The Australian Bureau of Statistics (ABS) launched the newest CPI information yesterday (June 26, 2025) – Month-to-month Client Worth Index Indicator – for Could 2025, which confirmed that the annual underlying inflation price, which excludes risky gadgets continues to fall – from 2.4 per cent to 2.1 per cent. The trimmed imply price (which the RBA screens as a part of the financial coverage deliberations) fell from 2.8 per cent to 2.4 per cent. All of the measures that the ABS publish (together with or excluding risky gadgets) at the moment are nicely throughout the ABS’s inflation targetting vary which is presently 2 to three per cent. What’s now clear is that this inflationary episode was a transitory phenomenon and didn’t justify the heavy-handed approach the central banks responded to it. On June 8, 2021, the UK Guardian printed an Op Ed I wrote about inflation – Worth rises ought to be short-lived – so let’s not resurrect inflation as a bogeyman. In that article, and in a number of different boards since – written, TV, radio, displays at occasions – I articulated the narrative that the inflationary pressures had been transitory and would abate with out the necessity for rate of interest will increase or minimize backs in internet authorities spending. Within the subsequent months, I acquired a whole lot of flack from fellow economists and people out within the Twitter-verse and many others who despatched me quotes from the likes of Larry Summers and different outstanding important stream economists who claimed that rates of interest must rise and authorities internet spending minimize to push up unemployment in the direction of some conception they’d of the NAIRU, the place inflation would stabilise. I used to be additionally informed that the emergence of the inflationary pressures signalled the loss of life knell for Trendy Financial Concept (MMT) – the critics apparently had some concept that the pressures had been attributable to extreme authorities spending and slack financial settings which demonstrated of their thoughts that this was proof that MMT insurance policies had been harmful. The proof is that this episode was nothing just like the Seventies inflation.

Listed here are some latest weblog posts that relate to my evaluation of the inflationary episode:

1. ECB analysis exhibits that rate of interest hikes push up rents and harm low-income households (January 20, 2025).

2. So-called ‘Workforce Transitory’ declared victors (January 8, 2024).

3. Banks gouging tremendous earnings, yield curve inversion – nothing good is on the market (October 19, 2022).

4. The inflationary episode is being pushed by revenue gouging and rate of interest hikes received’t assist a lot (March 27, 2023).

5. Electrical energy community firms revenue gouging as a result of authorities regulatory oversight has failed (November 22, 2023).

6. We’ve got an experiment below approach because the Financial institution of Japan holds its cool (March 31, 2022).

7. Two diametrically-opposed approaches to coping with inflation – stupidity versus the Japanese approach (October 6, 2022).

8. Central banks are resisting the inflation panic hype from the monetary markets – and we’re higher off because of this (December 13, 2021).

9. The present inflation nonetheless appears to be a transitory phenomenon (March 28, 2022).

There have been many extra.

I believe the proof signifies that my judgement on the onset of this episode was sound, regardless that it was not a really extensively held view by economists or coverage makers.

That ought to let you know one thing.

The RBA (in step with different central banks aside from the Financial institution of Japan) went rogue on the onset of this inflation and its public statements bore little relationship with actuality.

They relentlessly pushed the road that they needed to preserve mountaineering rates of interest regardless that the inflation peak was short-lived as a result of they feared a wages breakout.

Varied RBA officers claimed the federal government needed to push the unemployment as much as a minimum of 4.5 per cent (when it was round 3.5 per cent) as a result of the inflation was an extra demand-driven occasion and employees needed to lose revenue to resolve the surplus.

They ignored the truth that after the inflation started because of pandemic-caused provide constraints, exacerbated by Mr Putin’s invasion and OPEC’s non permanent greed, varied institutionally-driven worth changes (akin to indexation preparations), and abuse of anti-competitive, company energy turned the issue.

There was additionally proof that the RBA has induced among the persistence within the inflation price by the affect of the rate of interest hikes on enterprise prices and rental lodging.

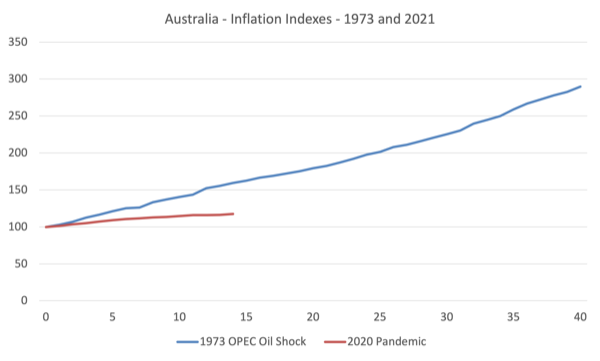

Contemplate the next graph, which compares the inflationary spiral that adopted the October 1973 oil worth hike and the latest pandemic-induced spiral.

The 2 collection are listed at 100 at:

1. December-quarter 1973 then out 40 quarters.

2. September-quarter 2021 then out to March-quarter 2025 (newest commentary).

These quarters mark the beginning of every inflationary spiral.

Fairly some distinction!

