Central banks around the globe tightened rates of interest beginning late 2021 in some locations and there was a scientific interval of hikes over the subsequent 12 months or extra regardless of the inflationary pressures principally displaying indicators of abatement on account of components that weren’t delicate to the rising rates of interest. In Australia, the RBA began mountain climbing in Could 2022 and continued by means of to November 2022, regardless of the inflation charge peaking in December 2022. The RBA persistently claimed the labour market was too tight and that the unemployment charge was beneath the unobservable Non-Accelerating-Charge-of-Unemployment (the so-called NAIRU), which meant to stabilise inflation of their eyes, they needed to drive unemployment greater. Their logic was not according to actuality and tens of hundreds of staff have misplaced their jobs over the previous few years on account of deliberate coverage selections all for nothing. The inflation outbreak was not the results of extra spending and got here down by itself accord because the COVID constraints abated and provide chains labored round Putin and all that. On this weblog publish I produce some analysis that additional cements that conclusion. There are some technical particulars however primarily the narrative needs to be straightforward to observe.

Background studying

The next earlier weblog posts present some background conceptual materials that can assist you perceive the idea of a U-V ratio and the Beveridge curve.

1. Labour market deregulation won’t scale back unemployment (January 11, 2012).

2. Nobel prize – hardly noble (October 13, 2010).

3. Extending unemployment advantages … an omen (March 8, 2010).

4. The unemployed can’t discover jobs that aren’t there! (April 14, 2009).

What’s full employment?

When Australia launched the path-breaking – The 1945 White Paper on Full Employment – which set the trail for a number of many years of prosperity for staff, it was following the worldwide post-WW2 dedication to nation constructing and utilizing fiscal coverage to make sure there have been sufficient jobs out there to fulfill the aspirations for work by the inhabitants.

The 1945 White Paper articulated the Authorities’s intention to make use of macroeconomic coverage to make sure there have been jobs for all, and for a number of many years the federal government used varied fiscal methods to take care of very low unemployment (< 2 per cent).

Many fascinating tendencies accompanied this era of true full employment – diminished earnings inequality, improved well being, sturdy productiveness development, diminished dependence on welfare help and extra.

Nations internationally adopted this sample of presidency intervention.

Nonetheless, clearly a system that delivered outcomes to staff however impinged on the capability of Capital to generate huge earnings and suppress wages development, ran afoul of the elites.

Whereas Capital opposed the total employment insurance policies of presidency, it wasn’t till a serious marketing campaign gathered tempo within the late Sixties that there was a concerted and organised effort by the elites to unwind the total employment consensus and stress governments to desert lively fiscal coverage.

I gave a chat at a union-organised workshop in Melbourne lately which was targeted on find out how to reassert a full employment agenda.

I famous that the usage of large-scale public sector job creation packages, which had been frequent in the course of the full employment interval, grew to become unpopular in the course of the Seventies, not as a result of they weren’t efficient in offering work for individuals when the non-public economic system faltered, however as a result of they offended the elites who needed governments to create a buffer of unemployment and destroy the capability of commerce unions to successfully symbolize their members in negotiations with employers.

Capital knew that they might get a bigger share of the true earnings produced every interval if governments grew to become their agent in suppressing wages development and making a precariat among the many working class.

It was the beginning of the neoliberal interval, which persists to now, and has been spectacularly profitable in reaching its goals on the expense of most of us.

Our e book – Reclaiming the State: A Progressive Imaginative and prescient of Sovereignty for a Put up-Neoliberal World (Pluto Books, September 2017) – gives an in depth account of this era.

This weblog publish – The precise-wing counter assault – 1971 (March 24, 2016) – gives some straightforward to entry dialogue of the ideological shift and the way it was manufactured by the elites representing Capital.

Whereas the hyperlink between inflation and unemployment actually got here into prominence within the theoretical literature within the Nineteen Fifties, it was weaponised by the NAIRU cult that emerged within the late Sixties as Monetarism began to take over the Academy and economists started to reject the Keynesian manner of developing the economic system.

The RBA and most central banks declare that they’re legislated to realize and maintain full employment amongst different targets.

The trick is that they outline full employment in a manner that permits them to justify pursuing ridiculously excessive charges of unemployment whereas nonetheless claiming they’re operating coverage according to full employment.

