A fast be aware on tariffs: Over the previous few weeks, I’ve been placing collectively my quarterly name for purchasers. The problem is the right way to body the present financial state of affairs in a manner that’s helpful and informative and never the standard run-of-the-mill noise.

It’s simple to get distracted by the chaos of random insurance policies which have been coming rapid-fire at People. We see this within the Tariffs On, Tariffs Off, Promote, Purchase sample of news-flow. However slightly than get pushed and pulled by the every day deluge, let’s discover some higher context.

Markets are attempting to digest a troika of unknowns:

1) What are the brand new proposals truly going to be?

2) What’s going to their affect be on financial exercise and inflation?

3) How will the above have an effect on company revenues and earnings?

That is what markets do: They suss out the complexities of occasions and calculate the likelihood of how they may affect future money flows.

~~~

The tariff construction that exists in the present day was based mostly on agreements from the Uruguay Spherical that established the World Commerce Group. Recognizing the rising significance of mental property and the companies economic system, the U.S. needed to verify three of America’s largest and fastest-growing company segments had commerce protections: Finance, Expertise, and Leisure.

The Washington Publish mentioned why the WTO was an enormous win for the US:

“These had been big wins for Hollywood, Silicon Valley and Wall Avenue, and introduced order to a kind of commerce that the U.S. dominated. Whereas the U.S. has run a deficit in its merchandise commerce since 1975, it has constantly offered extra companies to the remainder of the world than it has imported. The U.S. final yr exported greater than $1 trillion value of companies, having fun with an almost $300 billion commerce surplus.”

The broad incentives of low-cost labor and minimal regulatory oversight led Company America to shift a lot of its manufacturing abroad. In hindsight, maybe an excessive amount of. As we discovered through the pandemic, this created important nationwide safety dangers.

The final administration took some steps to appropriate this, and I give this administration the advantage of the doubt in making an attempt to do the identical – particularly on the subject of China.