Newest information

The newest month-to-month ABS CPI information exhibits for Could 2025 that the annual worth actions are:

- The All teams CPI measure rose 2.1 per cent over the 12 months (down from 2.4 in April).

- Meals and non-alcoholic drinks rose 2.9 per cent (down from 3.1 per cent).

- Alcohol and tobacco rose 5.9 per cent (from 5.7 per cent)

- Clothes and footwear 1.3 per cent (from 0.8 per cent).

- Housing 2 per cent (from 2.2). Rents – 4.5 per cent (from 5 per cent).

- Furnishings and family tools 0.9 per cent (from 1 per cent).

- Well being 4.4 per cent (regular).

- Transport -2.5 per cent (-3.2 per cent).

- Communications 1 per cent (0.7 per cent).

- Recreation and tradition 1.4 per cent (3.6 per cent).

- Schooling 5.7 per cent (regular)

- Insurance coverage and monetary providers 3.1 per cent (4 per cent).

The ABS Media Launch (June 25, 2025) – Month-to-month CPI indicator rises 2.1% within the 12 months to Could 2025 – famous that:

The month-to-month Client Worth Index (CPI) indicator rose 2.1 per cent within the 12 months to Could 2025 …

The two.1 per cent annual CPI inflation in Could was down from 2.4 per cent in April and the bottom since October 2024 …

Annual trimmed imply inflation was 2.4 per cent in Could 2025, down from 2.8 per cent in April. That is the bottom annual trimmed imply inflation price since November 2021 …

So just a few observations:

1. The underlying inflation price is constantly falling and appears like it should go under the RBA’s decrease certain for its inflation targetting vary – because it was for some years earlier than the pandemic.

2. This makes a mockery of the entire inflation targetting train – the RBA constantly failed to satisfy its goal (from under) however refused to decrease rates of interest.

4. The electrical energy element remains to be considerably decrease after the introduction of the federal and state authorities rebates offsetting the profit-gouging within the power sector. This demonstrates how expansionary fiscal coverage could be an efficient instrument in combatting inflation.

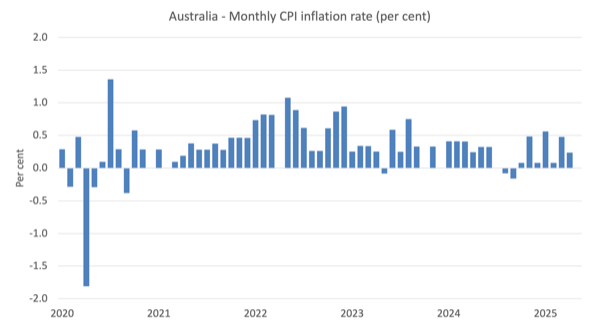

The following graph exhibits the month-to-month price of inflation which fluctuates in step with particular occasions or changes (akin to, seasonal pure disasters, annual indexing preparations and many others).

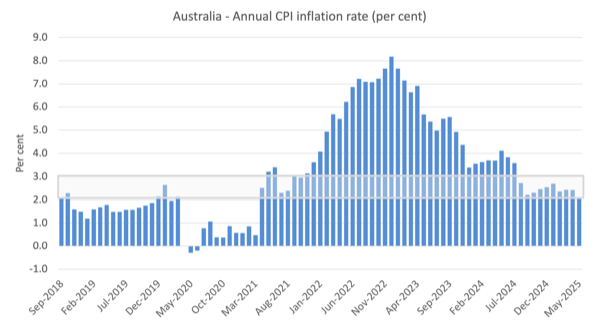

The following graph exhibits the annual motion with the shaded space displaying the RBA targetting vary.

The general inflation price was constantly throughout the targetting vary because the center of 2024.

Inflation peaked in December 2022 as the provision components pertaining to the pandemic, Ukraine and OPEC began to abate.

The RBA stored mountaineering by 2023 claiming that there was a hazard that wages development would ‘breakout’ even supposing the info was displaying no such factor with development at document or close to document lows.

It is usually helpful to notice that previous to the inflationary episode, the RBA largely did not preserve the annual inflation price inside their goal zone, which tells us in regards to the effectiveness of the financial coverage instrument in relation to its said goal.

Family and agency heterogeneity and the implications for financial coverage

Whereas the rate of interest hikes had been largely ineffective in killing mixture spending, which was their objective, given the RBA adopted the mainstream view that the inflation was as a consequence of extreme spending through the pandemic, they did have important distributional results.

Financial coverage is known as a ‘blunt’ instrument as a result of it’s thought of to be considerably indiscriminate in its impacts.

That’s solely partially true although.

In contrast to fiscal coverage, financial coverage is an instrument that can’t be targetted to particular demographic or revenue cohorts, or areas or sectors.

In that sense, it’s blunt.

However the issue is that rate of interest modifications do discriminate in opposition to those that are indebted and profit those that are collectors or who maintain monetary wealth.

Within the latest interval, these holding monetary wealth got huge revenue boosts from the RBA rate of interest hikes.