This weblog publish – Australia’s new White Paper on Full Employment is a dud and simply reinforces the failed NAIRU cult (September 25, 2023) – gives extra element on this subject.

For the RBA. full employment means a state the place the unemployment charge is the same as their estimate of the unobservable Non-Accelerating-Charge-of-Unemployment (the so-called NAIRU), which is a theoretical unemployment charge the place inflation is steady (neither rising nor falling).

Whereas the hyperlink between inflation and unemployment actually got here into prominence within the theoretical literature within the Nineteen Fifties (

The NAIRU cult emerged within the late Sixties as Monetarism began to take over the Academy and economists started to reject the Keynesian manner of developing the economic system.

Common readers will know that I’ve written concerning the NAIRU idea earlier than and have executed years of labor on the subject:

1. My – PhD thesis – included a whole lot of technical work (theoretical and econometric) on the subject – starting within the mid-Eighties, once I was simply beginning out.

2. In my 2008 e book with Joan Muysken – Full Employment deserted – we analysed the technical points of the NAIRU intimately.

3. Many refereed tutorial papers – right here.

4. The next weblog posts (amongst others):

(a) RBA enchantment to NAIRU authority is a fraud (February 23, 2023).

(b) The NAIRU ought to have been buried many years in the past (December 9, 2021).

(c) The NAIRU/Output hole rip-off reprise (February 27, 2019).

(d) The NAIRU/Output hole rip-off (February 26, 2019).

(e) No coherent proof of a rising US NAIRU (December 10, 2013).

(f) Why we’ve got to study concerning the NAIRU (and reject it) (November 19, 2013).

(g) Why did unemployment and inflation fall within the Nineteen Nineties? (October 3, 2013).

(h) NAIRU mantra prevents good macroeconomic coverage (November 19, 2010).

(i) The dreaded NAIRU continues to be about! (April 6, 2009).

RBA gone rogue

The RBA entered the NAIRU cult like most central banks and justified its rate of interest hikes utilizing this idea.

I final wrote about that on this publish – Treasurer, please sack the RBA governor and the Financial Coverage Board members – they’ve gone rogue (July 10, 2025).

The important details are:

1. The RBA continues to be operating what they consider is a restrictive financial coverage – which means, fairly aside from whether or not their coverage is efficient or not, their intention is to drive unemployment up additional.

Some will say that the RBA has been lowering rates of interest for the reason that peak in November 2023, which is true.

The publish simply cited explains the idea of a impartial charge, nonetheless the RBA nonetheless considers the present coverage charge exceeds it.

2. The RBA nonetheless believes the NAIRU is above the present charge of unemployment, which suggests they assume the labour market continues to be too tight and placing upward stress on inflation.

As I notice in that publish, the 2 claims by the RBA are with out basis in concept or proof.

Right now, I present some new work I’m doing to additional that argument towards the RBA.

Newest analysis

A technique of approaching this query is comparatively easy and makes use of precise knowledge units moderately than having to depend on utilizing econometric strategies to estimate unknown variables as within the case of the NAIRU estimates.

Economists have lengthy used the so-called Beveridge or UV curve to assist them perceive the labour market.

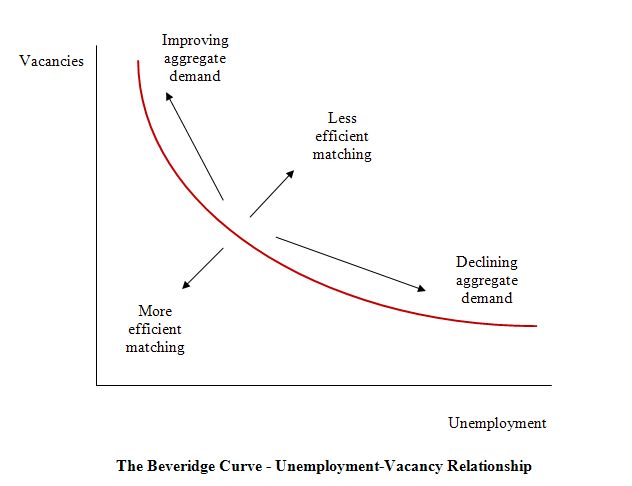

The Beveridge curve plots the unemployment charge on the horizontal axis and the emptiness charge on the vertical axis as proven within the following diagram.

