The British press are reporting that the Authorities there’s planning additional spending cuts of the order of billions of kilos as a result of the financial atmosphere has modified and the present fiscal trajectory is threatening their self-imposed fiscal guidelines thresholds. We already heard final week how the Authorities is considerably reducing Abroad Assist because it ramps up army expenditure. Now, it’s reported that billions shall be reduce from the welfare space and the justification getting used is that there’s widespread rorting of that system by welfare cheats. There are a number of factors to make. First, eliminating rorting is fascinating. However I’ve seen no credible analysis that means such skiving is of a scale ample to justify reducing billions out of welfare outlays. Second, fairly aside from that query, the micro assault on the welfare outlays have macroeconomic penalties. The British Workplace of Funds Duty estimates that the output hole is near zero which implies it’s claiming there’s full employment. Even when that’s true, that state is underpinned by the present stage of presidency spending (whether or not it’s on cheats or not). If the spending cuts which can be targetting rorting will not be changed by spending elsewhere then a recession will happen and the Authorities will certainly fail to attain its ‘non negotiable’ fiscal rule targets. It’s a mess of their very own making.

I’ve handled points referring to this in latest weblog posts in addition to an extended listing of posts from just a few years in the past.

The latest posts embrace:

1. Britain and its fiscal rule demise want (February 17, 2025).

2. These claimed important fiscal guidelines within the UK appears to be disposable on the whim of the polity (October 24, 2024).

3. The British authorities doesn’t must appease the monetary markets (October 14, 2024).

4. Extra economists at the moment are criticising the British authorities’s fiscal guidelines – together with those that influenced their design (September 23, 2024).

5. The brand new British Labour authorities must abandon its fiscal rule or ship little or no (July 24, 2024).

6. British Labour Social gathering as soon as once more tripping over their nonsensical fiscal guidelines (June 20, 2024).

The scenario is turning into extra absurd as time passes with Rachel Reeves setting the ‘fiscal guidelines are non-negotiable’ in concrete, which shall be her downfall.

Bear in mind again in June 2024 within the lead as much as the Common Election, which was held on July 4, 2024.

Labour chief Starmer gave many interviews the place he asserted to the voters that if he gained the election his authorities wouldn’t proceed with fiscal austerity.

For instance, on this interview (June 28, 2024) – Keir Starmer on being as ‘daring as Attlee’ and why there’ll be no return to austerity beneath his watch – which was recorded simply six days earlier than the election, Starmer mentioned:

I’ll be as daring as Attlee. I ran a public service throughout austerity, I noticed the influence of the Tories’ choices. There shall be no return to austerity with a Labour authorities. We’ll have a decade of nationwide renewal as a substitute, with formidable funding and reform.

He waxed lyrical about how the welfare system was not beneficiant sufficient and that his authorities would enhance entry and bolster funds.

His manner within the interview would lead a voter with progressive views to really feel favourably in direction of the chief who resonated empathy with the downtrodden and people depending on authorities providers for his or her existence.

Properly that manner was clearly only a veil of deceit and as soon as he had his fingers on energy he put in former funding banker Rachel Reeves into the Chancellor’s function and collectively what did they do?

Proceed fiscal austerity after which beneath the quilt of fixing worldwide occasions – title the madcap insurance policies popping out of Washington – they’re now saying they’ll ramp it up even additional.

I commented on the latest claims that British Abroad Assist was being reduce to ‘pay’ for the deliberate escalation in army spending on Monday – Britain can simply improve army expenditure whereas growing ODA to honour its worldwide obligations (March 3, 2025).

Yesterday, the BBC printed a report (March 5, 2025) – Chancellor set to chop welfare spending by billions – which revealed additional shifts within the place of the British authorities.

Apparently:

The chancellor has earmarked a number of billion kilos in draft spending cuts to welfare and different authorities departments forward of the Spring Assertion.

The “world has modified” cowl is getting used because the excuse.

One side of that’s the imposition by the US of tariffs on numerous nations.

I haven’t but written something about that challenge (however I’ll sooner or later) however the chances are the US coverage shift will improve the UK’s exterior deficit a bit.

I contemplate that prospect under.

The ‘billions’ in cuts are designed “to fulfill the chancellor’s self-imposed guidelines on borrowing cash.”

So the fiscal guidelines are set in stone and one thing else has to offer – which is spending, given they promised no important tax modifications.

The justification is that the federal government has to “keep credibility with monetary markets”.

So there are layers of absurdity that construct on one another to get so far.

