verify it.” -“Feelings Revealed: Understanding Faces and Emotions”

Ekman was discussing normal particular person conduct, nevertheless it affirmation bias certainly applies to markets: Bears fixate on gadgets that affirm their negativity; Bulls fixate on datapoints that affirm their constructive viewpoint.