The logic is that actions alongside the curve are cyclical occasions and shifts within the curve are alleged to be structural occasions.

So a motion “down alongside the purple curve” to the south-east suggests a decline within the variety of jobs out there as a consequence of an mixture demand failure, whereas a motion “up alongside the purple curve” signifies improved mixture demand and decrease unemployment.

If unemployment rises in an economic system the place there are actions alongside the Unemployment-Vacancies (UV) curve it’s known as “Keynesian” or “Cyclical” unemployment – that’s, arising from a deficiency in mixture demand.

Nonetheless, the notion that there’s a neat decomposition between shifts in and actions alongside the curve is extremely contested and has not been reliably established within the empirical or theoretical literature.

Certainly one of my earliest papers, which got here from my PhD work – The NAIRU, Structural Imbalance and the Macroequilibrium Unemployment Charge – revealed in 1987 within the Australian Financial Papers, 26(48), pages 101-118 – confirmed that structural imbalances (provide constraints) might be the results of cyclical variations and might be resolved, partially, by attenuating the amplitude of the downturns utilizing fiscal coverage.

In different phrases, there is no such thing as a decomposition because the mainstream would really like us consider.

My later work has clearly proven that nearly at all times UV shifts have been related to main recessions which generated structural-like adjustments within the labour market.

In different phrases, the shifts are pushed by cyclical downturns (mixture demand failures) moderately than any adjustments in autonomous provide facet behaviour (like employee attitudes altering, or welfare coverage introducing distortions to incentives, and so on).

Nonetheless, we are able to nonetheless use this framework to consider some minimal unemployment charge that we’d aspire to.

There may be by no means going to be zero unemployment as a result of individuals transfer between jobs and that takes time.

So we’re fascinated with what’s an irreducible minimal, above which economists Pascal Michaillat and Emmanuel Saez known as the “nonproductive use of labor—each recruiting and jobseeking”.

See their 2022 paper – u* = √uv – for additional dialogue.

I deploy their technique right here.

We wish all staff who need to work to be working and incomes earnings and producing issues which might be helpful (summary at this stage from degrowth concerns regarding fascinating and undesirable work).

Time spent searching for work and/or searching for staff to make use of is a value to the nation and needs to be minimised.

We will measure that value inside a UV framework by summing the unemployment and emptiness charges – u + v – and the coverage objective needs to be to minimise it.

u is an indicator of labour provide – so the “quantity of jobseeking”, whereas v is an indicator of labour demand – so the “quantity of recruiting”.

u and v fluctuate inversely as a result of mixture exercise reduces u and will increase v and when there is no such thing as a shifts within the UV curve occurring, the 2 transfer symmetrically in reverse instructions.

The objective of the coverage maker then is to get unemployment right down to match the present degree of unfilled vacancies.

If that degree of unemployment is taken into account extreme then the federal government itself has a duty to concurrently create vacancies to soak up the unemployed, in different phrases create a buffer inventory of jobs – which was the logic I adopted in creating the Job Assure idea.

With that final caveat given, we are able to outline a the minimal non-productive use of labour as u = v as a result of if u > v then the labour market is slack and losing extra labour than it ought to, and vice versa.

The uv ratio thus turns into a measure of labour market tightness or slackness.

1. u > v – extreme slackness (unemployed losing time)

2. u = v – minimal waste

3. u < v – extreme tightness (employers losing time)

For a given UV relationship (that’s, one not being disturbed by sudden shifts), the subsequent step requires some arithmetic which I’ll spare you from.

Primarily, we are able to outline the unemployment charge that minimises the “non-productive use of labour” by a method linking u and v.

Particularly, we take the geometric imply of the unemployment charge and the emptiness charge, to get the irreducible minimal unemployment charge for a given place of the UV curve.

This enables us to evaluate the RBA’s place with respect to the labour market and the validity of their financial coverage stance.