And the ‘payees’ for these items have been the low-income mortgage holders who are usually not solely being squeezed by the rate of interest rises straight, however are additionally within the front-line of the job losses that the RBA was making an attempt to drive on the economic system.

These price hikes created one of many largest redistributions of revenue from poor to wealthy in Australia’s historical past.

The one cause the rate of interest hikes didn’t kill general spending outright was as a result of the beneficiaries stored spending up huge on the again of the revenue boosts they acquired and inflationary impacts abated rapidly sufficient earlier than the losers adjusted their spending down.

There was some harm to employment and output development however not as important as occurred within the late Nineteen Eighties into the Nineteen Nineties when the RBA engineered an enormous recession.

The query of family and agency heterogeneity and its implications for the effectiveness and penalties of financial coverage modifications was the subject of a significant convention organised by the Financial institution for Worldwide Settlements on March 17-18, 2025.

On June 12, 2025, the BIS produced a quantity of papers that got here out of these conferences – How can central banks take account of variations throughout households and corporations for financial coverage? – which make for fascinating studying.

The BIS Background Paper carrying the identical title because the convention – How can central banks take account of variations throughout households and corporations for financial coverage? – gives an fascinating overview of the problems.

It notes that central bankers have more and more targeted on the “cross-sectional variations throughout households and corporations for the conduct of financial coverage”, which, amongst different causes, is as a result of:

… the transmission of financial coverage relies on such cross-sectional variations …

That’s, how efficient financial coverage is in manipulating mixture demand shifts.

The BIS surveyed “central banks in 22 rising market economies” to develop a data base.

Elements thought of are:

1. “central banks reported that essentially the most related traits for financial transmission embrace the extent and kind of debt, the extent and supply of revenue, and the extent and liquidity of belongings.”

2. “The share of so-called hand-to-mouth households (people who maintain little liquid wealth and largely eat their present revenue) issues specifically.”

3. “Within the case of corporations, essentially the most related traits are sector, dimension, foreign money publicity, the extent and composition of debt, and export orientation. Financial coverage has a stronger affect on small, domestically oriented corporations that are likely to depend on home funding as in comparison with export-oriented or foreign-owned corporations with entry to diversified funding sources. Within the case of each households and corporations, informality additional weakens transmission.”

What was important is that:

Whereas financial coverage can have distributional results, central banks contemplate these results to be much less essential than mixture results. When setting financial coverage, central banks concentrate on mixture outcomes. Financial coverage is a blunt instrument that’s not nicely fitted to influencing distributions within the inhabitants. Fiscal devices are extra simply focused and thus extra applicable for this objective. Furthermore, weak segments of society are finest served when financial coverage focuses on the value stability mandate.

The issue although is that financial coverage has very giant distributional results when wealth inequality is excessive, as it’s in most nations.

And people distributional impacts are key to figuring out the ‘mixture outcomes’ as a result of propensities to eat are starkly completely different throughout excessive and low revenue earners and excessive and low wealth holders.

Not solely do the distributional modifications affect on the combination however in addition they affect the timing of the impacts.

As I defined in lots of weblog posts through the inflationary interval, the preliminary affect of the rate of interest rises is to present revenue to the rich who’ve decrease propensities to eat (that’s, they may save a better proportion of every additional greenback acquired than a low-income earner).

Absolutely the increase to nominal spending although initially is constructive as a result of low-income earners are already spending 100 per cent of their revenue and the excessive revenue recipients can splurge the increase.

We noticed because the rates of interest rose, demand for luxurious automobiles and journey in Australia rose.

Finally, the affect on spending reverses and the excessive revenue recipients return to extra regular spending patterns whereas these hit with the rate of interest rises begin to minimize discretionary spending to remain solvent with their nominal mortgage commitments, which rise because the rate of interest rises stream by to all debt devices.

Mainstream macroeconomics has all the time downplayed the significance of revenue distribution in shaping the combination outcomes.

The BIS analysis additionally exhibits that central banks, whereas conscious of those distributional impacts shouldn’t have the modelling capability at current to include them into their resolution making.

Conclusion

In different phrases, central banks are making financial coverage selections which have severe implications for fairness and which additionally severely affect the effectiveness of their selections with out truly together with of their decision-making framework important components.

That has been one in all my main criticisms of the best way central banking is carried out on this neoliberal period.

Ballistic missiles stopped me in my tracks

I didn’t make it to Europe this week as I had deliberate.

After I arrived on the airport on Tuesday within the early night, I used to be met with the information that the flight I used to be booked on had been cancelled as a result of the planes couldn’t get into and out of Doha Airport because of the Iranian missile assault on the US navy base.

The airline (QATAR), which commonly wins awards for service, had not even been bothered notifying these with bookings that the flights had been cancelled regardless that they knew at 9:00 am on that day that the planes wouldn’t be arriving in time.

Stacks of individuals had been arriving on the check-in to seek out the identical information.

Complete waste of time.

Anyway, I used to be capable of rearrange commitments to subsequent week (I’m sorry for all of the inconvenience to individuals on the different finish) and can hope that issues work out then.

That’s sufficient for right this moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.