For the time being, the UK Chancellor is getting headlines together with her robust discuss on authorities spending and her promise to maintain an “iron grip on the general public funds”, which she outlined as “taking an iron fist in opposition to waste”. Okay. This robust man discuss (man being generic) appears to be the flavour of the month with the incoming US administration additionally speaking about making a Division of Authorities Effectivity (DOGE) to hack into public sector spending and employment. As soon as once more we see a Labour authorities consorting with the concepts of the conservatives. And excessive conservatives nonetheless. The British Chancellor has additionally decided that public officers are incapable of understanding the priorities and means to supply public companies and goes to pressure the division officers to seem earlier than a so-called ‘impartial committee’ of bankers and different monetary market sorts who will scrutinise the monetary plans with the goal of chopping 15 per cent over three years from every division’s price range. One other instance of conforming to neoliberal ideology. The issue with all this discuss, which generalises into public discussions about authorities spending, is that there’s an implicit assumption that it’s dysfunctional and simply goes up in smoke (waste) someplace. I by no means hear these politicians acknowledge that if they really achieve making these cuts then a spending hole will emerge and that hole needs to be crammed ultimately or the financial system strikes in direction of recession. In different phrases, what an individual would possibly deem to be wasteful expenditure, will at all times be underpinning GDP and employment development. Clear up the ‘waste’ and there are extra penalties that will not be thought-about fascinating. A minimum of these politicians and their advisors ought to make that clear to the general public.

First, let’s take care of the proposal for presidency departments to be vetted by some panel of specialists from the monetary markets.

The Minister for the Cupboard Workplace launched a press assertion (December 9, 2024) – Pat McFadden vows to make the state “extra like a begin up” as he deploys reform groups throughout nation – which introduced his “pledge to make the state ‘extra like a startup’” and use strategies developed in Silicon Valley to allegedly enhance public service supply.

Enterprise sorts might be employed by authorities on “Excursions of Responsibility” to carry an entrepreneurial mindset to the general public service.

A rest on recruitment guidelines will assist these characters take over authorities technique – a certain hearth means for ‘mates’ to be imported into profitable consulting positions with much less scrutiny.

Over the previous couple of many years, the upper training sector in Australia, for example, has been flooded with this form of entrepreneurial nonsense.

Teachers have been subjected to a conga line of consultants being marched into the schools and preaching austerity and KPIs.

The overwhelming majority of those consultants have by no means labored in a college and clearly have by no means taken the time to know the best way these establishments operate to ship analysis and instructing excellence.

As an alternative, administration consultants provide you with ridiculous cost-cutting plans, which lower prices within the areas that really do the work and pad out the senior administration areas, with all types of recent, fancy-titled positions.

I swear that universities might remove nearly all the senior administration positions and the establishments would operate higher in delivering their core capabilities.

I bear in mind one assembly with the so-called ‘exterior’ consultants the place the ‘professional’ introduced that they have been chopping prices by eliminating the usage of laptop computer computer systems.

When challenged he stated: “Why do teachers want transportable computer systems after they have desktops of their places of work?”

It was laughable how little he knew concerning the each day lifetime of a analysis tutorial with world networks.

Anyway, the Chancellor thinks that she will be able to sub-contract her ‘iron fist’ out to some characters from the monetary markets together with from Lloyds and Barclays banks.

Sure, the identical Lloyds that was bailed out by the UK authorities and partially nationalised through the GFC because of their appallingly dangerous mortgage behaviour.

And, sure, the identical Barclays Financial institution that noticed “4 former executives … charged with fraud over their actions within the 2008 monetary disaster” (Supply).

The opposite facet of the insanity that British Labour is indulging in at current pertains to the Chancellor’s plan to pressure authorities division officers to submit their spending ‘budgets’ to a so-called ‘impartial committee’ of bankers and different monetary market sorts who will scrutinise the monetary plans with the goal of chopping 15 per cent over three years from every division’s price range.

Extra insanity.

1. Authorities will not be a enterprise and its goals and analysis standards will not be remotely akin to how a profit-seeking enterprise ought to assess its progress.

What experience does a Lloyds’ Financial institution official have in delivering packages to the poor?

Hazard a guess! Mine is none!

We’ve got seen throughout many jurisdictions how these ‘effectivity’ drives play out.