Knowledge

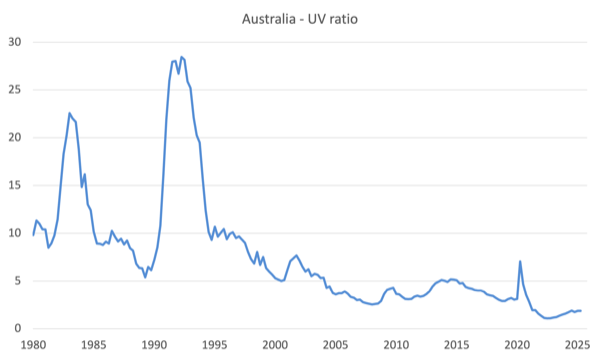

Noting that for a given UV place, u=v defines our desired minimal, the next graph of the ratio of unemployed to vacancies tells us that since Eighties, the Australian labour market has by no means achieved that objective.

The 2 main recessions are obvious, when unemployment skyrocketed.

At current, there are round 2 unemployed individuals per unfilled emptiness.

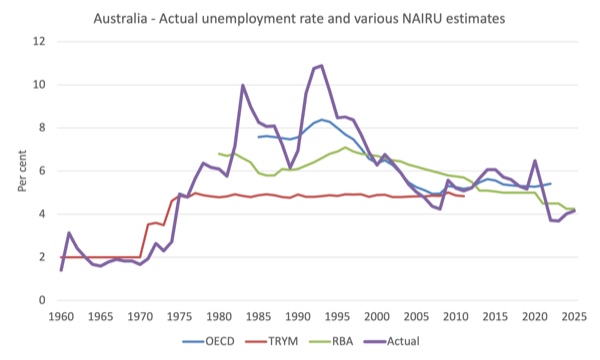

The following graph reveals the precise Australian unemployment charge since 1960 (annual knowledge) and varied NAIRU estimates offered by the OECD, the previous Treasury TRYM mannequin and the RBA.

What you see is NAIRU nonsense.

The NAIRU estimates are extremely variable – which makes figuring out whether or not the precise state of affairs is above or beneath the NAIRU unimaginable – which signifies that coverage settings that rely on whether or not the precise is above or beneath the so-called equilibrium are unimaginable to make.

In different phrases we’re on this planet of witchdoctors.

Now what concerning the unemployment charge that minimises the “non-productive use of labour” – which I’ll label ur* – which is the speed at which we’d conclude that there’s ‘full employment’ topic to {qualifications} about forces that might and do promote shifts within the UV relationship?

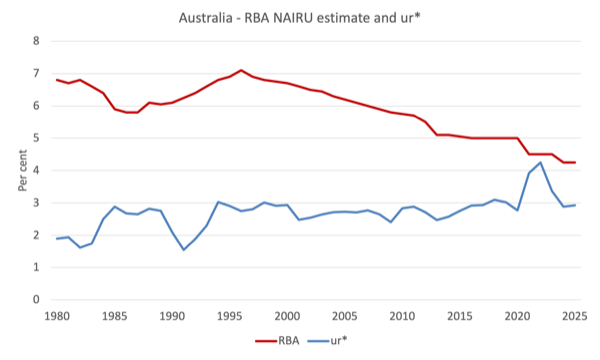

The next graph reveals the time sequence since 1980 for my estimate of ur* and the RBA NAIRU estimates.

Word: watch out to grasp that my ur* estimate just isn’t what I take into account to be the irreducible minimal unemployment charge.

Somewhat it’s the minimal unemployment charge that we are able to obtain given the extent of unfilled vacancies at any time limit.

In fact, authorities coverage can concurrently scale back each by means of public sector job creation schemes, which is why they had been so efficient within the pre-neoliberal period.

In reality, the federal government might drive ur* right down to effectively beneath 2 per cent if it had the inclination.

The tactic is straightforward and recognized – create employment.

Word additionally that I haven’t built-in the almost 6 per cent underemployment into this framework as but.

Conclusion

The conclusion is apparent.

Working throughout the mainstream NAIRU narrative has meant that unemployment charges have been intentionally held at elevated (wasteful) degree for no practical financial motive.

Even with unemployment charges at decrease ranges than have been skilled in current many years, there may be nonetheless scope for extra discount.

But, the RBA is making an attempt to push unemployment up greater.

That’s sufficient for in the present day!

(c) Copyright 2025 William Mitchell. All Rights Reserved.