The prepare of spurious logic is clear and goes like this:

Absurd proposition 1: The federal government which is the one establishment in Britain that points the pound has to get the pound from the non-government sector through taxation or borrowing with the intention to spend it.

Actuality: The British authorities spends by typing numbers into financial institution accounts – no taxes or borrowing are required.

Absurd proposition 2: Recurrent spending (no matter that’s) have to be matched always by tax income.

Actuality: This can be a self-imposed constraint with no foundation in financial idea.

Absurd proposition 3: Any extra capital spending have to be matched by issuing debt.

Actuality: This can be a self-imposed constraint with no foundation in financial idea and constitutes company welfare to the gamblers within the monetary markets.

Absurd proposition 4: If Absurd proposition 2 and Absurd proposition 3 are endangered then the monetary markets will cease shopping for the debt that the federal government points.

Actuality: So what? The selection wouldn’t alter the spending capability of the federal government in any respect.

Absurd proposition 5: To keep away from Absurd proposition 4 occurring, the federal government has to chop spending dramatically.

Actuality: the top of the chain of absurdity.

The federal government can also be including to its cowl by invoking the identical kind of examples {that a} succession of Australian governments deployed to chop spending on welfare – the ‘welfare cheat’ ruse.

The BBC article reviews that “there have been ‘too many’ younger individuals not in work, schooling or coaching” who had been skiving away on welfare funds.

I’ve seen no credible analysis that means there are sufficient of such instances to justify billions being reduce.

Additional, illness advantages are allegedly being rorted as individuals “sport the system”.

Many of the improve in funds for illness has occurred after the onset of Covid and there’s sturdy proof that there at the moment are tens of 1000’s of staff who’re disabled because of lengthy Covid and associated signs.

Once more, I’ve seen no credible analysis that means there are sufficient of such instances to justify billions being reduce.

However even when there are tens of millions of welfare cheats who’re ‘gaming the system’, the federal government is deceptive the voters as to the results of their proposed cuts.

That is the purpose.

No progressive ought to help authorities spending being ‘gamed’ by cheats.

I agree with that proposition.

Which is one purpose I advocated a Job Assure changing the earnings help funds referring to unemployment.

Then the ‘exercise take a look at’ turns into easy.

If the federal government gives a job to an individual looking for earnings help that’s inside their bodily capacities and near their dwelling then a refusal would counsel the individual doesn’t wish to work.

Fairly easy.

If there aren’t any jobs on provide beneath the Job Assure in some unspecified time in the future in time, then the applicant receives the Job Assure wage with out query till the federal government does provide them a job.

Fairly easy.

If an individual for no matter purpose is assessed by the NHS to be unable to work then they need to obtain earnings help with out query.

However the level is that it’s wise for the Authorities to enhance the veracity of the welfare help system by ridding it of criminals (cheaters).

Okay, let’s settle for that proposition with out shopping for into the declare that system rorting is widespread.

Even whether it is, the subsequent level is legitimate and signifies that reducing billions off authorities spending will trigger hurt.

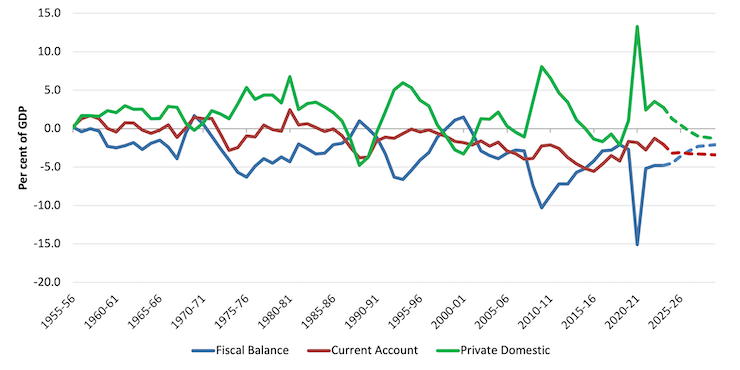

The next graph reveals the sectoral balances for the three main macroeconomic sectors: authorities (G – T), exterior (X – M), and personal home (S – I) – as a per cent of GDP.

The dotted traces mirror the most recent ahead estimates from the Workplace for Funds Duty – Information Right here – which exit to 2029-30.

These balances are derived from the nationwide accounts and are thus accounting statements with behavioural drivers (nationwide earnings shifts) underpinning the dynamics.

Do not forget that the three balances sum to zero as an accounting truth:

(S – I) – (G – T) – (X – M) = 0

What we deduce from these relationships is that if the exterior steadiness is zero, then the web total saving of the non-public home sector (households and companies) will equal the fiscal steadiness with an reverse signal.