In a personal enterprise, if prices are lower to the purpose that service supply is compromised, shoppers will quickly work out the issue and shift their customized to a different enterprise.

Companies rise and fall on this foundation within the non-public financial system.

Nonetheless, chopping a authorities service to the bone is a fairly completely different matter.

There are scads of proof displaying how numerous segments of the general public service have been decimated by these ‘effectivity’ cuts, to the purpose the place primary companies are not offered.

That challenges our conception of what a public service is.

It’s a variety of issues however one factor it isn’t – a product for personal shareholders to revenue from its sale.

2. The entire level of presidency is that we elect it and maintain it accountable and accountable as our brokers, for engaging in outcomes that we, individually can not obtain.

Choices taken by stated authorities ought to at all times be scrutinised by the general public and our voting intentions signalling our personal assessments of the outcomes.

3. Within the UK, round 60 per cent of companies (‘begin ups’) fail, for numerous causes, within the first three years of operation.

There’s appreciable ‘waste’ incurred within the startup Merry-Go-Spherical.

Capital is deserted, folks’s lives are disrupted, and companies disappear as rapidly as they emerge.

That form of mannequin is clearly not appropriate to authorities which should run steady departments that ship safe companies to the residents over lengthy durations of time.

The opposite level I need to make in the present day pertains to the macroeconomic actuality of presidency spending.

Whether or not one likes the place the spending goes is one factor.

And completely different worth programs will clearly have completely different most popular patterns of spending.

I might defund the army and the help for monetary markets and ramp up spending on local weather insurance policies and training, well being and the humanities.

And I would argue vehemently within the public area for governments to shift their spending priorities.

I may also say that the billions governments spend on making bombs to kill folks with is a basic spending ‘waste’.

And I would need to remove all such waste from the general public sector.

So at that stage I’m in settlement with the Chancellor – waste is dangerous and ought to be eradicated – even when I readily perceive that what may be thought-about waste is within the eyes of the beholder and I actually wouldn’t belief non-public financial institution officers who come from a tradition that landed them in a lot hassle through the GFC to be the very best set of eyes to make these judgements.

However then there may be the macroeconomic situation that’s at all times sidestepped or ignored in these ‘effectivity’ drive discussions.

Each $ or £ or ¥ that constitutes authorities spending goes someplace even when we contemplate the someplace to be a waste.

On the macroeconomic degree of study, ‘waste’ has no actual that means.

What has that means is that spending drives output which drives revenue era and employment.

That’s the primary rule of macroeconomics.

The federal government spending additionally units of the expenditure multiplier course of which merely implies that the primary recipient of the additional spending from authorities then is induced to spend a few of that further revenue elsewhere and that multiplies all through the financial system such that the preliminary $ spent by authorities produces a a lot bigger a number of in whole revenue change.

Please learn this weblog put up for extra on that – Spending multipliers (December 28, 2009).

Which implies that in the event you begin hacking into authorities spending then the present spending equilibrium might be disturbed and GDP will decline as a result of the spending hole that’s created results in falling gross sales, rising inventories, manufacturing and employment cutbacks and the remainder.

The purpose is that the federal government spending whether or not one calls it wasteful or not is contributing to revenue era and employment development.

Take it away and there’s a shortfall.

Now the British authorities would possibly suppose that the hole might be instantly crammed by non-government sector spending will increase.

That’s the usual ‘development pleasant austerity’ nonsense that the IMF and its ilk have been attempting to persuade us of for years.

The info are the other.

When the federal government imposes cutbacks and GDP begins to tank, households in worry of the rising unemployment reduce too, which then results in companies chopping again on funding spending.

It’s a vicious cycle.

And if we mirror on the present British Nationwide Accounts scenario then the federal government sector is enjoying a major position in protecting GDP development above water.