However the chaos of the best way that is being carried out, and the tossing apart of a broad total technique developed over many years, has been giving Mr. Market matches. He normally does an excellent job sniffing out new developments earlier than most of us notice it.

Any interpretation I attempt is extra artwork than science, so take this with a grain of salt. However the best way this sell-off feels, and particularly how sentiment measures from customers and CFOs are working on future spending plans and CapEx plans, implies the market fears one thing depraved this fashion comes.

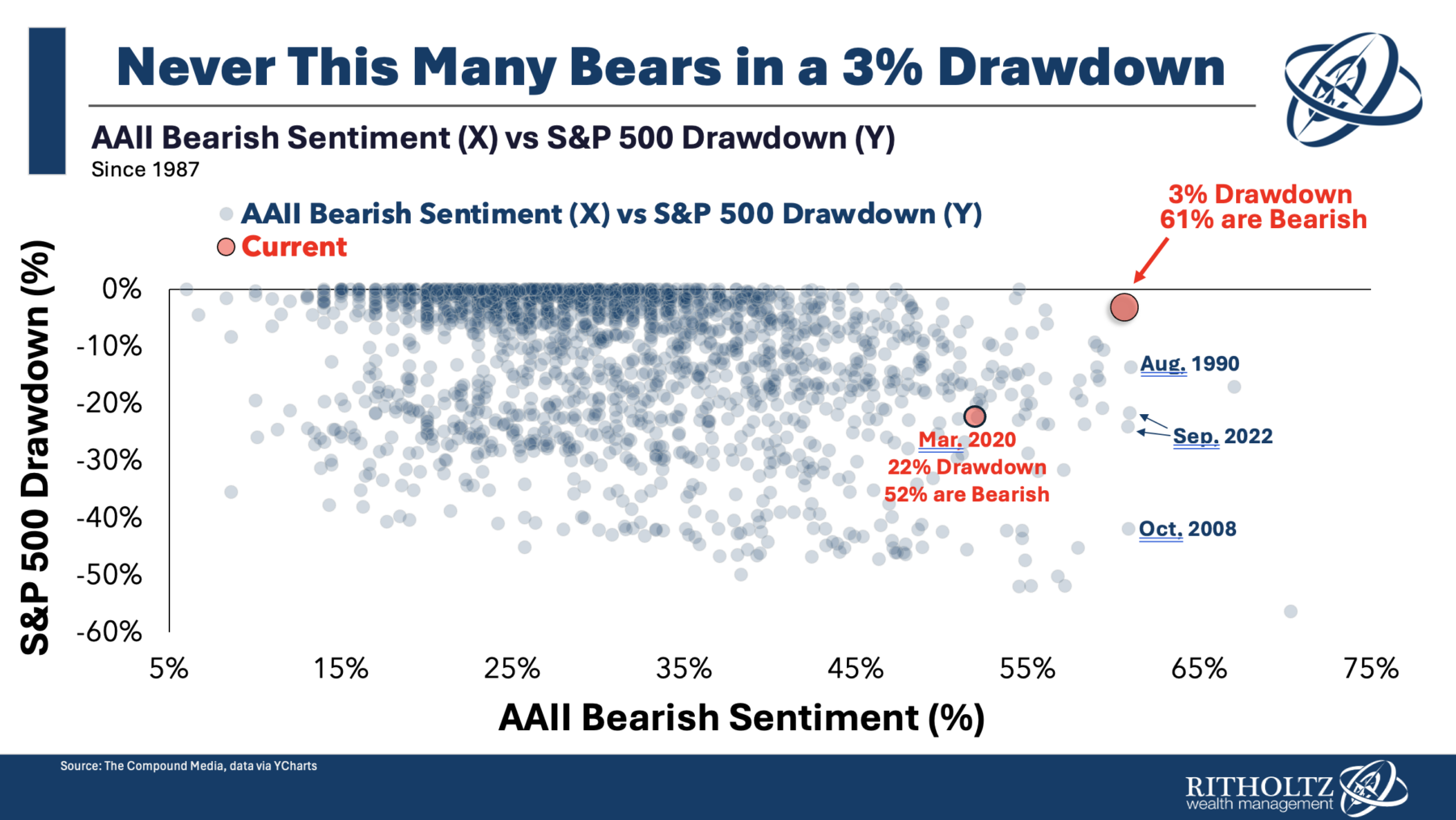

This turned obvious within the first 3% drop off of all-time highs:

Sentiment this excessive steered this was greater than a runoff-the-mill selloff. I didn’t perceive this as representing a big menace to the established financial order. Because the chart at high implies, it seems that the financial adjustments aren’t a one-time adjustment however a everlasting tax on consumption.

In a phrase, the U.S. tariff implementation appears to be transferring in direction of the equal of a nationwide VAT tax.

Hey, I perceive that tariffs aren’t the equal of a nationwide VAT tax. It’s not the identical factor in idea, however in follow, particularly with the chatter of decreasing earnings taxes, it feels that manner: European consumption tax minus the common well being care, schooling, and retirement advantages.

I hope this take is flawed. I perceive that any VAT or gross sales tax is agnostic as to put of manufacturing, whereas tariffs aren’t. It’s not an ideal metaphor, however the parallels between a consumption tax versus an earnings tax are there.

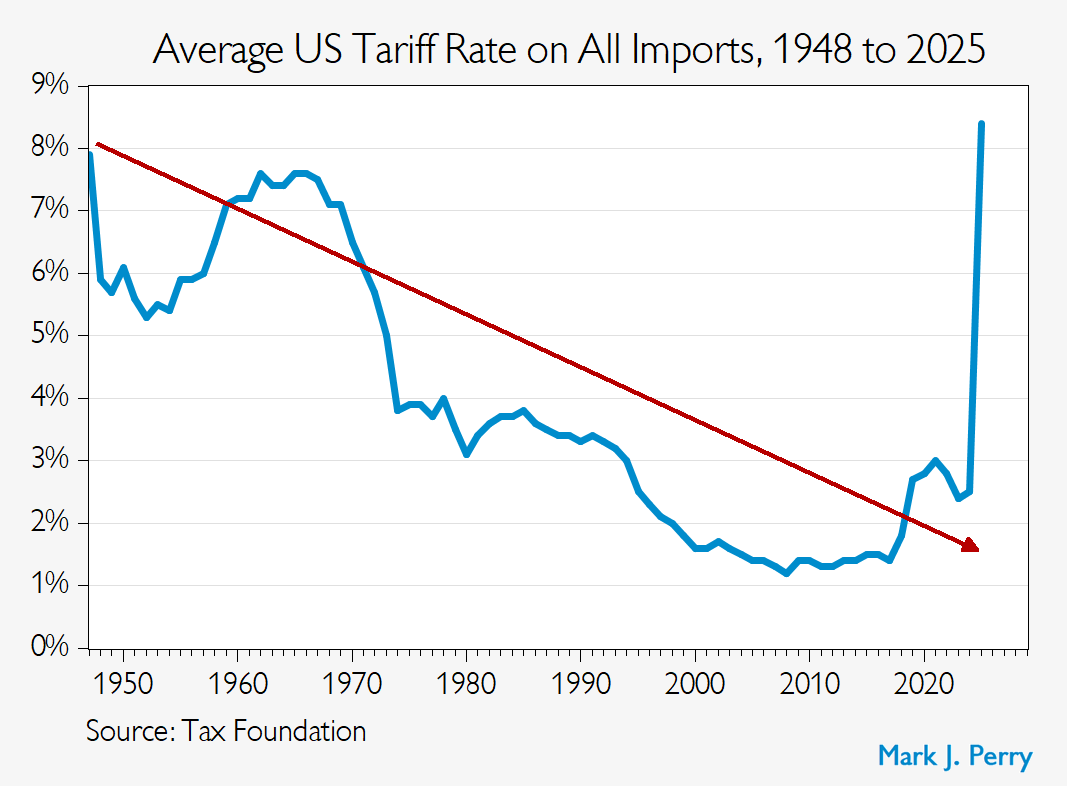

The market response appears to be anticipating one thing greater than reciprocal tariffs. Or as Mark Perry‘s chart under exhibits, the brand new proposal is an excessive post-war historic anomaly:

We’ll get a greater sense of precise tariffs Wednesday; for higher or worse, markets will continues incorporating these new VAT-like consumption Taxes into costs as we transfer ahead.

Beforehand:

7 Rising Possibilities of Error (February 24, 2025)

Tune Out the Noise (February 20, 2025)