So if the exterior steadiness is 0 per cent of GDP, and the Authorities is operating a deficit of two per cent of GDP, then the non-public home sector shall be web saving 2 per cent of GDP.

Because the exterior steadiness goes into deficit (as at current for the UK) – say 2 per cent of GDP, then the fiscal deficit must rise to 4 per cent of GDP, if the web total saving of the non-public home sector was to stay at 2 per cent of GDP.

If the fiscal deficit was recorded at 2 per cent of GDP, whereas the exterior sector recorded a deficit of two per cent of GDP, then the non-public home sector would file zero web saving.

Nationwide earnings shifts trigger the balances to vary, as a result of G and T have cyclical components (for instance, in a downturn, tax income T falls); the exterior steadiness is cyclical through the sensitivity of import spending to actions in GDP; and eventually, family saving and enterprise funding tends to rise when GDP will increase and vice versa.

A hanging function of this lengthy recorded historical past for the UK is the truth that at any time when there’s a fiscal shift in direction of surplus, the web total saving of the non-public home sector heads to detrimental territory.

However take into consideration the present fiscal technique of the British authorities.

The ahead estimates counsel the fiscal deficit will shrink from 4.8 per cent of GDP in 2023-24 to 2.1 per cent by 2029-30.

These estimates had been primarily based on GDP development forecasts of two per cent in 2025 falling to 1.6 per cent in 2029.

The lastest estimates from the Workplace of Nationwide Statistics (ONS) present that actual GDP grew by simply 0.1 per cent within the December-quarter 2024 following zero development within the September-quarter 2024.

Annual GDP development has not obtained close to 2 per cent during the last 15 years.

So to get the fiscal steadiness right down to round 2 per cent of GDP by 2029-30 on condition that tax income is unlikely to be as strong because the fiscal estimates counsel will take considerably increased cuts to authorities spending, which in flip will trigger GDP development to deviate farther from the forecasts.

But when the Authorities succeeded in attaining a 2 per cent of GDP deficit by 2029-30, then given OBRs exterior steadiness forecasts, the non-public home sector could be plunged into deficit of round 1.3 to 1.5 per cent of GDP, which implies the already precarious debt place of that sector would change into much more so.

The non-public home sector can solely fund an growing deficit (spending greater than its earnings) by operating down wealth and growing liabilities.

That technique is unsustainable and is more likely to lead pretty shortly to recession and a rising fiscal deficit.

It additionally implies that it might be arduous for the federal government to fulfill its fiscal guidelines, particulary the element referring to decreasing the general public debt ratio over the course of the present Parliament.

Additional, the tariff challenge, which is being utilized by the Authorities to justify additional fiscal austerity, will in all probability (if there’s any important impact) improve the exterior deficit.

Below that situation, if the Authorities actually digs in and retains reducing spending, then the earnings results will push the non-public home sector right into a deepening deficit and the true results of the possible recession (misplaced jobs, rising unemployment, misplaced incomes and so on) would in all probability result in widespread debt defaults and bankruptcies.

Which, in flip, would result in an growing fiscal deficit through the automated stabilisers, which might make it nearly inconceivable to fulfill the fiscal rule targets.

However there’s one other important level that pertains to the spending cuts and the sooner dialogue about welfare cheats.

The query of welfare fraud is a micro challenge however coping with it has macroeconomics implications.

Whether or not there’s widespread rorting in an attention-grabbing query however the authorities spending (on the rorting or not) continues to be flowing every day into the expenditure stream which is underpinning output and employment.

So the query then is whether or not there’s an output hole or not.

Based on the OBR, the present output hole is -0.2 per cent of GDP, which implies the OBR thinks the British economic system is near full capability operation.

I may let you know that the estimation methodology utilized by these businesses all the time produces forecasts which can be biased in direction of decrease output gaps than are precise,

However that may be a separate dialogue.

Even when we settle for the OBR estimate above, the very fact is that if total spending is reduce by billions then that output hole will improve and unemployment will rise.

So whereas they could wish to scale back welfare rorting which I feel is an okay aim (however please word I might estimate the rorting to be minor) – the very fact stays that the spending on such ‘rorting’ have to be changed by spending elsewhere if the output hole is to stay at its present stage.

The federal government may declare that as a result of the UK economic system is at full employment (courtesy of the OBR estimate) then issues are okay.

However it’s at ‘full employment’, partially, due to the present ranges of welfare spending.

Reduce it with out spending elsewhere and recession loom.

Conclusion

The British Labour authorities is proving to be a giant disappointment.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.