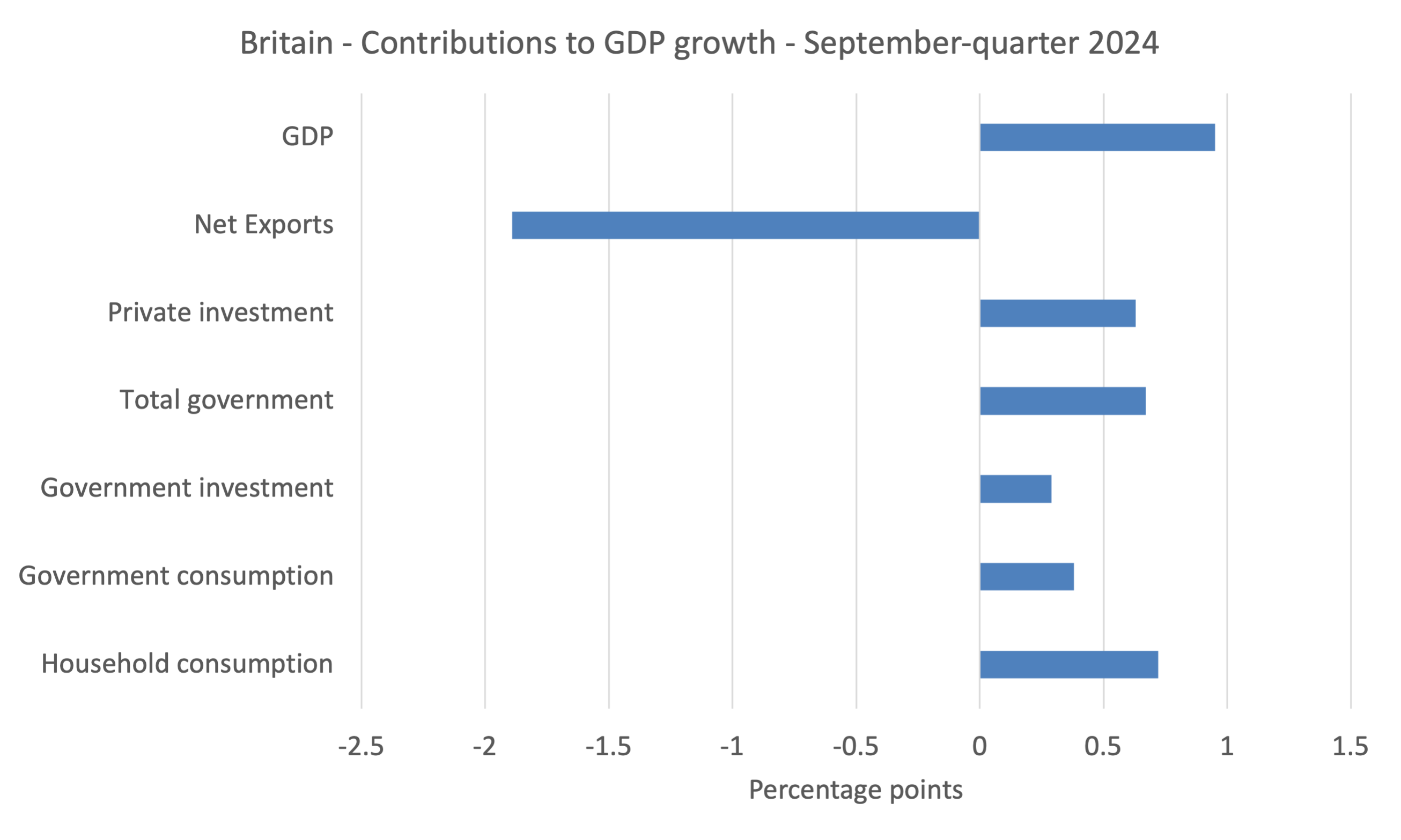

The next graph reveals the contributions to GDP development by main spending mixture for the September-quarter 2024 – in proportion factors.

GDP development was estimated by the Workplace of Nationwide Statistics to be 0.95 per cent within the September-quarter 2024.

Take out the federal government contribution (each recurrent spending and capital formation) and that development fee drops to 0.2 per cent.

At that decrease fee, unemployment can be rising pretty sharply.

Within the June-quarter it was much more clear what the contribution of presidency spending was: GDP grew by 0.7 per cent and the contribution of presidency equalled 0.66 per cent – that’s practically all the general development.

With out that contribution the UK development would have successfully been zero.

So the query that the journalists ought to be asking of presidency is which different spending supply goes to fill the hole left by the 15 per cent lower in authorities division expenditure over the following three years.

Conclusion

Foolish folks.

That’s sufficient for in the present day!

(c) Copyright 2024 William Mitchell. All Rights Reserved.